"Not raising the guidance for fiscal year 2026" is not a big issue, Goldman Sachs: increasingly confident in Broadcom's AI business

高盛表示,博通第四財季業績強勁、AI 收入大增,但因未上調 2026 財年全年指引,短期或承壓。該行仍堅持 “買入”,認為其在定製芯片領域地位穩固,AI 業務增速被低估,預計中長期持續跑贏。訂單積壓達 730 億美元,新客户與大額訂單強化增長動能。

儘管博通未能如部分投資者預期那樣上調 2026 財年的全年業績指引,並在短期內可能面臨股價回調壓力,但高盛依然重申了對該公司的 “買入” 評級。這家華爾街大行認為,博通在定製芯片領域的統治地位正在增強,其 AI 業務的基本面從未如此穩固。

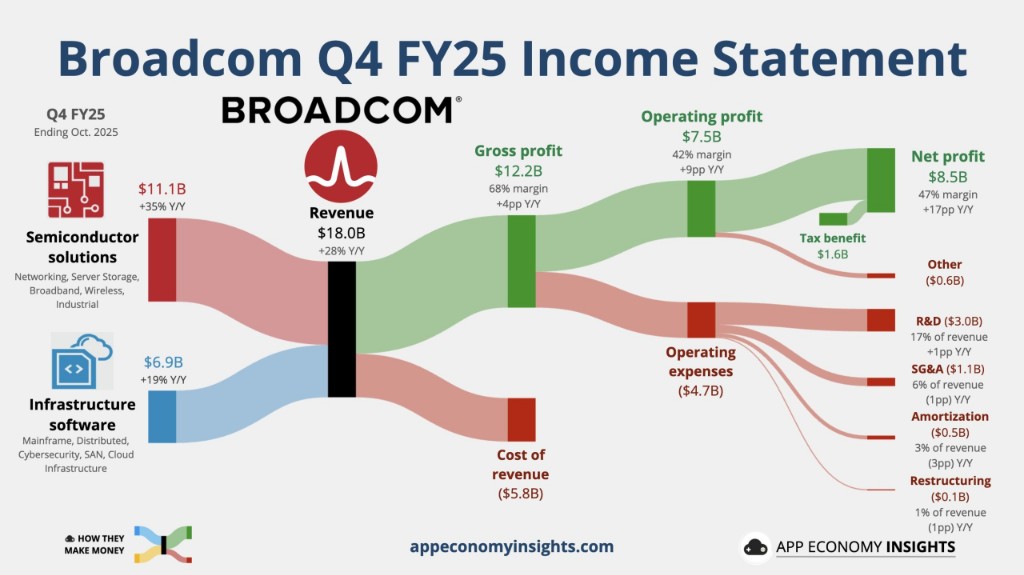

據追風交易台消息,博通公佈了一份表現強勁的第四財季業績,其營收錄得 180 億美元,超出市場預期的 175 億美元。更為關鍵的是,公司給出的 2026 財年第一季度營收指引達到 191 億美元,同樣顯著高於分析師預期的 183 億美元。這一增長主要得益於 AI 半導體收入的激增,該板塊在第四財季實現了 74% 的同比增長。

然而,市場對這份財報的反應可能夾雜着失望情緒。高盛分析師 James Schneider 團隊在最新發布的研報中指出,儘管業績強勁且第一季度展望樂觀,但管理層並未更新或上調其此前發佈的 2026 財年全年 AI 營收增長指引。考慮到投資者在財報發佈前已持樂觀看漲的倉位,且 AI 業務本身正顯示出加速跡象,缺乏正式的全年指引上調可能會被視為一種遺憾,從而導致股價在短期內出現回落。

儘管如此,高盛強調這並不改變其長期看好的邏輯,並將博通的 12 個月目標價從 435 美元上調至 450 美元。高盛表示,任何股價的疲軟都應被視為買入機會。該行堅信,博通在定製芯片(XPU)領域的優勢正在確立其在超大規模計算企業低成本推理市場的核心地位,來自谷歌等主要客户的持續需求將推動其 AI 業務在中長期內持續跑贏同行。

未更新的全年指引或引發回調

在此次財報電話會上,博通管理層雖然表示 AI 收入正從 2025 財年 65% 的增速加速,並預計第一季度將實現約 100% 的增長,但並未針對 2026 財年的 AI 收入增長預期提供正式更新。

James Schneider 在報告中寫道,鑑於市場對 2026 財年指引上調缺乏上行空間,儘管季度業績強勁且指引高於華爾街預期,預計股價仍將出現回調。投資者此前已建立了建設性的倉位,因此這一 “缺失的指引更新” 可能會在短期內抑制市場情緒。

不過,高盛基於自身的行業調研模型預測,博通在 2026 財年的 AI 收入增長實際上將遠超 100%。分析師認為,管理層的保守並未反映實際的業務動能,高盛對博通 AI 業務持續跑贏大盤的信心正在增加。

AI 客户版圖擴張:Anthropic 百億訂單與新客户

撇開指引問題,博通在客户拓展方面取得了實質性進展。報告顯示,博通不僅維持了與最大客户谷歌在 TPU 項目上的強勁勢頭,還披露了新的重要客户動態。

高盛強調,博通已宣佈獲得了第五家 XPU 客户(明確指出並非 OpenAI),並將於 2026 財年開始產生早期收入。此外,作為博通第四大 XPU 客户的 Anthropic,已為 2026 財年追加了高達 110 億美元的訂單。

