Three Major Characteristics of Fund Winners in 2025

In 2025, China's active equity fund market experienced a repricing of capabilities, with over 90% of products achieving positive returns and a median return close to 30%. The performance of the industry showed significant differentiation, with nonferrous metals rising by 94.73%, while food and beverages fell by 9.69%. The annual ranking of funds was influenced by track selection and rebalancing ability, emphasizing the value of active management and the importance of timing in track selection. Overall, 2025 marked a fundamental shift in the evaluation logic of funds, with a significant recovery in the overall profitability effect of active equity funds

In 2025, China's active equity fund market underwent a true "capability repricing," with over 90% of products achieving positive returns, a median return close to 30%, and top products even exceeding 200%. However, the differentiation is more important than the returns themselves—this year was not about "everyone making money," but rather "who made structural profits at the right time and with the right methods."

According to the latest research report from Shenwan Hongyuan, three core changes emerged in 2025 from the perspective of fund evaluation: track selection re-dominated the annual rankings, the pace of portfolio adjustment was more important than long-term style, and high turnover, strong active funds regained an advantage. Behind these changes is the typical "N-shaped market structure" of the A-share market: at the beginning of the year, technology, innovative pharmaceuticals, new consumption, and Hong Kong stock themes all exploded, while in the second quarter, external disturbances intensified and risks were quickly released, leading to a market rebound in the second half driven by policy expectations and medium-to-long-term capital.

There were significant differences in returns at the industry level, with nonferrous metals, telecommunications, and electronics leading the way for the year, among which nonferrous metals topped the list with a 94.73% increase, and the telecommunications industry performed well for the third consecutive year, with an increase of 84.75%. In contrast, food and beverage fell by 9.69%, resulting in a staggering 104.43% gap between the best and worst-performing industries. This directly led to one outcome: in 2025, whether a fund "heavily invested in the right tracks" almost determined its annual ranking range.

For investors, 2025 validated the value of active management but also highlighted the importance of timing in track selection. Among the products that performed well in the first half of the year, 31% fell to the bottom 20% in the second half, indicating that investors need to pay attention to the fund manager's ability to adjust portfolios flexibly, rather than simply using annual rankings to "deify" or "ban" a fund.

Reconstructing Evaluation Logic: From Track Dividend to Capability Differentiation

2025 marked a fundamental shift in fund evaluation logic. If the period from 2022 to 2024 was a "trust restoration period" for active equity funds, then 2025 was a true year of capability repricing.

The Wind All A Index rose 27.65% for the year, while the CSI 300 increased by 17.66%. Among the 31 first-level industries of Shenwan, 29 achieved positive returns, but the market did not simply crush everything in a one-sided manner; rather, it provided ample track choices. The overall profit effect of active equity funds significantly rebounded, with 96.85% of products achieving positive returns and a median return rate of 29.81%.

The report pointed out that what truly widened the gap was track beta. From the statistical results, high turnover funds had significantly higher average returns than low turnover funds throughout the year. Funds that ranked high in the first half of the year saw a noticeable decline in the second half; the "champion curse" still exists, but it is no longer a simple mean reversion, but rather a result of track misalignment. This means that 2025 is not suitable for evaluating "long-term capability" based on a single year's returns, but is very suitable for judging a fund manager's trading and adaptability skills.

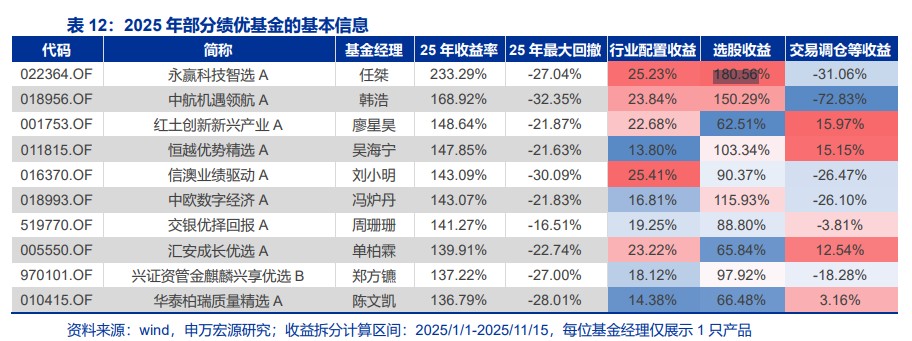

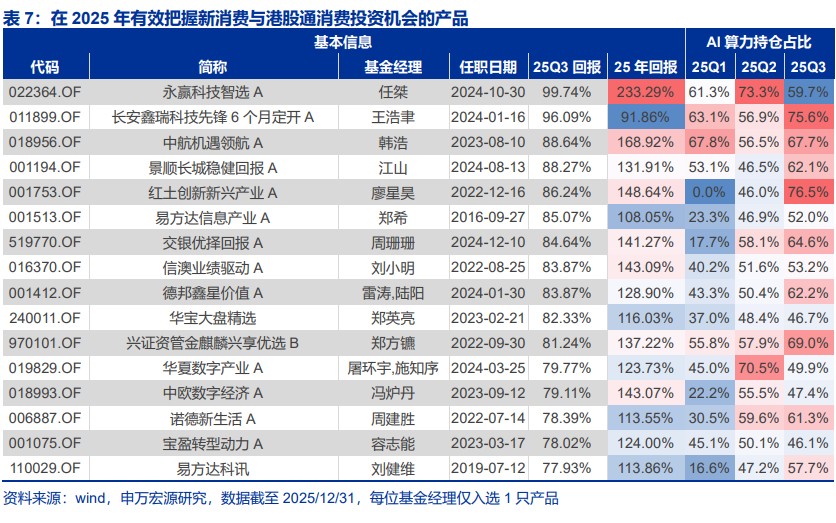

At the fund company level, capability differentiation began to emerge. Among companies with active equity assets exceeding 10 billion yuan, Yongying Fund, AVIC Fund, Caitong Fund, and Huashang Fund performed outstandingly, with arithmetic average performance exceeding 50%. Among them, Yongying Fund achieved an average performance of 56.76%, with its Yongying Technology Smart Selection yielding as high as 233.29% Few companies have consistently performed well across all four quarters of the year, with relatively balanced performance including Huashang Fund and Baoying Fund. Some small and medium-sized companies have shown strong explosive power in a single track, while platform-type companies, despite having a complete product line, do not have outstanding advantages in individual products.

Market Structure Determines Rankings: Industry Earnings Disparities Reach New Highs

The structural characteristics of the A-share market in 2025 are very typical, forming the underlying background that determines fund performance. At the beginning of the year, technology, innovative drugs, new consumption, and Hong Kong stock themes all exploded, while external disturbances intensified in the second quarter, leading to rapid risk release. In the second half of the year, the market strengthened again under the influence of policy expectations and medium to long-term capital.

There are significant earnings disparities between industries and themes:

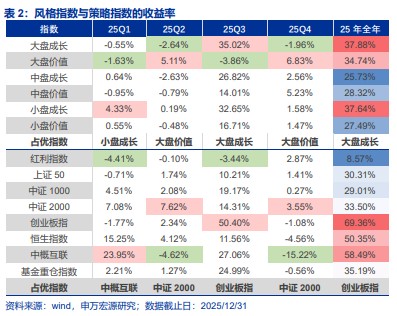

In terms of style, the large-cap growth index rose 37.88% throughout the year, while the ChiNext index surged 69.36%, becoming the best-performing broad-based index.

The electronic and power equipment industries, heavily weighted by active equity funds, rose 47.88% and 41.83% respectively throughout the year, contributing significantly to fund returns. In contrast, banks and non-bank financials, which performed well in 2024, fell into relative disadvantage in 2025, while nonferrous metals, which had lagged for the past three years, became the highest-yielding industry due to the strong performance of precious metals.

This structural characteristic is directly reflected in the common features of high-performing funds. Analyzing the funds that performed well in 2025 reveals that most belong to technology-themed funds, which obtained substantial excess returns through industry allocation.

In terms of contribution to returns, the contributions from telecommunications and electronics are significantly higher than those from other fields, becoming important sources of returns for top-performing products. For example, Yongying Technology Smart Selection achieved a return of 25.23% through industry allocation, with stock selection contributing 180.56%; AVIC Opportunity Navigator's industry allocation contributed 23.84%, with stock selection contributing 150.29%.

Key Tracks and Timing: The Two Dimensions of Victory

The report points out that from a results-oriented perspective, the key to the success of outstanding active equity funds in 2025 lies in two dimensions: whether they grasp the key tracks and whether their reallocation timing is precise.

Five major thematic opportunities emerged in succession. Precious metals were a stable opportunity throughout the year, with the Wind Precious Metals Index rising over 111% for the year. Fund managers such as Ye Yong, Li Xiaohua, Wu Guoqing, and Liu Wenzhe effectively seized this opportunity, with Li Xiaohua of Huafu Yongxin maintaining a 100% allocation to precious metals, achieving an annual return of 89.79%. This is a victory of "macro understanding plus portfolio execution capability," suitable for assessing fund managers' ability to adhere to long-term logic

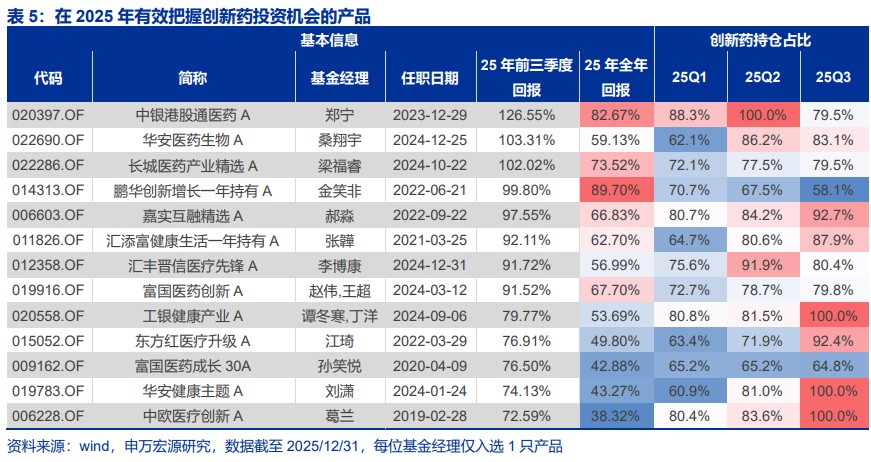

Innovative drugs completed a typical "valuation repair plus trading congestion" process in the first three quarters, with the China Securities Hong Kong Stock Connect Innovative Drug Index rising 118.52%. Fund managers such as Zheng Ning, Sang Xiangyu, Liang Furui, and Jin Xiaofei seized this market opportunity, with the Bank of China Hong Kong Stock Connect Pharmaceutical achieving a return of 126.55% in the first three quarters. However, the real difference was not whether to buy or not, but "when to reduce." Zheng Ning and Jin Xiaofei, who chose to moderately reduce their positions in innovative drugs in the third quarter, performed better over the entire year, while those who remained purely "long" saw their annual rankings decline.

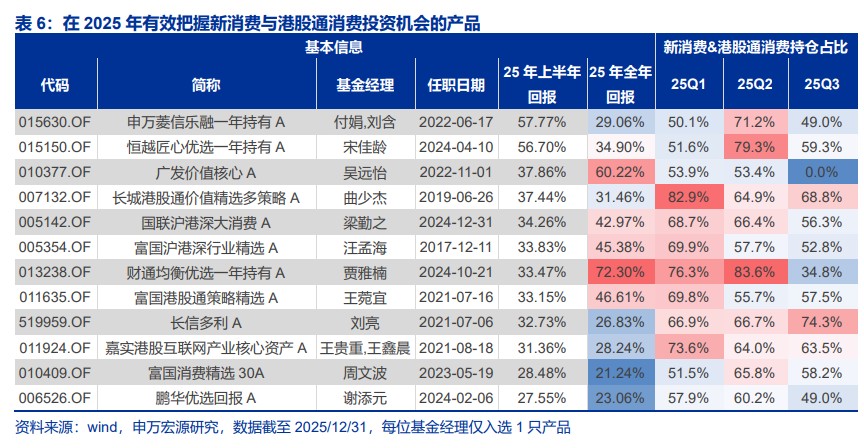

New consumption and Hong Kong Stock Connect consumption were typical dividends in the first half of the year. New consumption represented by Pop Mart and Lao Pu Gold rose 198% and 322% respectively in the first half of the year, but turned downward in the second half. Fund managers such as Fu Juan, Song Jialing, and Wu Yuanyi capitalized on the opportunities in the first half, with Wu Yuanyi significantly reducing holdings in the third quarter, achieving an annual return of 60.22%. This indicates that track funds are not necessarily good funds and must be evaluated in conjunction with "stage win rates."

AI computing power is not a year-round trend but concentrated in the third quarter, with the China Securities Computing Power Index rising 82.20% during that period. Fund managers such as Ren Jie, Wang Haoyu, Han Hao, and Jiang Shan quickly increased their positions during this phase, with Yongying Technology Smart Selection achieving a return of 99.74% in the third quarter. New energy made a strong comeback from September to mid-November, with the China Securities New Energy Index achieving a range increase of 33.65%. Fund managers such as Huang Qianyi, Yao Zhipeng, and Zheng Chengran benefited significantly, with Taixin Modern Service Industry achieving a return of 59.25% during this period.

The importance of timing is particularly prominent in 2025. The explanatory power of long-term style labels is significantly weaker than that of adjustment timing. High turnover funds achieved significantly higher average returns than low turnover funds, with funds that ranked high in the first half of the year experiencing a noticeable decline in the second half. Funds that can switch between multiple tracks and control drawdowns are more worthy of entering the core pool. The high returns of this year must be understood in conjunction with timing; otherwise, they cannot be replicated.

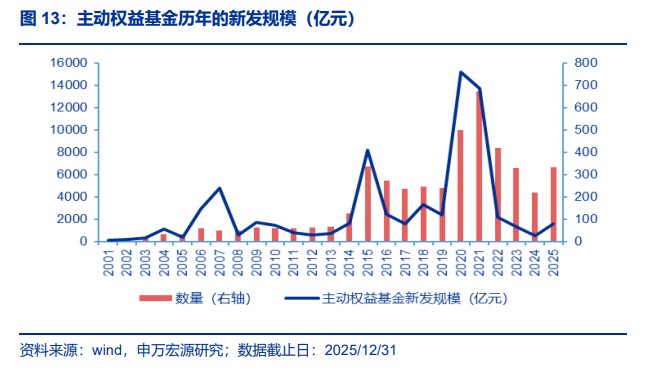

Market Recovery Signals: New Issuance Scale and Investor Preferences

The recovery of market confidence in 2025 is reflected in the warming of the new issuance market. A total of 334 active equity funds were newly issued, with a total scale of 161.898 billion yuan, showing a significant recovery compared to 2024, ending the continuous decline in new issuance scale since 2022 There are 12 new products with an initial offering scale exceeding 2 billion yuan, with China Merchants Balanced Optimal taking the lead with an initial offering scale of 4.955 billion yuan.

From the perspective of custodians, China Merchants Bank holds an advantage in both the number of products and the initial offering scale, with 52 products totaling 29.091 billion yuan. Among fund companies, E Fund has the largest new issuance scale, reaching 12.001 billion yuan. As of the third quarter, the top net subscription scales include Yongying Advanced Manufacturing Select and China Europe Digital Economy, with net subscription amounts exceeding 9 billion yuan.

Emerging fund managers are making their mark. In 2025, a group of outstanding emerging fund managers has emerged, including Dan Lin and Jie Ren, who focus on popular sectors, as well as Zheng Ke and Yi Yu, who maintain a moderate balance, along with quantitative style managers Xianzheng Kong and Weiming Liu. Among the mid-generation fund managers and veterans, Yuanhai Liu, Lihu Zou, and Yan Li have maintained good performance in the past two years; mid-generation fund managers such as Weiling Guo, Jianwei Liu, and Zhongyuan Hu have also remained at the forefront of similar products in 2025.

Overall, 2025 is a year very "suitable for fund evaluation," as the market provides ample sector choices, and there is no single dominant style. The entire process of fund managers' "judgment-execution-correction" is fully exposed.

Shenwan Hongyuan states that for investors, one should not simply use the 2025 rankings to "deify" or "ban" a fund. High-yield products are more suitable as samples for capability observation rather than mindless long-term allocation. Funds that can switch between multiple sectors and control drawdowns are more worthy of entering the core pool. Looking ahead to 2026, it is recommended to seek offensive directions while maintaining defensive discipline, enhancing the portfolio's risk resistance through diversified layouts across multiple sectors, and then finding offensive directions through moderate key allocations at different stages to avoid the drawdown risks brought by concentrated right-side allocations.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk