"Woodstock" ARK publicly reveals SpaceX's "valuation model": A in 2030, $2.5 trillion!

近期 SpaceX 估值因市場樂觀情緒被推高至 8000 億美元,ARK 模型則給出更長遠預測:其 2030 年估值或達 2.5 萬億美元,核心邏輯在於 “飛輪效應”——星鏈現金流驅動星艦迭代以支持火星計劃,但這一目標高度依賴於星艦快速複用等關鍵技術能否實現。

近期,埃隆·馬斯克旗下的太空探索技術公司 SpaceX 再度成為全球資本市場的焦點,SpaceX 正以 8000 億美元的估值進行二級市場股份出售,其估值動態與未來前景引發了持續熱議。

這一數字意味着,若交易達成,其估值將較短短 7 個月前(約 4000 億美元)實現翻倍,並一舉超越 OpenAI,成為美國市值最高的私營公司。同時,公司管理層正評估於 2026 年進行首次公開募股(IPO)的可能性,為這家成立近 25 年的巨頭指明瞭潛在的上市路徑。

市場的狂熱並非憑空而來。回溯至 2025 年 6 月 10 日,知名投資人、“馬斯克長期支持者”“木頭姐”(Cathie Wood)旗下的 ARK 投資管理公司就發佈了一份開源估值模型報告,預測 SpaceX 的企業價值到 2030 年有望達到約 2.5 萬億美元。

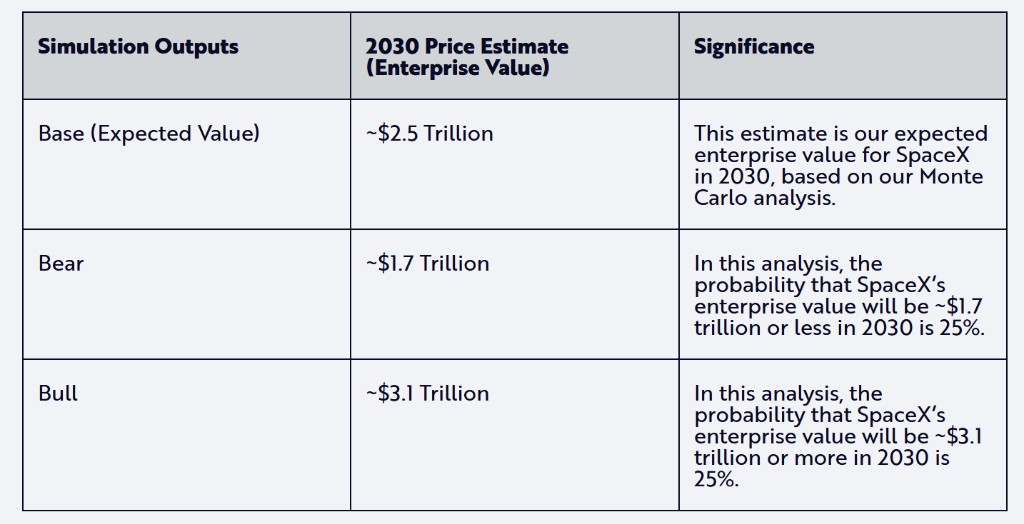

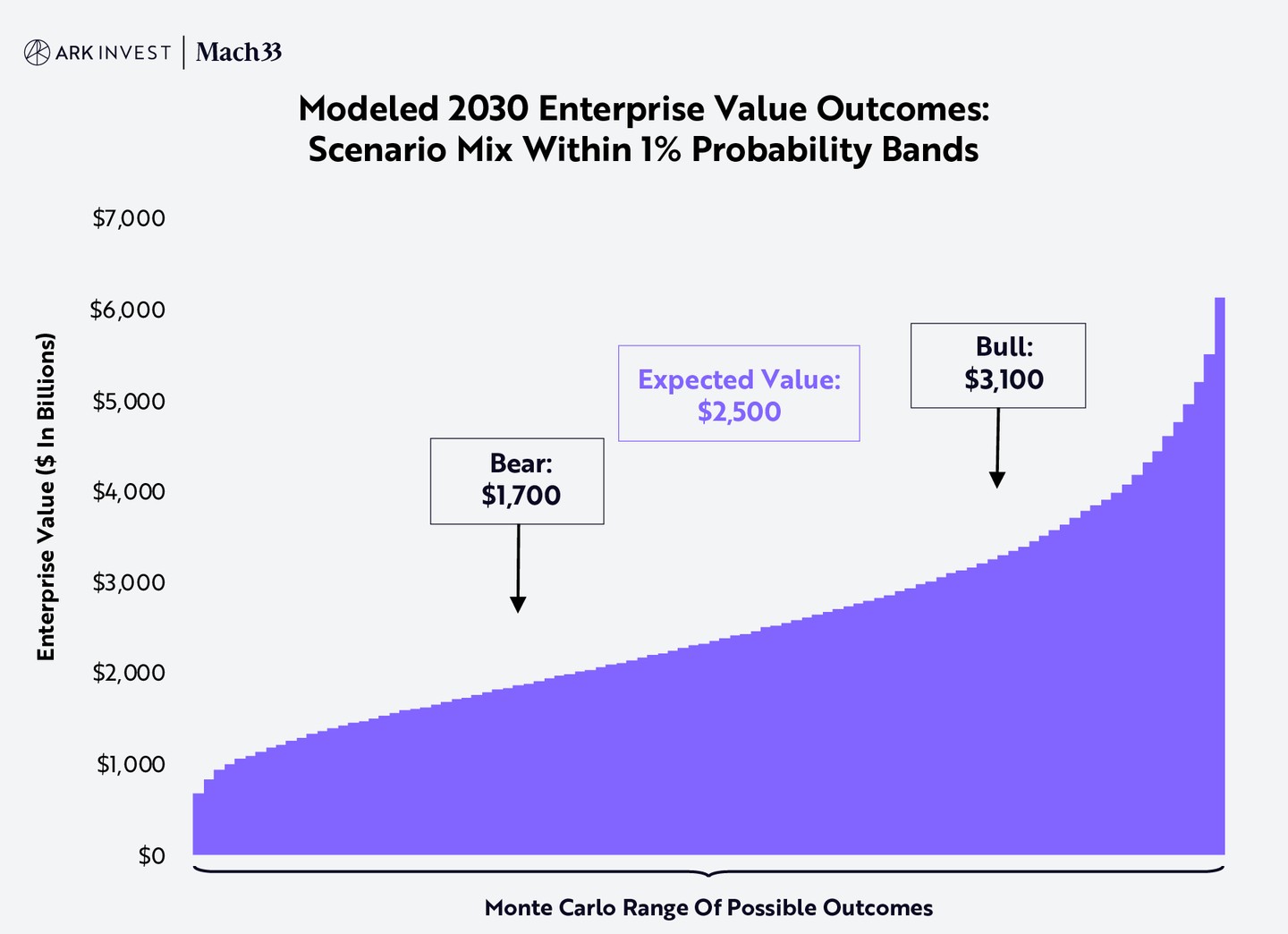

這一預測意味着,若以公司 2024 年 12 月上一輪融資時約 3500 億美元的估值水平為起點,投資者的複合年回報率將高達約 38%。根據 ARK 採用的蒙特卡洛模擬分析,模型同時勾勒出更廣闊的可能性:在樂觀情境下(75 百分位),估值可達約 3.1 萬億美元;而在悲觀情境下(25 百分位),估值約為 1.7 萬億美元。

該研究也坦承,儘管預測基於包含 17 個關鍵變量的一百萬次模擬運行,但其結果高度依賴於 “星艦” 的快速複用能力、“擎天柱” 人形機器人等核心假設的實現。

然而,ARK 報告更深層的意義在於,它系統性地拆解了支撐 SpaceX 宏大願景的 “飛輪” 邏輯——即 “星鏈” 業務產生的鉅額現金流,如何反哺 “星艦” 技術的迭代,並最終為火星殖民計劃奠基。這份開源模型,為市場理解 SpaceX 從一家航天公司向 “多行星物種” 基礎設施建造者的蜕變,提供了一個至關重要的長期分析框架。

