Huatai Securities: The supply and demand of lithium mines will be highly controversial in 2026, but a shortage in 2027 is certain

Huatai Securities analyzes the supply and demand of lithium mines, believing that there is a significant divergence in market expectations for demand growth in 2026, and a confirmed shortage of lithium resources in 2027. The price of lithium carbonate has risen since September, influenced by supply-side disruptions and high growth on the demand side. It is expected that the growth rate of lithium resource production will be 32.3% in 2026 and 17.1% in 2027. Energy storage demand is optimistic, but there are still divergences in growth rates

Standing at the current node and looking ahead, the market shows significant divergence in expectations for the demand growth rate for 2026/2027, especially for energy storage. This divergence directly leads to a large variance in the market's long-term supply and demand estimates for lithium carbonate. This article will calculate the demand for lithium carbonate under different terminal growth rate expectations and the supply under different price scenarios to analyze the reasonable central point for future lithium prices.

Core Viewpoints

Lithium Industry: Strong reality in the near term, significant divergence in long-term demand

Since September this year, lithium carbonate prices have continued to strengthen, with the main futures contract price once breaking 100,000 yuan/ton. The price increase can mainly be attributed to supply-side disruptions, such as the shutdown of the Jiangxi Jianxia Mine in August, and the demand-side showing a clear off-peak demand for downstream batteries. Under the resonance of supply disturbances and high demand growth, domestic inventories have continued to deplete. Meanwhile, domestic energy storage bidding has maintained high growth, leading to a significant upward adjustment in market expectations for global energy storage shipments in 2026. The strong reality combined with strong demand expectations has driven lithium carbonate prices to continue rising since the third quarter. Looking ahead from the current node, there is a clear divergence in market expectations for the specific demand growth rates for 2026/2027, especially for energy storage, which directly leads to a large variance in the market's long-term supply and demand estimates for lithium carbonate. This article will calculate the demand for lithium carbonate under different terminal growth rate expectations and the supply under different price scenarios to analyze the reasonable central point for future lithium prices.

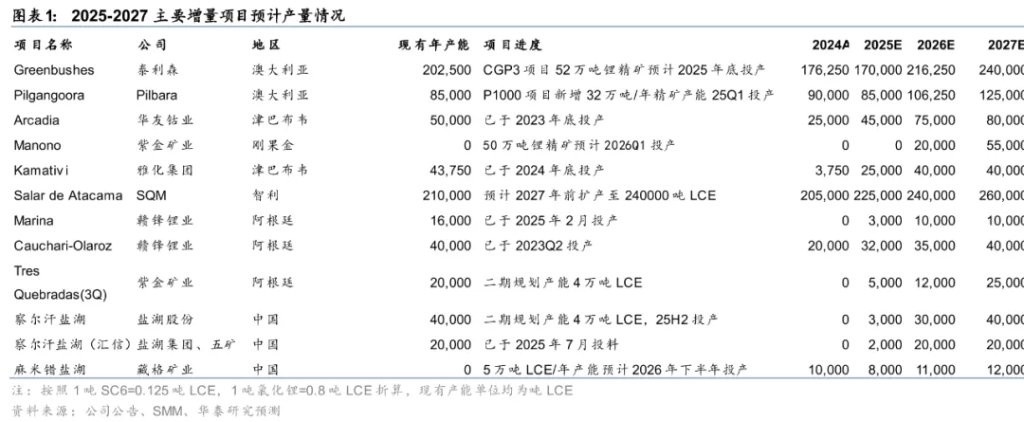

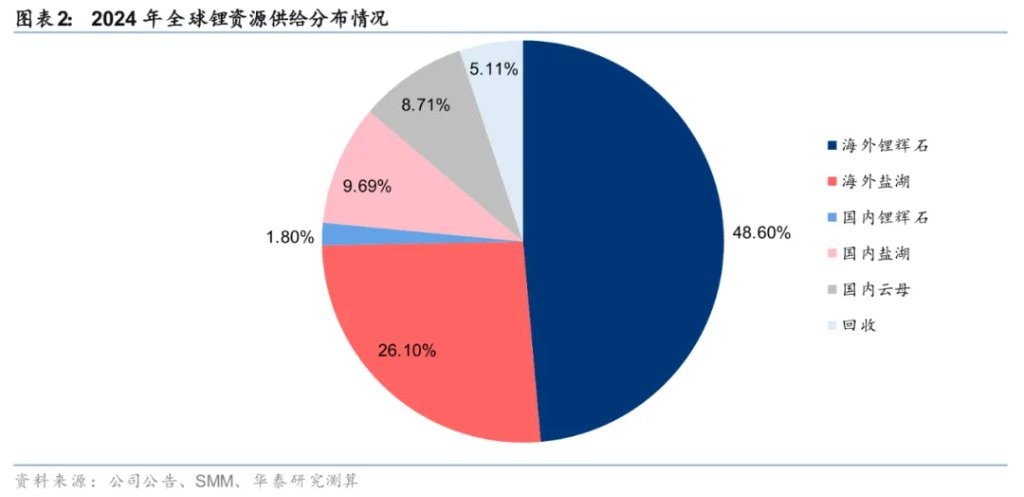

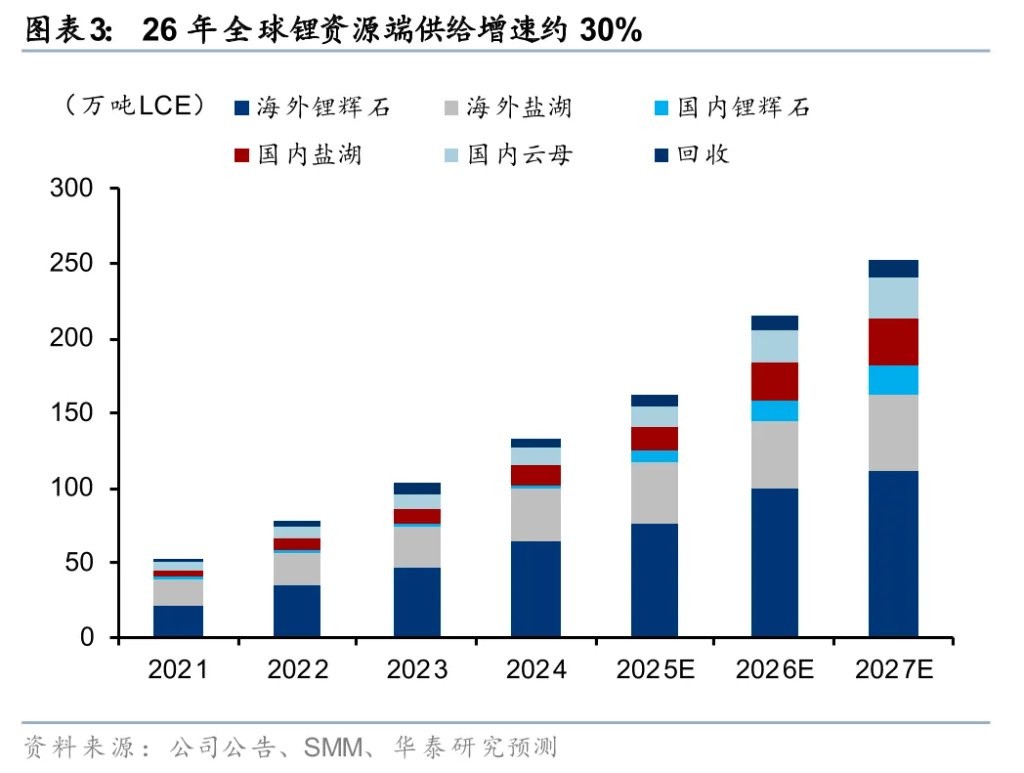

Supply: Expected lithium resource production growth rates of 32.3%/17.1% for 2026/2027

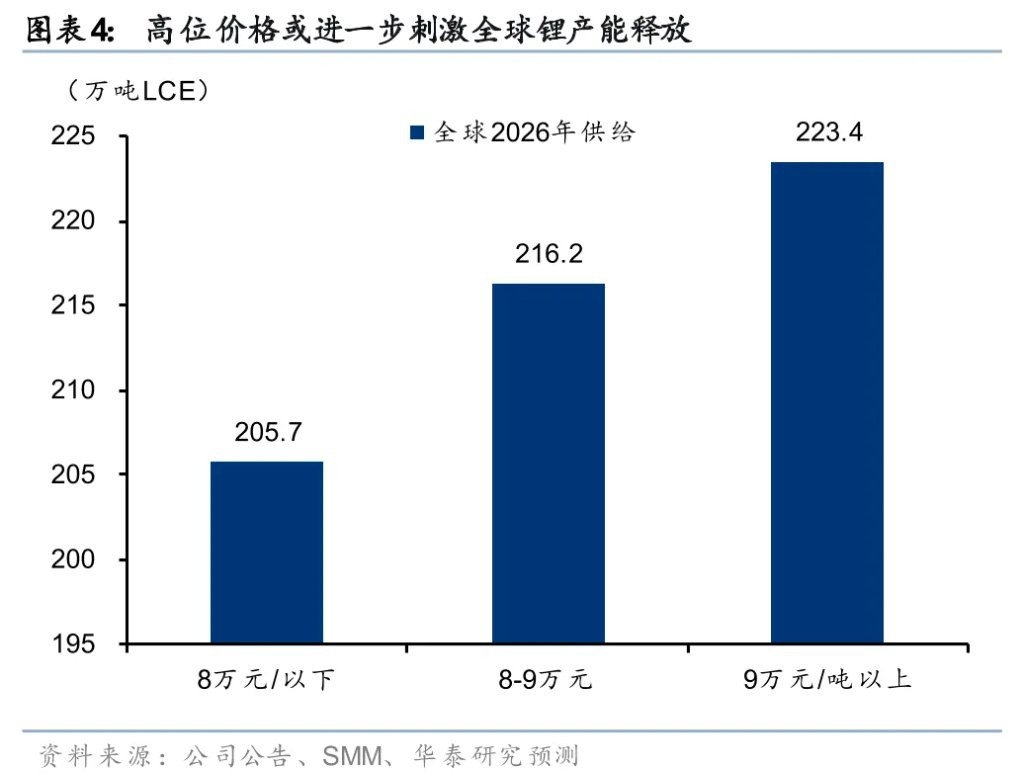

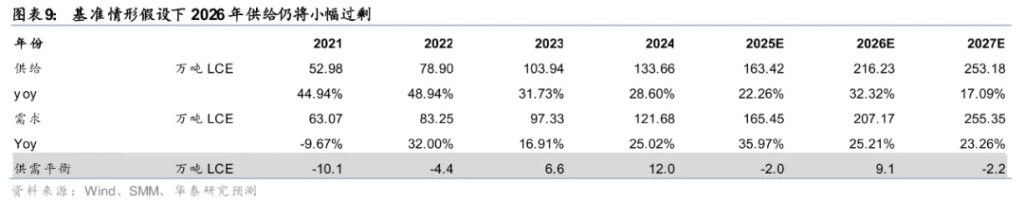

According to our calculations, the global lithium resource supply increase in 2026 will mainly come from the commissioning of new domestic salt lake projects, the ramp-up of African and Australian mines, and the gradual production increase from South American salt lakes. Under a neutral expectation, we predict that the global lithium resource supply from 2025 to 2027 will be approximately 1.634 million tons, 2.162 million tons, and 2.532 million tons of LCE, with year-on-year growth rates of 22.3%, 32.3%, and 17.1%, respectively. Considering the current high lithium prices stimulating capacity release, we believe that under three price assumptions of below 80,000 yuan/ton, 80,000-90,000 yuan/ton, and above 90,000 yuan/ton, the lithium resource supply in 2026 will be 2.057 million tons, 2.162 million tons, and 2.234 million tons of LCE, respectively.

Demand: Significant divergence in demand growth rates under generally optimistic energy storage demand

Due to the continuous over-expectation of energy storage bidding numbers in 2025, the market remains generally optimistic about domestic energy storage demand next year, but there is still significant divergence in the degree of optimism, leading to a large variance in the market's demand estimates for lithium carbonate in 2026. Under the baseline assumption, we expect the penetration rate of domestic new energy vehicles to be 60% in 2026, with energy storage installation demand increasing by 75% year-on-year, corresponding to a total global demand for lithium carbonate of approximately 2.072 million tons of LCE. If we further consider various growth rate combinations, we assume domestic energy storage growth rates of 50%/75%/100%, and domestic new energy vehicle penetration rates of 55%/60%/65%, resulting in a total demand range of 1.975 million tons to 2.168 million tons, with a range width of nearly 200,000 tons Balance: Expecting a Loose Supply-Demand Situation in 2026, Potential Shortage in 2027

In 2025, considering domestic mining disruptions and demand continuing to exceed expectations, the global actual lithium supply-demand situation is showing a shortage. According to our calculations, the global lithium resource shortage in 2025 is approximately 20,000 tons. For 2026, due to significant market divergence, we conducted a total of 27 supply-demand sensitivity analyses based on different demand and price assumptions. Based on a price level of 80,000-90,000 yuan/ton and a baseline demand scenario, we expect a surplus of 91,000 tons of lithium element in 2026. For 2027, due to the expected significant decline in supply growth, we believe that a continuous shortage of lithium carbonate supply-demand balance may occur after 2027, with a projected shortage of 22,000 tons in 2027.

Lithium Price: Fundamental Pricing for 2026 at 80,000-90,000 Yuan/Ton, Bullish on Price Upside in 2027

Based on our calculations for the supply-demand situation in 2026, under neutral and optimistic demand expectations, the price center for achieving a balanced state is around 80,000-90,000 yuan/ton. Therefore, we believe that the lithium carbonate price range under the fundamental pricing for 2026 may be between 80,000-90,000 yuan/ton. Due to the expectation that the global lithium resource supply-demand relationship may shift towards a shortage in 2027, the anticipated shortage may drive prices to start rising in the second half of 2026, potentially breaking through 100,000 yuan/ton again. Considering the relatively low sensitivity of downstream industries to lithium carbonate prices, we believe that if a continuous shortage occurs in 2027, the upward space for lithium carbonate prices may further open up, potentially rising to 120,000 yuan/ton.

Main Text

Supply: Expected Lithium Resource Production Growth Rates of 32.3% in 2026 and 17.1% in 2027

Under mining disruptions, the global actual lithium resource supply growth rate in 2025 may decline to 22.3% compared to 2024. Due to the impact of the shutdown of the Jiangxi Jianxiawo mine in China, our calculations indicate that the actual supply growth rate of global lithium resources in 2025 will decrease from 28.6% in 2024 to 22.3%, with an absolute volume of approximately 1.634 million tons of LCE.

Affected by the current price increase, the supply increment may accelerate in 2026, while the supply release rate in 2027 may significantly slow down. Domestically, according to company announcements, the 40,000 tons/year project of Qinghai Yanhu Industry and the 20,000 tons/year project of Qinghai Huixin at the Qarhan Salt Lake have respectively started production at the end of September 2025 and June 2025, and we expect them to ramp up in 2026. In Africa, the lithium sulfate project of Huayou Cobalt has started production in the second half of 2025, and we expect the Kamativi mine of Yahua Group and the Goulamina mine of Ganfeng Lithium to reach full production in 2026. Additionally, according to company announcements, the 500,000 tons/year lithium concentrate project of Zijin Mining at the Manono mine is planned to start production in the first quarter of 2026, equivalent to 95,000 tons of lithium sulfate; in Australia, the Greenbushes CGP3 project with a capacity of 520,000 tons of lithium concentrate is expected to start production by the end of 2025, corresponding to approximately 65,000 tons of LCE; The P1000 expansion project of Pilbara has begun trial operations in the first quarter of 2025 and is expected to gradually release capacity in 2026. The production release of the above project is mainly concentrated in 2026, while the expected increase in new projects in 2027 is significantly reduced, and the supply growth rate may decline significantly.

Based on a lithium carbonate price level of 80,000-90,000 yuan/ton, we estimate that the global lithium resource supply from 2025 to 2027 will be 1.634 million tons, 2.162 million tons, and 2.532 million tons of LCE, with year-on-year growth rates of 22.3%, 32.3%, and 17.1%, respectively.

Considering the different prices leading to varying global lithium supply levels, we estimate that under three price assumptions of below 80,000 yuan/ton, 80,000-90,000 yuan/ton, and above 90,000 yuan/ton, the lithium resource supply in 2026 will be 2.057 million tons, 2.162 million tons, and 2.234 million tons of LCE, respectively.

Demand: Significant Discrepancies Still Exist Under Optimistic Energy Storage Expectations

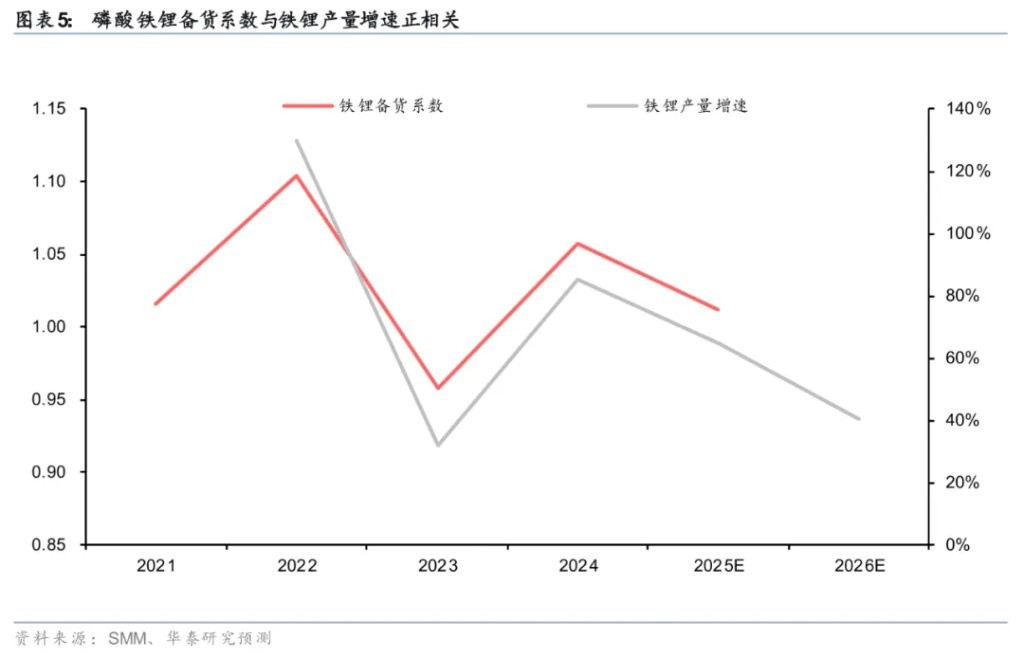

The premise for accurately estimating demand is how to determine the stocking coefficient. Due to the concentrated downstream demand in the lithium industry and the maintenance of high growth rates, both the battery segment and the cathode material segment often maintain high stocking coefficients. Currently, investors do not have a definitive estimate of the absolute value of the stocking coefficient, especially whether the stocking coefficient for lithium iron phosphate cathodes will be amplified. Optimists believe that the reversal of the industry cycle will inevitably lead to a large amount of stocking demand, resulting in the actual balance sheet potentially achieving destocking next year. However, based on our extrapolation of historical data, the stocking coefficient in the lithium iron segment is highly positively correlated with the production growth rate of lithium iron phosphate cathodes. Under optimistic expectations, next year's growth rate is expected to decline compared to this year, so we maintain a relatively cautious attitude towards the increase in battery manufacturers' stocking coefficients for lithium iron in 2026.

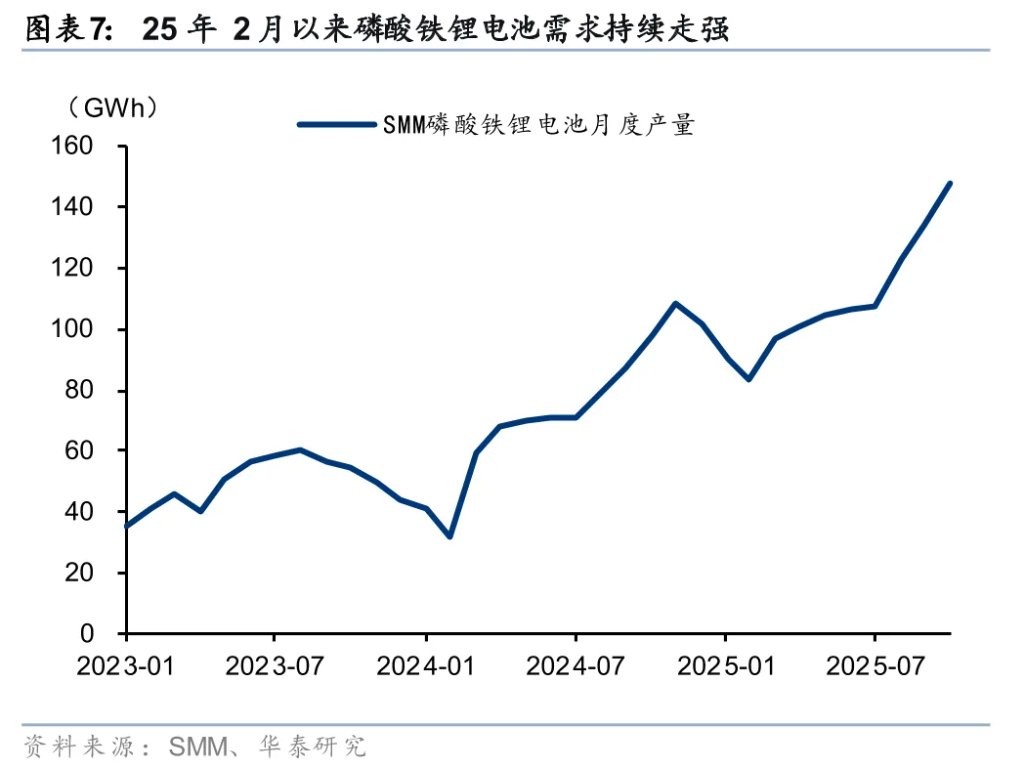

Demand growth in 2025 may reach 36.0%, and the demand for lithium carbonate in 2026 is expected to be 2.072 million tons, a year-on-year increase of 25.2%. Since the second half of 2025, the actual shipment volume of domestic energy storage has remained strong, leading to a sustained high growth rate in actual lithium carbonate demand, showing a significant off-season strength. According to our estimates, the global lithium resource demand growth rate in 2025 may reach 36.0% At the same time, the number of energy storage tenders in the domestic market in the second half of the year continues to exceed market expectations, leading most investors to hold a relatively optimistic attitude towards energy storage demand next year. However, there are still significant discrepancies in growth expectations amidst this optimism, and different growth expectations have a considerable impact on the supply and demand of lithium carbonate. In addition, the market expectation for demand in the power battery sector is relatively cautious, but considering the increase in battery capacity per vehicle and the rapid growth in demand for commercial vehicles, its growth rate is still expected to remain at a considerable level. Based on the above judgments, under the baseline assumption, we set the domestic penetration rate of new energy vehicles in 2026 at 60%, and the domestic installed demand for energy storage is expected to grow by 75% year-on-year. Accordingly, we estimate that the total global demand for lithium carbonate in 2026 will be approximately 2.072 million tons, a year-on-year increase of +25.2%.

There are significant discrepancies in growth expectations on the demand side under optimistic and pessimistic assumptions. We assume domestic energy storage growth rates of 50%, 75%, and 100%, as well as domestic new energy vehicle penetration rates of 55%, 60%, and 65%, thereby constructing nine optimistic scenario combinations. We estimate that the corresponding total demand range will be between 1.975 million tons and 2.168 million tons, with a range width of nearly 200,000 tons.

Balance: Strong reality in 2025 leads to inventory reduction, slight surplus expected in 2026

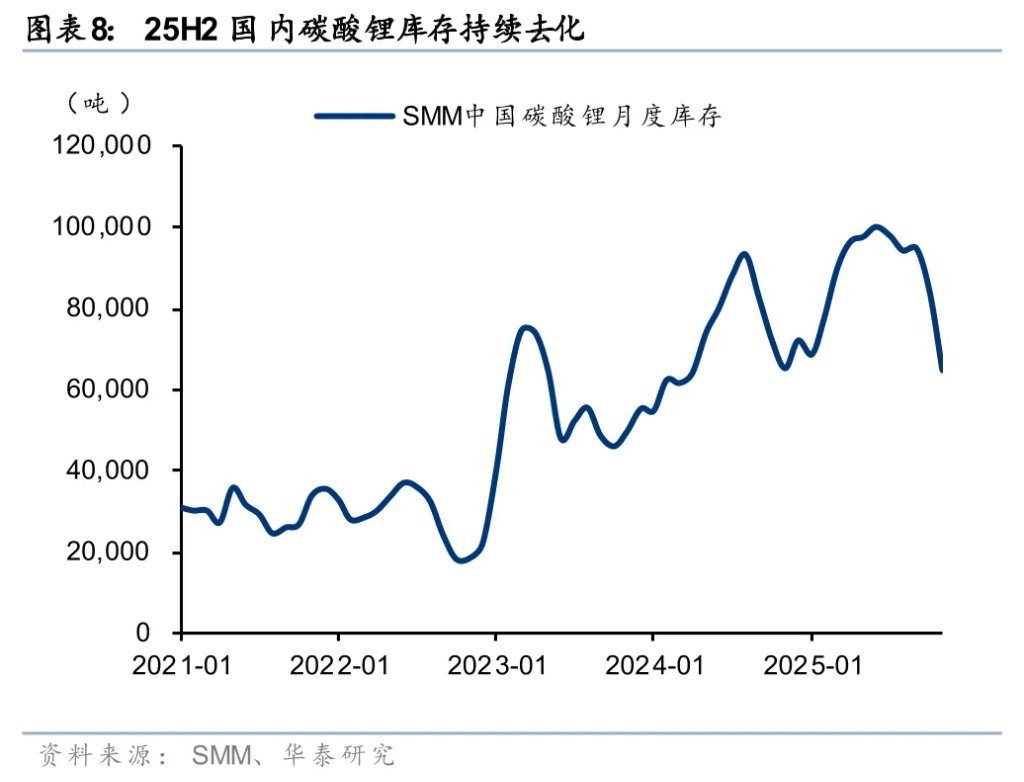

Supply disruptions + strong demand may lead to a global lithium supply shortage of 17,000 tons in 2025. Due to the suspension of the Ningde lithium project in August, coupled with the continuous strengthening of downstream battery demand growth in the second half of 2025, we estimate that the actual global lithium resource supply and demand may show a shortage state in 2025, approximately short by 20,000 tons. According to SMM data, as of November 30, the total monthly inventory of lithium carbonate was 65,000 tons, a reduction of 33,000 tons from the end of August, with a cumulative reduction of 7,000 tons from January to November this year. Strong real demand has pushed inventory down to the lowest level since May 2024.

We expect that supply and demand will still be relatively loose in 2026, and may shift towards a shortage pattern in 2027. We estimate that the global lithium resource supply from 2025 to 2027 will be 1.634 million / 2.162 million / 2.532 million tons LCE, and the demand will be 1.655 million / 2.072 million / 2.554 million tons LCE, with supply-demand balances of -20,000 / 91,000 / -22,000 tons LCE respectively. At the current price level, even if there is a temporary actual supply-demand shortage in 2025 due to the suspension in Ningde and the outbreak in the second half of the year, we believe that there may still be a slight surplus by 2026 Looking ahead to 2027, it is necessary to consider the global demand growth after the significant increase in energy storage in 2026. If it can maintain above 25%, the global supply and demand pattern for lithium carbonate will shift to a continuous shortage.

Short-term: After the resumption of production by CATL in 2026, the domestic market may enter a phase of inventory accumulation. Considering the short-term domestic situation, the actual supply-demand shortage in 2025 is expected to be concentrated in Q4 due to the production halt by CATL and the unexpected demand in the second half of the year. According to our calculations, the total domestic supply of lithium carbonate in 2025 is 1.22 million tons, with a total shortage of 21,000 tons, of which the total supply in Q4 2025 is 367,000 tons, resulting in a shortage of 20,000 tons. If the current price level of 90,000 yuan/ton remains unchanged, we expect inventory accumulation in Q1 2026 as CATL resumes production and lithium salt plants such as Zhongjin and Yongxing gradually ramp up capacity.

Lithium Price: The fundamental pricing for 2026 is 80,000-90,000 yuan/ton, bullish on the upward space for lithium prices in 2027

The price under the supply-demand fundamentals for 2026 is approximately 80,000-90,000 yuan/ton. Based on the aforementioned analysis, we have calculated the corresponding fundamental support prices under various demand scenarios by combining the expected global supply of lithium carbonate at different prices and the total lithium carbonate demand under different assumptions of domestic new energy vehicle and energy storage growth rates. Under the most optimistic assumption, the total demand in 2026 is expected to be 2.168 million tons LCE, with the fundamental support price for lithium carbonate around 90,000 yuan/ton. Under a neutral assumption with domestic new energy vehicle penetration rates/energy storage growth rates of 60%/75%, the total demand in 2026 is expected to be 2.072 million tons LCE, corresponding to a price center of about 80,000-90,000 yuan/ton. At this price level, the global supply of lithium carbonate is expected to be 2.162 million tons LCE.

Under the expectation of a shortage in 2027, prices are likely to start breaking through 100,000 yuan/ton in the second half of 2026. Looking at 2027, due to a significant slowdown in supply growth while demand growth remains high, we expect the overall supply-demand relationship for lithium resources to trend towards a shortage. The expectation of a shortage may drive prices to start rising in the second half of 2026, potentially breaking through 100,000 yuan/ton again. Considering the downstream sensitivity to lithium carbonate prices is relatively low (not considering the general rise in other raw materials), we believe that if a continuous shortage and inventory reduction occurs, the upward space for lithium carbonate prices may further open up, potentially rising to 120,000 yuan/ton Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk