"China may not be able to do it"! AI bubble fills Texas: Over 220GW large projects applied to enter the grid by 2030

得州電網管理機構 ERCOT 報告顯示,申請在 2030 年前接入得州電網的大型項目容量合計已超 220GW,是今夏該州峯值需求的兩倍多,其中超七成是數據中心。今年在得州申請電力連網的大型項目數量幾乎翻了兩番,其中超半數、約 128GW 項目還未提交 ERCOT 審查。

美國得州正在經歷一場瘋狂的數據中心建設熱潮,規模之大已引發業內人士對泡沫的警告。由 AI 繁榮推動的數據中心項目如潮水般湧入這個州,能源專家認為,這些需求根本不可能滿足。

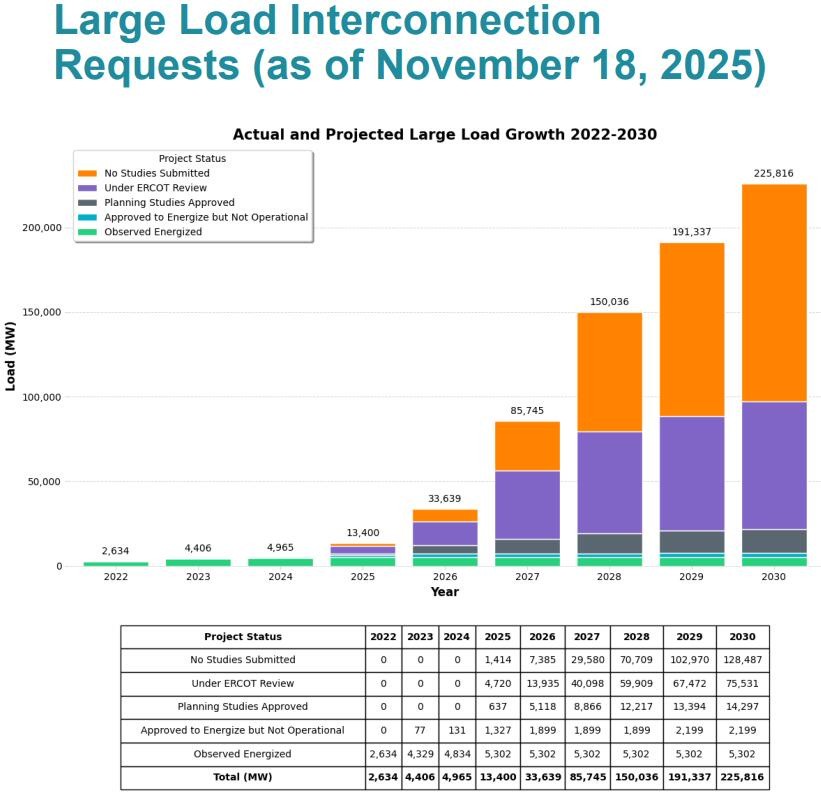

據得州電網管理機構得州電力可靠性委員會(ERCOT)本週稍早公佈的報告,申請在 2030 年前接入得州電網的大型項目容量合計已超過 220 吉瓦(GW)。ERCOT 數據顯示,其中超過 70% 是數據中心項目。220GW 是得州今年創紀錄的夏季峯值需求約 85GW 的兩倍多,也遠超該州約 103GW 的季度總髮電容量。

得克薩斯大學奧斯汀分校研究科學家、能源諮詢公司 IdeaSmiths 創始人 Joshua Rhodes 直言:

“這絕對看起來、聞起來、感覺起來——就像一個泡沫。整體的數字簡直可笑。

我們根本沒有辦法在地面上建造這麼多基礎設施來滿足這些數字。我甚至不知道中國能不能這麼快做到。”

這場熱潮還引發了更廣泛的信貸擔憂。橡樹資本管理公司聯合創始人霍華德·馬克斯(Howard Marks)在本週的報告中寫道:

“需要考慮的一個關鍵風險是,數據中心建設熱潮可能導致供應過剩。一些數據中心可能變得無利可圖,一些所有者可能會破產。我們將拭目以待,看看在當前這種令人興奮的環境下,哪些貸款機構能夠保持理性。”

“瘋狂” 的需求數字背後

得州 ERCOT 的數字規模令業內資深人士震驚。2014 年至 2019 年曾擔任 ERCOT 獨立市場監督員主任的 Beth Garza 表示,這些數字 “大得瘋狂”,“無論是設備方還是消費方面,都沒有足夠的東西來滿足這麼大的負荷。”

廉價的土地和廉價的能源吸引了大量數據中心開發商湧入得州。Rhodes 表示,到 2030 年末都將不可能滿足如此之大的需求。

2023 年,得州立法要求,將尚未簽署電力連接協議的項目納入電力需求預測。自那以來,該州的數據中心申請激增。今年,申請電力接入的大型項目數量幾乎翻了兩番。但其中一半以上、代表約 128GW 新增潛在需求增長的項目,尚未提交研究供 ERCOT 審查。另有約 90GW 正在審查中或已獲得規劃研究批准。

在能源政策諮詢專家組織 Regulatory Assistance Project 擔任高級顧問的 Michael Hogan 表示:

“我們知道並非所有需求都是真的。問題是有多少是真的。”

Hogan 在電力行業工作了 40 多年,自 1980 年在通用電氣開始職業生涯。他説,得州的巨大數字反映了美國更廣泛的數據中心泡沫,“與得州的其他事物一樣,這是一個超大規模的例子。”

實際已併入電網或獲得 ERCOT 批准的項目數量要小得多,容量僅約 7.5GW。儘管如此,這仍然是一個相當大的數字,相當於近八座大型核電站的電力。

但 Rhodes 表示,得州可以滿足這一水平的需求。他説,“我們完全可以輕鬆發展 8GW 的數據中心”,到 2030 年,得州或許能夠滿足 20GW 或 30GW 的數據中心需求。

得州出手抑制投機

得州已採取行動將嚴肅的數據中心項目與純粹投機性項目區分開來。5 月,該州通過的一項法律要求開發商為其項目的初步研究支付 10 萬美元,並證明通過所有權或租賃確保了場地。他們還必須披露是否在得州其他地方概述了同一項目。

得州公用事業委員會提議了一項規則,要求數據中心為每兆瓦峯值功率支付 5 萬美元的保證金。對於吉瓦級數據中心,開發商的成本將至少達到 5000 萬美元。

Rhodes 表示:“與核心租户簽訂長期合同的嚴肅開發商會願意支付這筆錢。” 更多投機性開發商可能會退出電力併網排隊,這將幫助當局獲得更準確的預測。

投資者面臨風險

Rhodes 表示,風險在於可能會為那些未能實現或用電量低於預期的投機性數據中心建造發電廠、輸電線路和變壓器等電力基礎設施。而且過度建設將發生在這些基礎設施成本飆升之際,因為數據中心和其他行業都在爭奪同樣稀缺的設備。

Rhodes 説:“當泡沫破裂時,誰來買單將取決於已經投入了多少鋼材。” 例如,天然氣發電廠的成本在過去五年中增長了一倍多。Rhodes 打比方解釋:

“這有點像在市價到頂部的時候買房子。如果五年後房價下跌,你就倒黴了。”

Rhodes 和 Hogan 表示,為得州電力市場建設新發電廠的成本通常由投資者承擔,如果建造了過多產能,這為家庭提供了一定程度的保護,避免電價上漲。

相比之下,一些中西部和中大西洋州的電價因數據中心需求而飆升,因為電網運營商 PJM Interconnection 提前數年購買發電量——負擔落在消費者身上。在伊利諾伊州,該州北部由 PJM 服務,9 月份的居民電價較去年同期上漲約 20%。但得州的電價同比僅上漲 5%,低於超過 7% 的全國平均漲幅。據美國能源信息署數據顯示。

Hogan 表示,由於市場結構的方式,得州過度建設的風險低於 PJM 所服務的州。“無論我們最終在得州看到什麼新建設施,最終投資於過剩產能的人將是受苦的人。”

信貸市場的瘋狂與擔憂

AI 數據中心繁榮正引發對債務融資狂潮的擔憂,因為企業正在使用金融工程將負債排除在資產負債表之外。一個典型的例子是:核能初創公司 Fermi Inc.尚未開發任何數據中心,但今年上市時估值一度飆升至 190 億美元以上,使公司創始人 Toby Neugebauer 和美國前能源部長 Rick Perry 之子 Griffin Perry 都成為億萬富翁。

本週五的報道指出,一些估計顯示,整個基礎設施建設的成本可能達到 10 萬億美元,有如此多的貸方排隊向這些資產投入資金,這讓人擔心正在形成泡沫,最終可能讓股權和信貸參與者面臨重大痛苦。

貸方正在切割和分割債務並將其出售給其他投資者,使其變得越來越不透明。一些借款人正在使用證券化市場將 AI 數據中心的風險從資產負債表中轉移出去,債務被分成具有不同風險和回報的部分,由保險公司和養老基金等機構買入。

媒體提到,兩位私人信貸方的人士稱,在貸款環境如此積極的情況下,一些借款人甚至要求 100% 超過項目建設成本的貸款。有一個案例顯示,借貸方要求的貸款與成本佔比達到 150%,房地產開發商以設施開始收租後估值提升為由證明這一請求的合理性。

媒體彙編的數據顯示,今年迄今已達成至少 1750 億美元的與數據中心相關的美國信貸交易。

霍華德·馬克斯質疑超大規模雲計算服務商為資助 AI 投資而出售的債務收益率。有時利差僅比美國國債高約 100 個基點,這讓這位投資老將質疑:“接受 30 年的技術不確定性來進行固定收益投資是否謹慎,而該投資的收益率僅略高於無風險債務?”

在監管機構方面,英國對支出和融資水平日益擔憂,正在審查對數據中心的貸款。

摩根大通全球數字基礎設施投資銀行業務的主管 Scott Wilcoxen 表示,市場上不斷出現的一個描述大量融資的短語:一切同時無處不在,這是對最近獲得奧斯卡獎的電影的戲仿。他表示:“追逐這一切的資金規模令人震驚。”