因此,從年中 ARK 的遠期藍圖,到年末市場的即時熱望,SpaceX 的故事始終圍繞着一個核心展開:其顛覆性的技術突破與商業化進程,正持續重塑人們對這家公司乃至整個航天產業價值空間的想象。

以下是 ARK 報告原文:

與 Mach33 合作開發後,ARK 的開源 SpaceX 模型預計在 2030 年的預期企業價值將達到約 2.5 萬億美元,從其 2024 年 12 月最後一輪融資(3500 億美元)開始,年複合回報率約為 38%。我們的牛市和熊市預測分別對應於 75 百分位和 25 百分位的蒙特卡羅模擬結果,分別為約 3.1 萬億美元和約 1.7 萬億美元,如下所示。

資料來源:ARK Investment Management LLC,2025。為了便於讀者理解,本文將 “預期”(或 “基準”)、“熊市” 和 “牛市” 情景分別列示,以闡明我們對 2030 年估值的預期。在方法論上,我們通過對蒙特卡羅模型生成的 100 萬次模擬結果取平均值來得出基準估值。熊市和牛市情景分別對應第 25 和第 75 百分位數值。預測本身具有侷限性,不能作為投資決策的依據,其基於我們的模型,反映了我們的偏好以及對公司的長期積極看法。

