Eurozone December CPI slows to 2%, market expects ECB to remain "on hold" for a long time

歐元區 12 月通脹率已回落至歐洲央行設定的 2% 目標,核心通脹也繼續放緩,鞏固了市場對於利率將在當前水平維持不變的預期。儘管服務通脹和薪資增長壓力仍存,但除非經濟前景出現重大變化,歐洲央行在可預見的未來料將維持政策不變,市場對降息的押注僅小幅增加。

歐元區通脹率已回落至歐洲央行設定的 2% 目標水平,這一關鍵數據進一步鞏固了決策者的核心觀點:除非經濟前景發生重大變化,否則當前的利率水平將得以維持。

根據歐盟統計局週三發佈的初值數據,12 月消費者價格指數(CPI)同比上漲 2%,低於前值 2.1%,與路透調查的經濟學家預期一致。剔除波動較大的食品和能源成本後,核心通脹率從 11 月的 2.4% 放緩至 2.3%,備受市場關注的服務業通脹率也從 3.5% 降至 3.4%。

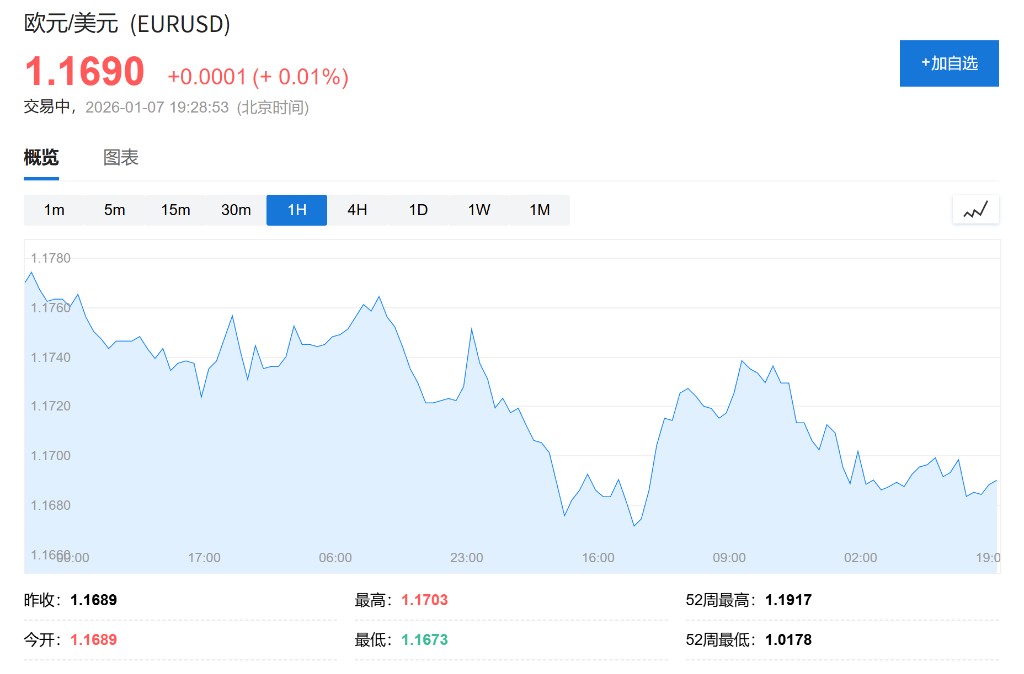

數據發佈後,市場反應相對平淡。歐元兑美元抹去早前跌幅,持平於 1.169 附近,斯托克 600 指數亦未見顯著波動。

儘管通脹迴歸目標可能為未來降息提供理由,但交易員僅小幅增加了對貨幣寬鬆的押注,定價顯示截至今年 9 月降息約 5 個基點的可能性上升,這相當於再一次降息 25 個基點的概率約為 20%。

價格增長已連續半年多在 2% 的目標附近徘徊,這使得歐洲央行得以自 6 月最後一次降息以來,連續四次會議保持借貸成本不變,目前關鍵存款機制利率維持在 2%。經濟學家和投資者普遍預計,在可預見的未來,央行不會有進一步的政策舉動。

通脹分化與薪資壓力

雖然整體通脹放緩符合預期,但歐元區內部的價格增長速度仍存在顯著差異。數據顯示,西班牙通脹率降至 3%,德國降至 2%,而法國則放緩至 0.7%。

在細分領域,服務業通脹仍是歐洲央行的主要關注點。儘管 12 月數據有所回落,但部分原因在於波動較大的機票價格下跌。更深層次的壓力來自於薪資增長。數據顯示,第三季度最廣泛的薪資漲幅指標保持在 4%,這一水平仍高於被認為符合價格穩定的標準。

歐洲央行行長 Christine Lagarde 上月曾表示,儘管薪資在經歷了疫情後的價格飆升後大多已完成追趕,預計今年將有所緩和,但央行仍需 “仔細觀察相關趨勢”。據彭博經濟研究的高級歐元區經濟學家 David Powell 分析,12 月通脹減速對歐洲央行而言是好消息,但這主要由能源成本驅動,可能與貨幣政策關係不大。

決策者立場與市場展望

大多數決策者認為通脹已得到控制,但鑑於全球經濟揮之不去的不確定性,對下一步行動仍持謹慎態度。雖然 Morningstar 首席股票策略師 Michael Field 在評論中指出,低而穩定的通脹可能促使央行更早傾向於刺激措施,這對股票市場是積極信號,但主流機構並未改變對利率路徑的判斷。

Nordea 分析師 Anders Svendsen 和 Tuuli Koivu 在報告中指出:“我們堅持長期的觀點,即歐洲央行將在 2026 年保持利率不變。上半年的風險偏向於降息,而長期風險偏向於加息。這與市場定價一致,今天的通脹數據不應改變這一觀點。”

長期預測與潛在風險

歐洲央行在 2025 年的最後一次會議上預測,受服務成本放緩速度較慢影響,今年通脹率僅會略微低於目標水平。根據央行的基準情景,預計 2026 年平均通脹率為 1.9%,隨後進一步下降,並在 2028 年回升至 2%。

然而,仍有多個外部因素可能導致通脹偏離目標。潛在的風險包括美國關税政策尚未完全顯現的影響、強勢歐元以及德國可能實施的財政擴張政策。此外,歐洲央行高級官員向 CNBC 透露,寬鬆週期已接近或處於尾聲,央行將繼續堅持逐次會議、依賴數據的決策方式。