When trillion-dollar giants start to "stockpile" brains, a "talent cognitive breakthrough battle" in the insurance industry has begun

The future insurance industry war will require a "cognitive dimension transformation" to accurately address new problems and create differentiated customer demands

In the business world, the most deafening artillery often begins with a quiet document.

Recently, PICC Group released a "Recruitment Outline for Postdoctoral Researchers in 2026." To most people, this is just a routine campus recruitment, lost among the tens of thousands of campus recruitment information each year, and is unremarkable.

However, to keen observers, the lines of this outline hide many of the future visions of this trillion-level financial giant.

If the operational model of the insurance industry over the past thirty years has been to use a "human wave tactic" to penetrate a larger customer base, relying on hundreds of thousands or millions of agents to sweep through buildings and streets to build scale; then the future war will require a "cognitive dimension transformation" to accurately solve new problems and create differentiated customer demands.

When a "firstborn of the insurance industry" managing tens of trillions of assets consciously begins to "stockpile" top interdisciplinary brains, the signal it conveys is clear: traditional empiricism is failing, and a battle for "cognitive breakthroughs" in the insurance industry has begun.

Farewell to the "Twilight of Empiricism"

To understand this "Recruitment Outline," one must first understand the current situation of PICC Group, or rather, the entire Chinese property and casualty insurance industry.

For a long time, insurance has been a business about the "law of large numbers." Its business model is not complicated: the front end relies on a large sales team and channels to collect premiums, the back end relies on actuaries to calculate probabilities, and the middle relies on investments to earn interest spreads. In this model, "experience" is the most valuable asset.

However, the world of 2025 is harshly punishing those who rely solely on old experiences.

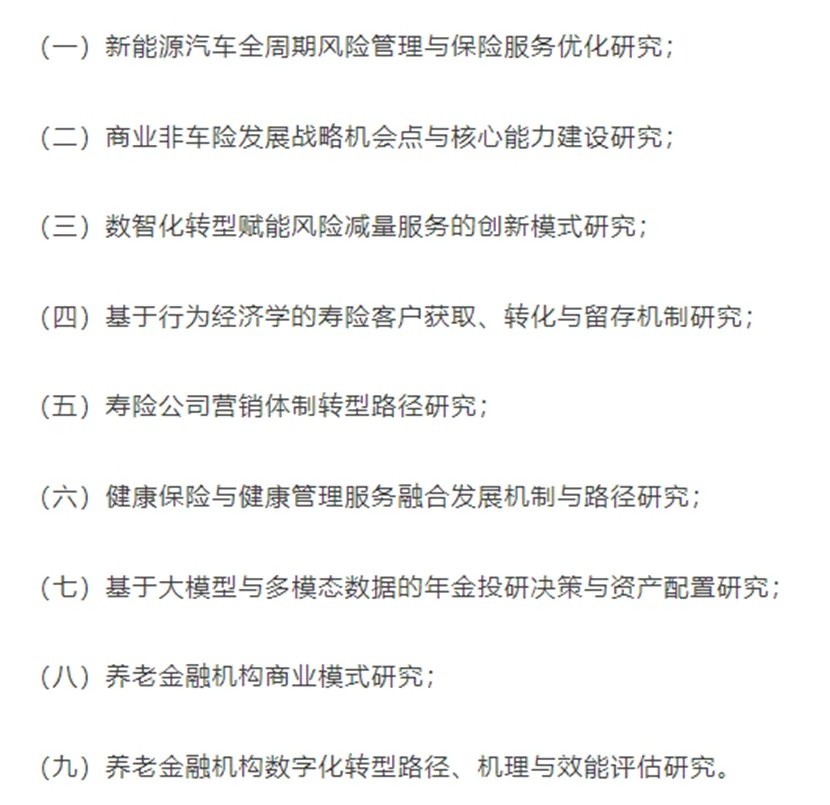

Flipping through this outline, you will find that the first major topic for recruiting postdoctoral researchers at PICC Group is "Research on the Risk Characteristics and Insurance Responses of New Energy Vehicles Throughout Their Lifecycle."

This is a highly symbolic signal.

As the largest property and casualty insurance company in Asia, PICC Group was the absolute king during the era of fuel vehicles. They possess the most comprehensive historical claims data, knowing which parts of a Passat are likely to fail in its fifth year, and the probability of a 35-year-old male driver having an accident. This data is the moat.

However, in the era of new energy, the depth of this moat is worth discussing. The rapidly growing new energy vehicle market has brought enormous underwriting demands, but at the same time, the combustion characteristics of batteries, the black box of accident rates potentially caused by autonomous driving algorithms, the soaring maintenance costs brought by integrated die-casting, and the new drivers on the road with more intelligent driving assistance... these new variables have made the value of traditional actuarial tables lighter and thinner, with some even becoming "waste paper." You cannot use data from the rearview mirror to predict the future beyond the windshield—let alone that they are not even the same type of vehicle.