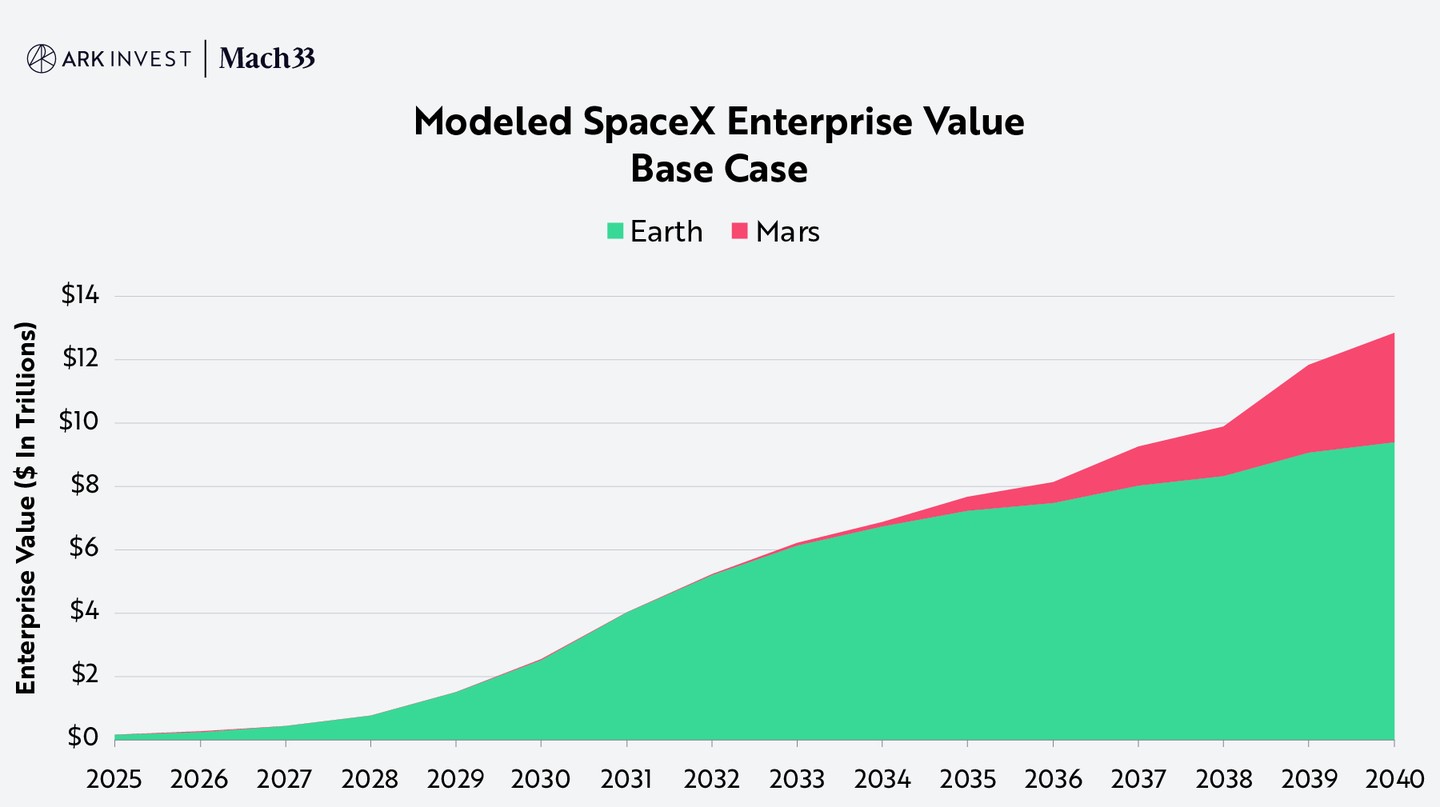

我們的開源模型包含 17 個關鍵的獨立輸入,用於模擬 SpaceX 的一系列潛在發展成果,包括火星探測計劃及其在 2030 年和 2040 年的企業價值,如下所示。

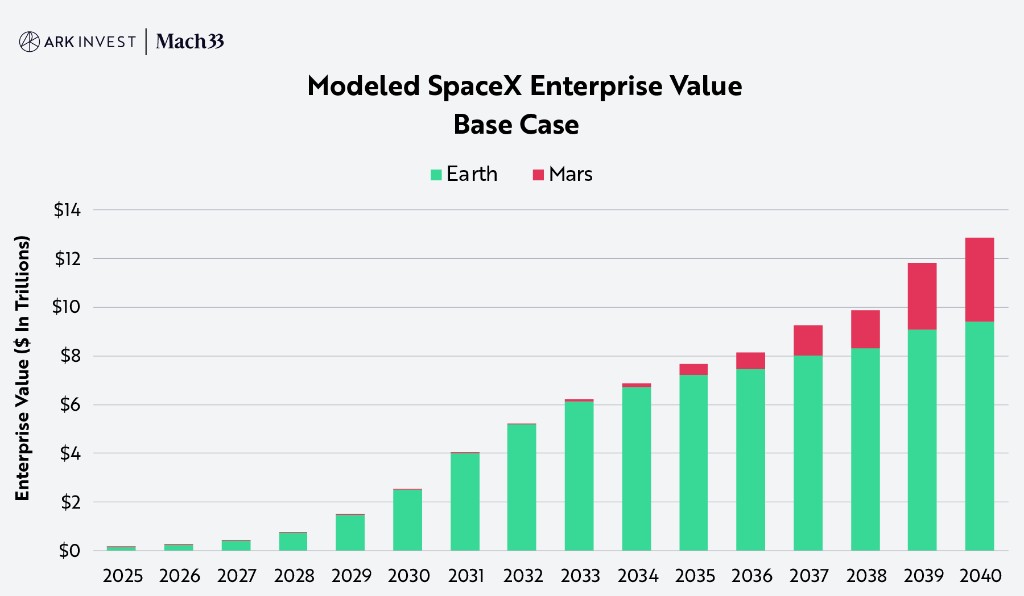

注:地球企業價值(EV)按我們預測的 EBITDA 計算。乘以 18 倍 EBITDA 與 EV 比率,根據斯特恩的説法,這與航空航天和國防公司的行業平均水平一致。火星企業價值反映了指定用於火星開發的累計現金加上 SpaceX 在火星上建造的基礎設施的賬面價值。數據來源:ARK Investment Management LLC 和 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據,如有需要可提供這些數據。本分析僅供參考,不應被視為投資建議或買賣或持有任何特定證券的推薦。預測本身具有侷限性,不能作為投資決策的依據,並且是基於我們反映自身偏好和對公司長期積極看法的模型構建的。

資料來源:ARK Investment Management LLC 和 Mach33,2025 年。本分析基於截至 2025 年 5 月 29 日的一系列外部數據來源,如有需要可提供完整數據。本分析僅供參考,不應被視為投資建議或買賣或持有任何特定證券的推薦。預測本身存在侷限性,不能作為投資決策的依據,且基於我們自身的模型,反映了我們對公司的長期積極看法。

我們將在以下七個部分詳細介紹我們的模型:

- 模型邏輯

- 潛在市場規模(TAM)和單位經濟效益

- 衞星性能

- 星艦與萊特定律

- 火星遊戲計劃

- 模型及其假設的風險和侷限性

- 結論

模型邏輯

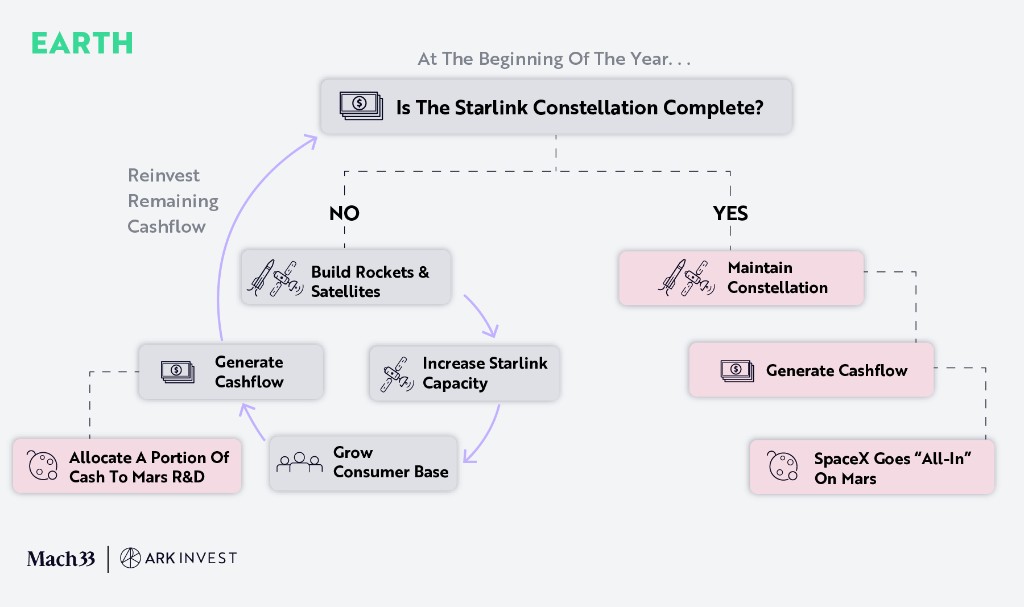

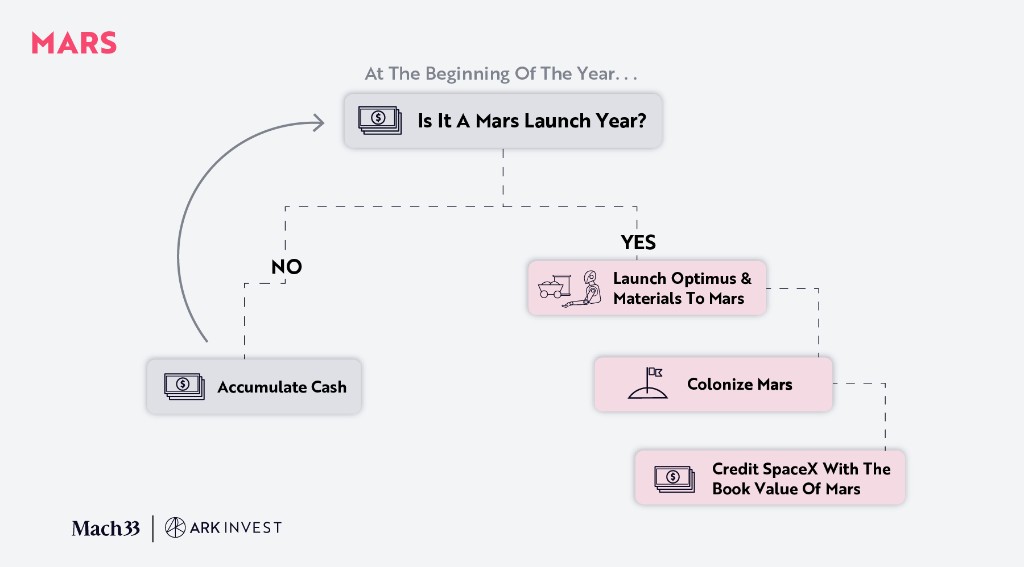

從分析角度看,該模型運作如同一個具有自我強化勢頭的飛輪,如下圖所示:從現金開始,SpaceX 製造火箭和衞星,創造軌道帶寬,獲取星鏈用户,並再投資產生的現金。隨着循環持續,資金逐步流向火星開發,直至星鏈星座部署完成。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年。僅作説明用途。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

星鏈星座完成後,我們假設 SpaceX 將維持星座運營,然後加大火星投資。每艘前往火星的火箭都搭載 Optimus 人形機器人和材料的組合。假設 Optimus 生產力隨時間提高且成本下降,SpaceX 將建立其火星"賬面價值",如下所示。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年。僅作説明用途。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

潛在市場規模(TAM)和單位經濟效益

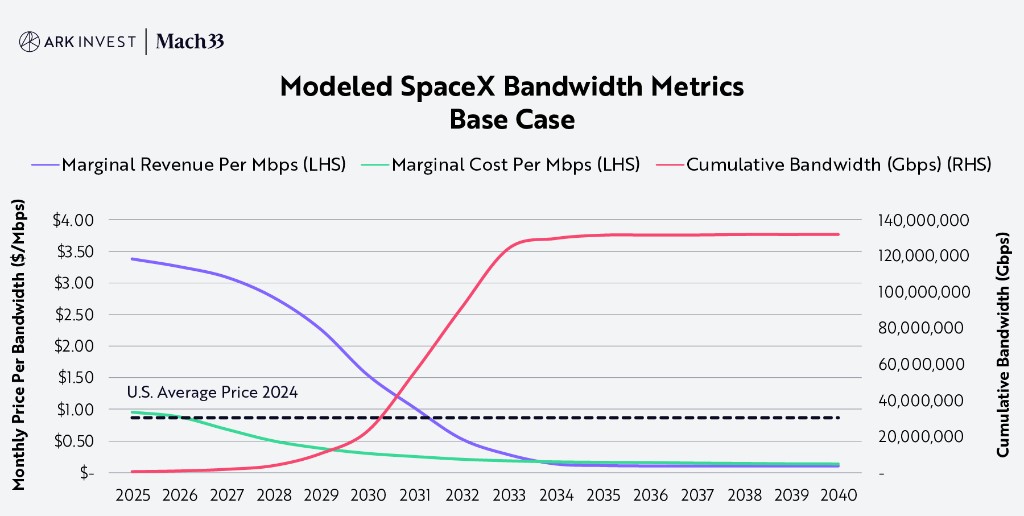

我們的自上而下開源衞星寬帶收入需求模型(鏈接)根據可用帶寬、可覆蓋人口數量以及各國可接受的寬帶價格和速度來分配 SpaceX 的收入。蒙特卡洛模擬表明,其帶寬平均在約 1.3 億吉比特每秒(Gbps)達到平台期,超出此範圍後增加帶寬將不經濟。盈虧平衡點出現在每月每兆比特每秒(Mbps)約 0.20 美元,比目前美國平均水平低約 75%,如下所示。

注:美國平均價格僅供參考;每月每 Mbps 邊際收入(紫線)為基於我們自上而下模型的全球數值。資料來源:ARK Investment Management LLC 與 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據源,可應要求提供。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

