Wall Street sings in unison: Goldman Sachs and Deutsche Bank bet on the Federal Reserve's interest rate cuts, and the decline of the US dollar in 2026 is unstoppable

Wall Street generally believes that the Federal Reserve will cut interest rates next year, with Deutsche Bank and Goldman Sachs expecting the US dollar to continue weakening in 2026. As the Federal Reserve continues to cut rates, central banks in Europe and Japan tend to maintain or even raise interest rates, which will weaken the attractiveness of dollar-denominated assets. If the Fed's rate cuts exceed expectations and the economies in non-US regions recover, the dollar may face sustained depreciation pressure

Deutsche Bank, Goldman Sachs, and other Wall Street investment banks predict that as the Federal Reserve continues its interest rate cuts next year, the US dollar may continue to decline. Several institutions have analyzed that the divergence in monetary policies between the US and other major economies is expected to exert continuous depreciation pressure on the dollar.

According to Bloomberg, George Saravelos and Tim Baker, the global foreign exchange research heads at Deutsche Bank, stated in their latest outlook report that the dollar is currently overvalued and is expected to weaken against major currencies next year. Goldman Sachs analyst Kamakshya Trivedi's team also pointed out that the market is gradually reflecting the more optimistic growth prospects of non-US economies in the exchange rate pricing of related currencies. When the growth momentum of other major global economies strengthens, the dollar tends to depreciate relatively.

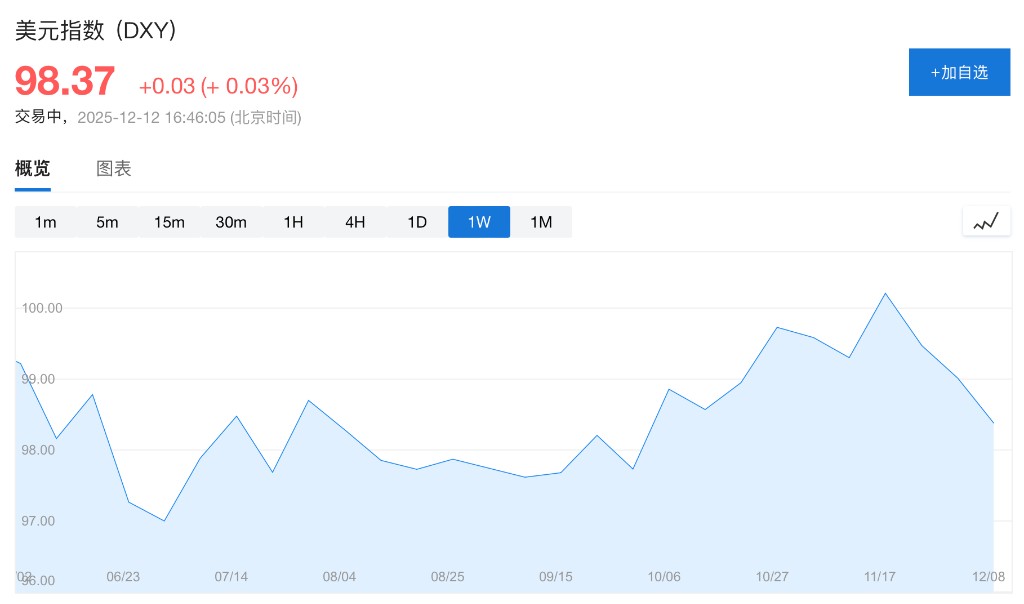

After experiencing a significant correction in the first half of this year, the dollar index has gradually stabilized and consolidated over the past six months. Looking ahead to 2026, experts from more than six major investment banks generally believe that the dollar will continue to weaken against major currencies such as the yen, euro, and pound. Consensus forecasts compiled by Bloomberg indicate that by the end of 2026, the dollar index is expected to decline by about 3%.

Federal Reserve's Interest Rate Cut Path and Global Policy Divergence

The dollar may face renewed depreciation pressure in 2026. Strategists point out that the core logic behind this expectation lies in the divergence of global monetary policy cycles. The Federal Reserve is likely to continue its interest rate cut process, while major central banks such as the European Central Bank and the Bank of Japan tend to maintain stable interest rates or even initiate rate hikes. This divergence will prompt investors to sell US Treasury bonds and shift funds to countries with higher yields.

According to Wall Street Insight, recent statements from the European Central Bank have further reinforced this trend. Several officials emphasized that their monetary policy will not simply follow the Federal Reserve. Bank of France Governor François Villeroy de Galhau clearly stated, "The monetary policy stance in Europe is already more accommodative than in the US," suggesting that the ECB is more likely to maintain current interest rate levels. ECB Executive Board member Isabel Schnabel pointed out that there is a possibility of rate hikes in the ECB's next actions. Meanwhile, the market generally expects the Bank of Japan to raise interest rates.

Although there are still differences regarding the specific timing of the Federal Reserve's interest rate cuts. Citigroup, Morgan Stanley, and JP Morgan predict that the first rate cut may occur in January next year, while Goldman Sachs, Wells Fargo, and Barclays look towards March, but the consensus on Wall Street believes that the easing cycle will continue. The ongoing divergence in monetary policy paths is building downward pressure on the dollar's medium to long-term trend. Morgan Stanley's G10 foreign exchange strategy head David Adams noted:

"The market still has ample room to price in a deeper rate cut cycle, which means there is a possibility for further weakening of the dollar."

Voice of Divergence: Can a Strong Economy Support a Strong Dollar?

Despite the bearish outlook on the dollar becoming mainstream in the market, some institutions hold opposing views. Analysts from Citigroup and Standard Chartered believe that the U.S. economy, driven by an artificial intelligence boom, remains strong and is likely to continue attracting international capital inflows, thereby supporting the dollar exchange rate.

The Citigroup team, led by Daniel Tobon, wrote in their annual outlook: “We see strong potential for a dollar cycle recovery in 2026.” This judgment is based on confidence in the resilience of U.S. growth. On Wednesday, Federal Reserve policymakers raised their economic growth forecast for 2026, which somewhat corroborates the possibility of economic outperformance.

However, George Saravelos, the global foreign exchange research head at Deutsche Bank, and others pointed out that although the dollar benefits from an "exceptionally resilient" economy and rising U.S. stock markets, its valuation is already too high. They predict that as economic growth and stock market returns in other parts of the world rebound, the dollar will depreciate against major currencies next year