Renminbi and Hong Kong stocks, who is whose "shadow"?

人民幣與港股的正相關關係自 2016 年以來顯著,但近期人民幣快速升值時,港股卻未能上漲,出現背離現象。歷史數據顯示,人民幣升值通常會推動港股上漲,但在最近的升值中,港股反而下跌。分析認為,疲軟的業績表現和市場獲利了結交易限制了港股對人民幣升值的反應。

摘要

2016 年以來,港股與人民幣的正相關關係較為顯著;然而,近期人民幣快速升值,港股卻一度 “踟躕不前”。股匯聯動背後的邏輯、誰是誰的 “影子”、未來可能的演繹?供參考。

一、熱點思考:人民幣與港股,誰是誰的 “影子”?

(一)人民幣匯率與港股的 “羈絆”?正相關關係顯著,但近期明顯背離

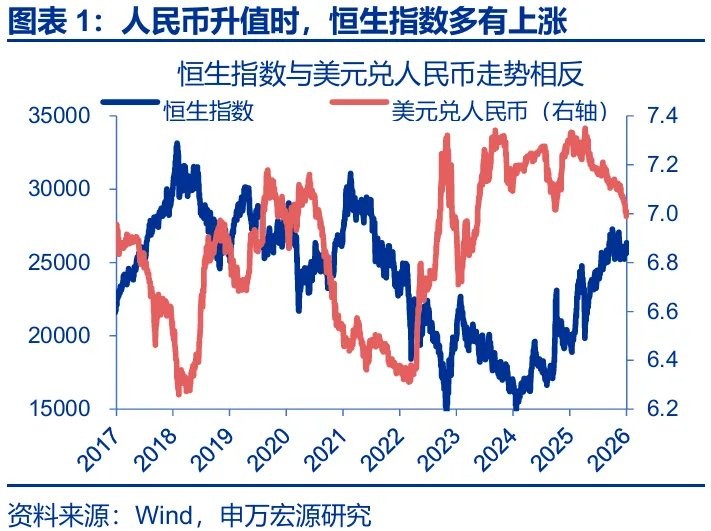

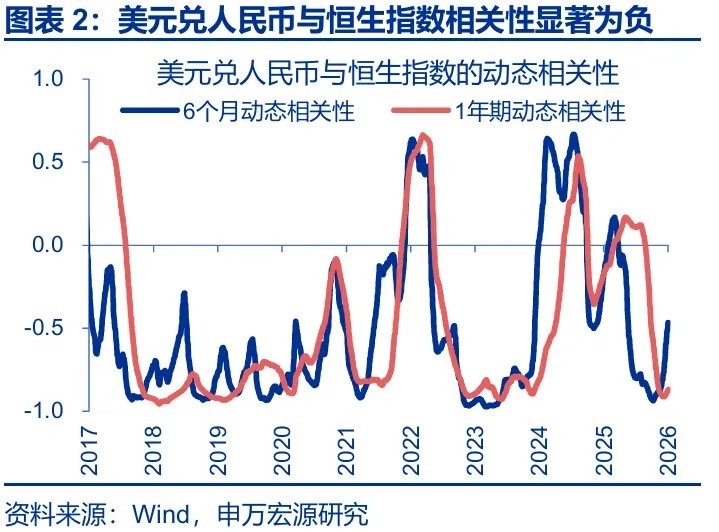

