Keling AI goes overseas for the New Year, JP Morgan: We reiterate that KUAISHOU-W is one of the cheapest AI stocks in the world

由於” 寵物跳舞” 視頻在新年引爆海外市場,可靈 AI 移動端收入暴增。數據顯示,2026 年 1 月可靈 AI 的移動平台日均收入相比 2025 年 12 月暴增 102%,其中韓國市場收入更是激增 13 倍。摩根大通分析師重申對快手的樂觀態度,認為當前估值僅對應 12 倍 2026 年預期市盈率,而 2026-2027 年利潤複合增長率預計達 21%,是全球最被低估的 AI 股之一。

可靈 AI 在 2026 年新年期間爆火,助推快手港股股價連漲兩個交易日,週一更是大漲超 11%。

追風交易台消息,1 月 5 日,摩根大通陳祺的證券研究團隊發表研報,認為快手不僅在核心短視頻業務保持穩健,在生成式 AI 這一關鍵賽道也佔據領先地位。

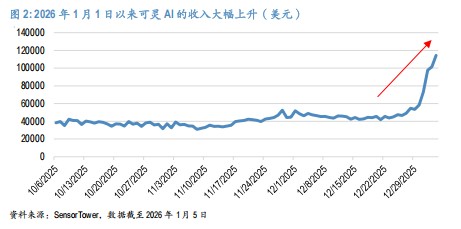

由於"寵物跳舞"視頻在新年引爆海外市場,可靈 AI 收入暴增。根據 Sensor Tower 數據,2026 年 1 月可靈 AI 的移動平台日均收入相比 2025 年 12 月暴增 102%,其中韓國市場收入更是激增 13 倍。

可靈 AI 的強勁表現證明了 AI 視頻生成市場的巨大潛力,而快手 4.16 億的龐大日活用户基數也為其廣告業務提供了堅實支撐。

分析師重申對快手的樂觀態度,維持"增持"評級。研報強調,快手當前估值對應 12 倍 2026 年預期市盈率,而 2026-2027 年利潤複合增長率預計達 21%,是全球最被低估的 AI 股之一。

"寵物跳舞"視頻引爆海外市場,可靈 AI 收入暴增

可靈 AI 在 2026 年新年期間的火爆表現源於其 2.6 版本推出的動作控制功能。

這項創新功能允許用户在短短一分鐘內,基於自己的照片和原始動作視頻(如舞蹈或表情)創建 AI 生成視頻。

(可靈 AI 的 ‘寵物跳舞’AI 視頻)

(可靈 AI 的 ‘寵物跳舞’AI 視頻)

"小狗跳舞"等創意視頻在社交網絡上迅速走紅,推動可靈 AI 成為韓國、土耳其等四個國家下載量最高的應用,並在十個國家躋身前十。

從收入地理分佈來看,過去 90 天可靈 AI 有 31% 的收入來自美國,9% 來自英國,6% 來自韓國,4% 來自俄羅斯和日本。下載量方面,52% 來自印度,8% 來自美國,6% 來自韓國。

值得注意的是,雖然移動平台收入增長顯著,但摩根大通指出,可靈 AI 的大部分收入仍來自 PC 平台的企業和專業消費者,因此預計 2026 年 1 季度實際收入增幅不會如移動平台數據所示那樣極端。

摩根大通預計,在產品更新和企業支出(佔總收入 40%)的支持下,2025 年 4 季度可靈收入將環比增長。對於 2026 年全年,分析師預測可靈收入將同比增長 62%,達到 17 億元。

這一樂觀預期基於全球 AI 視頻生成市場的巨大潛力——摩根大通估算該市場規模達 1400 億美元,短期內 AI 滲透率將達到 20-30%。

可靈還將於 2026 年 1 月 7 日在國際消費電子展(CES)上召開發佈會,預計將進一步提升品牌影響力。

AI 賦能廣告業務,成為 2026 年核心增長動力

除了可靈 AI 的直接收入貢獻,AI 技術對快手核心業務的改造同樣值得關注。

管理層透露,AI 廣告技術改善已對 2025 年 3 季度廣告收入產生 4-5% 的積極影響,2026 年還有更多潛在上升空間。摩根大通認為,AI 將成為 2026 年快手廣告增長的主要動力,體現在三個方面:

首先,主要超大規模雲服務商的 AI 服務(如聊天機器人、垂直 AI 應用等)獲客預算快速增長,而快手 4.16 億的日活躍用户基數使其成為理想的流量入口;

其次,AI 生成漫劇等新娛樂形式興起將帶來新的變現機會;

第三,廣告技術本身的持續改善將提升變現效率。

雖然電商廣告(約佔廣告總收入 50%)在 2026 年面臨市場增長放緩、税收和競爭等不確定性,但外循環廣告(非電商)預計將保持強勁增長態勢。

利潤率提升,盈利能力持續優化

快手將 2025 年資本支出指引從 120 億元上調至 140 億元,主要用於可靈 AI 和廣告技術投入。

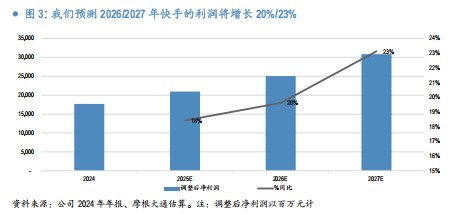

雖然資本支出增加會對短期利潤率產生一定壓力,摩根大通估算增加資本支出對毛利率的影響約為 1%,AI 相關費用(包括研發人員)對利潤率的整體拖累為 1-2%,但分析師仍看好長期利潤改善前景。

摩根大通預測 2026 年快手的調整後淨利潤率將同比上升 1.4 個百分點。2026 年調整後淨利潤預計同比增長 20%,2027 年將繼續增長 23%。這一盈利預測比市場一致預期高出 8%。

摩根大通認為快手在 AI 時代的增長潛力和估值優勢使其成為 2026 年值得重點關注的投資標的。

摩根大通維持快手"增持"評級,目標估值基於 14 倍 2026 年預期市盈率。該行預測快手 2026-2027 年利潤將實現 21% 的年複合增長率。值得關注的是,快手當前股價僅對應 12 倍 2026 年遠期市盈率,分析師認為其估值是最低的個股之一。

分析師強調,快手的投資價值體現在:廣告和電商業務未充分變現,且增速將快於整個廣告市場(預測 2026-2027 年廣告和電商佣金收入年複合增長率為 13%);收入結構向高利潤率業務傾斜將推動利潤率提升;可靈作為頭部 AI 視頻生成模型收入快速增長。