The Top Ten Possible Black Swans in the Global Market in 2026

Deutsche Bank macro strategist Jim Reid released a research report listing the top ten "black swan" events that could impact global markets in 2026. These events include AI-driven high growth in the U.S. economy, the S&P 500 index rising to 8,000 points, aggressive interest rate cuts by the Federal Reserve, easing global trade tensions, successful reforms in Europe, the Federal Reserve restarting interest rate hikes, the bursting of the AI bubble, a U.S.-Japan sovereign debt crisis, resonance of political and economic crises in Europe, and extreme disasters in the physical world

As 2026 approaches, Deutsche Bank macro strategist Jim Reid has released a new research report indicating that, given the unexpected and severe fluctuations in global markets over the past five years—from the pandemic and soaring inflation to the turmoil of "liberation day"—the most surprising outcome in the future may be precisely that "nothing unexpected happens."

However, beneath the calm surface, Deutsche Bank has listed ten potential "black swan" events that could change the course of global markets, covering extreme scenarios from AI-driven economic prosperity to the outbreak of a debt crisis.

- AI-driven U.S. economy returns to high growth: A surge in AI capital expenditure could boost productivity, allowing the U.S. economy's annual growth rate to return to above 4%, reminiscent of the late 1990s boom.

- S&P 500 index hits 8000 points: Driven by AI prosperity and liquidity, U.S. stocks may continue to rise, achieving an annual return of about 17%, with an increase to 8000 points still within long-term trends.

- Fed aggressively cuts rates for a "soft landing": The Fed may successfully curb inflation without triggering a recession, with the fastest rate cuts since the 1980s (expected to total over 175 basis points) during a non-recession period.

- Global trade tensions ease more than expected: Driven by political dynamics such as the midterm elections, the U.S. may expand tariff exemptions.

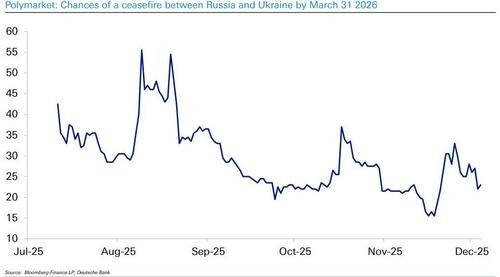

- Successful European reforms and easing geopolitical risks: If German fiscal stimulus proves effective, it could boost the European economy; simultaneously, any progress towards a ceasefire in the Russia-Ukraine conflict would greatly uplift European asset prices.

- Fed forced to restart rate hikes to combat inflation: If inflation remains above target, the Fed may reverse its rate-cutting process and unexpectedly raise rates, disrupting current market pricing logic.

- AI bubble bursts and market leverage collapses: If leading AI companies (like Nvidia) fail to meet earnings expectations, high valuations may become unsustainable; combined with high financing leverage, this could trigger a chain sell-off.

- U.S. and Japan sovereign debt crises: The market may question the sustainability of the U.S. "wartime level" deficit; if Japan's "low inflation" belief collapses, it could trigger a sell-off in Japanese bonds and capital flight.

- Resonance of political and economic crises in Europe: Ineffective German stimulus and worsening political deadlock in France could create negative feedback, raising risk premiums and triggering capital outflows.

- Extreme disasters in the physical world: Such as pandemics, solar flare eruptions, or supervolcano eruptions.

Although the current market expectations are generally stable, Jim Reid and his team emphasize that investors need to be wary of bidirectional risks.

In the extreme optimistic scenario, a replay of the 1990s tech boom could push the U.S. economy's annual growth rate back to 4% and elevate the S&P 500 index to 8000 points. However, the report also warns of potential downside risks, including a Fed policy misstep leading to a rebound in inflation, an AI bubble burst, and structural crises such as a collapse of confidence in the Japanese bond market.

These potential "variables" not only challenge the current market consensus but also reveal the deep vulnerabilities facing the global economy in the post-pandemic era. From the U.S. massive deficit to Europe's political deadlock, and the potentially reversing global trade tensions, each variable could trigger a repricing of asset prices

Upside Risks: AI Boom, Market Surge, Trade Easing, Successful European Reforms, and Geopolitical Risk Mitigation

1. AI Capital Expenditure Drives U.S. Economy Back to 4% Growth:

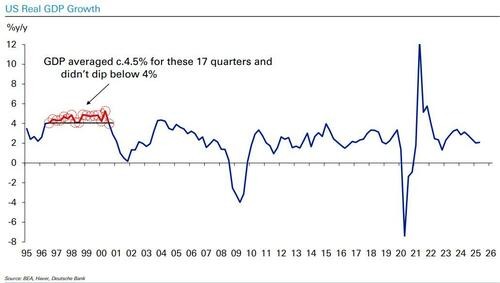

Deutsche Bank points out that between 1996 and 2000, the annualized growth rate of the U.S. economy consistently maintained above 4%. Although the current cycle has performed strongly since 2023, the average annualized growth rate is only 2.6%.

