2022 replay? JPMorgan Chase once again shows "costs exceed expectations," stock price plummets dragging down the entire U.S. stock market

JPMorgan Chase's expected spending for 2025 is $105 billion, which is about 9% higher than analysts' expectations. The cost warning reminds investors of a similar situation in 2022, when JPMorgan Chase's spending guidance also triggered a sharp drop in stock prices and market turmoil. The bank's Chief Financial Officer Marianne Lake stated that the cost increase is mainly driven by "volume and growth-related expenses," strategic investments, and "the structural impact of inflation."

JPMorgan Chase's spending expectations far exceed forecasts, reminiscent of a similar scene in 2022 when the bank's cost guidance also triggered a sharp decline in its stock price.

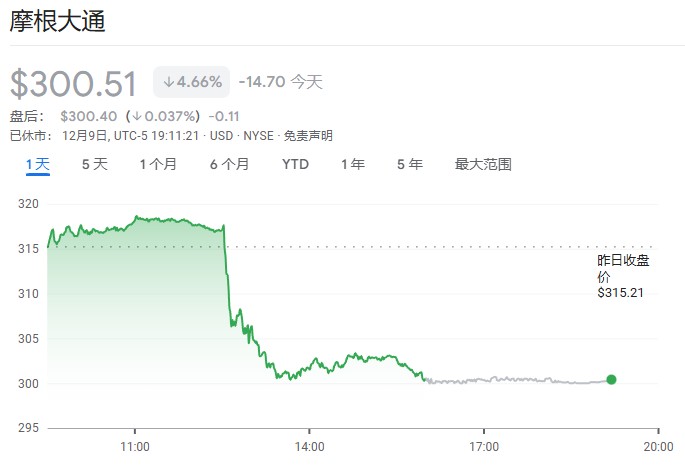

JPMorgan Chase expects its spending to reach $105 billion by 2025, surpassing analysts' expectations and raising concerns about cost inflation in the banking sector. The bank's stock plummeted 4.7% on Tuesday, marking its largest drop in eight months. The significant decline in JPMorgan Chase's stock dragged down the entire financial sector, becoming a major factor in the decline of the Dow Jones Industrial Average.

This cost warning reminded investors of a similar situation in 2022 when JPMorgan Chase's spending guidance also led to a stock price crash and market turmoil. The bank's Chief Financial Officer Marianne Lake stated at a Goldman Sachs conference that cost growth is primarily driven by "volume and growth-related expenses," strategic investments, and "structural impacts of inflation."

Analysts warned that as the largest bank in the U.S., JPMorgan Chase's increase in spending could force other banks to follow suit and increase investments to remain competitive, posing a negative impact on the entire banking industry.

Spending expectations far exceed forecasts, 2022 gloom reappears in the market

JPMorgan Chase's $105 billion spending expectation for 2025 not only exceeds the analysts' average expectation of $101.1 billion but also surpasses the highest estimate in Bloomberg's survey. This figure is approximately 9% higher than analysts' expectations for 2025 expenses.

Lake indicated that the consumer and community banking business she oversees is a "significant driver" of cost growth, with advisor incentive compensation, product marketing, branch construction, and artificial intelligence investments being the main reasons for the increase in costs.

In the first nine months of this year, JPMorgan Chase's non-interest expenses grew by 4% compared to the same period in 2024, indicating that cost pressures persist.

Tuesday's market turbulence recalled similar events in 2022 when JPMorgan Chase's cost guidance also led to a sharp decline in stock prices. The subsequent market rebound forced CEO Jamie Dimon and his team to hold an investor day to provide more transparency regarding spending plans, ultimately calming shareholder sentiment.

Wells Fargo analyst Mike Mayo noted in a report on Tuesday that while higher spending may help the largest U.S. bank deepen its competitive advantage, it is a "negative factor" for the entire industry, as "other banks may need to invest more to gain market share, and the impact will trickle down."

On Tuesday, JPMorgan Chase was the worst-performing stock in the KBW Bank Index, closing at $300.51.

Cautiously optimistic outlook for investment banking, warning signals in consumer environment

In terms of investment banking, Lake expects that investment banking fees will achieve "low single-digit" percentage growth in the fourth quarter of 2025 compared to the same period last year, below analysts' expected growth of 6.3%. The outlook for trading revenue is more optimistic, with Lake expecting "low double-digit" percentage growth, exceeding analysts' expectations. In the first nine months of this year, JPMorgan Chase's investment banking fees grew by 11%, and trading revenue surged by 20% Lake stated that the initial "animal spirits" sparked by Trump's election as president have faded due to the announcement of tariff policies, but the demand for merger and acquisition transactions returned in the third quarter and has continued into the last three months of this year.

Regarding the outlook for the U.S. economy, Lake provided a cautious assessment. She noted that while consumers and small businesses appear healthy, the overall environment is more fragile.

"The ability to withstand incremental pressures has declined," Lake said, "the cash buffer has normalized, and although inflation has decreased, price levels are still absolutely high."

This statement casts a shadow over the market's optimistic expectations for consumer resilience and provides new considerations for the Federal Reserve's future monetary policy decisions