Musk releases "mass production timeline," brain-computer interfaces collectively hit the limit up, is the commercialization turning point here?

With Musk clearly stating the timeline for Neuralink devices to start mass production in 2026, the brain-computer interface industry may be approaching a critical turning point from "medical trials" to "consumer products." The market is reassessing the broad application prospects of brain-computer interfaces in areas such as medical rehabilitation, AI connectivity, and humanoid robot collaboration. Morgan Stanley predicts that by 2045, the entire market size will soar to $320 billion

With Elon Musk clearly providing a timeline for the mass production of brain-machine interface devices, this cutting-edge field is accelerating its transition from scientific exploration in laboratories to commercial implementation, and the industry may be approaching a critical turning point from "medical trial products" to "consumer products."

On the first trading day of A-shares in 2026, the brain-machine interface sector performed strongly. BeiYikang hit the daily limit of 30%, while Sanbo Neuroscience, Xiangyu Medical, Meihao Medical, Aipeng Medical, Chengyitong, VISHEE, and several other stocks hit the daily limit of 20%, indicating that market funds have high expectations for the commercialization prospects of brain-machine interfaces.

The direct trigger for this round of market activity was the latest developments from Neuralink. On January 1st local time, Musk announced on social media that Neuralink would start large-scale production of brain-machine interface devices in 2026 and advance an almost fully automated surgical plan. Meanwhile, Merge Labs, supported by OpenAI CEO Sam Altman, is spinning off independently to focus on a new technological route that utilizes ultrasound to read brain activity. The actions of these two tech giants indicate that brain-machine interfaces are moving from a singular scientific experiment to a diversified commercial race.

This series of developments not only validates the feasibility of the technology but also prompts a reassessment of the broad application prospects of brain-machine interfaces in fields such as medical rehabilitation, AI connectivity, and humanoid robot collaboration. Multiple brokerages have pointed out that, driven by both technological breakthroughs and policy support, the industry is in a high-growth accumulation phase, and investors need to closely monitor leading companies with core technologies and compliance barriers, as well as the genuine market demand that can "distinguish the true from the false."

Mass Production Expectations Realized, Surgical Plan Revolutionized

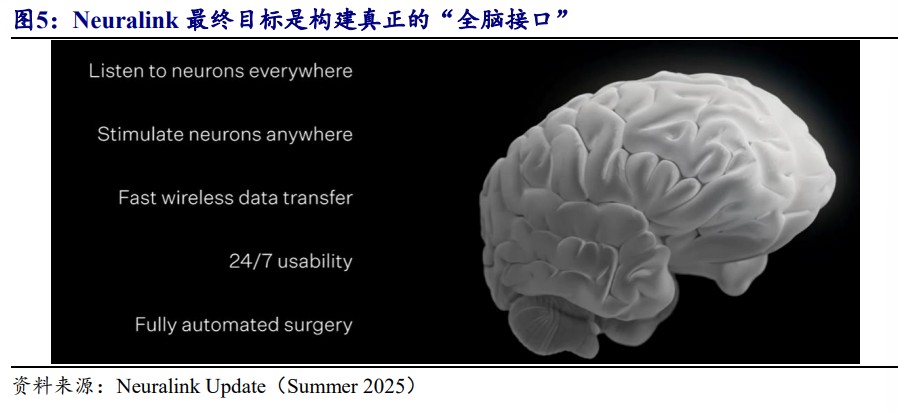

In its latest research report, KaiYuan Securities pointed out that Neuralink's expectations for large-scale production and automated surgical plans have dual milestone significance. This not only marks the transition of brain-machine interfaces from "medical trial tools" to "widely applicable products," but also lays the foundation for future collaborative applications with Tesla's Optimus humanoid robots.  The technological evolution path of Neuralink is already very clear. Currently, 12 people worldwide have implanted Neuralink devices, with a cumulative usage time exceeding 15,000 hours. The first implant recipient, Noland Arbaugh, can now type and play games using only his thoughts. According to Neuralink's plan, by 2026, the number of electrode channels will increase to 3,000, and blind vision clinical tests will be conducted; by 2028, the goal is to exceed 25,000 electrode channels per device, achieving full brain area connectivity

Morgan Stanley's Adam Jonas reported that Neuralink is currently valued at approximately $9 billion, with its commercialization process significantly accelerating. The report predicts that the potential total market size for brain-computer interface implant devices in the U.S. alone could reach $80 billion by 2035, primarily covering treatments for neurological diseases such as amyotrophic lateral sclerosis and stroke.

The technological evolution path of Neuralink is already very clear. Currently, 12 people worldwide have implanted Neuralink devices, with a cumulative usage time exceeding 15,000 hours. The first implant recipient, Noland Arbaugh, can now type and play games using only his thoughts. According to Neuralink's plan, by 2026, the number of electrode channels will increase to 3,000, and blind vision clinical tests will be conducted; by 2028, the goal is to exceed 25,000 electrode channels per device, achieving full brain area connectivity

Morgan Stanley's Adam Jonas reported that Neuralink is currently valued at approximately $9 billion, with its commercialization process significantly accelerating. The report predicts that the potential total market size for brain-computer interface implant devices in the U.S. alone could reach $80 billion by 2035, primarily covering treatments for neurological diseases such as amyotrophic lateral sclerosis and stroke.

U.S.-China Competition: A Diverse Technological Landscape

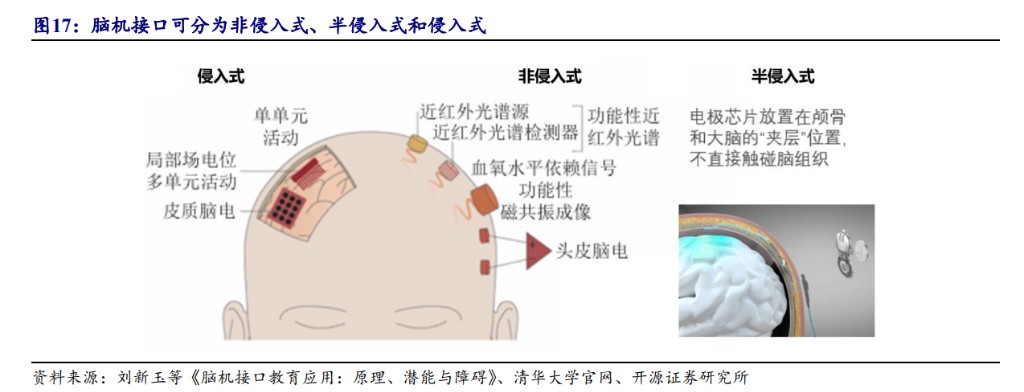

Currently, the global brain-computer interface field is highly competitive, showcasing a differentiated technological competition landscape. From the perspective of clinical and approval status, both the U.S. and China are in the clinical trial stage for invasive technologies, with the U.S. making faster progress in semi-invasive fields, while domestic companies are flourishing in non-invasive areas.

Domestic companies have made significant progress in specific fields. The domestic invasive brain-computer interface company Brain Tiger Technology has independently developed a 256-channel high-throughput implantable flexible brain-computer interface, marking China's achievement of world-leading status in this field. In the non-invasive sector, Qiang Brain Technology has launched a smart sleep aid aimed at consumers, while companies like Chengyitong and Xiangyu Medical plan to apply their technologies in anesthesia monitoring and medical rehabilitation.

CITIC Construction Investment believes that there is no superiority or inferiority between non-invasive and invasive brain-computer interfaces; the key lies in discovering "true brain-computer interfaces" that have national policy support and real demand. China's research progress in brain-computer interface technology is relatively leading globally, and its manufacturing industry chain advantages are prominent, which is expected to cultivate globally leading brain-computer interface companies.

Human-Machine Collaboration: From Medical Necessity to the Ultimate Form of AI

In addition to the medical necessity, brain-computer interfaces are seen as the key to unlocking the ultimate form of human-machine collaboration.

Open Source Securities analysis suggests that the brain-computer interface industry is penetrating from medical necessity into various fields such as AI applications and robotics. Musk has explicitly stated that with the upgrade of Neuralink technology, it is expected to remotely control the Optimus robot through thought, constructing the ultimate ecosystem of "human brain + robot."

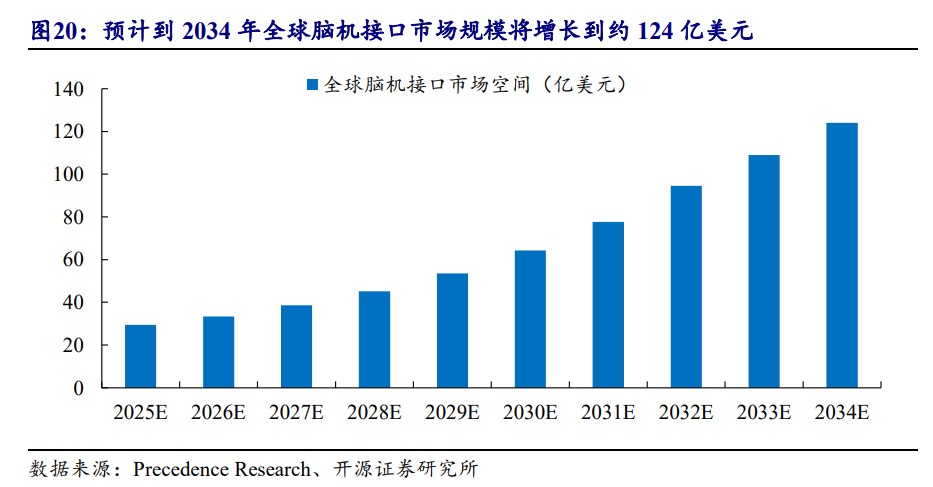

According to Precedence Research data, the global brain-computer interface market size is expected to grow to approximately $12.4 billion by 2034, with a compound annual growth rate of 17% from 2025 to 2034. Morgan Stanley further predicts that by 2045, the market size will surge to $320 billion.

CITIC Construction Investment pointed out that brain-computer interfaces are both medical investments and technology investments. In the short term, motion decoding products are expected to be commercialized first in rehabilitation for paralysis and amyotrophic lateral sclerosis; in the long term, if they can enhance human capabilities and integrate with AI and robotics, it will open up a trillion-level market space.

CITIC Construction Investment pointed out that brain-computer interfaces are both medical investments and technology investments. In the short term, motion decoding products are expected to be commercialized first in rehabilitation for paralysis and amyotrophic lateral sclerosis; in the long term, if they can enhance human capabilities and integrate with AI and robotics, it will open up a trillion-level market space.

Policy Support and Trillion Market Prospects

The continuous strengthening of policies provides solid support for the development of the industry.

Brain-computer interfaces have been included in China's "14th Five-Year Plan" as a clearly laid-out future industry. The special implementation opinions for 2025 set goals for core technological breakthroughs by 2027 and for the industry to rank among the world's top by 2030. In addition, the National Healthcare Security Administration has issued documents requiring the proper declaration and coding of innovative medical consumables such as brain-computer interfaces, solving the "last mile" problem for products entering hospitals; the industry standard "Terminology for Medical Devices Using Brain-Computer Interface Technology" issued by the National Medical Products Administration will also be officially implemented in 2026.

Tianfeng Securities suggests that investors should focus on companies that have a "policy + equipment + algorithm + clinical" closed loop, as well as leading companies with advantages in equipment research and development and algorithm optimization. At the same time, attention should be paid to the development of regional industrial clusters, such as Guangdong Province, which has a large number of brain-computer interface companies, and Beijing, which has the highest number of patent applications.

In the long term, leading companies will form dual barriers of technology and compliance. CITIC Construction Investment recommends focusing on companies with core patents, leading research and development capabilities, and those that meet strict medical regulatory requirements, as well as traditional business-linked companies that can leverage existing resources to accelerate the development of brain-computer interface businesses