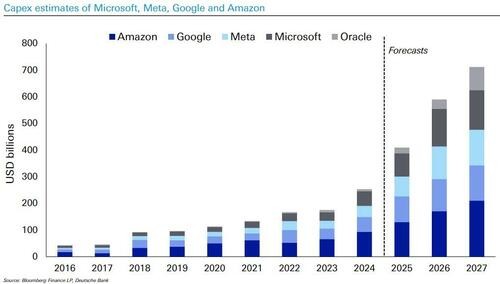

If AI capital expenditure and productivity improvements have a substantial impact, or even if driven merely by a bubble, it is entirely possible for the U.S. economy to replicate the high-speed growth of the late 1990s by 2026. Considering that large tech companies currently have ample cash flow and profit support, this capital expenditure plan is largely secure.

2. S&P 500 Index Surges to 8000 Points:

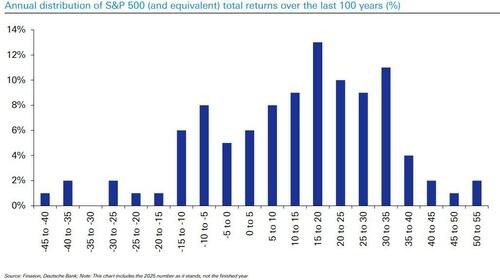

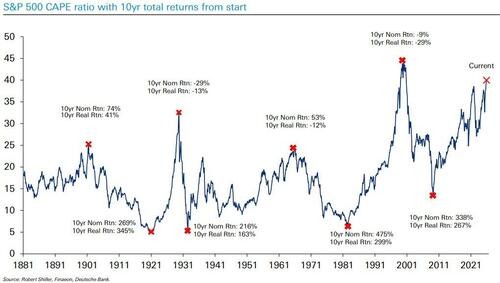

In the bank's optimistic forecast, the S&P 500 index could reach 8000 points by 2026, implying an annual return of about 17%. Historical data shows that annual returns of 15% to 20% have been the most common over the past century, with nearly 40% of years experiencing even higher gains. Furthermore, even if the market is in a bubble, referencing the experience during the internet bubble, the upward trend continued for another year after the price-to-earnings ratio reached current levels.

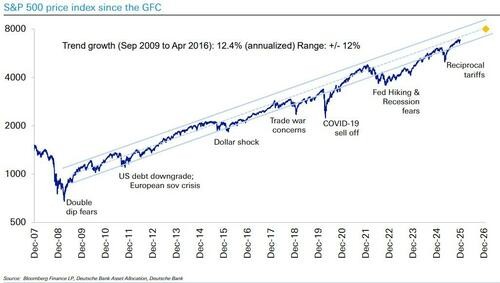

If U.S. stocks rise again in 2026, it will be the first time since the global financial crisis that there have been four consecutive years of increases, with the long-term trend still within the stable growth trajectory established after the 2008 financial crisis.

3. Aggressive Rate Cuts by the Federal Reserve Support "Soft Landing":

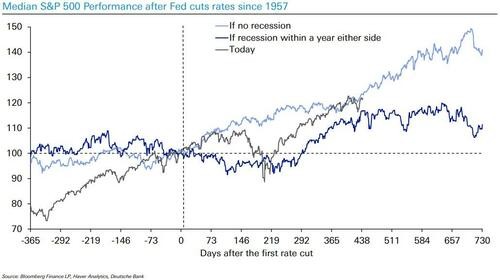

Deutsche Bank analyzes that if the Federal Reserve achieves a soft landing through rate cuts without an economic recession, historical median data shows that stock market gains typically hover around 50% two years after the onset of a rate-cutting cycle, and the current market trend aligns with this pattern. By December 2025, the Federal Reserve will have cumulatively cut rates by 175 basis points since September 2024, with more cuts expected in the future. This is the fastest pace of rate cuts in non-recession periods since the 1980s, which will provide ample liquidity to the market

