Risk appetite returning? Global stock markets rise together, U.S. stock futures mixed, copper continues to hit new highs, silver fluctuates at high levels

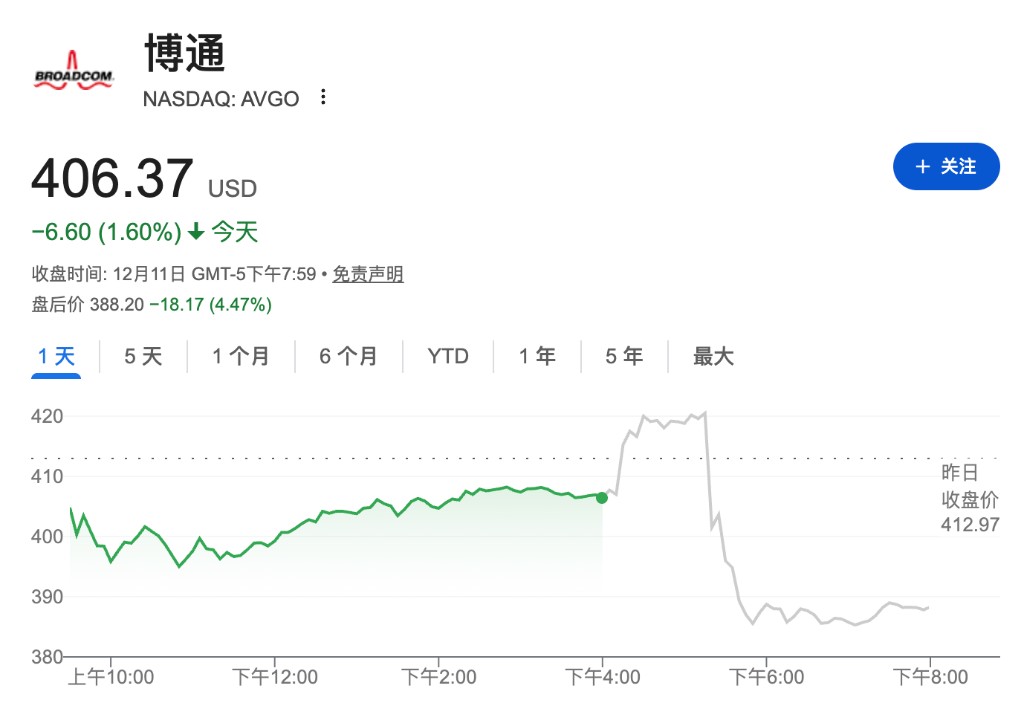

Broadcom and Oracle's financial reports have once again raised market concerns about the AI bubble, leading to a divergence in the U.S. stock market, with tech-heavy Nasdaq futures declining. Boosted by the Federal Reserve's interest rate cuts, precious metals performed well, with silver fluctuating at high levels, copper prices continuing to reach new highs, and gold rising slightly

The US stock market is experiencing significant style rotation. After the Dow Jones Industrial Average and the S&P 500 Index reached historic highs overnight, US stock index futures showed a mixed trend, with the tech-heavy Nasdaq 100 futures performing weakly.

On December 12, European and Asian stocks generally rose. The US dollar and US Treasury bonds remained stable overall, while the Indian rupee fell to a historic low. Commodities performed strongly, with gold and crude oil rising, silver fluctuating at high levels, and copper prices hitting a new all-time high. Cryptocurrencies showed divergence, with Bitcoin declining and Ethereum rising slightly.

Since the beginning of this week, the Federal Reserve's interest rate cuts and its positive outlook on the US economy have boosted market sentiment, driving global stock markets to higher levels. However, Oracle and Broadcom's latest earnings reports fell short of expectations, reigniting concerns about overvaluation in the artificial intelligence sector, leading to pressure on the tech stock sector.

Gina Bolvin, President of Bolvin Wealth Management Group, stated:

"This momentum should continue into the end of the year. With the progress of interest rate cuts, the new Federal Reserve chair about to take office, and corporate earnings continuing to rise, the bull market is expected to extend into 2026. As more companies adopt artificial intelligence technology, the scope of participation will expand, and other industries beyond the seven major sectors may also begin to show strong momentum."

Core market trends are as follows:

- S&P 500 futures flat, Nasdaq 100 futures down over 0.1%, Dow futures up 0.2%

- Germany's DAX 30 index opened up 0.37%, UK's FTSE 100 index opened up 0.26%, France's CAC 40 index opened up 0.17%, and Europe's Stoxx 50 index opened up 0.32%

- The Nikkei 225 index closed up 1.4%, at 50836.55 points, Japan's Topix index closed up 2%, and South Korea's Seoul Composite Index closed up 1.4%.

- The 10-year US Treasury yield was basically flat at 4.16%

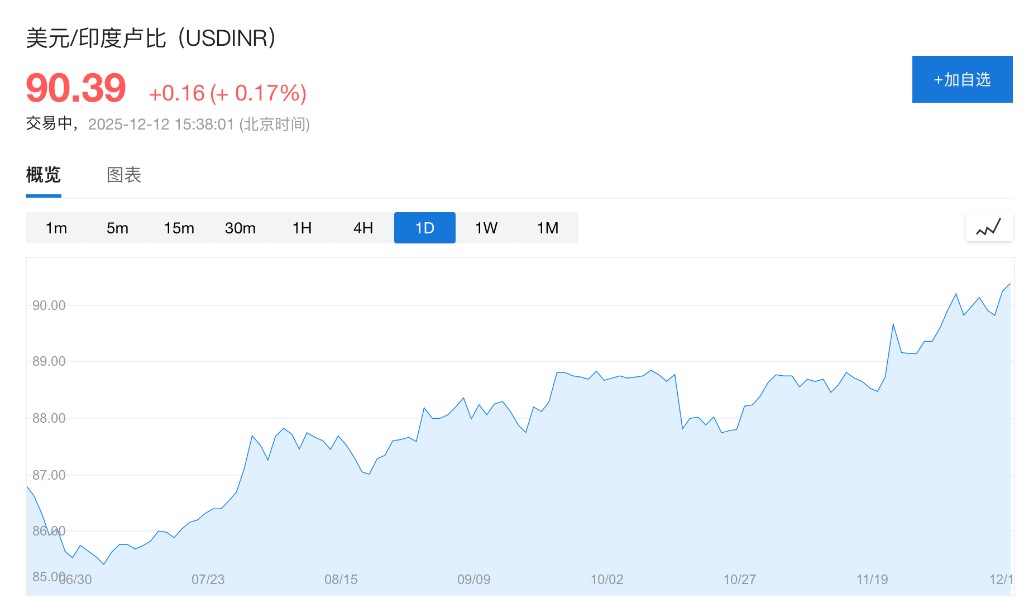

- The US dollar index was basically flat, the yen fell 0.1% against the dollar to 155.75, and the Indian rupee hit a historic low of 90.55 against the dollar

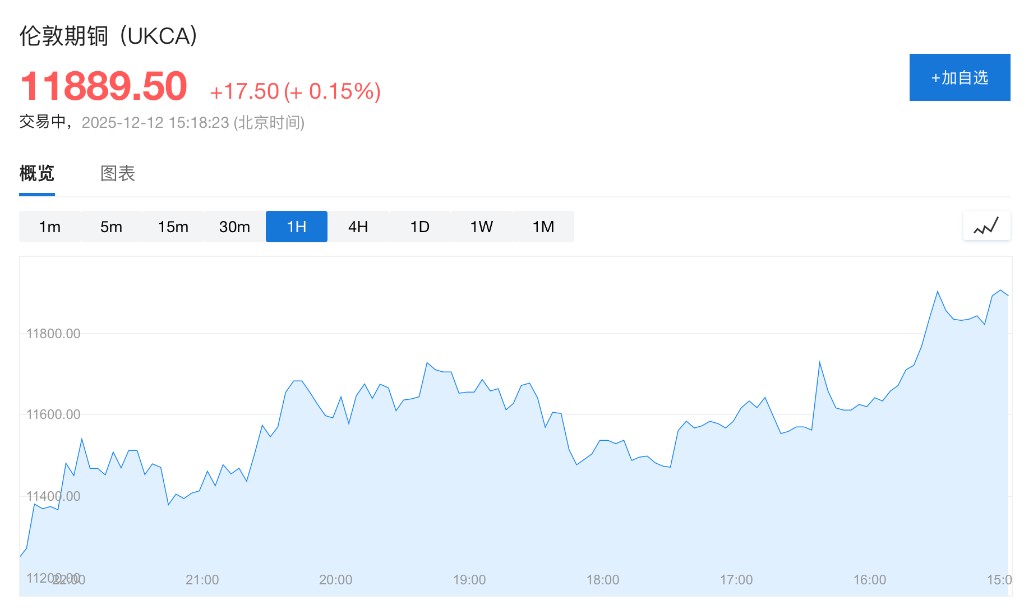

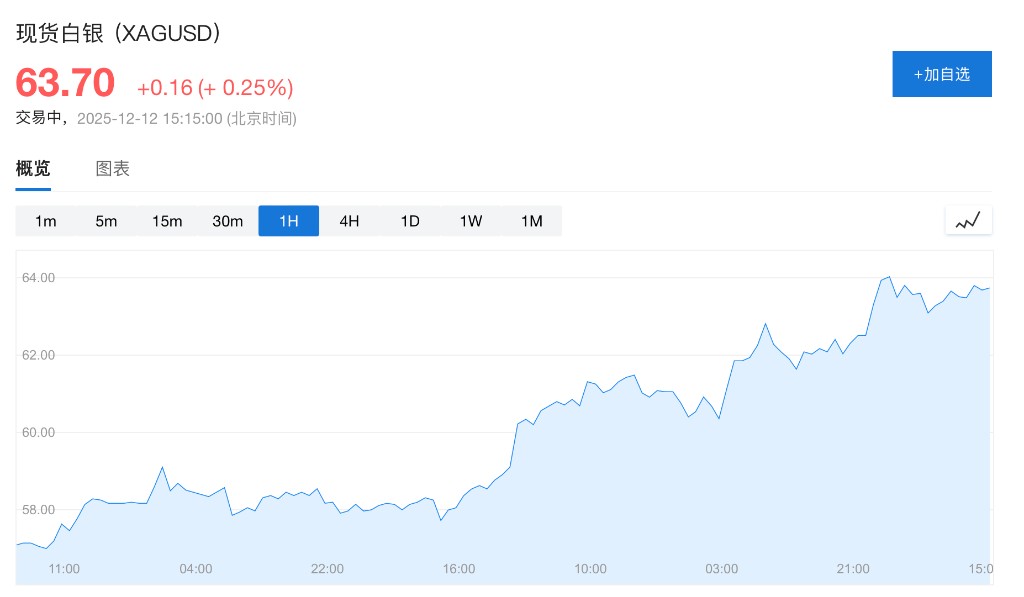

- Spot gold rose 0.1% to $4283 per ounce; spot silver rose 0.02% to $63.55 per ounce; LME copper broke through $11906 per ton, setting a new all-time high; WTI crude oil rose over 0.5% to $57.75 per barrel

- Bitcoin fell 0.3% to $92643.51, while Ethereum rose 0.4% to $3263.19

US stock index futures showed mixed results, with S&P 500 futures basically flat, but Nasdaq 100 futures down over 0.1%. The earnings reports of two tech giants have once again raised cautious sentiment in the market regarding the high valuations of the tech sector and the sustainability of massive investments in artificial intelligence infrastructure.

According to Wallstreetcn, although Broadcom reported record revenue and profit for the fourth quarter, its backlog of artificial intelligence-related orders was below market expectations, and the company warned that due to changes in the sales structure of AI products, overall profit margins may face narrowing pressure Previously, the weak cloud business revenue and aggressive capital expenditure plans in Oracle's latest financial report have raised market concerns about the efficiency of its artificial intelligence investment returns and the risks of debt financing.

The Tokyo Stock Exchange index led the major Asian stock markets, closing at a historic high. The market generally expects the Bank of Japan to raise interest rates next week, driving strong performance in the financial sector, which has become the core driving force behind this round of gains.

The US dollar index approached a two-month low on Friday and may record a decline for the third consecutive week. The market generally expects the Federal Reserve to cut interest rates next year, while expectations for interest rate hikes in Europe have reignited, leading to a divergence in monetary policy that will put pressure on the dollar.

The Indian rupee fell to a historic low on Friday due to a lack of confidence in the prospects of the India-US trade agreement and ongoing capital outflows. The Reserve Bank of India may have intervened to curb the decline. So far this year, the rupee has become the worst-performing currency in Asia, depreciating nearly 6% against the dollar. The United States has imposed high tariffs of up to 50% on Indian goods, impacting exports to its largest market and reducing foreign investors' interest in the Indian local stock market.

Spot silver fluctuated at a high level, rising over 0.2% to $63.7 per ounce. According to Wallstreetcn, silver prices have doubled since the beginning of the year, with severe supply-demand imbalances creating a solid fundamental backdrop. Geopolitical risks have intensified market volatility, and retail enthusiasm along with "fear of missing out" psychology has further boosted demand, while expectations of dollar depreciation that may arise from the Federal Reserve's interest rate cut cycle have expanded its financial attractiveness.

London copper futures hit a new high, rising to $11,948 per ton during the day.