目前的訂單積壓情況也印證了需求的強勁。管理層透露,未來 18 個月的 AI 訂單積壓金額已達到 730 億美元,且隨着額外訂單的增加,這一數字還在繼續擴大。除了谷歌,管理層還提到包括蘋果和 Cohere 在內的其他客户也已開始使用其 TPU 相關技術,儘管目前仍有兩家現有客户專注於自己的定製芯片項目。

超預期的財務表現與利潤率趨勢

從具體財務數據來看,博通的表現全面超出高盛及華爾街的一致預期。第四財季,公司 AI 半導體收入達到 65 億美元,高於預期的 62 億美元;半導體解決方案總收入為 111 億美元,高於預期的 107 億美元;基礎設施軟件收入為 69 億美元,亦小幅超出預期。

在盈利能力方面,博通第四財季的毛利率為 77.9%,略高於市場預期。對於 2026 財年第一季度,公司給出的調整後 EBITDA 利潤率指引為 67%。

值得注意的是,高盛在報告中提到,隨着博通在 2026 財年下半年開始向 Anthropic,以及潛在的 OpenAI 交付全機架解決方案(full-rack solutions),由於這些方案包含較高比例的直通組件,可能會在百分比層面上對毛利率和營業利潤率造成一定程度的稀釋。然而,公司預計這項業務在絕對美元金額上將保持強勁的增厚效應,並將通過運營槓桿和其他成本優化措施來抵消部分稀釋影響。

估值邏輯與風險因素

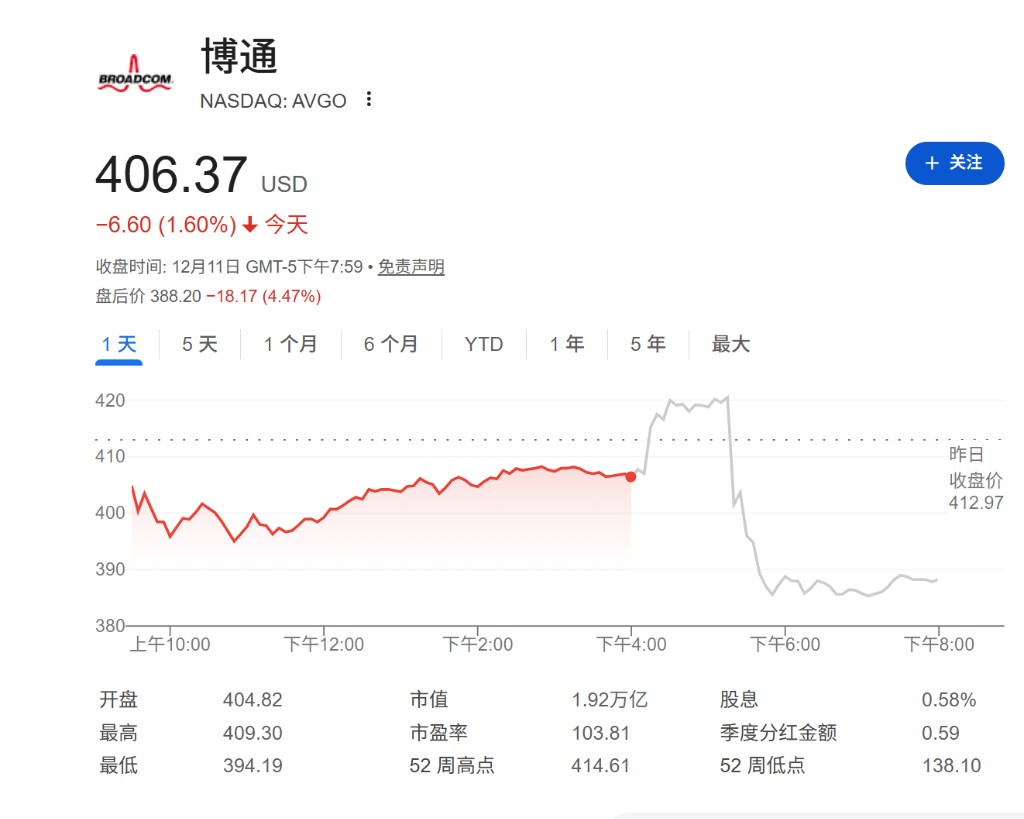

基於對 AI 收入預期的上調和對行業週期的更高能見度,高盛雖然維持了 38 倍的市盈率乘數不變,但將標準化每股收益(EPS)預估值從 11.50 美元上調至 12.00 美元,從而得出 450 美元的新目標價。截至發稿,博通盤後下跌 4.47% 至 406 美元。

高盛重申,博通在定製芯片領域的統治地位使其能夠為超大規模企業和模型構建者提供低成本的推理方案,這構成了其投資邏輯的核心。

同時,報告也列舉了該股面臨的主要下行風險,包括:AI 基礎設施支出的放緩、在定製計算領域的市場份額流失、非 AI 業務持續的庫存消化問題,以及 VMware 面臨的競爭加劇。