Therefore, for a property and casualty insurance leader like PICC Group, what it needs is no longer just people who understand insurance terms, but more postdoctoral researchers who understand electrochemistry, mechanical engineering, algorithms, and artificial intelligence. They need to study not only "how to sell car insurance," but also redefine "what is risk" and "where does the ability to generate returns come from" from the underlying logic of physics and code, and from the group behavior after generational shifts in the population This is what a trillion-level property and casualty insurance institution should be thinking about.

Seeking "Non-linear" Growth Poles

If auto insurance is the "basic plate" for PICC Group, then the other two topics revealed in the "recruitment guidelines" — "commercial non-auto insurance capability building" and "integration of health management and commercial insurance development" — expose the anxiety and ambition of this giant.

In the era of low interest rates, as the yield on the asset side continues to decline, the cost expenditures on the liability side remain rigid and difficult to shake. All property and casualty and life insurance companies face the same soul-searching question: Where is the next trillion-level growth pole beyond traditional business? The answer from PICC Group may be hidden in these obscure research topics. For example, "the application of behavioral economics in life insurance customer conversion." This sounds very academic, but translated into business language, it means: how to understand the deeper aspects of human nature.

If past insurance sales were "selling," bombarding with diligence and advertising, then behavioral economics studies human irrational preferences. PICC Group has included this field in its postdoctoral research topics, which may indicate that they are trying to elevate their thinking from the intersection of psychology and economics.

Following this line of thought, it is not surprising that two "pension finance" related topics appear consecutively in the postdoctoral topics. With the accelerated aging of Chinese society, simple "compensation-type" insurance has reached its end. Future insurance companies must be "payer + service provider." However, healthcare and elderly care are extremely specialized deep waters that require more professional capabilities. The prerequisite for professional capability is research ability, and research ability must match talent.

Therefore, for large financial institutions, if they want to extend their reach into broader physical industrial chains such as healthcare and elderly care, they must learn to strategically place "idle pieces" in the talent field in advance.

"New Infrastructure" in the Digital Age

In the latter part of the guidelines, we also unsurprisingly see terms like "large model technology" and "digital risk control."

This is not surprising. For a large institution with hundreds of millions of customers and massive data, digital transformation is not an optional question, but a necessary one. However, it is worth noting that PICC Group is not recruiting ordinary programmers, but researchers in "the application of large models in the insurance field."

The difference here is: programmers solve "result" problems, while researchers solve "paradigm" problems. The emergence and rapid development of generative AI (AIGC) are reshaping the underlying business forms of the insurance industry. From the automation of underwriting and claims to the emotional interaction of intelligent customer service, and to the quantitative models of asset allocation, AI is taking over more and more manual positions and decision-making authority.

Forward-looking property and casualty insurance institutions must realize that their needs cannot be met by simply purchasing a ready-made IT system; they need to have the capability to "tame AI." How complex this path will be is still unclear, but through the recruitment guidelines of the postdoctoral workstation, we can see that PICC Group is already thinking about creating a "chemical reaction" between cutting-edge algorithm technologies and complex insurance business scenarios The results of this reaction are certainly not lines of code, but rather sets of "models" corresponding to various needs and individual "intelligent agents." With a trillion-level asset scale, even a 0.1% improvement in the accuracy of investment or risk control models can bring value in the hundreds of millions and provide unprecedented advantages. Such occurrences have happened in China's quantitative investment sector and are likely to be replicated in the insurance industry in the future.

A "War" About "Long-term" and "Future"

Returning to the beginning, why should we pay attention to a "recruitment brochure"?

Because in the noisy financial industry, truly smart people must strive to do things that are "difficult yet correct." This applies to giants like PICC Group and also to other small and medium-sized property and casualty insurance institutions.

As time goes on and technology erupts like a volcano, property and casualty insurance companies must realize that short-term performance fluctuations may just be ripples, but the underlying cognitive shortcomings could be the iceberg that sinks the Titanic.

Recruiting postdoctoral researchers and establishing high-standard research workstations reflect a talent strategy. The essence of a talent strategy is that companies are "investing today to buy certainty for tomorrow." This is an investment that appears expensive but is necessary, even though the transformation of research results often requires a long cycle and is filled with uncertainty. However, it is precisely because of this that it constitutes a real competitive barrier.

Whether the industry is booming or declining, the institutions that truly survive will not just lay off or expand with the economic fluctuations. They need to engage in significant actions to "hoard brains" against the trend, conducting deep cognitive layouts in uncharted territories such as new energy, big health, and digitalization. Those who can achieve this will have a greater probability of gaining "survival opportunities" in the future. Some insurance institutions have already taken the lead in this battle of wisdom and cognition