Roller Coaster Night? Global Markets Tonight "A Series of Great Shows"

Tonight is destined to be a sleepless night. Multiple heavyweight events resonating may trigger significant market fluctuations: the U.S. non-farm payroll report will set the tone for the Federal Reserve's interest rate path; the Supreme Court's tariff ruling may land, presenting a "choose one" scenario for the existence or abolition of tariffs; combined with the ongoing rebalancing of commodity indices, the pricing logic of the bond market, stock market, and commodity market will face multiple reshaping within hours

Global investors are holding their breath, preparing for a highly volatile "Super Friday." Tonight, a series of major events will erupt, ranging from macroeconomic data to the highest judicial rulings, as well as structural adjustments in the commodity markets. This could not only break the recent calm in the markets but also directly reshape the short-term pricing logic of the bond market, stock market, and commodity market.

First and foremost is the U.S. December Non-Farm Payroll Report to be released at 21:30 Beijing time on Friday. After several weeks of data vacuum due to the government shutdown, the market urgently needs this "reliable reading" to calibrate its assessment of economic health. This report will be a decisive reference ahead of the Federal Reserve's January meeting, directly determining whether the central bank will maintain interest rates or continue the rate-cutting pace.

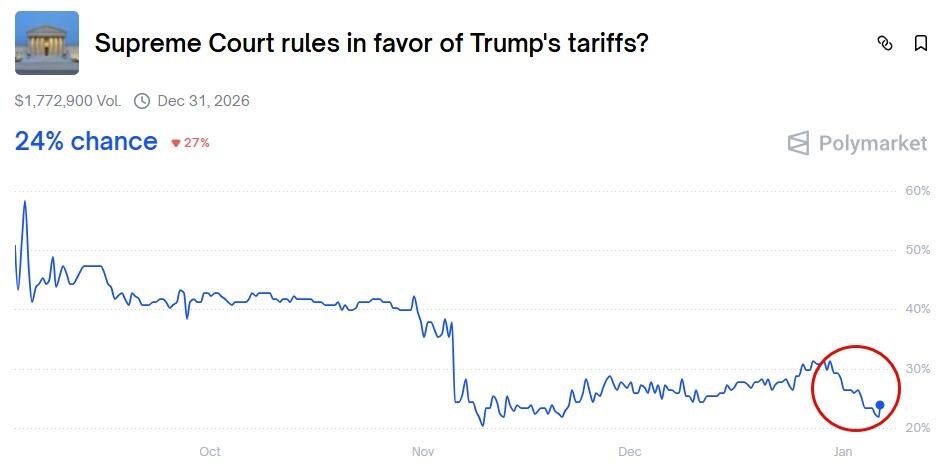

Following closely, market nerves will be on edge regarding the U.S. Supreme Court's potential ruling on the legality of Trump's tariffs. If the court rules the tariffs illegal, it will undermine an important source of revenue for the government amounting to hundreds of billions of dollars, potentially exacerbating concerns about the fiscal deficit and pushing up long-term U.S. Treasury yields. Although the Trump administration is expected to seek alternative legal avenues to restore most tariffs, short-term market volatility is unavoidable. JP Morgan strategists have stated that the removal of tariffs could "reignite fiscal concerns, push up long-term yields, and lead to a steepening of the yield curve."

Meanwhile, the commodity market is also facing a "double storm." In addition to the upcoming results of the Section 232 tariff investigation potentially triggering severe repricing in the precious metals market, large-scale index rebalancing trades have also commenced, with silver and other commodities facing unprecedented selling pressure. The impact of this series of events comes at a critical moment. The U.S. Treasury market has been trapped in a narrow range for a month, with the 10-year Treasury yield fluctuating between 4.1% and 4.2%, marking the narrowest monthly fluctuation range since 2020. For global traders, tonight is destined to be sleepless, as market volatility under multiple catalysts may be exceptionally intense.

Non-Farm Data: The "Tipping Point" for Federal Reserve Policy

Bond market traders are preparing for tonight's volatility, as the U.S. 10-year Treasury yield has been stuck in a narrow range of 4.1% to 4.2% for the past month. Zach Griffiths, head of investment-grade and macro strategy at CreditSights, stated, "The lack of economic data in recent months has made the market more complacent, and we may see volatility rise." After the impact of the government shutdown fades, this report is seen as the first reliable data reflecting economic conditions

Investors generally expect the labor market to show signs of stabilization. According to economists surveyed by Bloomberg, after an increase of 64,000 in November, non-farm payrolls are expected to rise by 70,000 in December, and the unemployment rate is expected to drop from 4.6% to 4.5%. Currently, market pricing indicates that investors believe the likelihood of the Federal Reserve cutting interest rates this month is only about 10%, with the next rate cut expected in June, one month after Federal Reserve Chairman Jerome Powell's term ends.

Gregory Faranello, head of U.S. interest rate trading and strategy at AmeriVet Securities, analyzed that if a "very weak" employment report emerges, such as flat job growth, it would force the Federal Reserve to intervene, potentially raising the probability of a January rate cut to 50%. In this scenario, U.S. Treasury yields would decline across the board, with short-term bonds outperforming long-term bonds, leading to a steepening of the yield curve.

Supreme Court Ruling: "Either/Or" on Tariffs

After digesting the employment data, the market's focus will quickly shift to the tariff ruling that the Supreme Court may issue. This ruling has a clear binary effect: if the tariffs are overturned, the stock market is expected to benefit, while the bond market may come under pressure; if the tariffs are upheld, the market reaction will be the opposite.