4. Trade Ceasefire and Tariff Reductions:

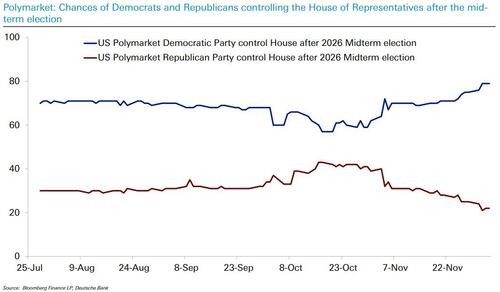

As the U.S. midterm elections approach, the political motivation to reduce inflation may prompt the government to expand tariff exemptions for certain goods.

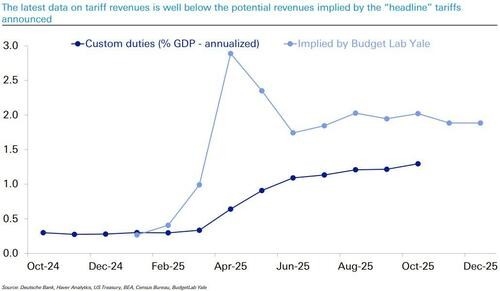

Deutsche Bank points out that the actual tariff revenue currently collected is far below the levels implied by the nominal tax rates, indicating that the policy is "more sound than substance."

5. Successful European Reforms and Easing Geopolitical Risks:

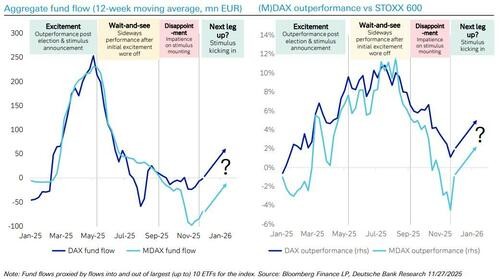

On one hand, Germany's reforms and fiscal stimulus may inject vitality into an economy that has fallen into stagnation.

Since the surge in oil prices in 2022, oil prices have continued to decline and are currently near their lowest levels in nearly five years.

However, in the long run, oil prices will ultimately only align with the inflation rate, which is currently comparable. Considering the midterm elections in 2026 and issues like rising living costs, Trump may hope for further declines in oil prices.

The prediction market still believes that the likelihood of reaching a ceasefire agreement in the coming months is low; therefore, any progress towards a ceasefire in the Russia-Ukraine conflict would have a significant positive reaction on European assets and exert downward pressure on oil prices.

Downside Risks: Inflation Resurgence, Bubble Bursts, Sovereign Debt Crisis, Resonance of Political and Economic Crises in Europe, Extreme Scenarios

6. Federal Reserve Forced to Restart Rate Hikes:

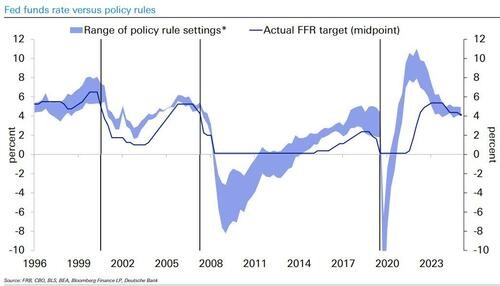

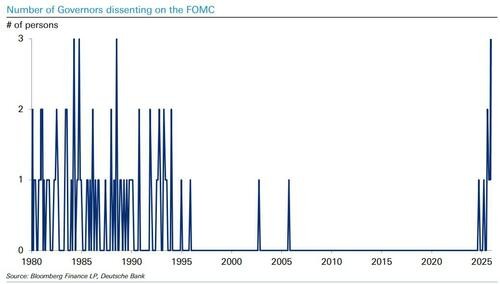

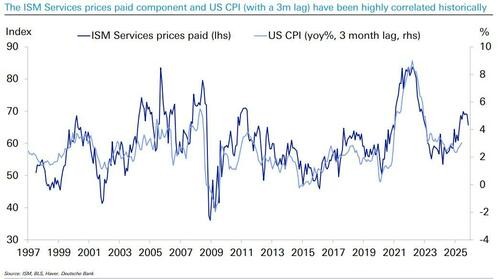

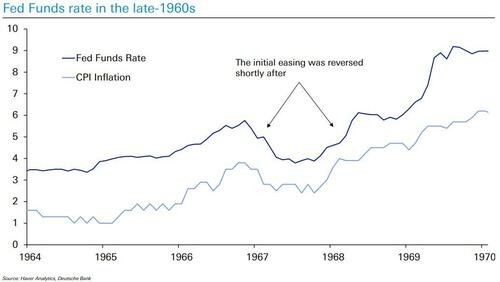

Despite market expectations for rate cuts, Deutsche Bank warns that if inflation remains above target in 2026 and the policy rule rates are low, the Federal Reserve may not only stop cutting rates but may even be forced to raise rates.

This narrative shift will disrupt the market, especially considering that major positions at the Federal Reserve may change in 2026.

Unless oil prices drop significantly or an economic shock occurs, we have reason to believe that U.S. inflation will remain above target levels for the foreseeable future.

If the new chair adopts a dovish stance while inflation continues to rise under tariff pressures, it could lead to policy mistakes similar to those in the 1960s, where premature easing resulted in runaway inflation.

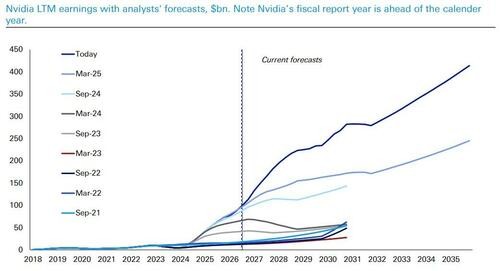

7. AI Bubble Burst and Profit Warnings:

Currently, U.S. stock valuations are at their highest level since the peak of the internet bubble. This high valuation is based on the assumption that U.S. corporate earnings will continue to exceed expectations.

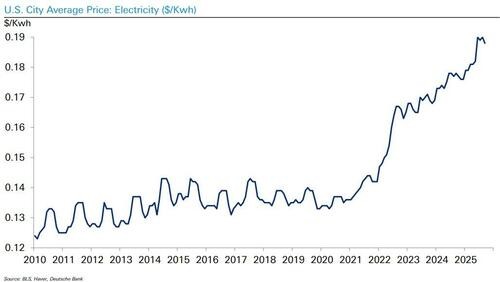

If the economy slows amid soaring electricity costs brought on by the data center boom, it could trigger a negative feedback loop.

If future earnings forecasts for leaders like Nvidia start to level off or the market's willingness to finance loss-making companies suddenly dries up, the entire AI trading logic and global market optimism will face severe challenges.

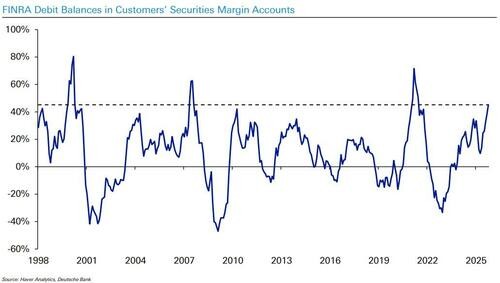

The surge in margin financing balances is typically a signal of the late stages of a bull market. The current pace of leverage accumulation is comparable to that seen before the burst of the internet bubble and the frenzy period post-pandemic

The surge in margin financing balances is typically a signal of the late stages of a bull market. The current pace of leverage accumulation is comparable to that seen before the burst of the internet bubble and the frenzy period post-pandemic

At the same time, the U.S. economic expansion has reached the post-war average level, with signs of weakness in the job market, and the failures of companies like Tricolor and First Brands have raised concerns in the private credit bond sector.

Will the wave of unemployment caused by artificial intelligence in 2026 worsen? Small businesses are struggling to hire, while large companies are accelerating the application of artificial intelligence. Despite economic growth, the unemployment rate has temporarily risen, which may lead to more negative feedback loops.

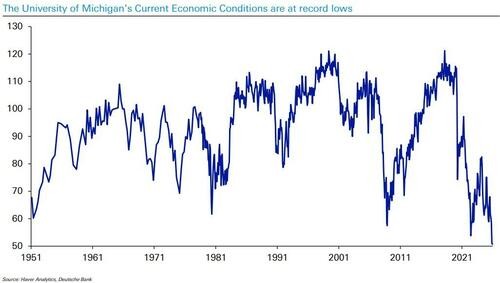

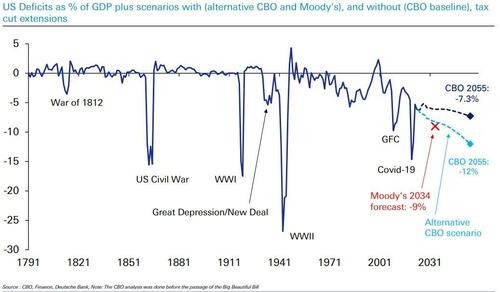

8. Sovereign Debt Crisis:

Deutsche Bank specifically mentioned the risks of sovereign debt in developed markets. As long-term yields approach nominal GDP growth rates, the once "debt financing dividend period" has ended. The persistent massive deficit levels in the U.S. are typically only seen during wartime, which poses challenges to long-term fiscal sustainability.

