国泰海通梁中华:11 月核心服务价格弱于季节性,仍待政策提振

2025 年 11 月核心 CPI 同比维持高位,PPI 同比降幅扩大。财政补贴和反内卷政策效果持续,核心服务 CPI 修复弹性是价格回暖关键。11 月 CPI 受食品、消费补贴政策及金价上涨推动,核心服务价格弱于季节性,需政策提振。全球有色金属涨价支撑 PPI,国际油价下行拖累。未来需政策发力以提振内需。

概要

11 月核心 CPI 同比维持高位,PPI 同比降幅扩大。财政补贴、反内卷政策效果持续,后续价格修复的关键变量或在于核心服务 CPI 修复弹性。

2025 年 12 月 10 日,国家统计局发布 2025 年 11 月物价数据,CPI 同比回升至 0.7%,PPI 同比回落至-2.2%,价格端总体仍有待提振。

11 月 CPI 主要受到食品、消费补贴政策及金价上涨推动,核心服务价格仍弱于季节性,仍待政策提振。近期的 “十五五规划” 及中央经济工作会议当中也强调了对于服务消费的重视,我们认为,与 2025 年依靠 “以旧换新” 对实物消费的拉动不同,2026 年物价回暖的关键变量将切换至服务 CPI 的修复弹性。

11 月 PPI 表现主要由上游价格支撑,背后驱动因素为全球有色金属涨价,同时 “反内卷” 政策对部分行业的影响仍在体现,而国际油价下行对 PPI 价格形成拖累,下游耐用品消费价格仍然偏弱。往后看,“反内卷” 政策对工业品价格的影响或将持续体现,结合高频数据来看,12 月以来以铜、白银为代表的国际有色金属价格仍在上行,短期输入性因素或将对 PPI 形成支撑,不过上下游价格分化,反映内需仍待提振,后续仍需期待政策发力。

正文

事件:2025 年 12 月 10 日,国家统计局发布 2025 年 11 月物价数据,CPI 同比回升至 0.7%,PPI 同比回落至-2.2%。我们的解读如下:

1 核心 CPI:同比维持高位

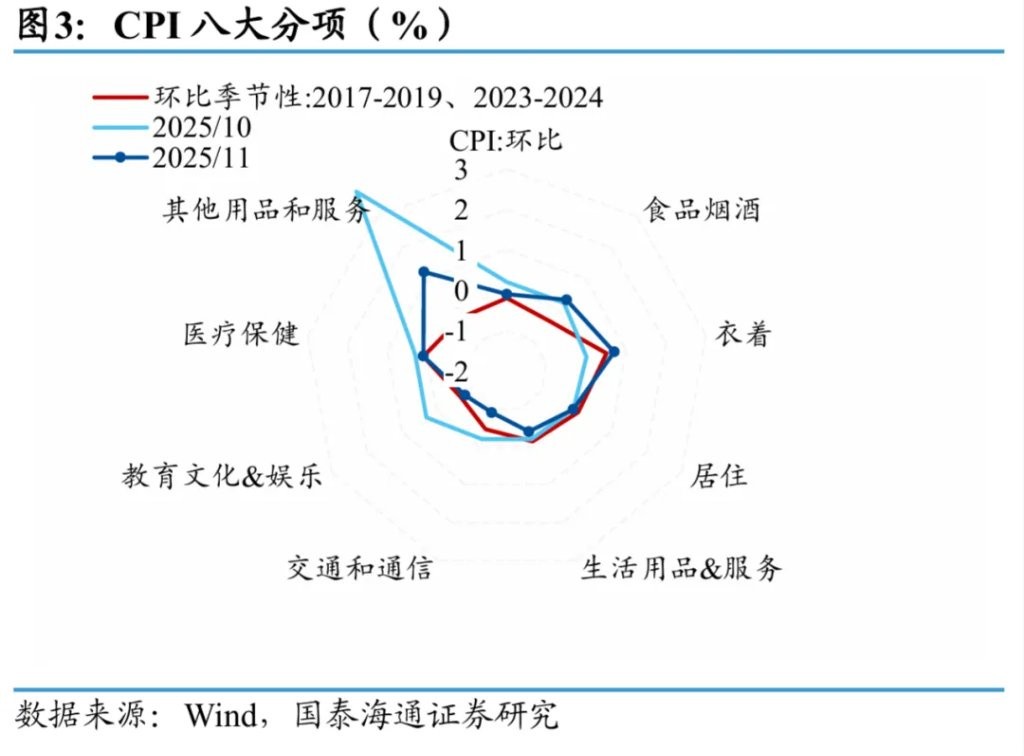

11 月 CPI 环比下降 0.1%,同比涨幅则回升至 0.7%。其中食品价格环比涨幅由前一月的 0.3% 扩大至 0.5%,同比也由负转正,对 11 月 CPI 表现形成支撑;非食品 CPI 环比下降 0.2%,同比涨幅降至 0.8%(前值 0.9%)。11 月核心 CPI 同比上涨 1.2%,与前一月持平,维持在 2024 年 2 月以来高位。

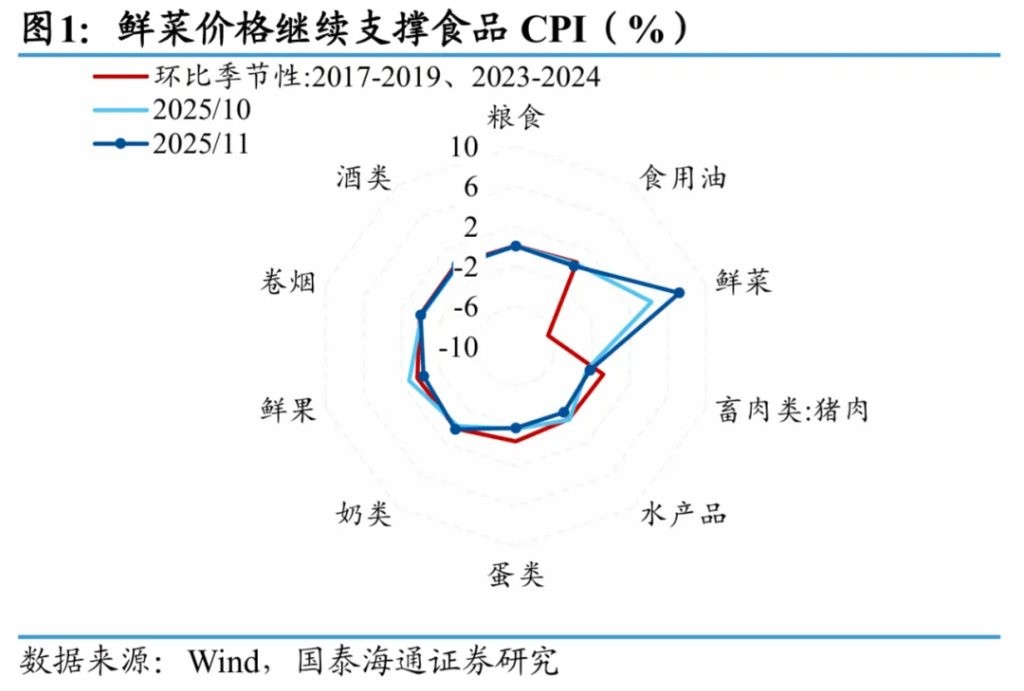

分项来看,食品方面主要受到鲜菜价格支撑。11 月鲜菜价格环比上涨 7.2%,较前一月涨幅扩大,主要受到部分地区降温降雨等天气因素影响。在充足供应背景下,猪肉、鸡蛋和水产品价格分别下降 2.2%、2.1% 和 1.8%。对于猪价,从高频数据来看,11 月生猪价格平均值为 11.8 元/公斤,较 10 月基本持平,位于近两年来最低位。12 月以来猪肉价格仍在回落,进入年底,尽管腌腊需求可以一定程度支撑猪肉价格,但年末集团猪企或会出栏冲量,供给强于需求的局面或仍将持续。

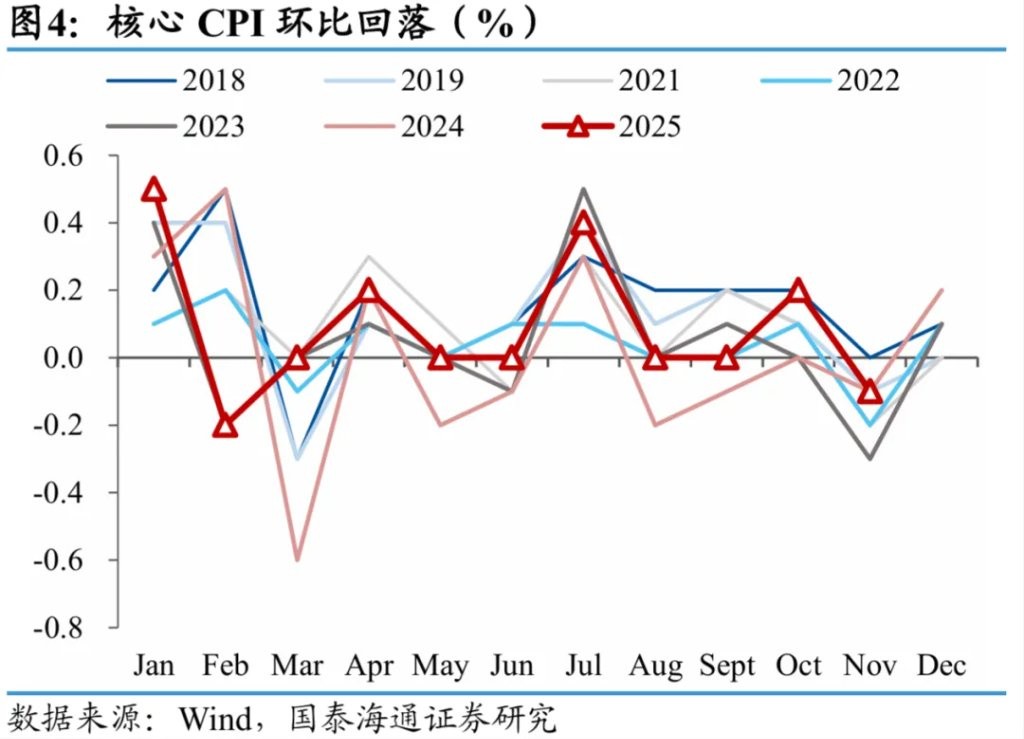

剔除食品和能源影响,核心 CPI 同比维持高位,环比小幅回落。11 月核心 CPI 同比上升 1.2%,与前一月涨幅持平,位于 2024 年 2 月以来最高位,环比回落 0.1%,略好于季节性。核心 CPI 同比维持高位,继续受到扩内需政策及金饰品涨价等因素拉动。

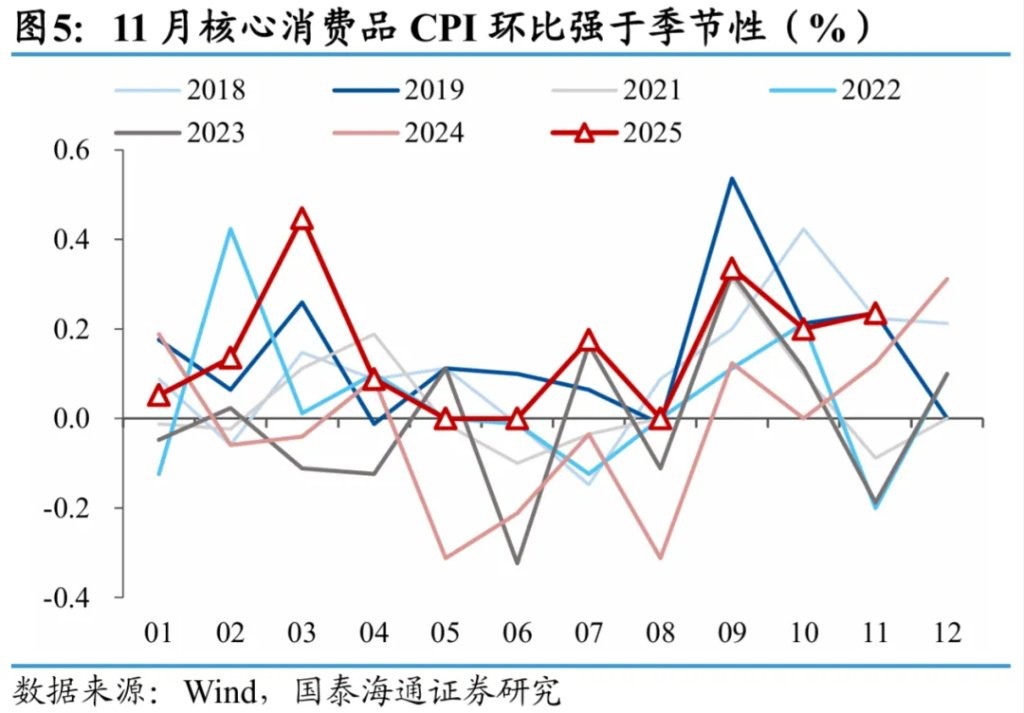

分项来看,核心消费品 CPI 强于季节性。11 月核心消费品 CPI 环比上涨 0.2%,高于 2018-2024 年同期 0.05% 的平均水平。冬季换装上新拉动下,服装价格环比上涨 0.8%,国际金价变动影响下,国内金饰品价格环比上涨 7.3%,涨幅有所回落。“以旧换新” 政策影响持续,11 月家用器具价格同比上涨 4.9%,维持在年内高位,不过环比跌幅由 0.7% 扩大至 1.0%,反应补贴政策的影响边际走弱。

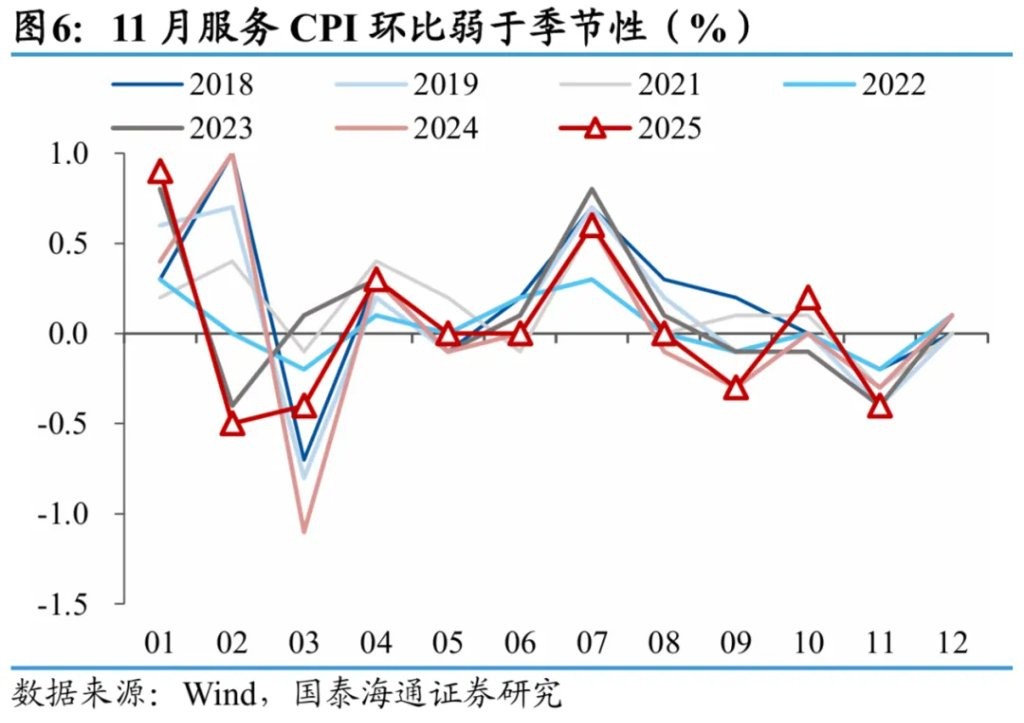

而服务 CPI 则明显弱于季节性。11 月服务 CPI 环比回落 0.4%,弱于 2018-2024 年同期-0.31% 的平均水平。节后出行需求季节性回落,宾馆住宿、飞机票、旅行社收费和交通工具租赁费价格分别下降 10.4%、10.2%、6.2% 和 3.6%,租房市场进入淡季,房租价格下降 0.2%。

整体上,11 月 CPI 主要受到食品、消费补贴政策及金价上涨推动,核心服务价格仍弱于季节性,仍待政策提振。近期的 “十五五规划” 及中央经济工作会议当中也强调了对于服务消费的重视,我们认为,与 2025 年依靠 “以旧换新” 对实物消费的拉动不同,2026 年物价回暖的关键变量将切换至服务 CPI 的修复弹性。

2 PPI:环比改善

11 月 PPI 环比上涨 0.1%,同比下降 2.2%,较前一月跌幅扩大。11 月 PPI 表现主要由上游价格支撑,背后驱动因素为全球有色金属涨价,同时 “反内卷” 政策对部分行业的影响仍在体现,而国际油价下行对 PPI 价格形成拖累,下游耐用品消费价格仍然偏弱。

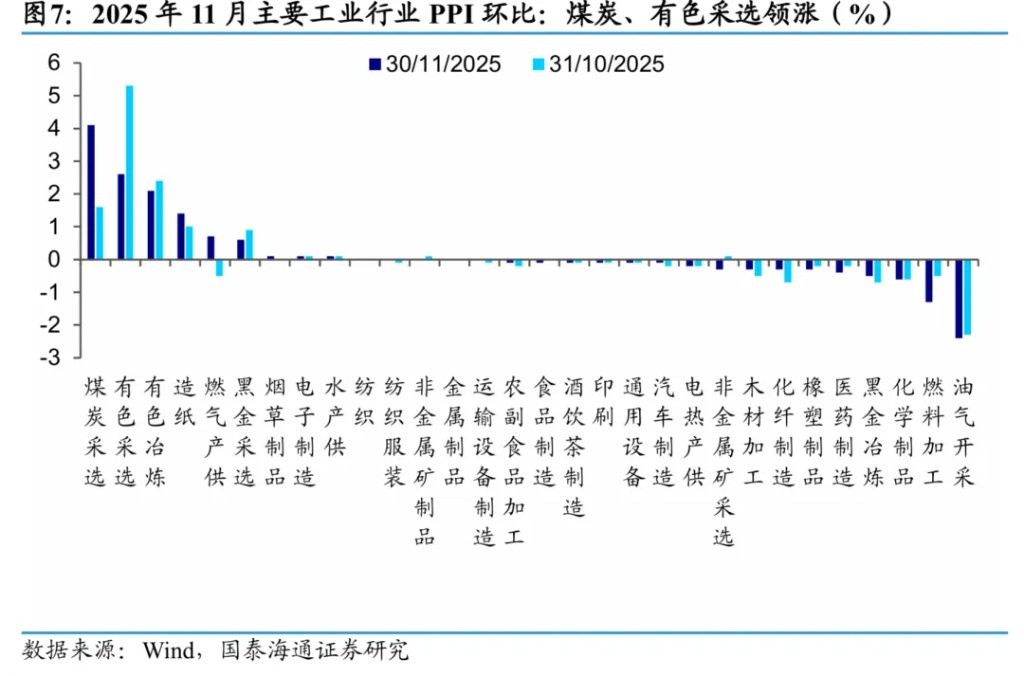

分行业来看,煤炭采选、有色采选领涨,油气开采、燃料加工跌幅较大。进入冬季,随着天气降温,煤炭、燃气需求季节性增加,煤炭开采和洗选业价格环比上涨 4.1%,煤炭加工价格上涨 3.4% ;国际有色金属价格上涨带动国内有色采选业、有色冶炼业价格分别环比上涨 2.6% 和 2.1%。国际油价下行带动油气开采业价格环比下降 2.4%。