J.P. Morgan's Delta-One trading desk provided a detailed scenario analysis. The baseline scenario (probability 66%) is that the tariffs are overturned and immediately replaced, with the S&P 500 index potentially rising by 0.75%-1% on the day, but then the gains would recede, ultimately closing up by 10-20 basis points. If the tariffs are upheld (probability 24%), the index could drop by 30-50 basis points. The most optimistic scenario (probability 9%) is that the tariffs are overturned and replaced only after the midterm elections, with the index potentially rising by 1.25%-1.5%, and small-cap stocks significantly outperforming large-cap stocks.

Wells Fargo's chief equity strategist Ohsung Kwon expects that if the tariffs are ruled overturned, the EBITDA of S&P 500 constituent companies in 2026 could increase by about 2.4% compared to last year. Consumer goods, industrial manufacturing, and large banks will be the most obvious beneficiaries, while materials and commodities sectors may lag due to the loss of price protection.

However, for the bond market, J.P. Morgan's strategist team pointed out that the cancellation of tariffs carries the risk of "reigniting fiscal concerns, pushing up long-term yields, and leading to a steepening of the yield curve," but the overall impact "should be quite limited," as the Trump administration may seek other legal avenues to restore most tariffs. The Morgan Stanley team cautioned that investors need to pay attention to the specific timing and scale of potential tariff refunds to importers, which directly affects the demand for Treasury issuance.

Forecasting platforms indicate that bettors believe the probability of the court supporting Trump's tariffs is about 24%, while the probability of immediately refunding tariff revenues is only around 40%

Commodity Storm: The Double Blow of the 232 Investigation and Index Rebalancing

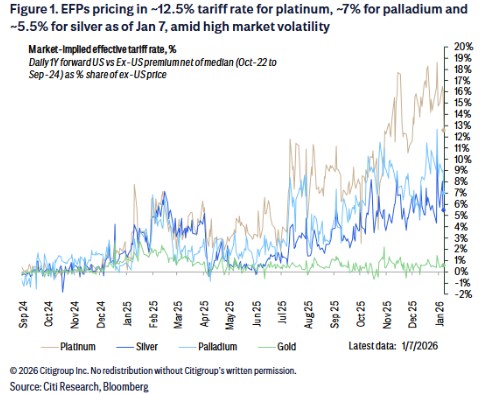

Beyond the macro drama, the commodity market is facing more complex microstructural shocks. The results of the U.S. critical minerals "Section 232" tariff investigation are expected to be announced this Saturday, and the market is highly sensitive to the trends of silver, platinum, and palladium.

According to a research team led by Citigroup's Kenny Hu, palladium is most likely to face high tariffs (such as 50%), which will lead to a surge in prices in the U.S. market, creating a huge premium relative to the London market and triggering short-term "rush to ship to the U.S." behavior. In contrast, silver is likely to be exempt from tariffs. If no tariffs are imposed, the metal will flow out of the U.S. to alleviate the tight spot in the London market, potentially leading to a correction in silver prices.

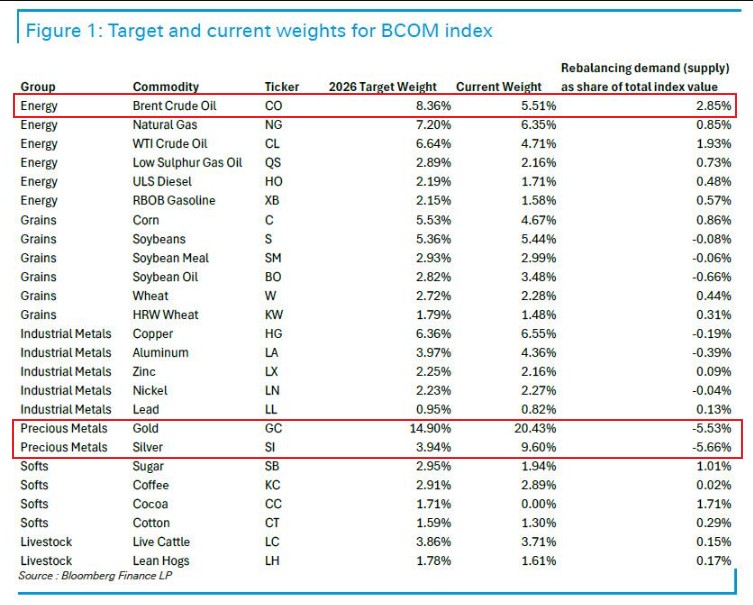

More urgent pressure comes from the funding side. The Bloomberg Commodity Index (BCOM) annual rebalancing began after the market closed on January 8. Due to a significant reduction in silver's weight, TD Securities and Deutsche Bank expect approximately $7.7 billion in silver sell orders to flood the market in the next two weeks, equivalent to 13% of the total open interest in COMEX silver contracts.

TD Securities analyst Daniel Ghali warned that in a liquidity vacuum, this could trigger a severe repricing similar to a "liquidation." However, Goldman Sachs analyst Lina Thomas offered a different perspective, arguing that as long as the tight inventory situation in London remains unresolved and the supply-demand mismatch in the U.S. market continues, extreme price volatility will persist, and may even rise further under investor enthusiasm. But she also cautioned that once liquidity in London recovers, the downside risks will significantly increase