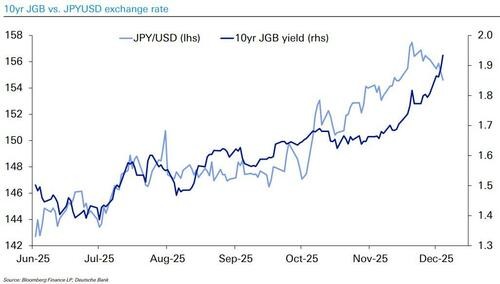

In Asia, Japanese government bonds are seen as another potential eye of the storm. Japan has the highest public debt-to-GDP ratio in the world, relying on high domestic household savings and expectations of low inflation to maintain system stability. However, once domestic confidence in the government's and the Bank of Japan's commitment to controlling inflation is lost, the rationale for purchasing Japanese bonds will disappear, potentially triggering destructive capital flight.

9. Resonance of Political and Economic Crises in Europe:

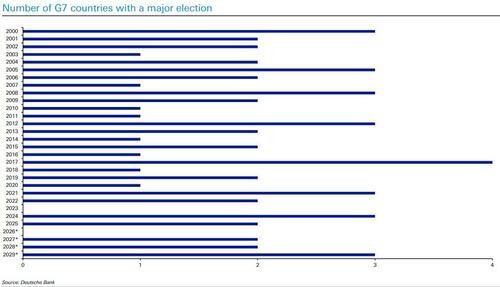

The European market faces distinctly different risks. The year 2026 will be the second time in the 21st century without elections for major G7 member countries. This will differ from the situation in recent years where new governments have emerged in the U.S., the U.K., and Germany.

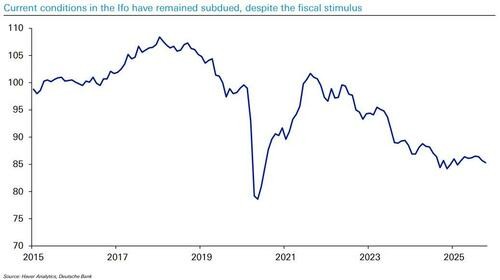

Deutsche Bank holds a cautious attitude towards the effects of Germany's fiscal stimulus. Germany has not seen significant growth for six years, and historical precedents indicate that large-scale fiscal stimulus may not yield positive feedback in supply-constrained economies.

Deutsche Bank holds a cautious attitude towards the effects of Germany's fiscal stimulus. Germany has not seen significant growth for six years, and historical precedents indicate that large-scale fiscal stimulus may not yield positive feedback in supply-constrained economies.

In France, the political deadlock may come to an end, and if legislative elections are held early in 2026, it could lead to further instability, pushing up the yield spread between French and Italian government bonds.

10. Extreme Black Swans in the Physical World:

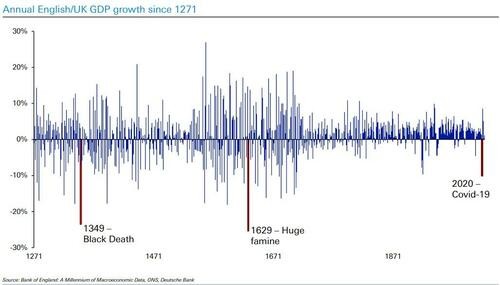

Finally, the report reminds investors not to overlook non-financial tail risks, such as pandemics, solar flare outbreaks, or supervolcano eruptions. Just as the eruption of Mount Tambora in 1815 led to the "Year Without a Summer" and triggered widespread famine the following year, extreme natural events have the potential to render all benchmark economic forecasts instantly invalid. Although the probability of such risks is extremely low, their destructive power is sufficient to reshape the global economic landscape.

Risk Warning and Disclaimer

Markets are risky, and investments should be made with caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk