AI enters the "Monetization Era"! Google's latest report: Enterprises bid farewell to the experimental phase, with 88% of AI pioneers achieving positive returns

The global AI application has entered an era of large-scale monetization centered around "intelligent agents," with commercial value becoming the core focus of the market. A report from Google Cloud shows that companies willing to invest heavily in AI intelligent agents have achieved substantial returns through efficiency and revenue improvements, and are leading a new round of capital reallocation and market competition landscape

The global artificial intelligence wave is undergoing a critical turning point, with market focus shifting from technological hype to the realization of commercial value.

According to the latest "2025 AI Return on Investment Report" released by Google Cloud, enterprises are no longer in the wait-and-see phase of "whether to adopt" generative AI, but have entered an era of scaled monetization centered around "intelligent agents." The report shows that in the race to transition to advanced AI, AI intelligent agents capable of independently executing tasks are becoming the key to unlocking the next wave of commercial value.

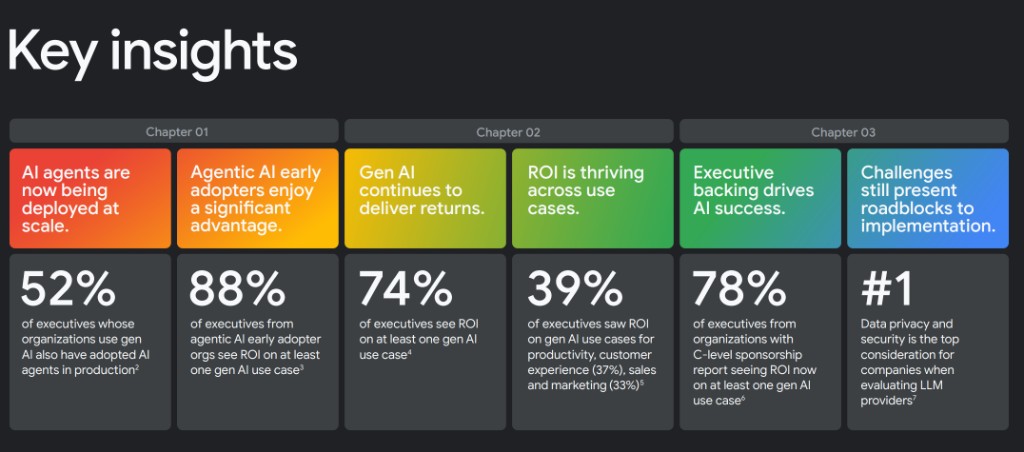

Core data from the report indicates that early adopters with a strategy centered on AI intelligent agents have achieved significant financial returns. Among this group, as many as 88% of corporate executives reported that they have realized positive return on investment (ROI) in at least one generative AI application scenario. This percentage is significantly higher than the global average of 74%. This marks a breakthrough for AI technology in enterprise applications, moving beyond the proof-of-concept stage to have a substantial impact on corporate balance sheets.

The realization of these returns is reshaping corporate capital allocation strategies. Although the costs of AI model training and operation are decreasing, companies are not cutting back on spending; instead, they are increasing their investments. Data shows that 77% of surveyed executives indicated that as technology costs decrease, their organization's spending on generative AI is actually increasing, and 58% of companies are funding AI investments by reallocating non-AI budgets. This trend indicates that companies are shifting resources from traditional IT areas to AI intelligent agent projects that can generate direct benefits, aiming to establish an advantage in fierce market competition.

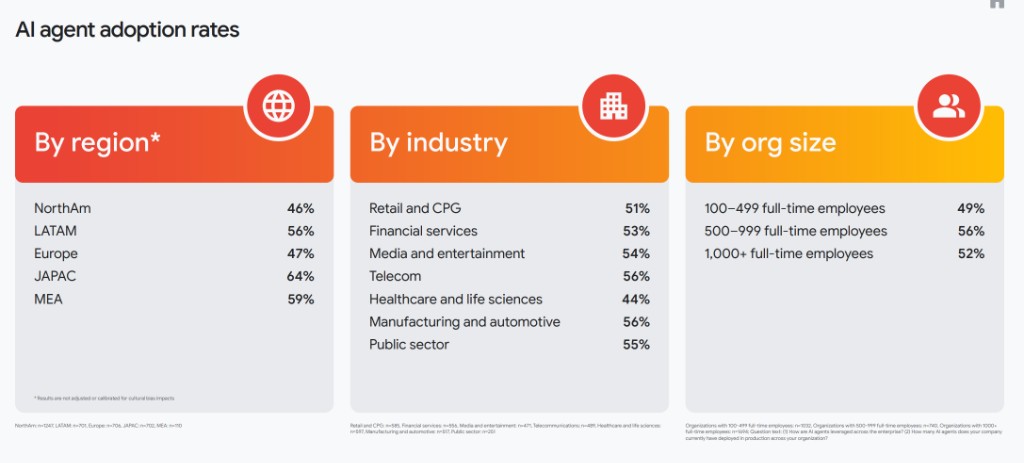

The report is based on a survey of 3,466 senior corporate leaders worldwide, covering multiple industries such as retail, finance, and manufacturing. The survey results reveal a clear market signal: As AI intelligent agents begin to independently undertake complex workflows in areas such as customer service, code development, and data analysis, those companies with clear C-level executive sponsorship and a willingness to invest heavily are widening the gap with followers.

The Era of Intelligent Agents Has Arrived: From "Assistance" to "Autonomy"

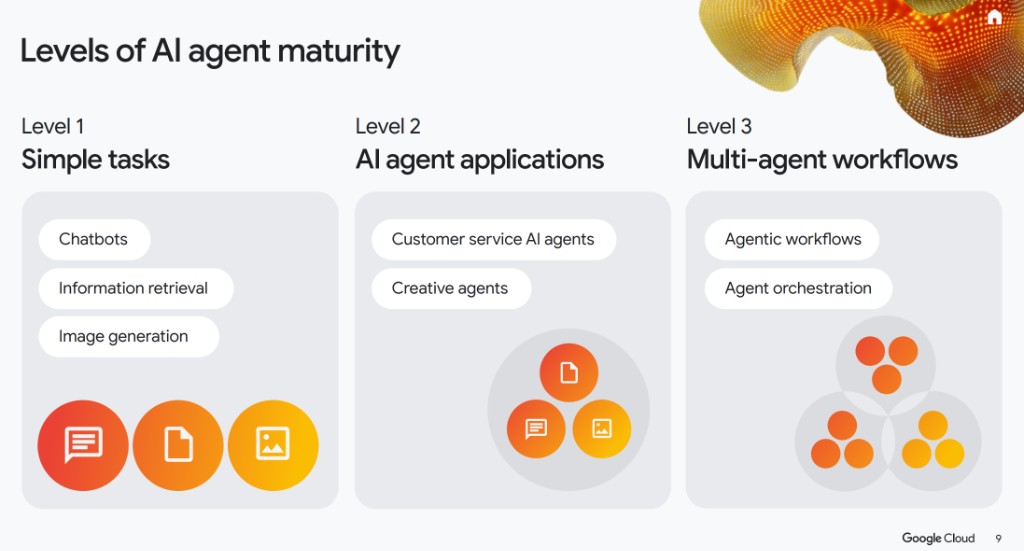

The Google report points out that the development path of AI has evolved from "predictive" to "generative," and has now officially entered the "intelligent agent era." Unlike traditional chatbots, AI intelligent agents are defined as systems capable of combining advanced model intelligence with tool access, allowing them to independently execute tasks and make decisions under human-set constraints and guidance.

This generational leap in technology is rapidly permeating corporate operations. According to statistics, 52% of executives using generative AI reported that their organizations have adopted AI agents in production environments. More notably, 39% of companies indicated that they have deployed more than 10 AI agents internally. This deployment is no longer limited to the technology sector but is widely distributed across retail, financial services, and manufacturing, demonstrating strong cross-industry penetration.

This generational leap in technology is rapidly permeating corporate operations. According to statistics, 52% of executives using generative AI reported that their organizations have adopted AI agents in production environments. More notably, 39% of companies indicated that they have deployed more than 10 AI agents internally. This deployment is no longer limited to the technology sector but is widely distributed across retail, financial services, and manufacturing, demonstrating strong cross-industry penetration.

Oliver Parker, Vice President of Global Generative AI at Google Cloud, pointed out in the report, "As the hype around AI settles, the conversation has shifted to value." The core issue for leaders now is how to scale proven use cases and build complex AI agents to capture business value.

Return on Investment Realization: Five Key Areas Become Profit Battlegrounds

When considering the return on AI investments, companies are highly focused on improving specific business metrics. The report shows that productivity enhancement, customer experience optimization, business growth, marketing, and secure operations have become the five core areas for monetizing AI.

In terms of productivity, 70% of executives reported significant efficiency improvements. Notably, among those companies reporting productivity growth, 39% indicated that employee productivity had at least doubled due to the introduction of generative AI. This efficiency dividend is spreading from IT departments to non-IT departments, with marketing, human resources, and finance also benefiting greatly.

Improvements in customer experience directly translate into revenue potential. 63% of executives reported that generative AI enhanced customer experience, with 51% of respondents indicating that user satisfaction or Net Promoter Score (NPS) improved by 6% to 10%. Regarding revenue growth, 56% of executives confirmed that generative AI directly drove business growth, with 31% of companies reporting annual total revenue growth exceeding 10%.

"First Mover" Dividend: Aggressive Investment for High Returns

Data indicates a significant positive correlation between the level of investment in AI agents and the speed of returns. The group of companies known as "agent pioneers" exhibits unique investment characteristics: they allocate at least 50% of their future AI budgets specifically to agent technology, and the proportion of their total IT spending on AI reaches 39%, far exceeding the market average of 26%.

This aggressive strategy has resulted in a higher success rate. In addition to 88% of pioneers achieving ROI, they are also more likely to see results from large-scale deployments. For example, 82% of pioneer companies deployed more than 10 agents, while the global average is only 39% Cristina Nitulescu, Head of Digital Transformation and IT at Bayer Consumer Health, emphasized in the report that assessing ROI should not only consider the scale of returns but also the speed of returns. As a massive investment, companies must focus on which areas of super automation and scalability can generate returns the fastest.

Reconstructing Capital Flows: C-Level Executives at the Helm, Security Becomes the Biggest Concern

As AI becomes the core of corporate strategy, its funding sources and management models are undergoing profound changes. AI investment is no longer a marginal experimental budget but a strategic task that requires direct involvement from top management. The report found that companies with comprehensive C-level executive sponsorship have a significantly higher likelihood of achieving ROI (78%).

However, large-scale deployment still faces severe challenges. When selecting large language model (LLM) vendors, data privacy and security are listed as the primary considerations for companies, surpassing cost and system integration. More than one-third of surveyed companies view data security as the number one challenge, which also explains why 55% of companies report that AI has significantly improved their security posture—using AI to combat AI security threats is becoming part of the corporate defense system.

Velit Dundar, Vice President of Global E-commerce at Radisson Hotel Group, stated that humanity is entering an era of true symbiosis with machines, where AI will save human time by handling backend tasks, and all of this will ultimately translate into improved financial performance