UBS: Volatility has surged significantly, be cautious of a short-term correction in gold, recently benefiting from the ride of "platinum, silver, and palladium."

瑞銀警告黃金短期回調風險,黃金波動率飆升至俄烏衝突水平,與實際利率關係破裂,削弱其避險吸引力。金銀比降至 65 附近,歷史數據顯示後續表現疲弱。但瑞銀維持長期看多,基於央行持續購金、ETF 穩定流入、多元化需求及金礦股低估等因素支撐。

瑞銀向投資者發出最新的明確信號:雖然長期看多黃金至每盎司 4,750 美元的目標未變,且過去兩個月金價已完成了該目標一半的漲幅,但短期警報已經拉響。

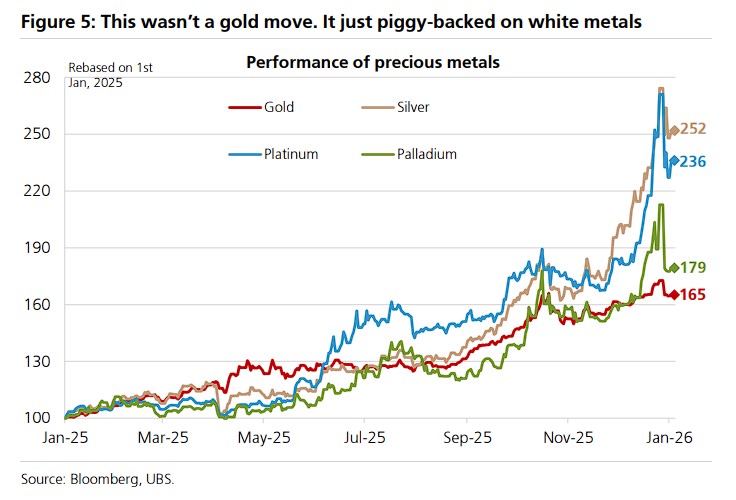

1 月 6 日,據追風交易台消息,瑞銀全球宏觀策略團隊在最新研報中稱,金價上漲的 “成色” 不足,12 月的這波行情並非由黃金自身的獨立利好驅動,而是單純 “搭了白銀、鉑金和鈀金爆發的便車”。

該行特別強調,更令人擔憂的是,黃金的波動性已飆升至俄烏衝突爆發初期的水平,這種高波動性正在削弱黃金在私人投資組合中作為 “壓艙石” 的吸引力。

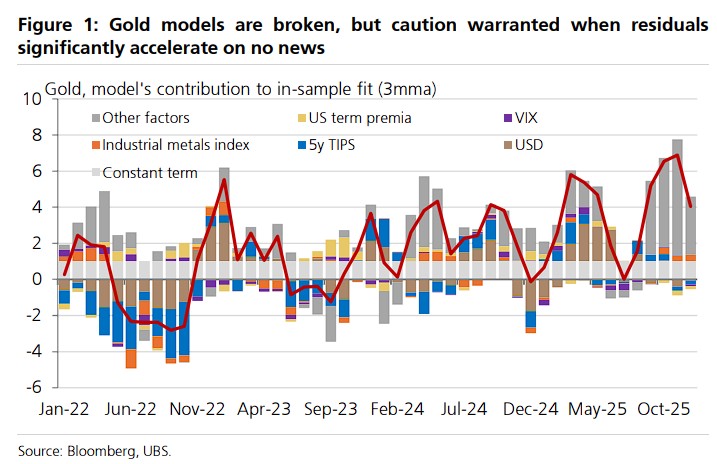

模型顯示,黃金與實際利率的關係已經破裂,在沒有新消息刺激的情況下,殘差顯著加速,這通常是回調的前兆。

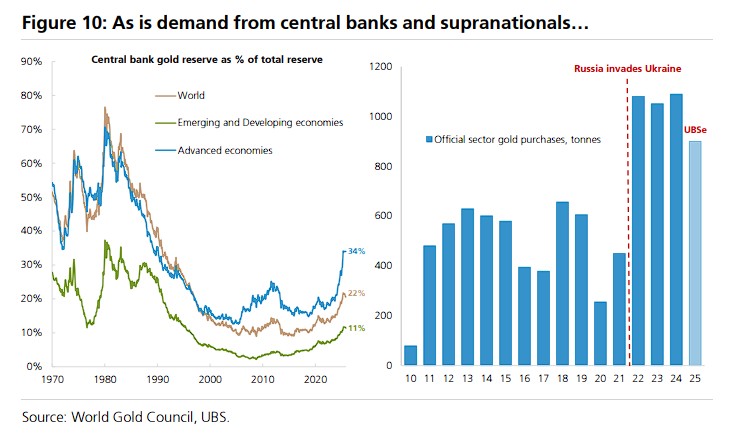

研報指出,儘管如此,鑑於全球央行的買盤、多元化需求、ETF 流入、金礦股的估值滯後等因素,瑞銀維持長期看多觀點不變,目前大跌(跌幅 20% 以上)的條件不具備。

模型失效與波動性飆升:短期最大的敵人

研報指出,自俄烏衝突導致俄羅斯央行儲備被凍結後,傳統的黃金定價模型就已經 “壞了”。

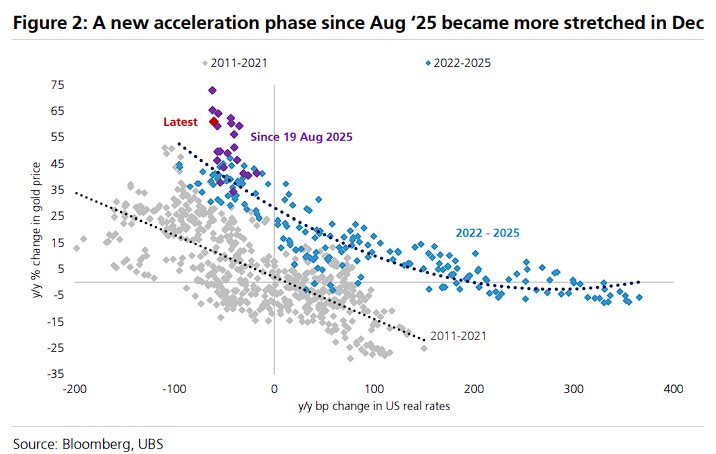

在此之前,黃金與美國實際利率有着極強的負相關性——實際利率每變動 100 個基點,通常會導致金價反向波動約 12-14%。

但自 2025 年 8 月以來,儘管實際利率並未大幅下行,金價卻在沒有任何基本面新聞支撐的情況下加速上漲,這種與基本面的背離在 2025 年 12 月變得尤為極端。

該行稱,對於投資者而言,最大的風險在於波動性。目前的黃金波動率已經回到了俄烏衝突爆發時的水平。通過分析歷史數據,高波動性往往與未來的低迴報相關聯。黃金 3 個月隱含波動率從 21 升至 51。

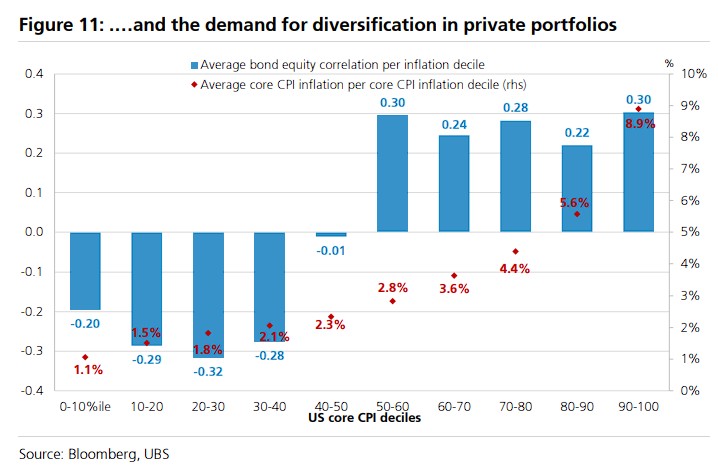

瑞銀指出,黃金上漲的最大潛力來自私人投資組合的配置,但私人投資者厭惡高波動。如果黃金不再僅僅是避險資產,而是變成了高波動資產,其在資產配置中的吸引力將大打折扣。

“搭便車” 行情:真正的主角是白銀與鉑族金屬

對於金價 12 月行情,瑞銀全球宏觀團隊策略師 Joni Teves 在研報中一針見血地指出:“黃金在 12 月的波動中,只不過是搭了白色金屬(White Metals)大幅波動的便車。”

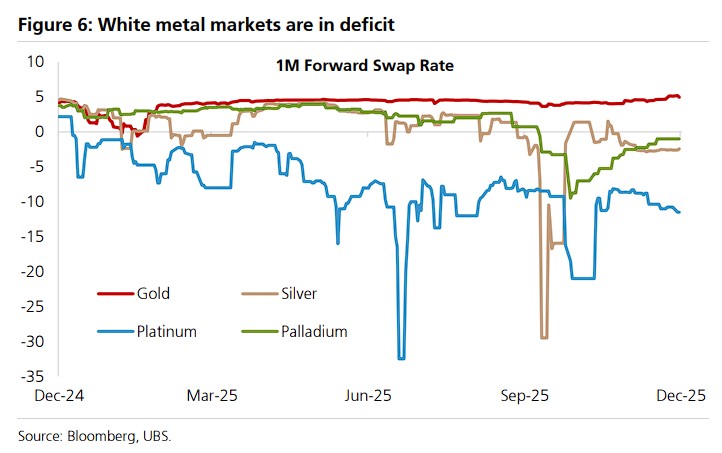

該行認為,真正處於供應短缺、流動性稀缺並爆發上漲的是鉑金、白銀和鈀金。遠期曲線倒掛證明了這些金屬現貨市場的極度短缺。

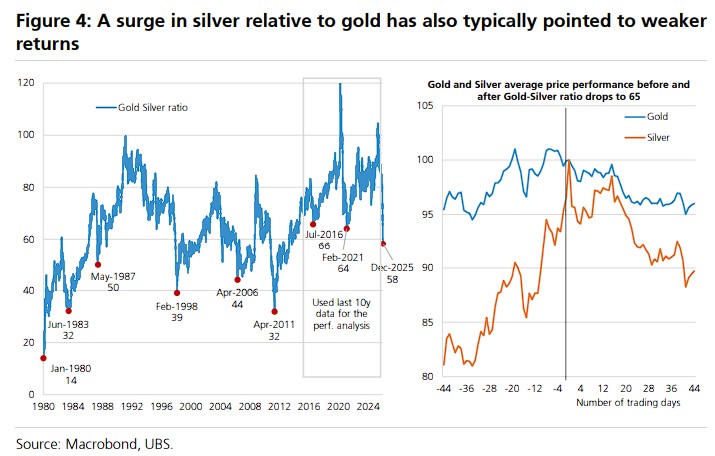

一個關鍵的技術指標是金銀比(Gold-Silver Ratio),目前該比率已降至 65 附近。過去 10 年數據顯示,每當該比率降至 65 附近,隨後 3 個月黃金和白銀的平均表現都較為疲弱。

歷史上類似情況出現在 1980 年 1 月、1983 年 6 月、1987 年 5 月、1998 年 2 月、2006 年 4 月、2011 年 4 月、2016 年 7 月和 2021 年 2 月。

瑞銀還表示,當投資者開始瘋狂追逐白銀這種 “高貝塔” 交易時,往往是市場過熱需要冷靜的信號。

長期邏輯未變:還沒到 “大撤退” 的時候

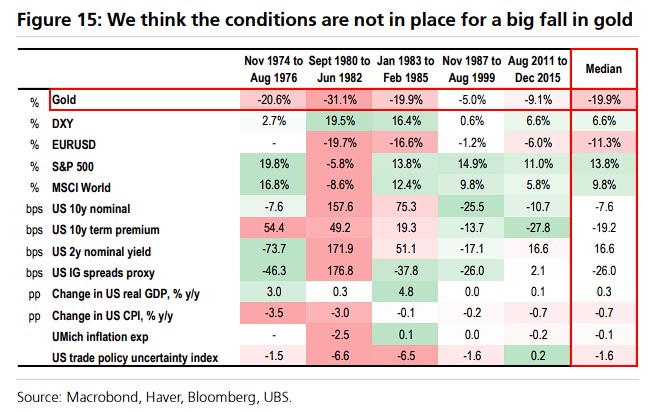

儘管短期面臨回調風險,但是瑞銀認為大幅下跌的條件尚不具備,該行分析了歷史上黃金大幅下跌(接近 20%)時期的共同特徵,發現這些時期通常伴隨股市波動性和信用利差大幅下降、通脹下行、美元大幅升值。

但是瑞銀預計,未來 3-6 個月將出現相反情況,因此維持黃金多頭倉量。同時,瑞銀強調黃金的長期上漲趨勢尚未結束,4750 美元/盎司的目標價依然有效,主要基於以下幾個支撐點:

央行買盤:雖然發達國家央行持有大量黃金,但新興市場央行的黃金儲備僅佔其總儲備的 7-11%,雖然不會像最近這樣瘋狂購買,但會在回調時持續買入,為金價提供支撐。

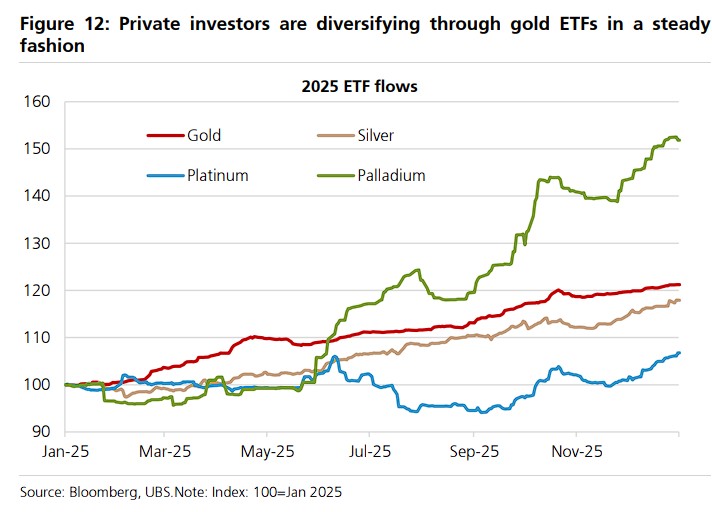

ETF 流入穩定:2025 年黃金 ETF 資金流入保持穩定增長。瑞銀表示,儘管 12 月金價創歷史新高,但並未出現明顯的購買激增,顯示投資者以穩健方式通過黃金 ETF 進行多元化配置。

多元化需求:債券 - 股票相關性數據顯示,當美國核心 CPI 處於較高區間時,相關性轉為正值(最高達 +0.30)。黃金成為少數能夠分散風險的資產。

瑞銀預計債券 - 股票正相關性將持續,直到美國核心通脹可持續降至 2.6% 以下。未來 6 個月瑞銀預計通脹將升至 3.5% 年化水平,這將維持對黃金的需求。

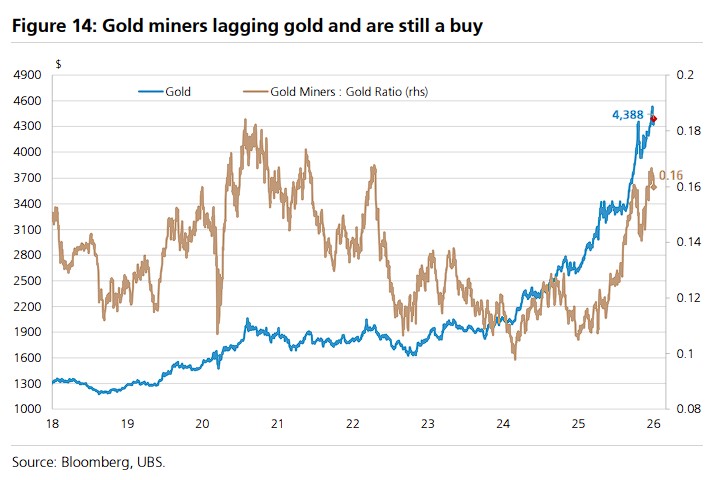

金礦股被嚴重低估:投資者更傾向於持有實物黃金而非礦企股票,導致金礦股表現嚴重滯後。目前金礦股的定價隱含的金價僅為每盎司 3600 美元左右,相比現貨金價存在巨大折價,仍是買入良機。