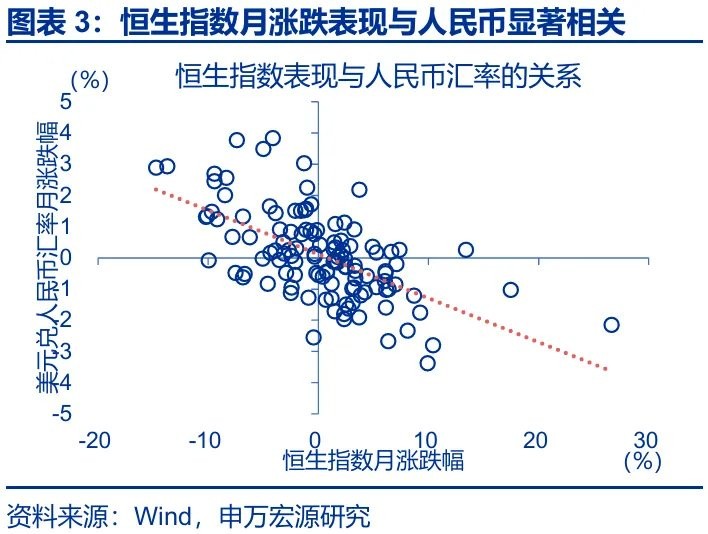

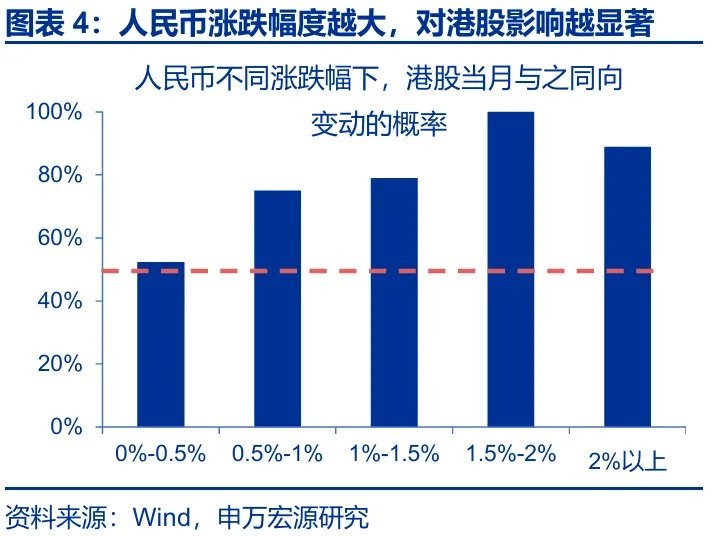

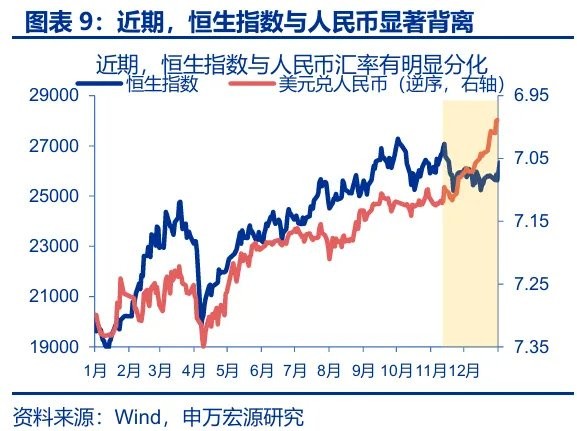

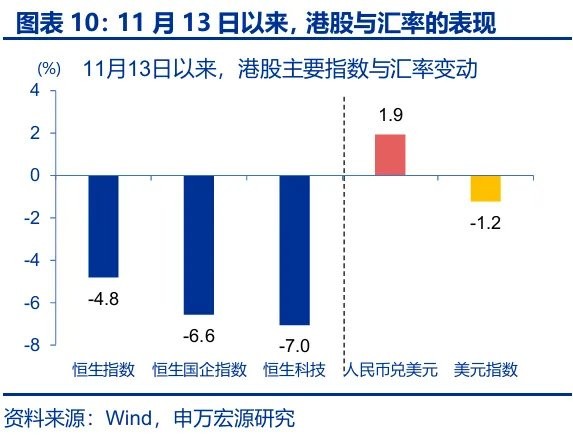

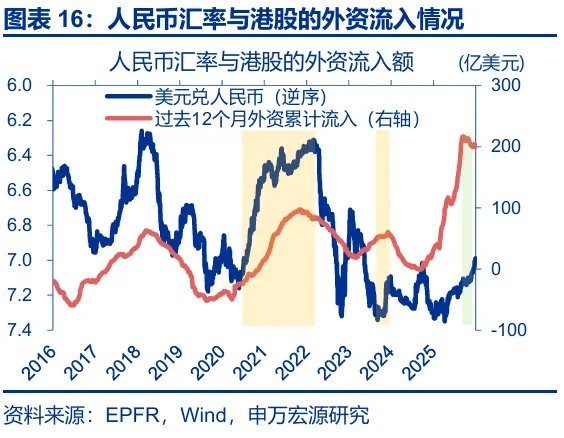

歷史回溯來看,人民幣與港股有着顯著的正相關關係;但近期人民幣快速升值,港股卻仍走弱。2016 年以來,港股與美元兑人民幣的負相關係數高達-0.54;當人民幣月漲幅超過 1.5% 時,恒生指數當月有 93.5% 的概率上漲。然而,11 月 13 日以來,人民幣快速升值 1.9%,恒生指數卻下跌 4.8%、與匯率顯著背離;這是 2016 年以來 12 次人民幣升值中第 3 次出現的股匯背離。

人民幣升值時,港股盈利、資產的重估效應與外資的回流,或是港股上漲的主因。1)貨幣價值重估,當人民幣升值時,港股公司賺取的人民幣利潤折算成港幣時會放大。2)資產重估效應,在港上市地產股等底層資產以人民幣計價,在升值時會面臨價值重估。3)全球配置的比較效應,人民幣匯率走強多指向中國基本面具有一定相對優勢,這會令全球投資者配置更多中國資產。

(二)人民幣升值,港股緣何不漲?疲軟的業績影響下,重估效應、外資配置效應均未顯現

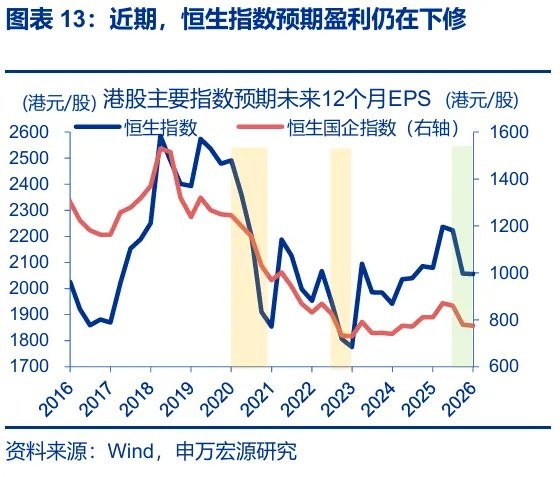

第一,2025 年港股權重板塊較弱的業績表現,導致人民幣升值對港股盈利放大作用較為有限。1)人民幣升值既會放大港股盈利、也會擴大虧損;2025 年四季度以來,恒指未來 12 個月 EPS 持續走低,弱化了換匯因素對港股盈利的 “重估效應”。2)人民幣升值理當利多重資產板塊,但近期房價、油價仍未企穩,反而成為了港股的拖累。“資產重估” 邏輯也未對港股有利。

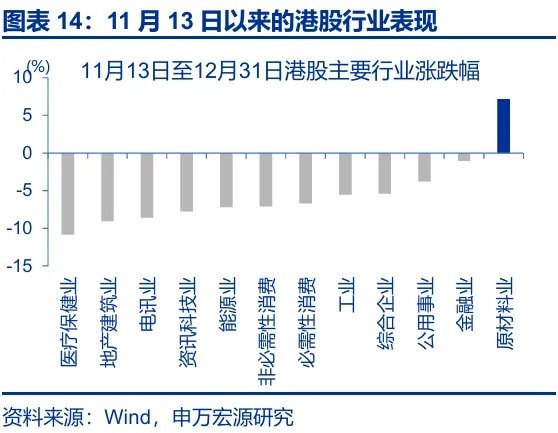

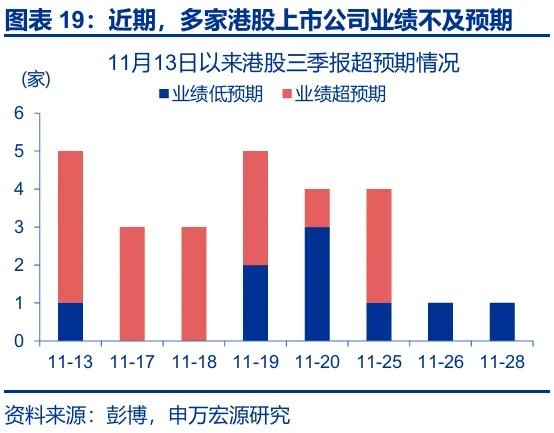

第二,港股市場或以獲利了結交易為主,市場整體交投清淡限制了港股對利好因素的即時反饋。1)本輪匯率升值更多由外因驅動而非基本面改善,這弱化了外資的 “配置效應”。2)歷史回溯來看,2011 年以來恒生指數 12 月的平均換手率為 4.4 次、為全年各月份最低。3)11 月 13 日以來,多家互聯網平台企業等三季報業績不及預期,一定程度上強化了獲利了結交易的慣性。

(三)未來港股與人民幣關係可能的演繹?聯動或將回歸,港股有望與人民幣共振

隨着港股盈利的改善與外資 “配置效應” 的恢復,港股與美元的負相關關係或將重新迴歸。1)業績表現是決定港股能否受益匯率升值 “重估效應” 的關鍵,而當下港股 “下一財年盈利增速向上 + 當前財年盈利預期向下” 的組合往往是盈利預期改善的前瞻信號。2)匯率升值的配置效應有望恢復:PPI 的回升有望繼續吸引外資流入,居民存款再配置效應對港股也有溢出效應。

向後看,人民幣升值有望再度成為港股上漲的助力之一。短期來看,年底獲利了結交易結束後,港股年初的一月效應往往較為強勁。展望全年,隨着 “待結匯” 邏輯的演繹、名義 GDP 的修復、中美貿易摩擦的邊際降温,人民幣韌性有望延續。伴隨着匯率升值 “重估效應”、“配置效應” 的逐步修復,人民幣升值有望成為宏觀層面港股上漲的又一助力。

報告正文

2016 年以來,港股與人民幣的正相關關係較為顯著;然而,近期人民幣快速升值,港股卻一度大跌。股匯聯動的背後、誰是誰的 “影子”、未來可能的演繹?供參考

一、熱點思考:人民幣與港股,誰是誰的 “影子”?

(一)人民幣匯率與港股的 “羈絆”?正相關關係顯著,但近期明顯背離

歷史回溯來看,人民幣匯率與港股有着顯著的正相關關係。1)2016 年以來,港股與美元兑人民幣的負相關係數高達-0.54;2025 年 11 月 13 日,美元兑人民幣與恒生指數 6 個月、1 年動態相關性一度均走低至-0.88。2)2016 年以來,當人民幣月漲(跌)幅超過 1.5% 時,恒生指數當月有 93.5% 的概率上漲(下跌);當人民幣月漲(跌)幅位於 1-1.5% 時,恒生指數當月也有 78.9% 的概率上漲(下跌)。

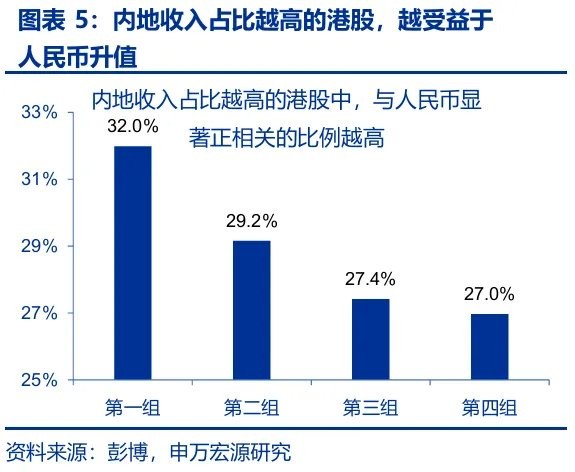

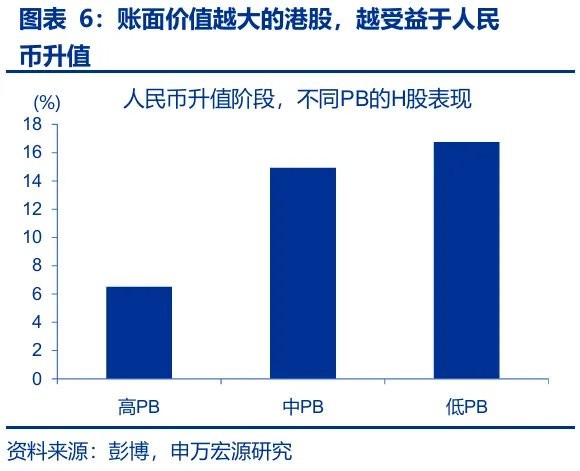

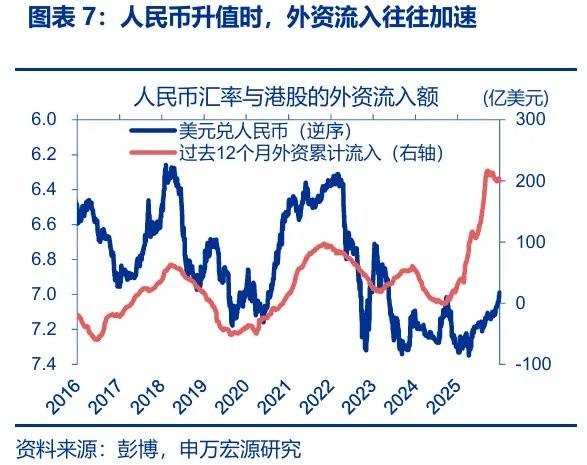

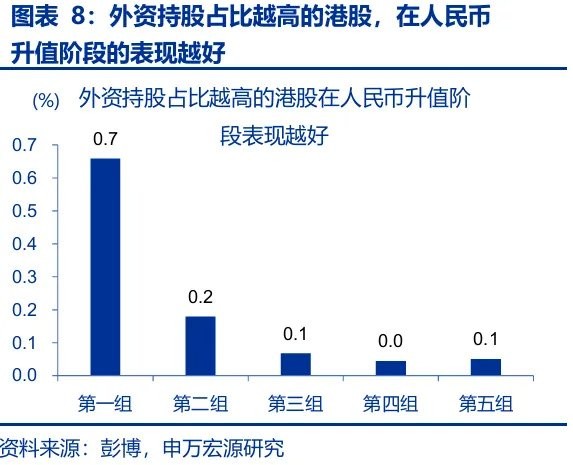

人民幣升值時,港股盈利、資產的重估效應與外資的回流,或是港股上漲的主因。1)貨幣價值重估效應,內地公司是港股重要構成,這類公司盈利由人民幣計價,當人民幣升值時,公司賺取的人民幣利潤折算港幣時數值會放大。2)資產重估效應,許多在港上市的地產股等,其底層資產以人民幣計價,在升值時會面臨價值重估。因而,賬面價值越大的上市港股公司(PB 越低),在匯率升值時表現越突出。3)全球配置的比較效應,人民幣匯率走強多指向中國基本面具有一定相對優勢,這會令全球投資者配置更多中國資產。 因此,外資青睞的個股在升值時通常表現更突出。

[1] 為驗證這一邏輯,我們將所有港股按照中國內地收入佔比由高到低劃分為 4 組,海外佔比高的第四組中,僅 27.0% 的公司股價與人民幣顯著正相關,而內地收入佔比高的第一組則高達 32.0%。

[2] 由於全球投資者是出於基本面相對強弱的邏輯來進行全球資產配置,但常用的宏觀指標更多用來進行縱向比較,橫向間相對強弱的指標數量並不多,匯率是其中較為常用的指標之一。

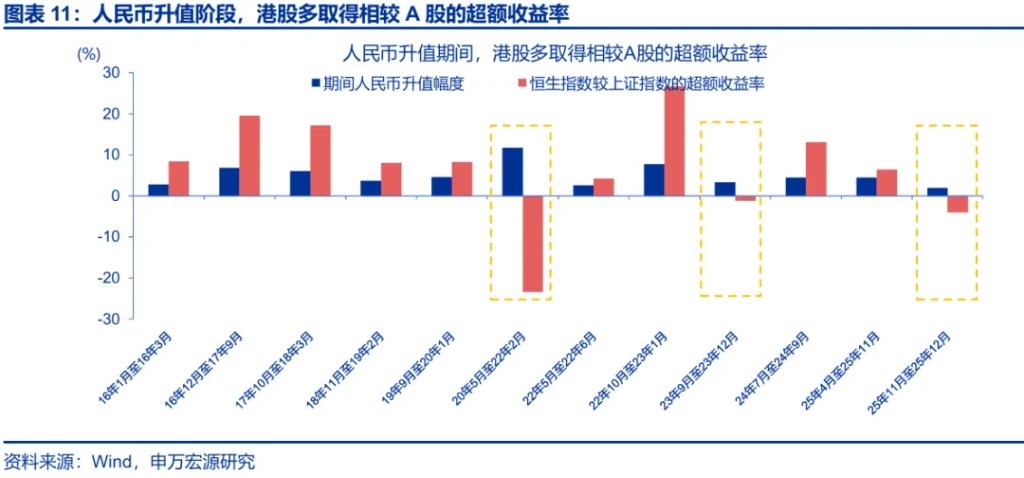

然而,近期人民幣快速走強,港股卻仍在走弱,二者間出現明顯背離。11 月 13 日以來,在美元走弱、結匯潮緩緩開啓的背景下,人民幣匯率大幅走強;截至 12 月 31 日,美元指數快速回落 1.2%,人民幣兑美元升值 1.9%;但港股卻並未受到美元回落的提振,恒生指數、恒生中國企業指數、恒生科技指數分別下跌 4.8%、6.6%、7.0%,與人民幣匯率表現顯著背離。這一現象在歷史上並不多見,2016 年以來的 12 次人民幣升值階段,僅 2020 年 5 月至 2022 年 2 月、2023 年 9 月至 12 月以及本輪,出現了人民幣匯率與港股走勢的背離,其他 9 次中港股均顯著跑贏 A 股。

(二)人民幣升值,港股緣何不漲?疲軟的業績影響下,重估效應、外資配置效應均未顯現

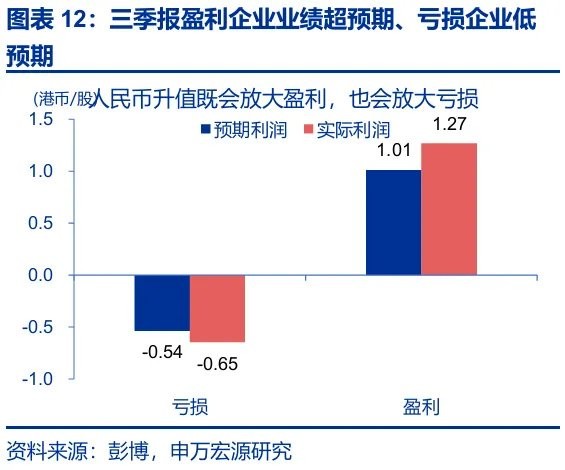

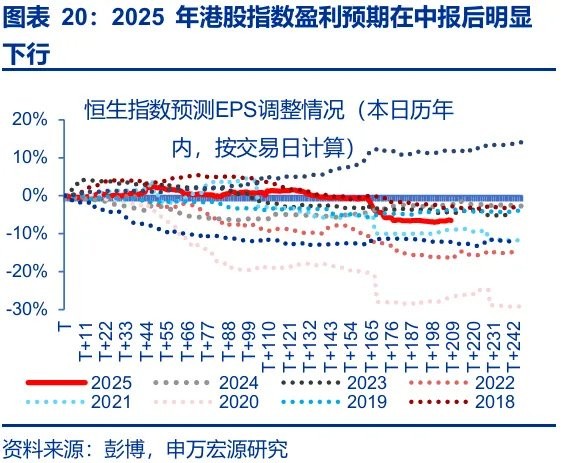

第一,2025 年港股權重板塊較弱的業績表現,導致人民幣升值對港股盈利的放大作用較為有限。1)匯率對內地經營、港股上市公司的業績影響是一把雙刃劍,人民幣升值既會放大盈利、也會擴大虧損,這一效應在港股三季報中也有體現:三季報港股盈利公司業績多超預期、虧損公司業績多低預期。2025 年四季度以來,恒生指數、恒生國企指數的未來 12 個月 EPS 持續走低,或弱化了換匯因素對人民幣盈利的放大。 2)分行業來看,地產、能源等重資產行業較弱表現也是港股的重要拖累;人民幣升值理當利多重資產板塊,但近期房價、油價仍未企穩,反而成為了港股的拖累。

[3] 歷史回溯來看,人民幣升值但港股不漲的其他兩個階段——2020 年 5 月至 2022 年 2 月、2023 年 9 月至 12 月,也都出現了相似的情況。

第二,港股 12 月交投平淡的季節性、海外投資者的獲利了結、部分港股上市公司三季報不及預期等也有拖累。1)本輪匯率升值更多由外因驅動而非基本面改善,且時值年終,部分海外投資者的獲利了結弱化了外資的 “配置效應”。2)歷史回溯來看,2011 年以來,恒生指數 12 月的平均換手率為 4.4 次、為全年各月份最低。3)11 月 13 日以來,多家互聯網平台企業、車企等三季報業績不及預期,對市場情緒也有一定影響,一定程度上強化了獲利了結交易的慣性。整體而言,四季度港股市場或以獲利了結交易為主,市場整體交投清淡限制了港股對利好因素的即時反饋。

(三)未來港股與人民幣關係可能的演繹?聯動或將回歸,港股有望與人民幣共振

一方面,業績表現是決定港股能否受益匯率升值 “重估效應” 的關鍵;申萬策略此前發佈的《從彼岸,到此岸——2026 年港股和海外中資股投資策略》中提到,2026 年港股盈利有望出現邊際改善。

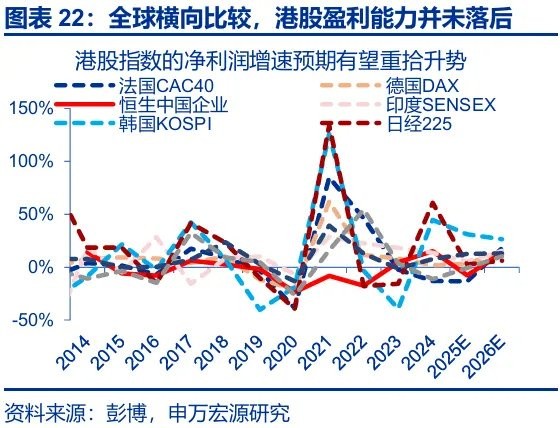

1)表面上,2025 年港股指數層面的盈利預期在中報後明顯下行,但其背後主要由部分大型平台類企業拖累,且這一趨勢在中報之後並未出現線性下滑。2)若以盈利預期修正寬度來看,以我們追蹤的五百餘家港股公司樣本股來統計,當前財年盈利預期上修公司佔比自今年年初以來處於明顯的上行趨勢中,越來越多的公司盈利出現了改善的跡象。3)歷史回溯來看,“下一財年盈利同比增速向上 + 當前財年盈利預期向下” 這一組合往往是盈利預期改善的前瞻信號 。疊加 2026 年相關權重板塊的盈利有望在低基數效應下明顯修復,盈利有望成為 2026 年港股市場上行的重要驅動力。

[4] 背後的邏輯是,往往在新技術新應用推廣前夕,相關行業需要加大 Capex 支出從而壓低當年盈利預期,但未來的盈利預期有望受到新技術的提振而上行,因此觀察市場當前財年和下一財年盈利預期的增速缺口有助於判斷投資者對盈利趨勢的看法。

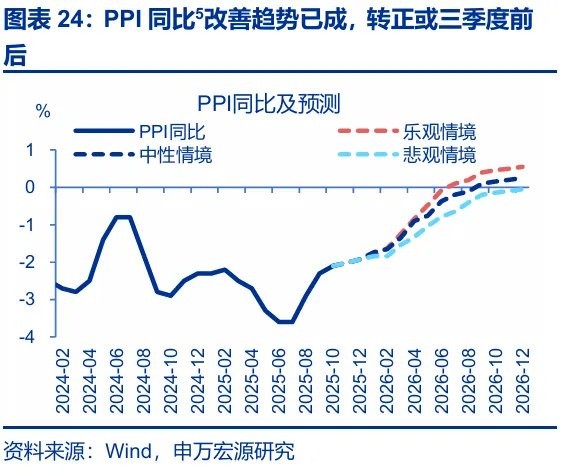

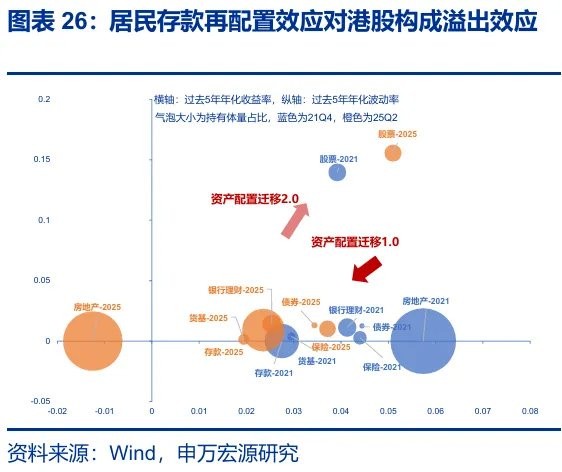

另一方面,人民幣匯率升值對港股的 “配置效應” 也有望恢復:PPI 的回升有望繼續吸引外資流入,居民存款再配置效應對港股也有溢出效應。1)在 “反內卷” 政策加碼下,供給收縮的預期升温提振大宗商品價格,另一方面產能利用率的拖累在產能出清的影響下在明年亦有望逐步緩解,中國 PPI 在明年有望維持當前的改善態勢。歷史回溯來看,當 PPI 出現改善信號時,外資對中國資產的態度也往往出現明顯轉折。2)本輪潛在牛市,居民存款再配置有很大空間;多數情況下,內地投資者往往在 A 股賺錢效應明顯擴散後,將戰場轉移至港股。

[5] 中性情境下,2026 年國際油價中樞或為 65 美元/桶,銅價保持高位,國內鋼價低位震盪,國內煤價或有所上行;中下游方面,雖然民企佔比較高、反內卷政策推進速率或偏慢,但也有望更穩健的推動中下游價格逐步走出通縮;預計 PPI 同比在明年 9 月轉正。樂觀情境下,若國際油價中樞為 75 美元/桶,國內反內捲進度推進較快,PPI 同比轉正時點或在明年 7 月。悲觀情景下,國際油價中樞回落至 55 美元/桶,國內反內卷推進進度較慢,PPI 同比轉正時點或在 2027 年初。

向後看,隨着匯率與港股關係的逐步修復,2026 年,人民幣升值有望再度成為港股上漲的助力之一。短期來看,年底獲利了結交易結束後,港股年初的一月效應往往較為強勁。展望全年,隨着 “待結匯” 邏輯的演繹、名義 GDP 的修復、中美貿易摩擦的邊際降温,人民幣的韌性有望延續。伴隨着匯率升值 “重估效應”、“配置效應” 的逐步修復,如果人民幣匯率與港股重回正相關關係,人民幣升值有望成為宏觀層面港股上漲的又一助力。

[6] 更多分析可參考報告《人民幣升值,“結匯潮” 的助推?》。

通過研究,本文發現:

1、歷史回溯來看,人民幣與港股有着顯著的正相關關係。人民幣升值時,港股盈利、資產的被動放大與外資的回流,或是港股上漲的主因。1)貨幣價值重估效應,當人民幣升值時,港股公司賺取的人民幣利潤折算成港幣時會放大。2)資產重估效應,在港上市的地產股等,其底層資產以人民幣計價,在升值時會面臨價值重估。3)全球配置的比較效應,人民幣匯率走強多指向中國基本面具有一定相對優勢,這會令全球投資者配置更多中國資產。但近期人民幣快速升值,港股卻仍走弱。

2、疲軟的業績影響下,重估效應、外資配置效應均未顯現,或是人民幣升值但港股不漲的原因。一方面,2025 年港股權重板塊較弱的業績表現,導致人民幣升值對港股盈利放大作用較為有限。另一方面,12 月港股市場或以獲利了結交易為主,市場整體交投清淡限制了港股對利好因素的即時反饋。二者並非互為 “影子”,而是國內基本面在不同資產維度的 “映射”。

3、隨着港股盈利的改善與外資 “配置效應” 的恢復,港股與美元的負相關關係或將重新迴歸。1)業績表現是決定港股能否受益匯率升值 “重估效應” 的關鍵,而當下港股 “下一財年盈利增速向上 + 當前財年盈利預期向下” 的組合往往是盈利預期改善的前瞻信號。2)匯率升值的配置效應有望恢復:PPI 的回升有望繼續吸引外資流入,居民存款再配置效應對港股也有溢出效應。

4、向後看,人民幣升值有望再度成為港股上漲的助力之一。短期來看,年底獲利了結交易結束後,港股年初的一月效應往往較為強勁。展望全年,隨着 “待結匯” 邏輯的演繹、名義 GDP 的修復、中美貿易摩擦的邊際降温,人民幣韌性有望延續。伴隨着匯率升值 “重估效應”、“配置效應” 的逐步修復,人民幣升值有望成為宏觀層面港股上漲的又一助力。

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。