Oracle's $300 billion gamble: The "epicenter" of the AI bubble, the "barometer" of the market

No technology giant has bet on AI as fully as Oracle. Whether this company can come out on top will be a key barometer for whether the entire industry is thriving or in a bubble

The largest cloud computing deal in history, "Stargate," originated from an inconspicuous LinkedIn private message, backed by Oracle co-founder Larry Ellison's gamble, but now Wall Street's enthusiasm is cooling.

In the spring of 2024, an executive from OpenAI sent a private message on LinkedIn to Oracle's sales director. At that time, OpenAI was desperately seeking computing power, while Oracle had a large data center project in Texas that had been shelved due to Musk's xAI project.

In January of this year, the two parties, along with SoftBank, jointly announced the AI data center construction project named "Stargate" at the White House with U.S. President Trump. This deal caused Oracle's market value to soar by $250 billion at one point, making Ellison the world's richest person temporarily.

However, the frenzy is fading, and Oracle, which symbolized investors' confidence in AI just a few months ago, is now becoming a sign of panic.

From the peak in September to the release of the financial report in December, Oracle's stock price has fallen by more than a third. To fulfill the contract, the company has reported negative free cash flow for the first time since 1992. Wall Street traders have begun buying Oracle credit default swaps, a tool that was used to short the real estate bubble during the subprime crisis.

(Oracle's stock price has significantly dropped from its peak)

(Oracle's stock price has significantly dropped from its peak)

The Birth of the Largest Cloud Computing Contract in History

This unprecedented deal originated from a LinkedIn private message sent by OpenAI's infrastructure chief Peter Hoeschele to Oracle's sales team. According to Hoeschele's public statement in October, this message facilitated dialogue between the two parties.

On December 12, Bloomberg Businessweek reported that Oracle was then drawing up plans for a large data center in West Texas, originally intended to collaborate with Musk's xAI, with the building even designed in an X shape to match the company's name.

Musk has a close relationship with Ellison, who served on Tesla's board for many years. However, the capricious Musk believed he could build it faster and abandoned the project.

Just then, OpenAI's plea for help arrived.

Since the emergence of ChatGPT in 2022, this AI company has been desperately seeking computing power. It has signed numerous agreements to lease data centers, procured dedicated AI chips (GPUs), and even attempted to develop its own chips, but none of this could meet its enormous demand for processing power.

OpenAI promised to spend about $300 billion to lease servers from Oracle, and the two sides also discussed the possibility of further expanding cooperation. To provide this computing power, Oracle needs to build about five data center complexes, each of which will rank among the largest in the world, requiring millions of chips and 4.5 gigawatts of electricity, exceeding the total household electricity consumption of the entire city of Chicago.

However, Wall Street Journal mentioned that on Friday morning, U.S. stocks, media reports indicated that Oracle has pushed back the completion date of some data centers being developed for OpenAI from 2027 to 2028, mainly due to labor and material shortages Oracle subsequently denied the news, with a spokesperson stating that the company is confident in fulfilling its obligations and future expansion plans. The statement read:

Site selection and delivery timelines are determined in close coordination with OpenAI. There have been no delays for all sites required by the contract, and all progress is proceeding as planned.

Financial Pressure and Bubble Warnings

Oracle's aggressive strategy is bringing significant financial pressure.

To build these data centers, the company needs hundreds of billions of dollars in upfront investment. Against the backdrop of soaring material and labor costs, Microsoft spent nearly $40 million in just six months for a data center in Wisconsin to purchase concrete.

Energy is also a major issue. Many utility companies are facing capacity constraints, and connecting data centers to the grid requires long waiting times. Reports indicate that to expedite power supply, Oracle has adopted novel but expensive methods, such as using gas generators to power entire sites. This will cost over $1 billion annually for a data center park in Shackelford County, rural Texas.

Through off-balance-sheet financing, Oracle has excluded many AI-related development costs from its books.

Real estate developer Vantage Data Centers is borrowing $38 billion for two data center parks, which it will then lease to Oracle. Other facilities have similar arrangements, with Oracle typically signing 15-year leases. According to analyst forecasts compiled by Bloomberg, Oracle's large infrastructure investments are expected to yield returns, but only if it can withstand approximately $70 billion in free cash flow losses over the next four to five years.

Today, Oracle is just one of many companies building data centers for OpenAI. KeyBanc Capital Markets analyst Jackson Ader stated:

OpenAI's commitments are inversely related to Oracle's stock price. As OpenAI's spending increases, the value of each commitment is declining.

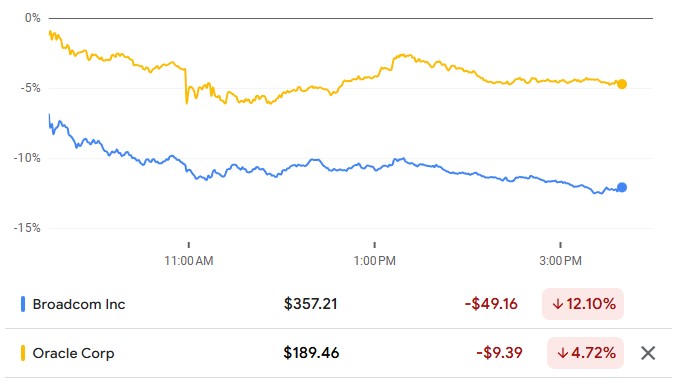

On December 10, Oracle's financial report showed that spending growth far exceeded analyst expectations and will continue, leading to a sustained decline in Oracle's stock price. Another signal of AI-related tension is that chipmaker Broadcom's AI order data was disappointing, causing its stock to plummet 11% on Friday.

Microsoft's Cautious Comparison

Microsoft has been a partner of OpenAI since 2016, with the models that underpin ChatGPT built on the Microsoft Azure cloud computing platform. However, Microsoft is increasingly concerned about occupying too much data center capacity with OpenAI, even having to limit processing power for some of its largest customers to meet OpenAI's demands.

Microsoft CEO Satya Nadella summarized these concerns in an October podcast interview. He said:

Sometimes Sam says, 'Hey, can you build me a dedicated multi-gigawatt data center for training?' It makes sense from OpenAI's perspective, but 'it doesn't make sense' for Microsoft Azure In 2024, Microsoft allowed OpenAI to seek other cloud providers, as long as Microsoft retained the right of first refusal. In October, Microsoft even gave up this right.

Analysis suggests that aside from the massive investment of hundreds of billions of dollars in data centers, the economic impact of artificial intelligence remains unclear, with warnings of a bubble emerging continuously.

Oracle Corporation may be particularly vulnerable. No other tech giant has invested in artificial intelligence as heavily as it has. For Oracle to profit from the Stargate project, its partner OpenAI must maintain the astonishing growth momentum of the past few years.

This is also why Oracle's longtime rival Microsoft hesitated when OpenAI proposed a similar deal after careful consideration.

The deal structure of the Stargate project allows OpenAI the opportunity to recommit or withdraw in about five years, while many of Oracle's leases will still have about ten years until expiration.

If OpenAI's revenue stops growing rapidly, this startup may neither need as much computing power nor have the ability to pay for it. Oracle may ultimately be left with some extremely expensive and illiquid assets.

81-Year-Old Ellison Leading the Tech Boom

Silicon Valley culture typically celebrates youth and boldness, but 81-year-old Ellison continues to play a central role in another tech boom.

According to documents reviewed by Bloomberg in November, he has actually increased the proportion of employees under his supervision during this year's restructuring. Most importantly, he controls the company's spending, with the top financial officer now reporting directly to him, bypassing the two CEOs.

Although he appears in public less frequently, Ellison remains willing to discuss topics far removed from Oracle's core business. In his keynote speech at AI World in October, he spent ten minutes discussing his views on agriculture. However, most of his 90-minute speech focused on AI.

He pointed out that two years ago he publicly asked whether AI would become "the most important technology in human history." He no longer doubts it. He said:

This is the largest and fastest-growing business in human history, bigger than railroads, bigger than the Industrial Revolution.

For Oracle's bets to pay off, he just needs to be right. But in the current climate of declining AI expectations, the old company faces a question: has it overcommitted to a future that has yet to prove profitable? The market's answer is changing.

D.A. Davidson & Co. analyst Gil Luria stated:

I see three possible scenarios. Either Oracle lowers its forecasts next year but still manages to salvage some business, or OpenAI collapses and the contract falls through, or OpenAI achieves superintelligence, spending $14 trillion, and we no longer have to work, and Oracle is fine.

Analysis suggests that the current hype cycle is partly based on grand predictions, such as computers curing multiple cancers, eliminating a large amount of human labor, or even the emergence of post-biological life forms. However, the dates for achieving these goals are being pushed further and further away, perhaps back into the realm of science fiction The lack of transformative progress makes the logic of massive investments in AI seem untenable. Even a popular consumer product like OpenAI, which has 800 million active users, is not enough to make the numbers add up.

Once you set aside the hundreds of billions spent on data centers, warnings of a bubble abound, and no tech giant has bet on AI as heavily as Oracle. Whether this company can come out on top will be a key barometer for whether the entire industry is thriving or in a bubble.