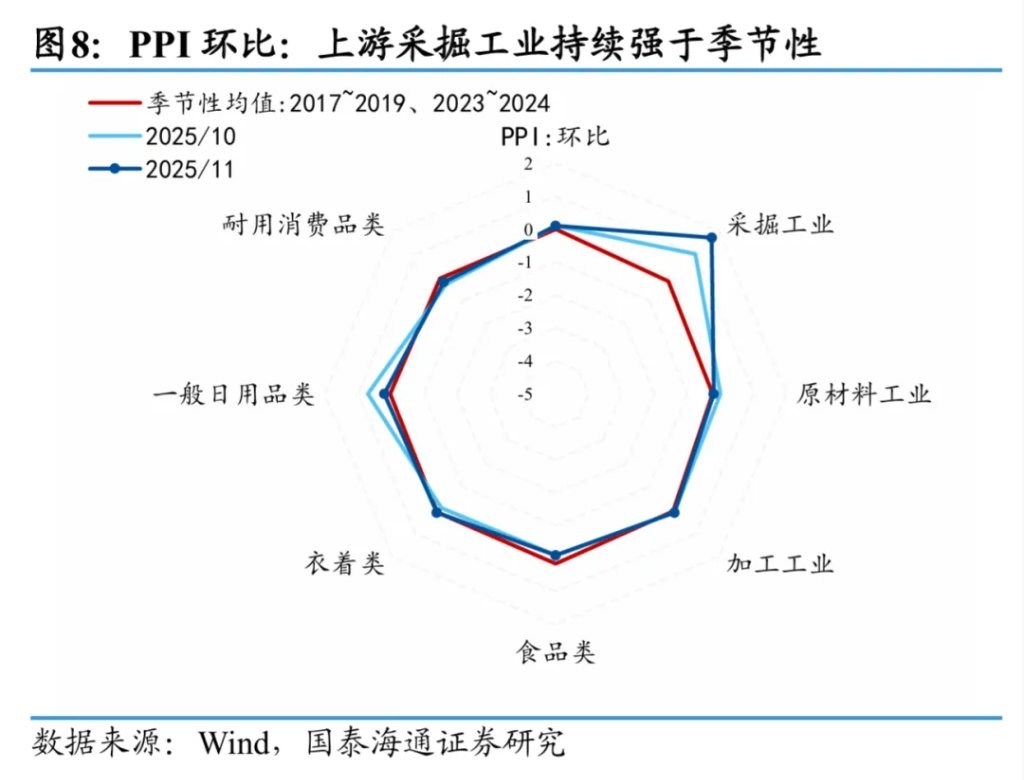

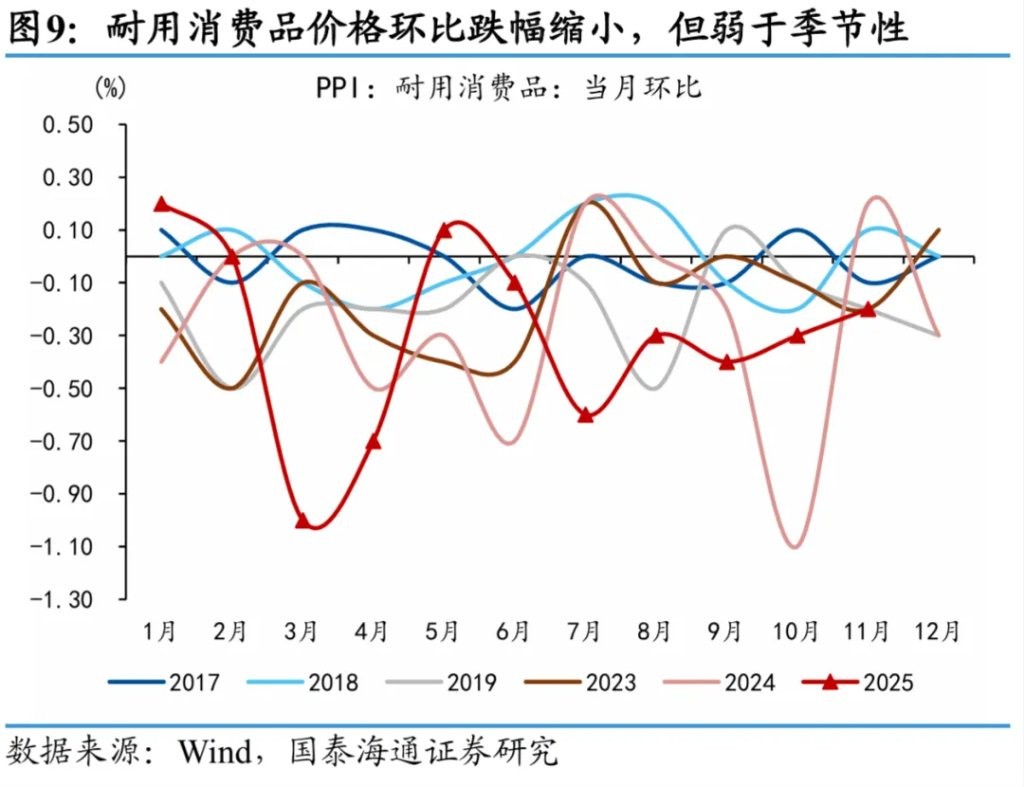

从产业链来看,上游采掘工业价格继续强于季节性,下游耐用消费品价格边际改善但弱于季节性。其中,上游采掘业价格涨幅扩大至 1.7%,明显强于季节性;原材料工业价格环比转为下降 0.2%,稍强于季节性;加工业环比上升 0.1%(前值 0.1%);下游生活资料环比持平(前值 0.0%),具体来看,耐用消费品 PPI 环比跌幅虽小幅收窄-0.2%,但仍弱于季节性,与 CPI 消费品价格的连续走高继续背离。

中游制造方面,汽车制造价格跌幅缩小至 0.1%,非金属矿物制品业价格环比持平,锂离子电池制造价格环比上涨 0.2%。

往后看,“反内卷” 政策对工业品价格的影响或将持续体现,结合高频数据来看,12 月以来,以铜、白银为代表的国际有色金属价格仍在上行,短期输入性因素或将对 PPI 形成支撑,不过上下游价格分化,反映内需仍待提振,后续仍需期待政策发力。

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。