Oracle's plunge reignites the AI bubble theory, but almost no one dares to short!

Oracle's warning of a capital expenditure surge of $15 billion triggered a 16.5% plunge in its stock price, reigniting discussions about an AI valuation bubble. Despite "big short" Burry warning of bubble risks, short selling is mainly focused on small companies, with limited short bets against leading AI stocks. Some analysts pointed out that this is merely an issue with Oracle itself, rather than a problem with the entire AI trade

Oracle's earnings warning has triggered severe fluctuations, reigniting market concerns about an artificial intelligence valuation bubble. Nevertheless, Wall Street investors remain cautiously optimistic about this hot trade, with almost no one daring to assert that the AI market has peaked.

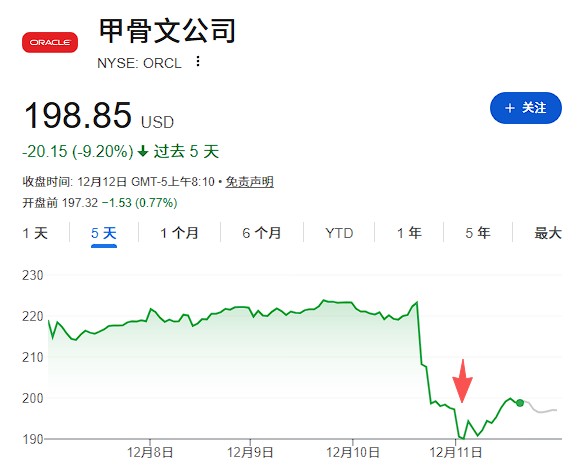

On Thursday, Oracle's stock price plummeted by as much as 16.5% after the company warned that capital expenditures for fiscal year 2026 are expected to be $15 billion higher than anticipated in September. In after-hours trading, Broadcom also fell due to the rising proportion of AI business impacting profit margins, further exacerbating negative market sentiment.

This round of sell-off has affected other tech stocks, as investors begin to worry about the scale of AI spending and the uncertainty of investment returns. However, the S&P 500 index still saw a slight increase on Thursday, reaching a historic high, indicating that the broader market remains robust. Analysts pointed out that this is merely an issue with Oracle itself, rather than a problem with the entire AI trade.

It is noteworthy that, despite well-known investors like "big short" Michael Burry comparing the current AI craze to the internet bubble of the 1990s, short-selling activities are primarily concentrated on small companies, with short bets against leading AI stocks still being limited.

Market Attitude Towards AI Spending Shifts

Investors' criteria for selecting AI investments are becoming more stringent. Data shows that the market no longer rewards aggressive AI investments unconditionally. Mark Hackett, Chief Market Strategist at Nationwide, stated:

"In the past, there was a very positive correlation between capital expenditures and stock prices... but this has significantly changed beneath the surface in recent months."

In late November, Meta's stock price fell by 11% after it forecasted that capital expenditures would "significantly increase" next year.

Since the release of ChatGPT in November 2022, capital expenditures have been a key driver of AI trades. However, Robert Gill, a portfolio manager at Fairbank Investment Management, pointed out:

"The time it takes for all this heavy investment in AI to translate into cloud revenue is much longer than investors expect."

Additionally, several market participants believe that Oracle's issues are more of an isolated case rather than a systemic crisis for the entire AI trade.

"I think this is more of an issue with Oracle itself, rather than a problem with the entire AI trade," said Chuck Carlson, CEO of Horizon Investment Services

"Oracle is trying to become a hyperscale cloud service provider, but it lacks the cash flow and financial strength of hyperscale vendors like Alphabet, Microsoft, and Amazon... I don't think this will destroy the entire AI trade,"

Short Sellers Remain Cautious

Even investors questioning AI valuations are reluctant to bet on a downturn.

"I believe the stock market today is in a phase that could evolve into an extreme topping," Michael Burry wrote in a post. The investor, known for successfully shorting the U.S. housing market in 2008, has recently intensified his criticism of tech giants like Nvidia and Palantir, questioning the sustainability of the cloud infrastructure boom.

However, according to reports, two senior U.S. fund managers indicated that concerns about a bubble are exaggerated. They pointed out that large tech "hyperscale vendors" are still struggling to meet the ongoing demand for more data centers.

Peter Hillerberg, co-founder of data analytics firm Ortex Technologies, stated:

"Among the 61 AI-related stocks we track, we have not seen signs of investors aggressively betting on an AI bubble burst."

Ortex data shows that while there has been an increase in the willingness of investors to short small and mid-cap AI stocks, the largest AI beneficiaries are still only lightly shorted. Hillerberg said:

"We see specific spikes in short positions for certain AI-related stocks around earnings reports and major news announcements, including Oracle, where some trades naturally seem wiser after the sharp volatility post-earnings, but overall, the data looks more like targeted questioning of individual AI stories rather than a broadly coordinated attempt to predict an AI bubble peak."

For investors, a positive signal is that even if some leading AI stocks face setbacks, the broader market remains strong.

Driven by long-term strong performance, tech stocks have become the largest sector in the S&P 500 index, accounting for 35% of the benchmark's weight as of Wednesday's close. Investors are concerned that if the enthusiasm for high-flying AI stocks, which have driven the index up 17% this year, wanes, it could impact the market.

On Thursday, despite the sell-off in AI stocks, the benchmark index still avoided significant damage, somewhat alleviating concerns.

"The key question is whether we can see a leadership change without a significant misalignment in the overall index? So far, so good," Hackett said