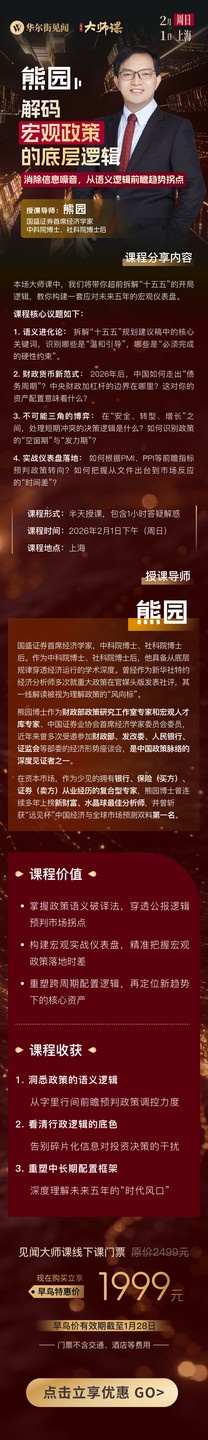

Understanding the "14th Five-Year Plan": Chief Economist Xiong Yuan of GUOSHENG SECURITIES takes you to decode the underlying logic of macro policies, from the semantic logic of policies to the forward-looking trend inflection points

2026 年將成為中國經濟的重要轉折點,標誌着 “十五五” 規劃的開始。隨着外部摩擦和全球產業鏈重構,舊有的貿易與增長邏輯失效。歷史上每個五年計劃都伴隨財富邏輯重構,未來的政策將從 “效率優先” 轉向 “安全優先”。投資者需適應新的經濟環境,傳統的 GDP 增速和降息策略已不再有效。

2026 年,註定將成為中國經濟史上一個極具分水嶺意義的年份。

隨着外部摩擦的常態化與全球產業鏈的深度重構,舊有的貿易與增長邏輯正在失效。國內正式步入 “十五五” 規劃的開局之年,這不僅是一個五年週期的更迭,更是中國經濟從 “規模紅利” 徹底轉向 “系統安全與質效革命” 的劇變起點。

歷史的鏡像:五年一度的 “系統升級”與財富重組。回望過去二十五年,每一個五年計劃的轉折,都伴隨着財富邏輯的重構。如果你看不懂政策語言的迭代,就會在時代的變遷中錯失座標:

- “十五” 期間(2001-2005)入世紅利與 “世界工廠”:隨着中國加入 WTO,城鎮化大幕拉開,基建、地產與外貿成為了財富的主軸。

- “十一五” 期間(2006-2010)高速增長與科學發展:“四萬億” 讓市場見證了宏觀政策調控的巨大威力,金融、地產與重工業進入了狂歡的巔峯。

- “十二五” 期間(2011-2015)轉型陣痛與 “戰略新興”:互聯網 +、移動支付、消費升級開始取代傳統制造。

- “十三五” 期間(2016-2020)供給側改革與 “去槓桿”: 政策邏輯發生了底層質變。“去產能、去槓桿” 開始重塑產業格局。

- “十四五” 期間(2021-2025)安全與 “新質生產力”:從 “碳中和” 到 “半導體自主可控”,宏觀邏輯從 “效率優先” 轉向了 “安全優先”。

2026:開啓 “十五五”,為什麼舊劇本徹底失效了?

當 “新質生產力” 從願景變為量化指標,當 “人口老齡化” 從遠期風險變為即期約束,當 “中央加槓桿” 與 “貨幣錨點轉向” 開始嘗試前所未有的突破——投資者發現,過去盯着 GDP 增速、猜降準降息的 “老套路”,在 “十五五” 這個複雜的非線性系統面前徹底失靈。

今天的焦慮,本質上是 “邏輯塌陷”:

- 你讀到了政策強調 “穩預期”,卻不知道它將如何落地為具體的流動性支撐;

- 你聽到了 “逆週期調節”,卻看不透地方債重組與財政擴張背後的博弈;

- 你看到了 “十五五” 的宏偉藍圖,卻無法將那些嚴謹的行政語言,落地到實際的資產配置上。

而即將開啓的 “十五五”,宏觀經濟政策所針對的局勢正變得前所未有複雜,政策落地的節奏與影響也越來越難看清。 當中央加槓桿、貨幣錨點轉軌、人口結構拐點與全球政經重組疊加,你手中的 “舊地圖” 已無法指引 “新世界”——真正的危險,不在於政策的缺位,而在於你用“舊時代的地圖”,尋找 “新世界的出口”。

為什麼要跟熊園博士一起解讀 “十五五”?

熊園,國盛證券首席經濟學家。他不僅是宏觀數據的拆解者,更是中國政策語義學的 “破譯專家”。 作為中科院博士、社科院博士後,他具備從底層規律穿透經濟運行的學術深度。更重要的是,作為財政部宏觀人才庫專家、中國證券業協會首席經濟學家委員會委員,他曾多次受邀參加財政部、發改委、人民銀行、證監會等部委的經濟座談會。他不僅是政策脈絡的深度見證者,更是頂層設計的參與者。

他曾多次就重大政策在官媒頭版發表社評,其一線解讀被視為理解政策的 “風向標”。而在資本市場,他更是 “實戰王者”,連續多年入選新財富、水晶球最佳分析師,並曾斬獲 “遠見杯” 中國經濟與全球市場預測雙料第一名。

他具備獨一無二的 “雙向翻譯”能力,深諳 “十五五”規劃的邏輯底色: 從工行總行的實務經歷到部委智囊建言,熊園博士最擅長的,是穿透行政公報的表象,直達決策層的底層思維,實現從政策到投資的精準轉化:

他能從文件字裏行間的 “段落微調” 中,敏鋭捕捉中央在 “保增長” 與 “防風險” 天平上的微妙傾斜,識別政策語義的強弱信號。

他不僅能看透願景,更能將虛無縹緲的宏觀目標,具象化為 PMI、社融結構、匯率波動等一系列可觀測、可對沖的投資指標。

他曾親歷數個五年計劃的週期更迭,深知在每一次 “系統升級” 的關鍵時刻,哪些舊邏輯必須被拋棄,哪些新信號預示着未來五年的 “長坡厚雪”。

本門課程不是教你去 “預測”,而是去 “理解”。

2 月 1 日在上海舉行的本場大師課中,熊園博士將帶你超前拆解 “十五五” 的開局邏輯,教你構建一套應對未來五年的宏觀儀表盤。

我們將深度探討:

- 語義進化論: 拆解 “十五五” 規劃建議稿中的核心關鍵詞,識別哪些是 “温和引導”,哪些是 “必須完成的硬性約束”。

- 財政貨幣新範式: 2026 年後,中國如何走出 “債務週期”?中央加槓桿的邊界在哪裏?這對你的資產配置意味着什麼?

- 不可能三角的博弈: 在 “安全、轉型、增長” 之間,高層如何處理短期衝突?如何識別政策的 “空窗期” 與 “發力期”?

- 實戰儀表盤落地: 如何根據 PMI 等前瞻指標預判政策轉向?如何把握從文件出台到市場反應的 “時間差”?

“十五五” 不是一個遙遠的數字,它是每一個投資者未來五年必須面對的生存環境。真正成熟的投資者,不會在風暴來臨時才尋找避風港,而是在氣候改變的那一刻,就已做好了準備。

2026 年的大門即將開啓。在這個充滿噪音與誤讀的年代,讓我們跟着熊園博士,重回邏輯的基石,在繁榮的表象下看清市場的真相,在政策的字裏行間發現未來的中國經濟發展脈絡。

點擊下方海報,立刻報名參加本門大師課,目前報名可享早鳥特惠。

温馨提示

本場課程包含一個小時的互動問答,學員可以就自己最關心的問題與熊園博士展開討論,面對面答疑解惑。對本場課程感興趣的朋友,可點擊上圖報名。您想了解更多課程詳情的話,也歡迎掃碼下方圖片,諮詢課程助手。

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。