Costco 第一财季营收超预期增长 8.2%,线上销售额飙升 20% | 财报见闻

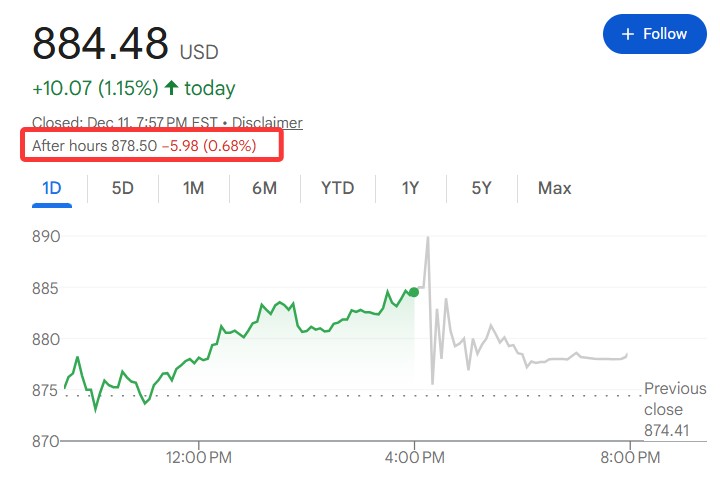

In the first fiscal quarter, Costco's revenue grew by 8.2% to USD 67.31 billion, with an EPS of USD 4.50, both exceeding Wall Street expectations. Net profit increased from USD 1.8 billion in the same period last year to USD 2 billion, a growth of 11.1%. The effects of the e-commerce transformation are encouraging, with website traffic increasing by 24% and app traffic surging by 48%. The company's stock price fell slightly by 0.68% after the earnings report

Thanks to the growth in its online sales and the opening of new stores, Costco, the favorite warehouse-style supermarket of the American middle class, exceeded Wall Street expectations in its first fiscal quarter.

After the U.S. stock market closed on Thursday, Costco's first fiscal quarter report showed strong performance, with revenue increasing by 8.2% compared to the same period last year. The effects of the e-commerce transformation were impressive, with e-commerce sales surging by 20.5%.

In addition, quarterly profit growth exceeded expectations, indicating that price-sensitive American consumers are still pursuing quality goods at reasonable prices. The specific performance of the financial report is as follows:

- Strong financial performance: First fiscal quarter revenue reached $67.31 billion, a year-on-year increase of 8.2%, with earnings per share of $4.50, all exceeding Wall Street expectations; net profit was $2 billion, up 11% year-on-year.

- Accelerated e-commerce transformation: E-commerce sales surged by 20.5%, website traffic increased by 24%, and app traffic skyrocketed by 48%; Black Friday's single-day non-food orders broke $250 million, setting a record.

- Membership system expansion: Paid members reached 81.4 million, a year-on-year increase of 5.2%, with the membership fee adjustment policy contributing to profits since it took effect in September; renewal rates in the U.S. and Canada were 92.2%.

- Store expansion plan: Eight new warehouse stores opened in the first quarter, bringing the global total to 921; plans to open more than 30 new stores each year in the future.

- Tariff challenges intensify: About one-third of U.S. sales come from imported goods, and the company has sued the Trump administration to seek a refund of tariffs and to prevent their imposition.

After the earnings report, the company's stock price fell slightly by 0.68%. Year-to-date, as of Thursday's close, the stock has fallen by 3.5%, while the S&P 500 index has risen by 17% during the same period.

The Logic Behind Revenue Growth

The company's first fiscal quarter revenue of $67.31 billion, a year-on-year increase of 8.2%, exceeded Wall Street expectations.

However, it is important to note that this growth largely relies on two factors: store expansion and membership fee increases.

Analysts believe that global comparable sales grew by 6.4%, with the U.S. market at 5.9%. This growth rate is not particularly impressive in the context of inflation and reflects more of a consumer search for "value for money" rather than a true increase in purchasing power.

CFO Gary Millerchip emphasized that the membership fee increase (effective in September in the U.S. and Canada) has started to contribute to earnings. Paid members increased to 81.4 million, a year-on-year increase of 5.2%, with cardholders reaching 145.9 million.

What is truly noteworthy is the explosion of the e-commerce business. E-commerce sales grew by 20.5%, website traffic increased by 24%, and app traffic soared by 48%. These figures indicate that Costco has finally found its footing in the e-commerce transformation

Costco has also had a good start in the busiest weeks of the holiday shopping season. Millerchip stated that Black Friday was a record day for the company's e-commerce business in the U.S., with non-food orders exceeding $250 million.

The growth of same-day delivery services offered by Instacart, Uber, and DoorDash has even outpaced overall e-commerce growth, indicating that instant delivery is becoming a new battleground for competition.

Costco has been expanding its online business and trying to enhance the in-store experience by speeding up checkout and extending shopping time for some customers. Additionally, Costco has been reducing the impact of tariffs by adjusting product shipping routes, ordering more inventory in advance, and completely changing the types of products offered.

However, it is worth noting that the renewal rate in the U.S. and Canada is 92.2%, while the global renewal rate is 89.7%, which has slightly declined. Management attributes this to a lower online membership renewal rate, and analysts believe that although the e-commerce business is growing rapidly, the loyalty of online members may not be as strong as that of offline members.

Price Stability

As a warehouse-style membership supermarket, Costco relies on membership fees to increase revenue and maintain low prices for products. However, with rising tariffs, this retailer faces the dilemma of increasing costs. About one-third of Costco's sales in the U.S. come from imported goods.

Millerchip stated that price levels "have remained basically stable compared to recent quarters." He pointed out that in grocery items, Costco has found that inflation rates for commodities such as beef, seafood, and coffee are high, while inflation rates for eggs, cheese, butter, and agricultural products are low, offsetting some of the inflation impact.

Millerchip mentioned during the earnings call that Costco has been looking for ways to reduce the impact of tariffs, including sourcing more products from the U.S., integrating global procurement to lower product costs, and replacing product categories or items with those less affected by high tariffs.

He noted that its private label, Kirkland Signature, is another way to offset tariff prices, as it has greater control over the supply chain.

In late November, Costco sued the Trump administration, seeking a full refund of the new tariffs paid so far this year and to prevent the company from being charged these import tariffs while the Supreme Court makes a ruling on the tariff issue.

CEO Ron Vachris reiterated plans to open more than 30 new stores each year, with 8 new stores opened in the first quarter. The total number of global stores has reached 921. Analysis suggests that this pace of expansion appears aggressive in the overall cautious environment of the retail industry, but it is also an inevitable choice for Costco to maintain growth— as a membership-based warehouse model, store density directly affects members' perceived value