In the first week of 2026, global risk assets rose together, and investor "sentiment was high."

The global market is experiencing a "risk frenzy": the S&P 500 in the U.S. stock market hits a new high, the Russell 2000 surges over 4%, A-shares achieve a historic "16 consecutive up days," climbing above 4,100 points, with trading volume exceeding 3 trillion. Amid geopolitical risks, silver skyrockets by 10%, gold approaches historical highs, and crude oil sees its largest increase in three months. Investors are frantically fleeing defensive assets and pouring into high-risk sectors, with junk bonds and meme stocks soaring together. Market optimism has surpassed risks and gained the upper hand

In the first trading week of 2026, global financial markets demonstrated a strong risk appetite, with stocks, commodities, and credit markets rising simultaneously from Wall Street to Shanghai. Investors are significantly withdrawing from last year's defensive assets and are instead betting on cyclical sectors and high-risk assets, driving major stock indices to record highs.

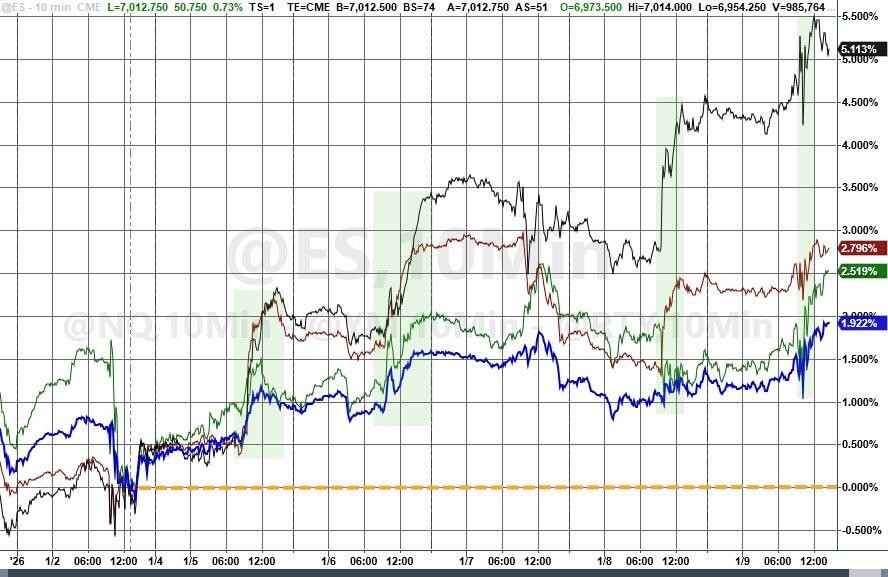

The S&P 500 index in the U.S. rose 1.6% this week to reach a new high, while the Russell 2000 index, representing small-cap stocks, surged 4.6%, indicating an expanding market breadth.

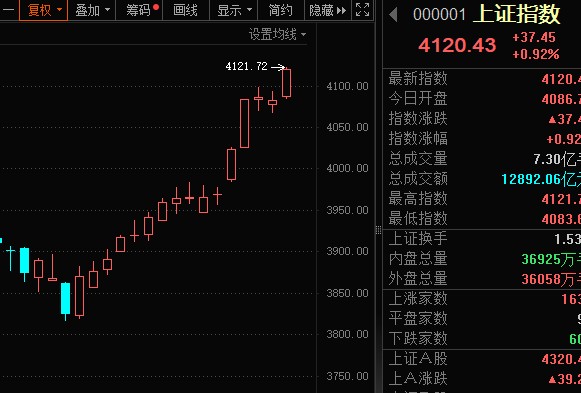

Meanwhile, the Asian markets are also in high spirits, with the A-share market witnessing history as the Shanghai Composite Index broke through the 4100-point mark, closing with an astonishing "16 consecutive gains" on the daily candlestick chart, and the single-day trading volume exceeding 3.15 trillion yuan, showcasing a surge of funds entering the market.

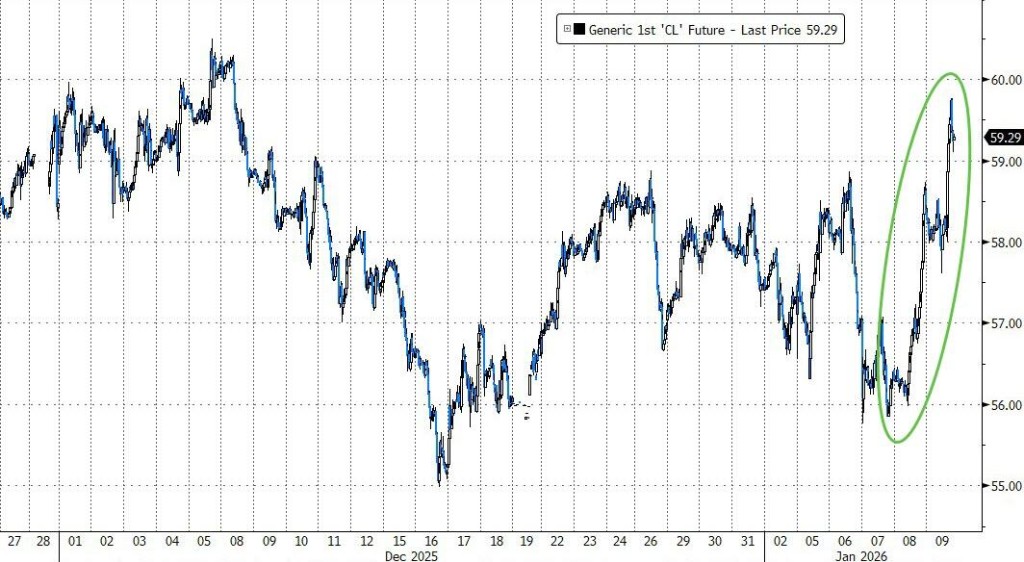

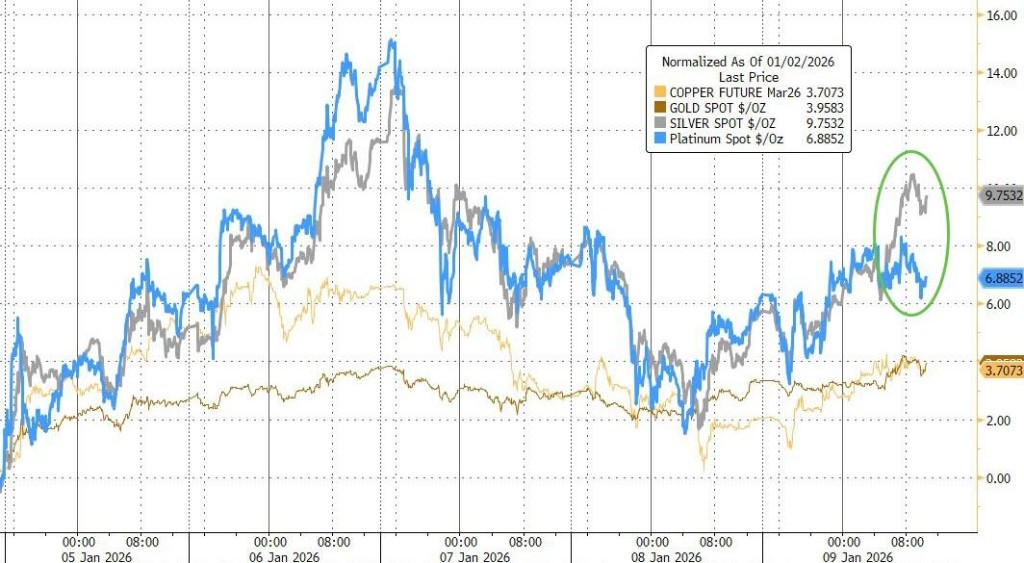

The commodities market also performed impressively, with oil prices experiencing the largest single-day increase since October of last year, driven by geopolitical factors and inflation expectations. Silver saw a weekly increase of 10%, while gold approached historical highs. Despite U.S. non-farm payroll data slightly missing expectations, the expansion of service sector activity and productivity improvements, combined with policy support from Washington, led the market to temporarily overlook potential macro uncertainties.

Guolian Minsheng Securities Tao Chuan believes that the "indiscriminate rise" of global stock markets at the beginning of the year is driven by a liquidity game between short-term "small happiness" and long-term "big" expectations. In the short term, the Federal Reserve's RMP has restarted balance sheet expansion, coupled with the release of TGA accounts, which may bring a liquidity feast of $600 billion in the first quarter, returning basic liquidity to a comfortable zone. However, while enjoying the current "ideal scenario," one must be wary of the lack of empirical support for a weak dollar and the risk of market shifts due to future expectation corrections.

Wall Street's Risk Appetite Heats Up, Funds Flowing to High-Beta Assets

As investors bet on a strengthening real economy, funds are flowing from last year's high-performing tech giants to riskier parts of the market. In addition to the notable performance of the Russell 2000 index, the Vanguard S&P 500 ETF (VOO) attracted $10 billion in just a few days.

More speculative assets are also active, with a "Meme stock" ETF soaring nearly 15%, while a basket of the most shorted stocks rose 7%, marking the best start since at least 2008

The credit market has also joined this frenzy. The junk bond spread has narrowed by 10 basis points, stimulating new corporate borrowing. Julie Biel, portfolio manager at Kayne Anderson Rudnick, stated, "Overly defensive strategies just don't work; too much 'sugar' has been injected into the economy."

Additionally, policies from Washington have fueled the rally, such as new initiatives to support the real estate market introduced by U.S. President Trump. Michael O’Rourke, chief market strategist at JonesTrading, pointed out that Intel's stock surged to a new high due to the CEO's meeting with Trump, and stocks of mortgage originators also rose due to Trump's credit market support plan.

Trump's quantitative easing policy has led to a surge in mortgage-backed securities (MBS) prices.

Despite the bullish market sentiment, the latest employment data is not without flaws. According to data from the U.S. Bureau of Labor Statistics, non-farm payrolls increased by only 50,000 in December, below the expected 70,000, and the unemployment rate slightly decreased to 4.4%.

However, investors seem to be more focused on the positive side. According to Bloomberg, U.S. service sector activity expanded at its fastest pace in over a year in December, and labor productivity rose at its fastest rate in two years, helping to control employment costs.

Nathan Thooft, chief investment officer at Manulife Asset Management, believes that the combination of the U.S. loose monetary policy and strong fiscal support continues to provide a favorable backdrop for economic growth, with expectations for improved economic activity in the second quarter of 2026 and beyond.

A-shares witness history: Shanghai Composite Index rises for 16 consecutive days with a trading volume of 3 trillion

In the Chinese market, the situation is equally hot.

On Friday, January 9, the A-share market continued its strong performance, with the Shanghai Composite Index breaking through the 4,100-point mark, reaching a nearly 10-year high, and achieving a historic "16 consecutive days of gains."

As of the close of that day, the trading volume of A-shares reached 3.15 trillion yuan, marking the first time since October 2025 that it has surpassed the 3 trillion yuan threshold.

Historical data shows that including that day, there have been 6 instances in A-share history where the trading volume exceeded 3 trillion yuan, highlighting the current market's extremely high activity and enthusiasm for capital participation.

Geopolitical factors boost commodities, oil, gold, and silver all rise

Under the dual influence of geopolitical risks and inflation expectations, the commodities market surged significantly this week, with oil prices soaring on Friday, marking the largest single-day increase since October Robert Rennie, the head of commodity research at Westpac Banking Corp., commented: "Crude oil remains caught in a complex game between escalating geopolitical risks and rising inventories."

Meanwhile, precious metals have also performed strongly. Silver surged 10% this week, followed closely by platinum.

Despite a stronger dollar, gold has soared to near historical highs.

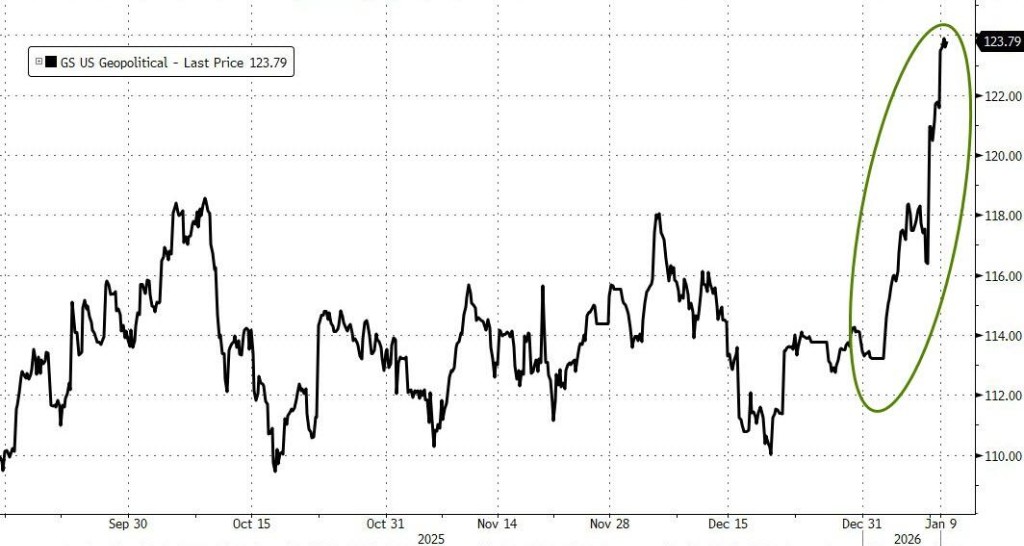

Goldman Sachs' geopolitical risk basket surged significantly this week, driving up sectors like defense stocks.

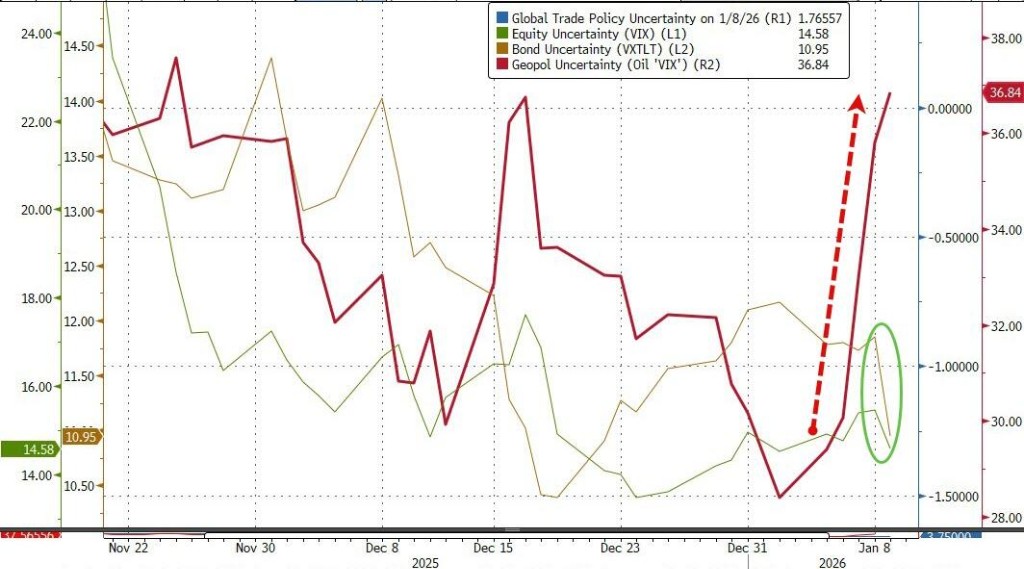

At the same time, as geopolitical risks soared, the volatility of stocks and bonds plummeted.

Concerns Behind the Market's High Spirits

Although the market is immersed in a bullish atmosphere, not all voices are so optimistic. Michael O’Rourke of investment firm JonesTrading believes that this heightened speculative spirit seems somewhat out of place after a three-year bull market where the S&P 500 has nearly doubled, and this optimism appears to be wishful thinking.

Rich Privorotsky, head of Goldman Sachs' Delta-One division, stated that the market feels like it is "harvesting everyone," with high market dispersion, poor performance in tech stocks, and the ongoing winners not being purely long-term growth stocks but rather cyclical stocks tied to nominal economic strength. He questioned whether the market has taken on too much risk premium due to oil volatility before the weekend.

Additionally, the successor to the Federal Reserve Chairman has also become a focal point for the market. Reports indicate that Trump is expected to decide on Jerome Powell's successor this month, with Waller and Hassett currently seen as the main contenders