Waiting for the Federal Reserve's decision! U.S. stocks remain flat, U.S. Treasury yields fluctuate at high levels, spot silver continues to hit new highs, and crude oil stabilizes

Global markets are awaiting the latest interest rate decision from the Federal Reserve, with U.S. stock futures largely flat and U.S. Treasury yields fluctuating at high levels. The commodity market shows mixed performance, with silver hitting new highs and oil stabilizing. Investors are focused on the subsequent policy path and economic forecasts

The market is waiting for the latest interest rate decision from the Federal Reserve, with overall sentiment tending towards caution, and U.S. stocks and bonds fluctuating narrowly.

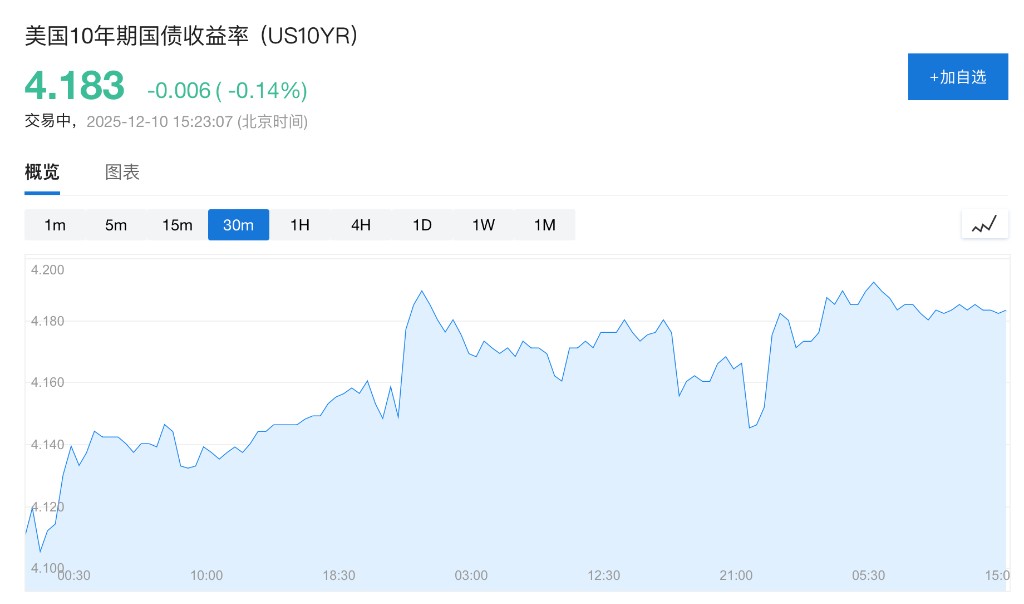

On December 10, U.S. stock index futures were basically flat, European stocks opened lower, and Asian stock markets showed mixed results. U.S. Treasury yields consolidated at high levels, while the dollar and yen were under pressure. Commodity performance was mixed, with gold prices slightly retreating, silver continuing its upward trend after breaking new highs, oil prices stabilizing, and cryptocurrencies rising slightly.

Despite widespread expectations for the third rate cut of the year, investors' focus has shifted to the subsequent policy path, especially the signals released by the dot plot and economic forecasts. Chen Hebei, an analyst at Melbourne Vantage Markets, stated:

"Investors are closely watching one of the most 'known yet unknown' final rounds of stimulus from the Federal Reserve this year. While a 25 basis point rate cut is generally considered a foregone conclusion, the real volatility factor will be the Fed's economic forecast. The way this forecast is released is unusual, lacking a complete quarter of verification data—this leaves a lot of room for market interpretation and volatility."

Core market trends are as follows:

- U.S. stock index futures collectively rose slightly, with S&P 500 futures up 0.05%, Nasdaq 100 futures up 0.01%, and Dow futures up 0.03%

- The Euro Stoxx 50 index fell 0.06%, the UK FTSE 100 index fell 0.17%, the French CAC40 index fell 0.24%, and the German DAX30 index fell 0.10%

- The Nikkei 225 index closed down 0.1%, at 50602.80 points; the Tokyo Stock Exchange index closed up 0.1%; the South Korean Seoul Composite Index closed down 0.21%

- The 10-year U.S. Treasury yield was basically flat at 4.18%

- The dollar index was basically flat, with the yen rising 0.1% against the dollar to 156.70

- Spot silver rose nearly 1.3% to $61.42 per ounce; Brent crude oil rose 0.18% to $62.05 per barrel; spot gold fell 0.06% to $4205 per ounce

- Bitcoin prices were basically flat at $92623.68, while Ethereum prices rose 0.6% to $3323.17.

Global markets are awaiting the results of the Federal Reserve's last meeting of the year on Wednesday. U.S. stock futures were basically flat, and U.S. Treasury yields continued to fluctuate at high levels. The market generally expects the Federal Reserve to cut rates by 25 basis points for the third consecutive time, with the current pricing probability for this rate cut in the federal funds futures market at approximately 87.6%, according to CME FedWatch tool data.

However, there are still differences of opinion within the Federal Open Market Committee (FOMC). Some members support continuing to cut rates to alleviate the risk of a potentially further weakening labor market; others are concerned that another rate cut may exacerbate inflationary pressures.

Investors are looking forward to further interpreting the decision-makers' stance and inclination on future policy paths from the statement of this meeting and the press conference held by Federal Reserve Chairman Jerome Powell on Wednesday afternoon.

Former White House economic advisor Kevin Hassett, viewed as a potential candidate for Federal Reserve Chairman, stated that he believes there is "significant room" for implementing larger rate cuts, potentially exceeding the conventional 25 basis points

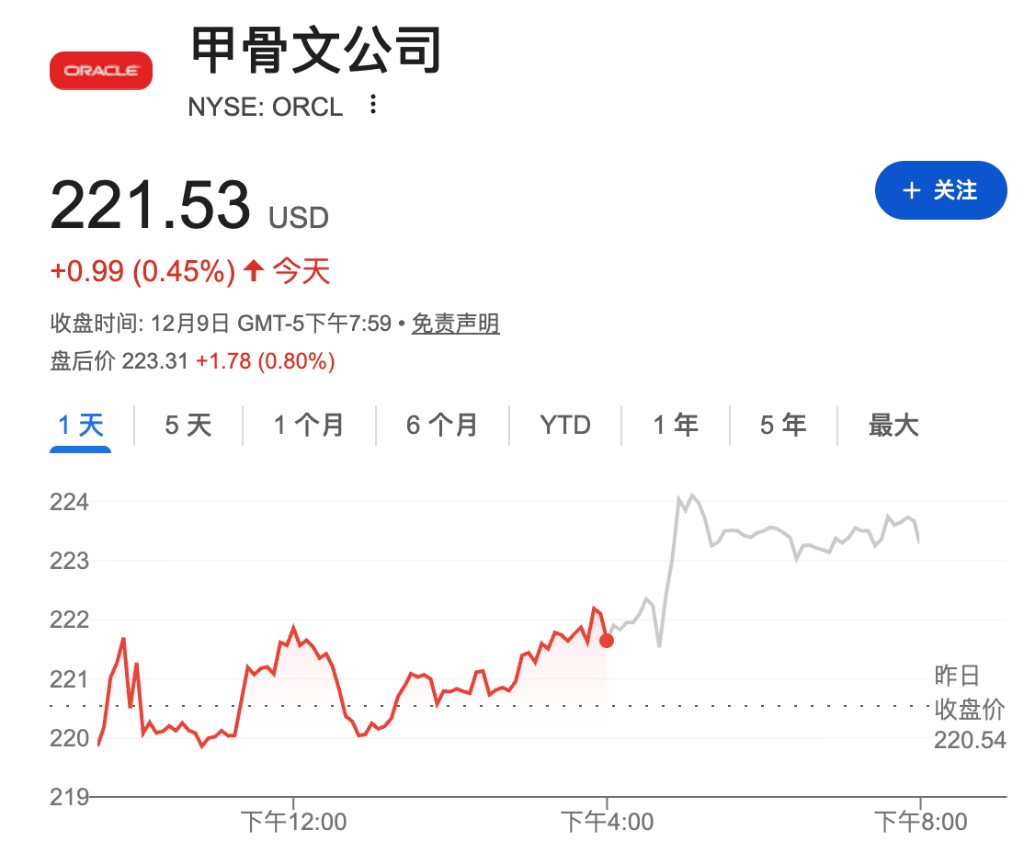

At the same time, the market is paying attention to Oracle's second fiscal quarter earnings report, which will be released on Wednesday Eastern Time (Thursday early morning Beijing Time). According to Wall Street News, the market focus is on its debt-driven AI infrastructure expansion plan and its heavy reliance on OpenAI. In pre-market trading, the company's stock price rose slightly by 0.4%, while its five-year credit default swap (CDS) price surged to a record high.

Spot silver has reached a historic high and continues to rise, increasing nearly 1.3% to $61.42 per ounce, mainly driven by global supply tightness and expectations that the Federal Reserve will further ease monetary policy. David Wilson, head of commodity strategy at BNP Paribas, stated: "Silver has a large retail and speculative base. Once prices start to rise, it often attracts more capital inflow."

According to Wall Street News, silver has risen nearly 110% this year, far exceeding gold's 60% increase, causing the gold-silver ratio to drop below 70 for the first time since July 2021.

Brent crude oil stabilized after a significant drop yesterday, rising over 0.2% to $62.07 per barrel. Investors are closely monitoring the progress of the Russia-Ukraine talks. According to Xinhua News Agency, Zelensky stated that the initial 28-point "peace plan" has been split into three documents: a 20-point framework agreement, a security guarantee document for Ukraine from the U.S. and Europe, and a document regarding Ukraine's post-war reconstruction. He indicated that if the U.S. and Europe can ensure election security, Ukraine is willing to hold elections within 60 to 90 days.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk