Goldman Sachs: A major strategic shift in China's internet industry, with cloud and data centers becoming the top picks, surpassing gaming

Goldman Sachs has made a strategic shift in the Chinese internet industry, prioritizing cloud and data centers, surpassing gaming. The demand for AI is driving growth in computing power and capital expenditures. ByteDance's AI assistant may impact user traffic entry points. The subsidy war in food delivery and instant retail is unsustainable, with expectations for profit recovery. The latest core stock pool includes Alibaba, GDS, Vnet, and others

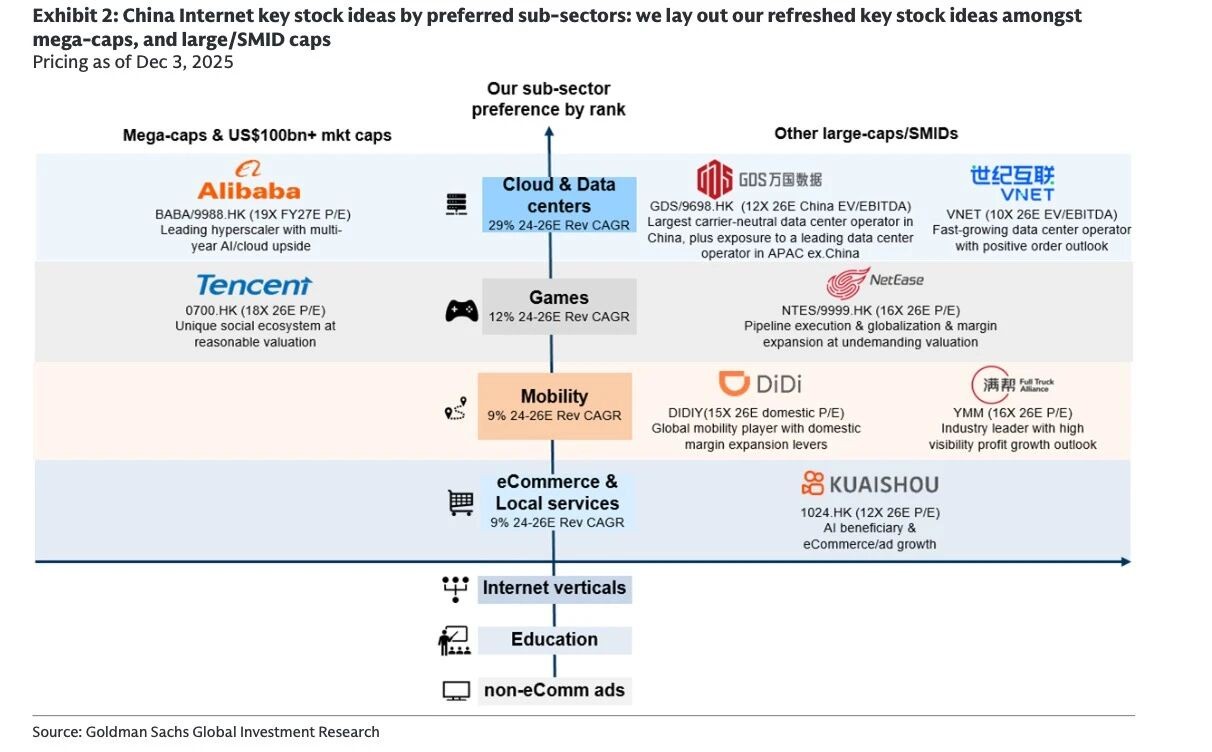

Goldman Sachs has made a significant strategic shift regarding the Chinese internet industry after the release of its Q3 earnings and research: it has elevated "cloud and data centers" to the preferred sector, placing it ahead of gaming and mobility.

The demand for computing power and capital expenditure (Capex) expansion driven by AI has become the most certain growth logic.

- The biggest expectation gap: Cloud and data centers become the "new king"

Goldman Sachs has decisively raised the cloud and data center sector from third to first. The logic is solid: the demand for AI training and inference continues to explode, coupled with major players adopting a "multi-chip strategy," resulting in a very robust order volume for data centers.

Core logic: It's not just NVIDIA; after domestic chip supply ramps up, the utilization and return rates of computing infrastructure are improving.

- The "battle for entry" of AI assistants is a major concern

The report specifically discusses a long-term risk: ByteDance's "Doubao mobile assistant." This tool can directly help users operate across apps at the operating system level (OS-level), such as price comparison and food delivery.

This poses a dimensionality reduction attack on the existing app ecosystem. Although major players like WeChat have currently blocked its interface for security and privacy reasons, this "super AI agent" competition for user traffic entry is the biggest variable in the coming years. ByteDance's apps currently occupy four of the top five spots on the iOS free chart, showing a strong offensive.

- Local life: The money-burning phase should end, focus on profit recovery

The competition in food delivery and instant retail has been fierce, with the industry likely losing about 70 billion RMB in Q3, which is excessive. Goldman Sachs judges that this irrational subsidy war is unsustainable.

Pattern projection: The market shares of Meituan, Alibaba, and JD may ultimately stabilize at 5:4:1.

Meituan: Although the long-term average profit expectation has been slightly adjusted (from 0.8 RMB to 0.7 RMB), at this price level, bad news has already been priced in, and with the reduction of subsidies, profit recovery is highly probable.

- The latest "core stock pool" list

Based on the latest sector preferences, Goldman Sachs has updated its preferred list:

Cloud/Data Centers: Alibaba, GDS, Vnet.

Gaming (defensive counterattack): Tencent, NetEase.

Mobility (stable pattern): Didi, Manbang.

E-commerce (new face): Kuaishou (newly added as a key recommendation, optimistic about its AI model Kling's breakthroughs and e-commerce monetization).

- How to view valuations?

Currently, the median expected price-to-earnings ratio (P/E) for the Chinese concept internet sector in 2026 is about 18 times. The previous increase was mainly driven by valuation repair (Multiple Expansion), and the upcoming growth must rely on solid earnings per share (EPS) growth. Therefore, selecting companies with strong profit realization capabilities is much more prudent than simply betting on rebounds.

Overall, the wind has changed; the priority of hard technology infrastructure (data centers) is rising, while businesses focused solely on traffic monetization face challenges from new AI gameplay. (Source: Hard AI)