In November, China's new social financing was 2.49 trillion yuan, with new RMB loans of 390 billion yuan, and the M2-M1 scissors difference expanded

中國 11 月新增社融 2.49 萬億元,新增人民幣貸款 3900 億元。11 月末的 M2-M1 剪刀差是 3.1 個百分點,較上月的 2.0 個百分點有所擴大。

中國 11 月新增社融 2.49 萬億元,新增人民幣貸款 3900 億元。11 月末的 M2-M1 剪刀差是 3.1 個百分點,較上月的 2.0 個百分點有所擴大。

12 月 12 日,中國人民銀行公佈金融數據顯示:

- 2025 年前十一個月,社會融資規模增量累計為 33.39 萬億元,比上年同期多 3.99 萬億元。結合前值計算可得,中國 11 月新增社融 2.49 萬億元。

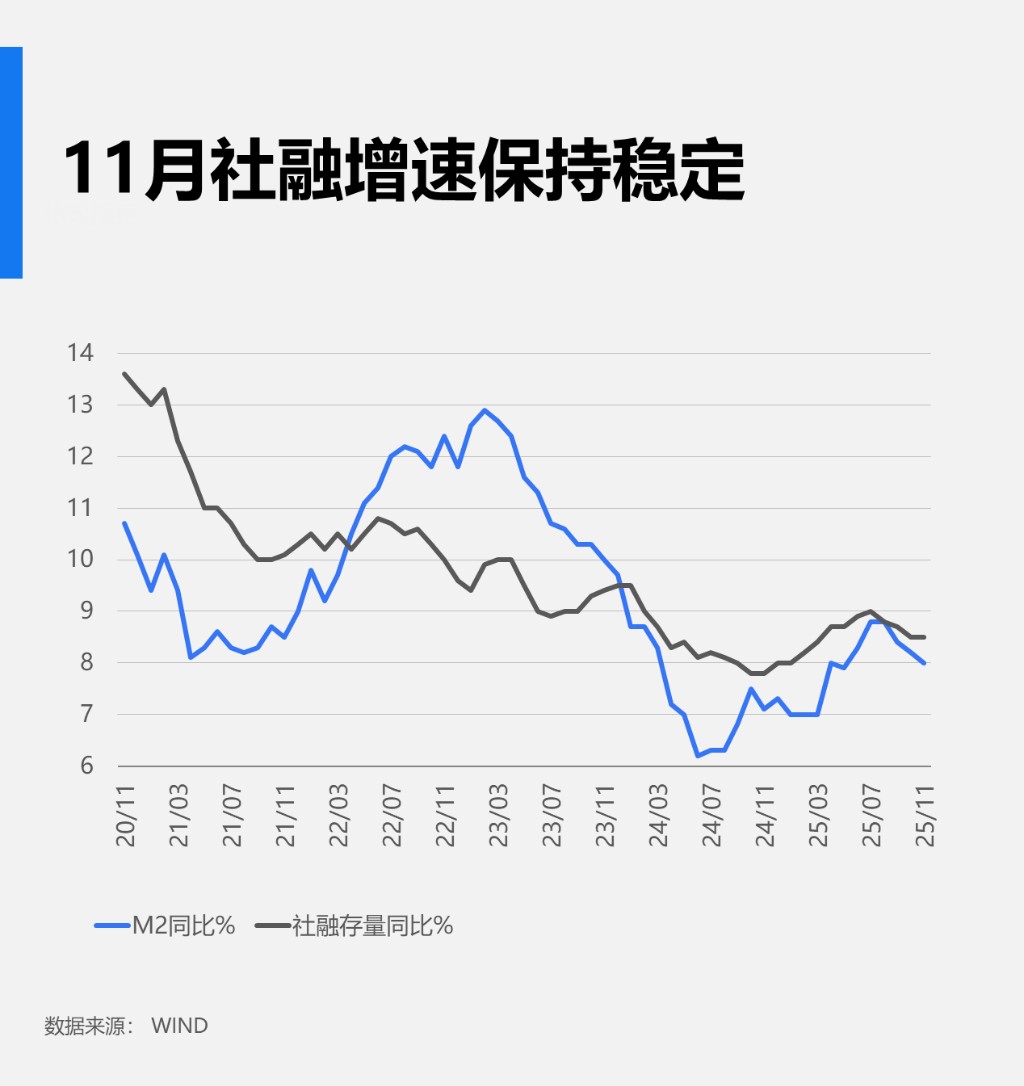

- 2025 年 11 月末社會融資規模存量為 440.07 萬億元,同比增長 8.5%。

- 前十一個月人民幣貸款增加 15.36 萬億元。11 月新增人民幣貸款 3900 億元。

- 前十一個月人民幣存款增加 24.73 萬億元。11 月新增人民幣存款 1.41 萬億元。

- 11 月末,廣義貨幣 (M2) 餘額 336.99 萬億元,同比增長 8%。狹義貨幣 (M1) 餘額 112.89 萬億元,同比增長 4.9%。11 月末的 M2-M1 剪刀差是 3.1 個百分點,較上月的 2.0 個百分點有所擴大。

央行主管媒體《金融時報》表示,中長期來看,貸款增速回落是經濟新舊動能轉換在金融領域的反映。一方面是傳統信貸大户需求回落。前些年,基礎設施建設、房地產和地方融資平台等領域是信貸投放的主力,經過幾十年大規模開發建設後,傳統投資驅動模式的邊際效益在遞減,房地產市場從 “增量擴張” 轉向 “存量提質”,地方債務風險化解工作也在有序推進,導致這些傳統領域的信貸需求有所降温。

另一方面是新的經濟增長點較少依賴銀行貸款。經濟增長由投資驅動轉向消費驅動,但居民日常消費多依賴自有資金,相關融資需求較少;科技創新等新動能領域往往與股權融資更為適配,對信貸資金的依賴度也不高。加總起來看,舊的信貸缺口難以被新的信貸需求完全填補,導致當前貸款增速出現趨勢性放緩,這也是經濟向高質量發展轉型在信貸領域的反映。

一、社會融資規模存量同比增長 8.5%

初步統計,2025 年 11 月末社會融資規模存量為 440.07 萬億元,同比增長 8.5%。其中:

對實體經濟發放的人民幣貸款餘額為 267.42 萬億元,同比增長 6.3%;

對實體經濟發放的外幣貸款摺合人民幣餘額為 1.13 萬億元,同比下降 16.5%;

委託貸款餘額為 11.32 萬億元,同比增長 1%;

信託貸款餘額為 4.6 萬億元,同比增長 7.4%;

未貼現的銀行承兑匯票餘額為 2.3 萬億元,同比增長 0.4%;

企業債券餘額為 34.08 萬億元,同比增長 5.6%;

政府債券餘額為 94.24 萬億元,同比增長 18.8%;

非金融企業境內股票餘額為 12.14 萬億元,同比增長 4%。

從結構看:

11 月末對實體經濟發放的人民幣貸款餘額佔同期社會融資規模存量的 60.8%,同比低 1.3 個百分點;

對實體經濟發放的外幣貸款摺合人民幣餘額佔比 0.3%,同比持平;

委託貸款餘額佔比 2.6%,同比低 0.2 個百分點;

信託貸款餘額佔比 1%,同比低 0.1 個百分點;

未貼現的銀行承兑匯票餘額佔比 0.5%,同比低 0.1 個百分點;

企業債券餘額佔比 7.7%,同比低 0.3 個百分點;

政府債券餘額佔比 21.4%,同比高 1.8 個百分點;

非金融企業境內股票餘額佔比 2.8%,同比低 0.1 個百分點。

二、前十一個月社會融資規模增量累計為 33.39 萬億元

初步統計,2025 年前十一個月社會融資規模增量累計為 33.39 萬億元,比上年同期多 3.99 萬億元。其中:

對實體經濟發放的人民幣貸款增加 14.93 萬億元,同比少增 1.28 萬億元;

對實體經濟發放的外幣貸款摺合人民幣減少 1368 億元,同比少減 1873 億元;

委託貸款增加 895 億元,同比多增 1453 億元;

信託貸款增加 3003 億元,同比少增 823 億元;

未貼現的銀行承兑匯票增加 1605 億元,同比多增 3568 億元;

企業債券淨融資 2.24 萬億元,同比多 3125 億元;

政府債券淨融資 13.15 萬億元,同比多 3.61 萬億元;

非金融企業境內股票融資 4204 億元,同比多 1788 億元。

三、廣義貨幣增長 8%

11 月末,廣義貨幣 (M2) 餘額 336.99 萬億元,同比增長 8%。狹義貨幣 (M1) 餘額 112.89 萬億元,同比增長 4.9%。流通中貨幣 (M0) 餘額 13.74 萬億元,同比增長 10.6%。前十一個月淨投放現金 9175 億元。

四、前十一個月人民幣存款增加 24.73 萬億元

11 月末,本外幣存款餘額 334.46 萬億元,同比增長 8%。月末人民幣存款餘額 326.96 萬億元,同比增長 7.7%。

前十一個月人民幣存款增加 24.73 萬億元。其中:

住户存款增加 12.06 萬億元,非金融企業存款增加 1.09 萬億元,財政性存款增加 2.04 萬億元,非銀行業金融機構存款增加 6.74 萬億元。

11 月末,外幣存款餘額 1.06 萬億美元,同比增長 28.3%。前十一個月外幣存款增加 2067 億美元。

五、前十一個月人民幣貸款增加 15.36 萬億元

11 月末,本外幣貸款餘額 274.84 萬億元,同比增長 6.3%。月末人民幣貸款餘額 271 萬億元,同比增長 6.4%。

前十一個月人民幣貸款增加 15.36 萬億元。分部門看,住户貸款增加 5333 億元,其中:

短期貸款減少 7328 億元,中長期貸款增加 1.27 萬億元;

企(事)業單位貸款增加 14.4 萬億元,其中,短期貸款增加 4.44 萬億元,中長期貸款增加 8.49 萬億元,票據融資增加 1.31 萬億元;非銀行業金融機構貸款減少 332 億元。

11 月末,外幣貸款餘額 5429 億美元,同比下降 1.6%。前十一個月外幣貸款增加 8 億美元。

六、11 月份銀行間人民幣市場同業拆借月加權平均利率為 1.42%,質押式債券回購月加權平均利率為 1.44%

11 月份銀行間人民幣市場以拆借、現券和回購方式合計成交 187.7 萬億元,日均成交 9.38 萬億元,日均成交同比下降 1.2%。其中,同業拆借日均成交同比下降 13.2%,現券日均成交同比增長 7.6%,質押式回購日均成交同比下降 2.1%。

11 月份同業拆借加權平均利率為 1.42%,比上月高 0.03 個百分點,比上年同期低 0.13 個百分點。質押式回購加權均利率為 1.44%,比上月高 0.04 個百分點,比上年同期低 0.15 個百分點。

七、11 月份經常項下跨境人民幣結算金額為 1.49 萬億元,直接投資跨境人民幣結算金額為 0.71 萬億元

11 月份,經常項下跨境人民幣結算金額為 1.49 萬億元,其中貨物貿易、服務貿易及其他經常項目分別為 1.19 萬億元、0.3 萬億元;直接投資跨境人民幣結算金額為 0.71 萬億元,其中對外直接投資、外商直接投資分別為 0.26 萬億元、0.45 萬億元。