Deutsche Bank in-depth report: True or false AI bubble, who is really swimming naked?

Deutsche Bank believes that the current AI boom is not a single bubble, but rather a complex intertwining of three bubbles: valuation, investment, and technology. The valuations of public market giants are supported by profits, while the valuations of private companies have soared to extreme levels. Massive investments are driven by cash flow, not debt expansion, but complex circular financing and potential technological bottlenecks pose risks. AI demand is strong and costs are plummeting, but energy and chip supply may become the ultimate constraints

Standing at the time node of December 2025, just three years after the release of ChatGPT, discussions in the market about the "AI bubble" have reached a boiling point. Deutsche Bank believes that the current AI boom is neither a complete bubble nor entirely risk-free; the key lies in distinguishing between different types of "bubbles."

On December 12, according to hard AI news, Deutsche Bank innovatively categorized the AI bubble into three dimensions: valuation bubble, investment bubble, and technology bubble in its latest research report. The report states that the valuations of large tech companies in the public market are supported by earnings, investment growth aligns with trends and is driven by cash flow, and technological advancements are ongoing. The real risks are concentrated in overvalued private companies, potentially uncontrollable circular financing structures, and potential technological bottlenecks and supply constraints.

Valuation Bubble: Valuation Differentiation Reveals Real Risks

Deutsche Bank's core view is that the current AI boom is not a single bubble but is composed of three different types of bubbles.

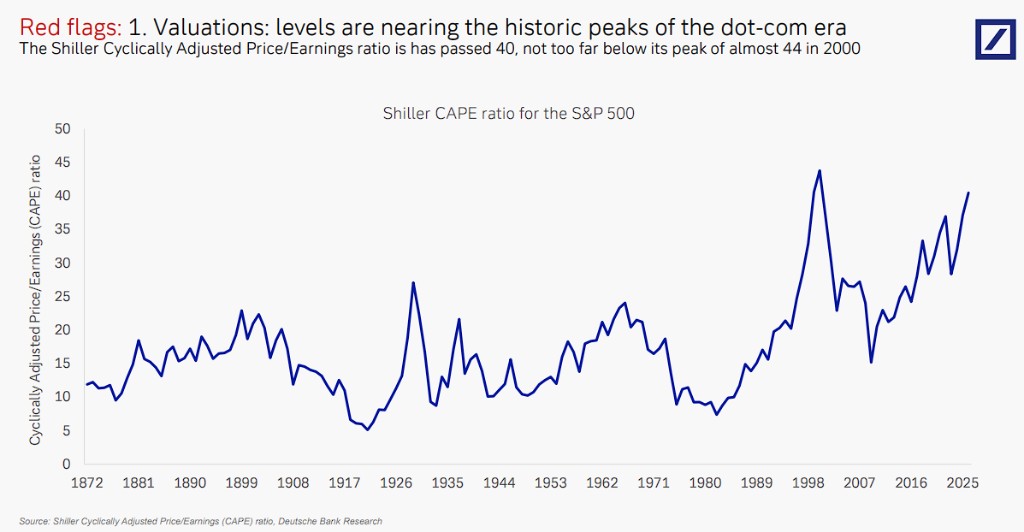

In terms of valuation, the report shows that the Shiller Cyclically Adjusted Price/Earnings ratio has exceeded 40, approaching the peak level of 44 times during the 2000 internet bubble. This indicator measures long-term profitability adjusted for inflation, and the current level is indeed alarming. Historical data suggests that such high valuation multiples typically indicate an overheated market.

However, Deutsche Bank believes that this valuation is primarily driven by earnings growth rather than pure speculation. The bank states that although overall valuations are high, the S&P 500 index has been operating within a 22.7% annualized growth trend channel since October 2022, currently sitting at the lower end of that channel.

More critically, the valuation premium of large tech stocks is driven by earnings growth: the valuation premium of large tech stocks is about 60%, but this premium is supported by over 20% differences in earnings growth.

Deutsche Bank points out that current tech stock valuations have not reached the extreme levels seen during the internet bubble, and earnings growth is spreading to a broader range of industries.

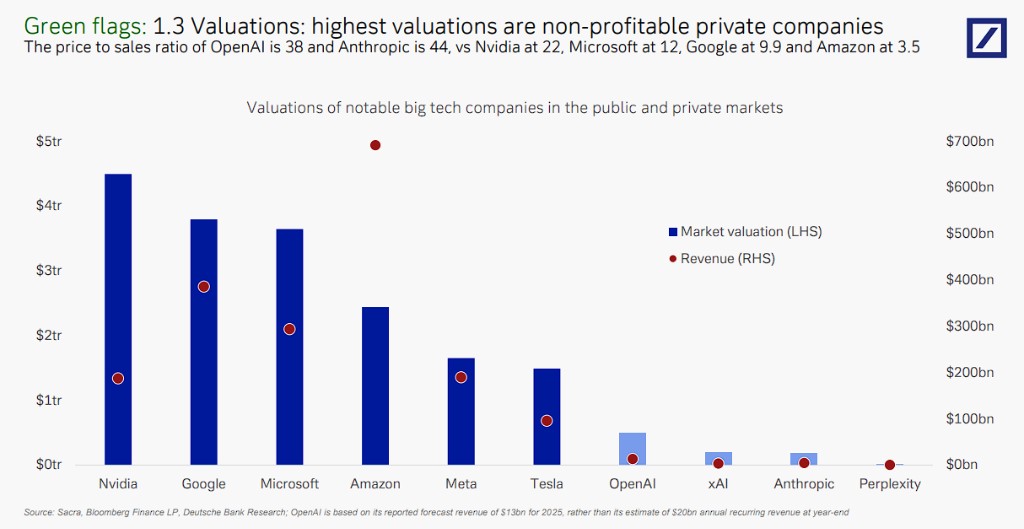

In contrast, the truly overvalued entities are private companies: OpenAI's price-to-sales ratio based on a projected revenue of $13 billion in 2025 reaches 38 times, while Anthropic is as high as 44 times. The valuations of publicly traded tech giants are relatively reasonable—NVIDIA is only 22 times, Microsoft 12 times, Google 9.9 times, and Amazon 3.5 times. This public-private differentiation indicates that pricing in the public market is relatively rational

Investment Bubble: Cash Flow Support vs Debt Risk

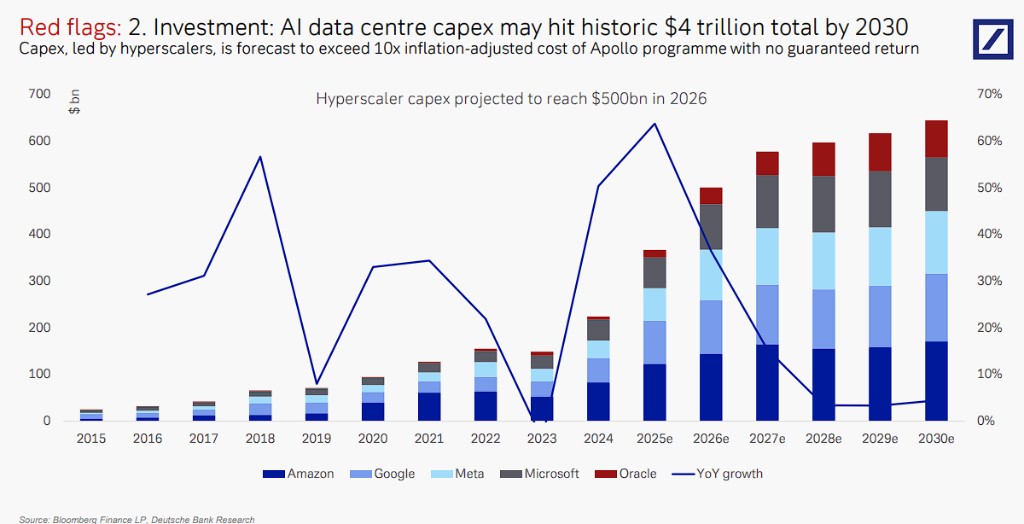

The report states that, in terms of investment, Deutsche Bank data shows that capital expenditures for ultra-large cloud service providers are expected to reach $500 billion by 2026, and may accumulate to $4 trillion by 2030, more than ten times the inflation-adjusted cost of the Apollo program. This scale is indeed unprecedented, but Deutsche Bank believes that current investments are still within a reasonable range.

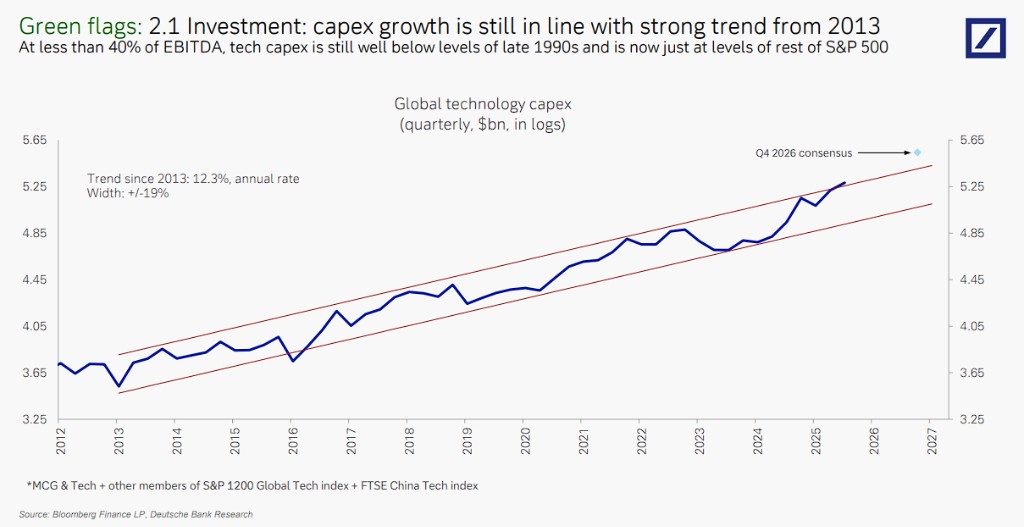

Despite the astonishing growth rate, Deutsche Bank indicates that since 2013, the annual growth rate of global tech capital expenditures has been 12.3%, and current growth remains within this trend channel.

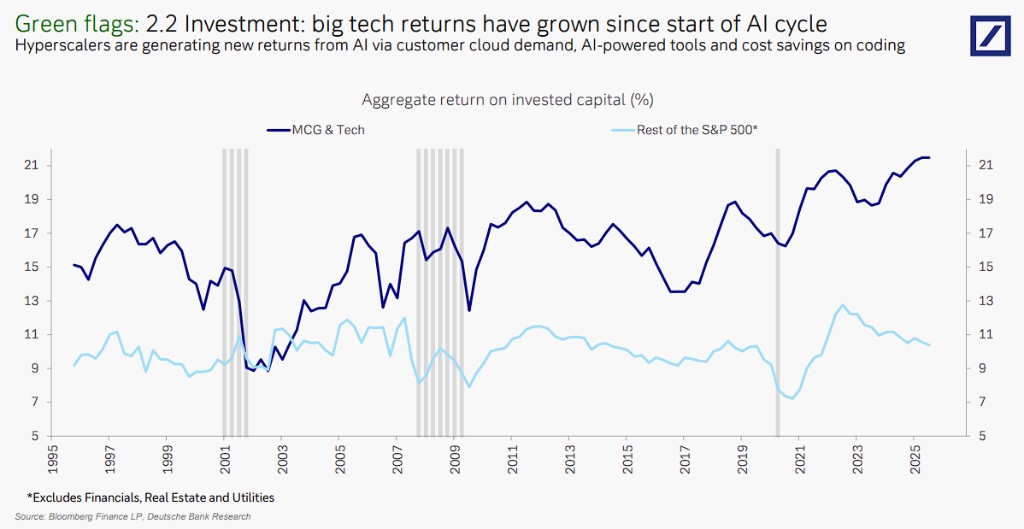

More importantly, the return on investment for large tech companies has continued to rise since the start of the AI cycle, generating actual returns through cloud customer demand, AI tools, and programming cost savings.

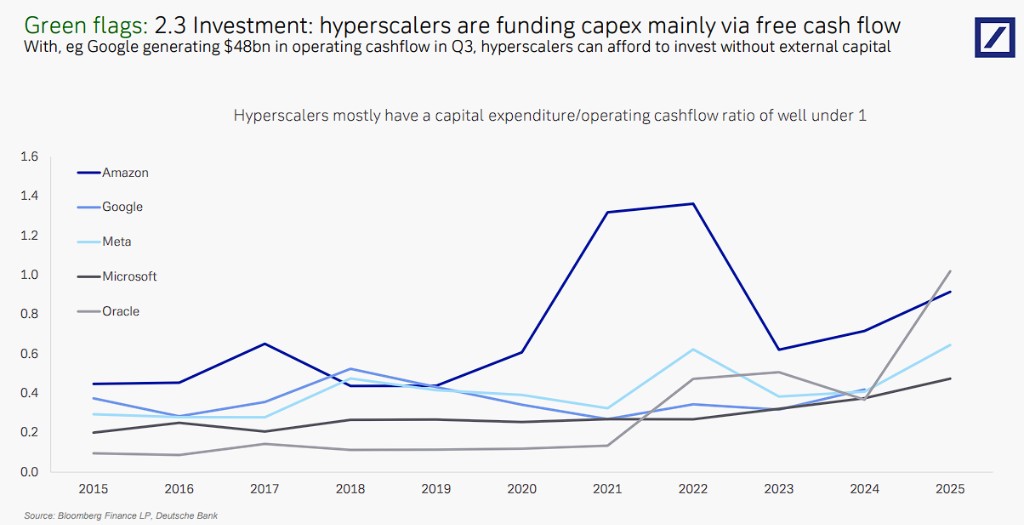

The bank also emphasizes in its research report that, unlike the debt-driven period of the internet bubble, current AI investments are primarily supported by free cash flow. Google's operating cash flow in the third quarter reached $48 billion, and the capital expenditure to operating cash flow ratio for ultra-large cloud service providers is generally below 1, indicating a healthy financial condition.

Technology Bubble: Usability and Scalability in Doubt vs Technological Advancement and Demand Growth

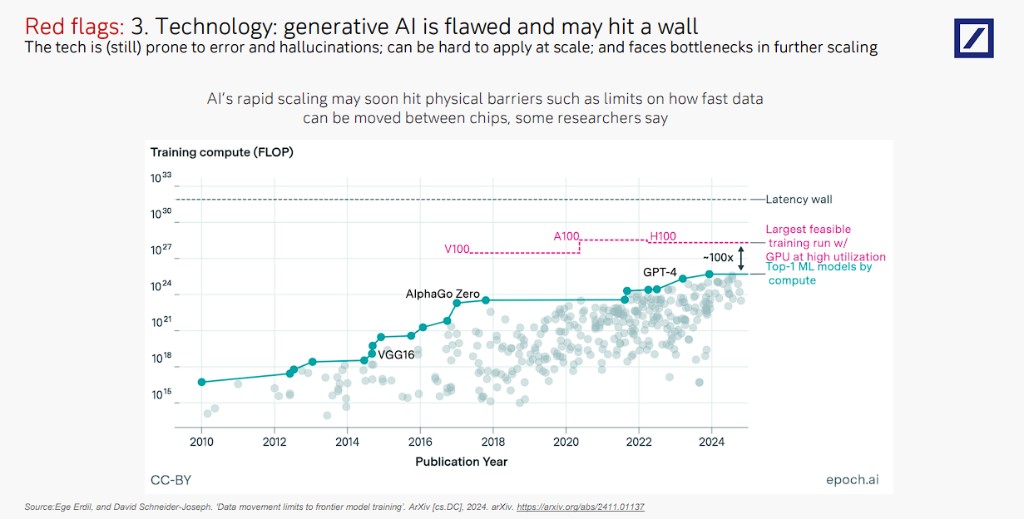

On the technology dimension, Deutsche Bank believes that generative AI is still prone to errors and hallucinations, making large-scale application difficult. More importantly, researchers point out that the rapid expansion of AI may soon encounter physical bottlenecks, such as limitations in data transfer speeds between chips. These technological barriers could become a ceiling for development.

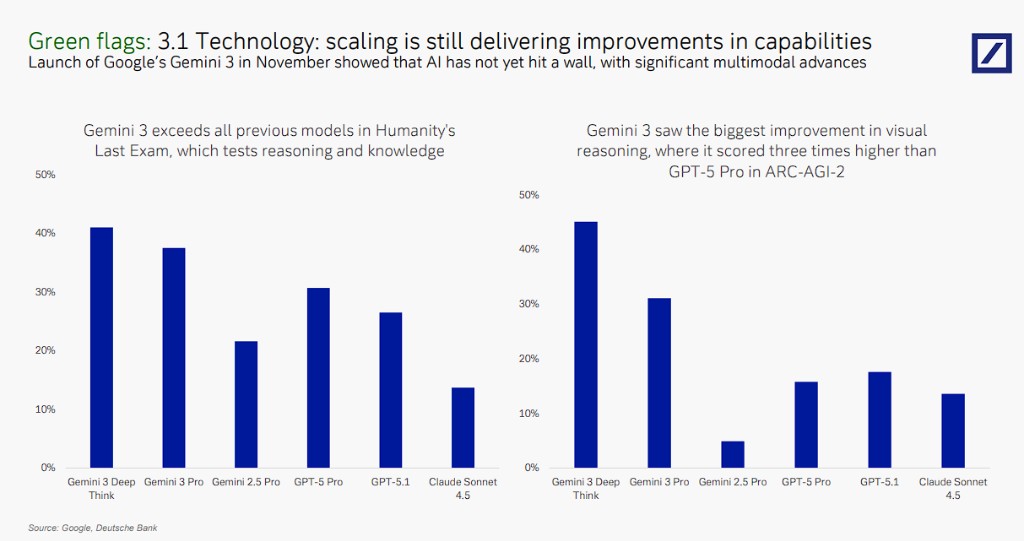

However, Deutsche Bank states that the launch of Gemini 3 by Google in November 2025 proves that AI has not yet reached its ceiling, achieving significant progress in multimodal capabilities. Gemini 3 surpassed all previous models in the "final exam of humanity" (testing reasoning and knowledge), scoring three times higher in visual reasoning than GPT-5 Pro in the ARC-AGI-2 test This indicates that the AI expansion law is still in effect, with continuous improvements in technological capabilities.

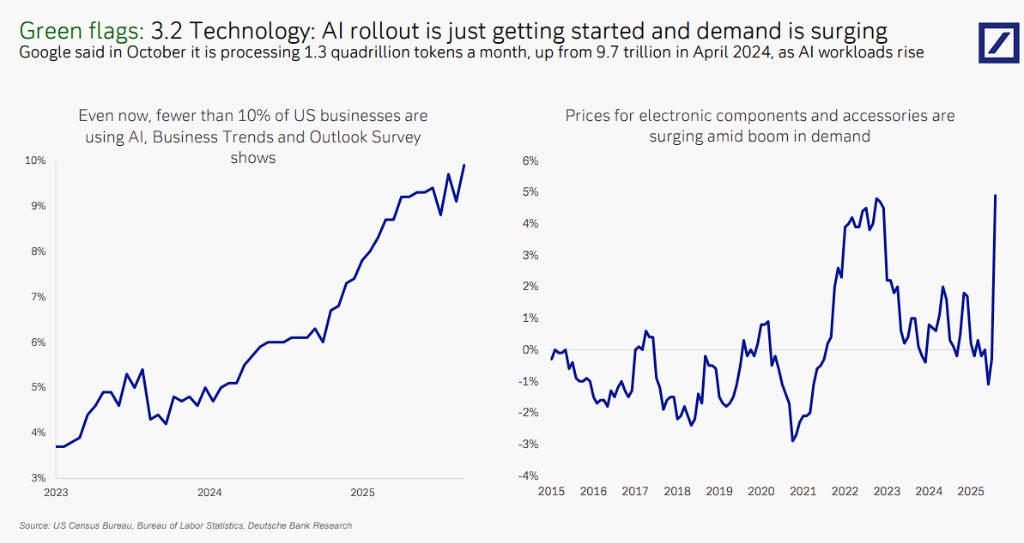

Moreover, the demand-side data is even more impressive. Google revealed in October that it processes 1.3 quadrillion tokens monthly, a significant increase from 970 trillion in April 2024. According to the U.S. Business Trends and Outlook Survey, currently, less than 10% of U.S. companies are using AI, indicating a huge growth potential.

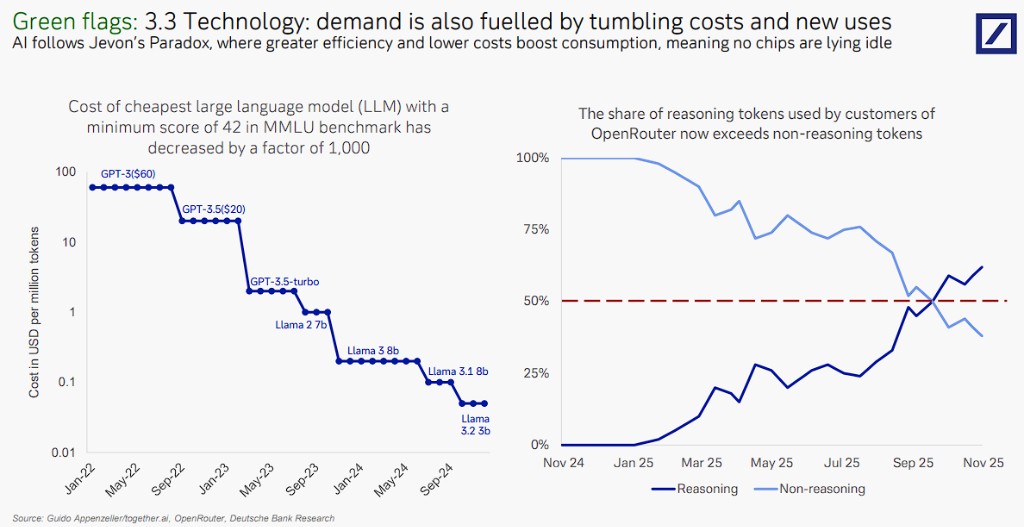

Cost reduction is a key driver of the surge in demand. The cheapest large language models scoring at least 42 points on the MMLU benchmark have seen costs drop by a factor of 1,000, following the Jevons Paradox—efficiency improvements and cost reductions drive consumption growth, ensuring no chips are left idle.

Potential Triggers for Bubble Bursting

Despite strong fundamentals, Deutsche Bank still pointed out five potential risk factors that could lead to a bubble burst in its report.

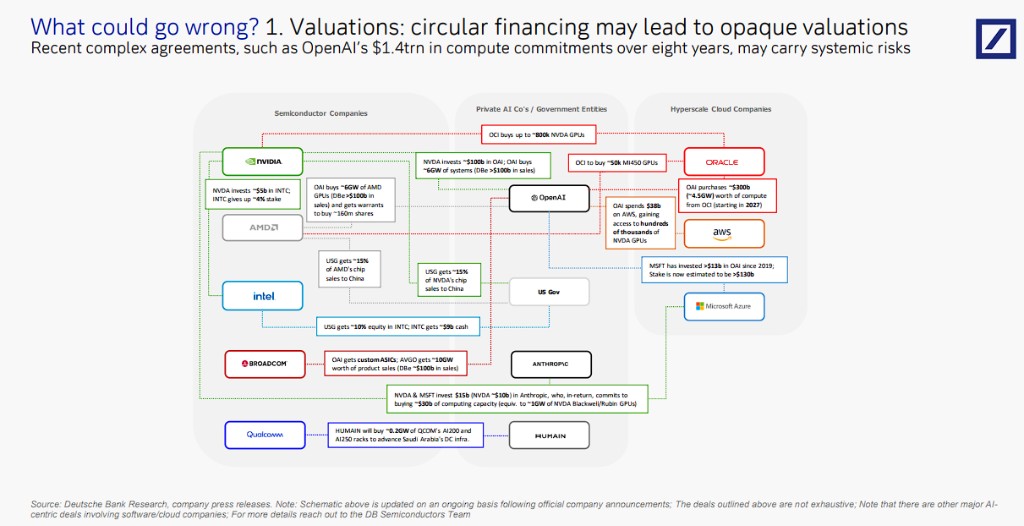

Cyclical financing leads to valuation opacity

The report first notes that recent complex agreements may introduce systemic risks. For example, OpenAI has committed to $1.4 trillion in computing purchases over eight years, involving cross-investment and purchase agreements among multiple parties including NVIDIA, AMD, Oracle, Microsoft, and Amazon. This cyclical financing structure may lead to valuation opacity, and once a link breaks, it could trigger a chain reaction.

Debt surge leads to uncontrolled costs

Deutsche Bank states that even cash-rich hyperscale cloud service providers are starting to issue more debt. The issuance of U.S. investment-grade bonds has exceeded $35 billion in 2025, and the net debt to EBITDA ratios of Microsoft, Google, Meta, Amazon, and Oracle are rising. If costs continue to spiral upward, companies may be forced to take on significant debt.

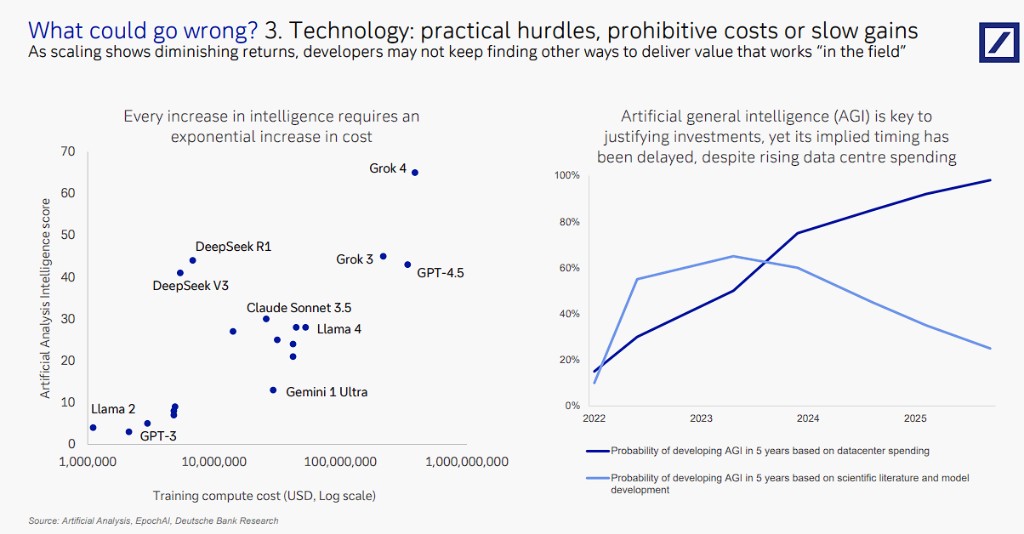

Technical barriers: diminishing returns to scale

The report points out that as scaling shows diminishing returns, each additional unit of intelligence requires exponentially increasing costs. From Llama 2 to Grok 4, training computing costs skyrocketed from $10 million to over $1 billion. More concerning is that despite rising data center expenditures, the probability of developing AGI (Artificial General Intelligence) based on data center spending has actually decreased over five years, from nearly 100% in 2022 to about 20% in 2025

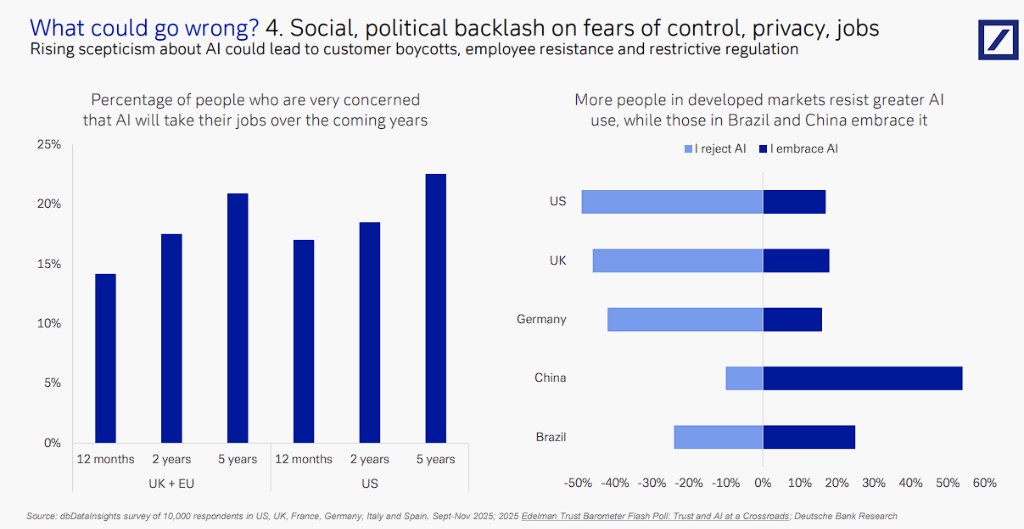

Social and Political Backlash

The report states that skepticism towards AI is rising. In the UK and EU, over 20% of respondents are very concerned that AI will take their jobs in the coming years. People in developed markets (the US, UK, Germany) are more resistant to larger-scale AI usage, while countries like Brazil are more accepting of AI. This could lead to customer backlash, employee resistance, and restrictive regulations.

Supply Bottlenecks: Energy and Chips

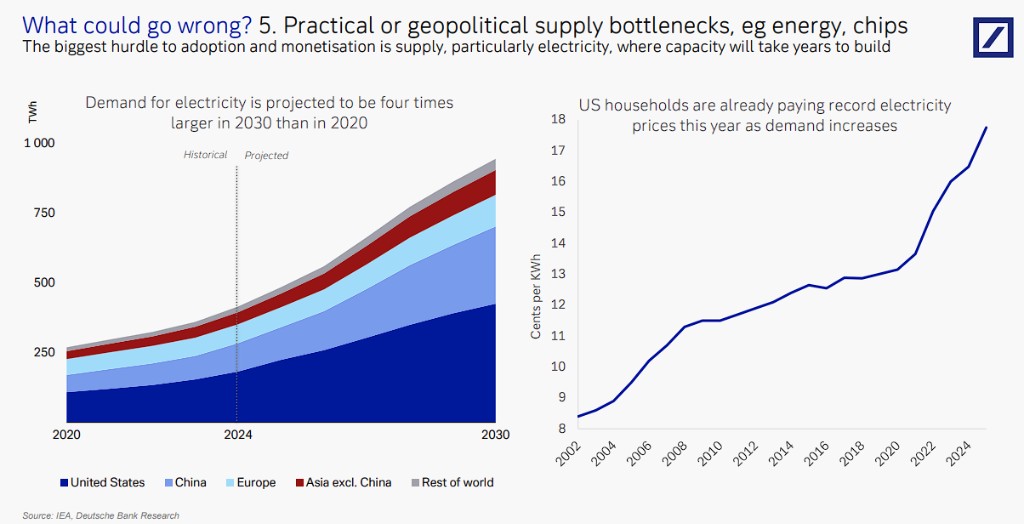

Finally, Deutsche Bank believes that electricity demand is expected to be four times that of 2020 by 2030. American households have already paid record electricity prices this year, reaching about 17 cents per kilowatt-hour. As building electricity capacity takes years, energy supply could become the biggest obstacle to AI adoption and monetization.