The decline of the Korean won has narrowed, reports: South Korea plans to postpone a $20 billion investment in the U.S. to alleviate the pressure of currency depreciation

South Korea has decided to postpone its planned investment of up to $20 billion in the U.S. this year to alleviate the ongoing depreciation pressure on the Korean won. Since the second half of 2025, the Korean won has cumulatively fallen by more than 8% against the U.S. dollar, raising concerns in the market about South Korea's ability to fulfill its total investment of $35 billion in the U.S. After the announcement, the decline of the Korean won narrowed. The agreement reached between South Korea and the U.S. last year allows for a capital outflow limit of $20 billion per year from South Korea, with the pace adjustable to stabilize the foreign exchange market

Due to the ongoing depreciation pressure on the Korean won, South Korea has decided to postpone its planned investment commitment of up to $20 billion to the United States this year.

On January 20, Bloomberg reported, citing informed sources, that this investment will be postponed until the foreign exchange market stabilizes. The source indicated that the capital outflow from businesses and individual investors is putting significant pressure on the won, but it is expected that the exchange rate will gradually stabilize in the future.

Since the second half of 2025, the won has depreciated by more than 8% against the dollar, and despite multiple market interventions by authorities, it has not been able to prevent its decline to the lowest level since the global financial crisis. South Korea had previously committed to invest a total of $350 billion in the U.S. as part of a trade agreement, and this long-term capital outflow plan has further raised market concerns about its financing capacity and currency stability.

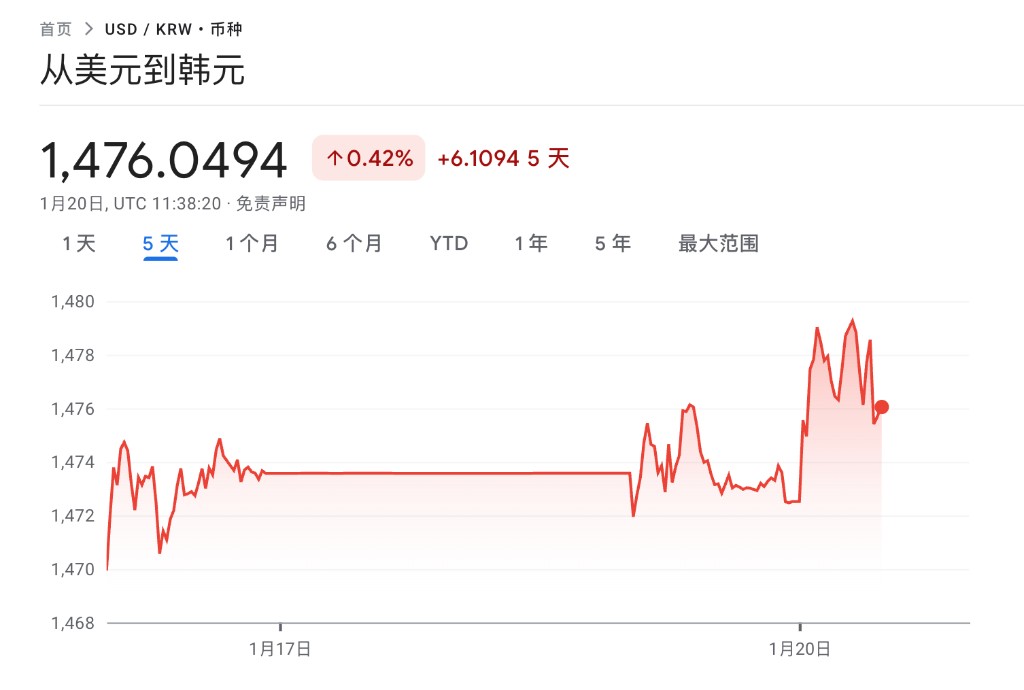

Following the announcement of the investment delay, the depreciation of the won against the dollar significantly narrowed. As of the time of writing, the won was quoted at 1476.05 against the dollar.

The trade agreement has flexible terms

According to CCTV News, in November last year, the South Korean government announced that South Korea and the United States officially signed an investment agreement totaling $350 billion. Of this, $150 billion will be invested in the U.S. shipbuilding industry, while another $200 billion will cover high-tech fields such as energy, semiconductors, pharmaceuticals, critical minerals, and artificial intelligence.

According to the agreement, as a corresponding condition, the Trump administration lowered tariffs on South Korean imports. The agreement also established a key restriction: South Korea's annual capital outflow to the U.S. cannot exceed $20 billion. The U.S. agreed to set this annual capital outflow limit and allowed South Korea to flexibly adjust the pace of capital outflow in the event of instability in the foreign exchange market to maintain stability in its currency market.

In response to recent market concerns about the investment progress, the South Korean Ministry of Finance, in response to Bloomberg News, cited the minister's previous statement that the likelihood of the $350 billion investment plan starting in the first half of 2026 is low.

Continued weakness of the won

Data shows that the won continues to face depreciation pressure against the dollar, at one point approaching the key psychological level of 1,600 won per dollar. Although U.S. Treasury Secretary Scott Pessenet stated last week that "the weakness of the won does not match the country's strong economic fundamentals," briefly boosting the exchange rate.

Pessenet's remarks led to a significant rebound of the won on January 14, but in the following two trading days, the exchange rate fell again, reflecting the market's cautious attitude towards the future of the won