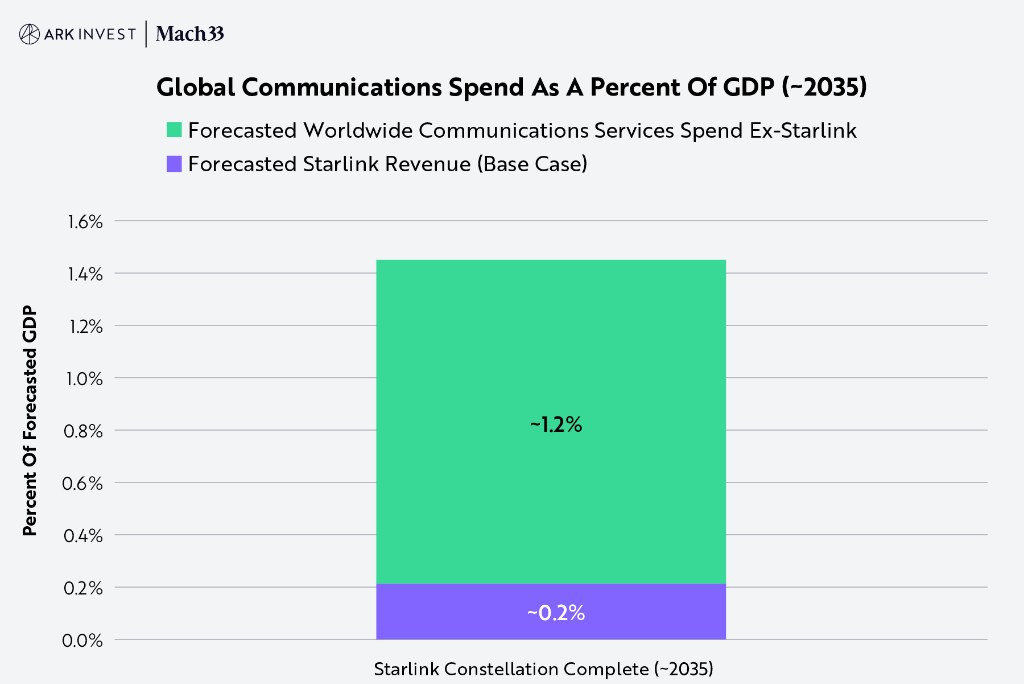

根據我們的基準情景,星鏈星座約在 2035 年完成後,ARK 研究顯示 SpaceX 可能產生約 3000 億美元的年收入,約佔全球通信總支出的 15%,如下所示。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年,基於世界銀行和高德納截至 2025 年 5 月 29 日的數據。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

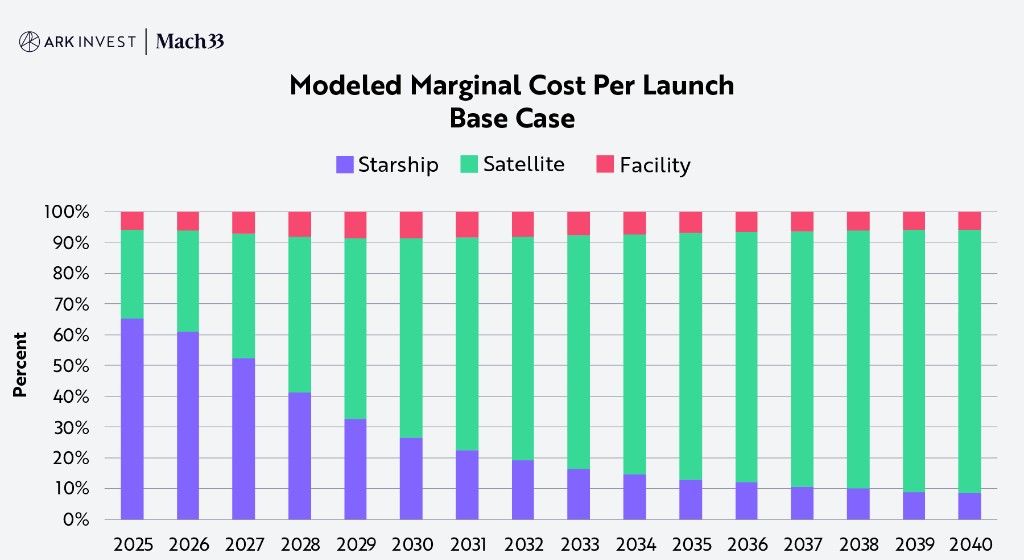

仔細觀察蒙特卡洛模擬中的邊際成本可以發現,隨着星艦可重用性提高,衞星佔總邊際成本的比例隨時間從約 30% 上升至約 90%,如下所示。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據源,可應要求提供。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

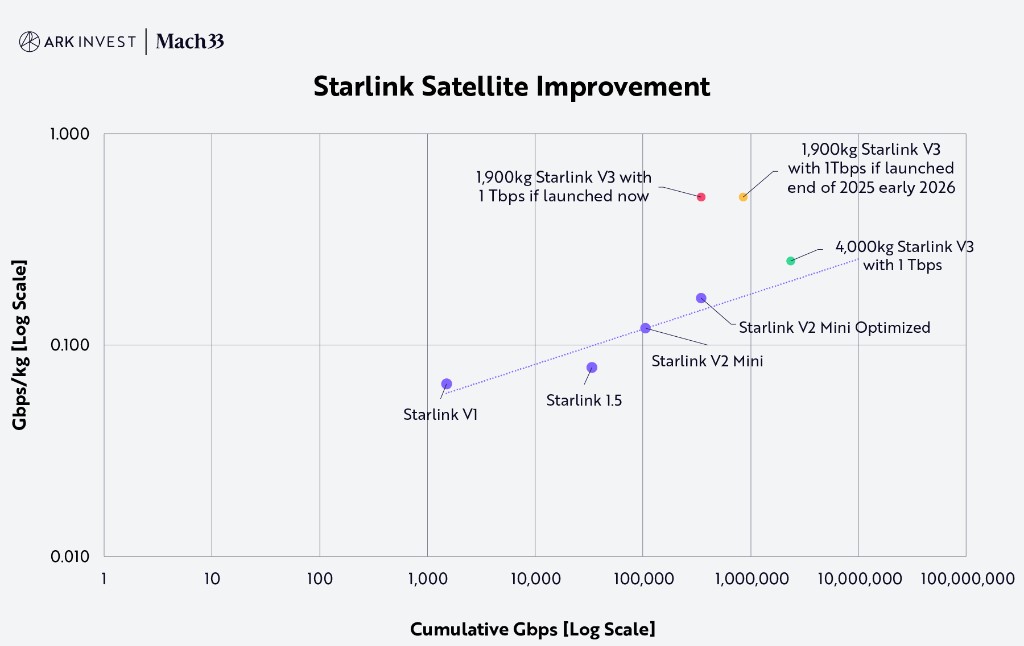

因此,以 Gbps/千克衡量的衞星性能成為模型中最敏感的輸入變量,影響收入生成和資本支出。衞星性能對帶寬部署的效率和成本至關重要,也是決定 SpaceX 完成星鏈星座建設速度以及將資本重點轉向火星目標的關鍵。

衞星性能

從 V1 到 V2 Mini Optimized,星鏈衞星性能一直遵循萊特定律的學習曲線。SpaceX 已向美國聯邦通信委員會提交了關於下一代衞星的文件,質量約 2000 千克,並在另一份關於未來衞星的披露中提及 1Tbps 帶寬。如果這些規格適用於同一顆衞星,性能躍升將是巨大的,如下圖中紅點和黃點所示。然而,我們的研究表明,這兩份披露可能指向不同的衞星。若是如此,1Tbps 衞星將與萊特定律保持一致,如下圖中綠點所示。

資料來源:ARK Investment Management LLC,2025 年,基於 SpaceX 截至 2025 年 5 月 29 日的數據。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性。

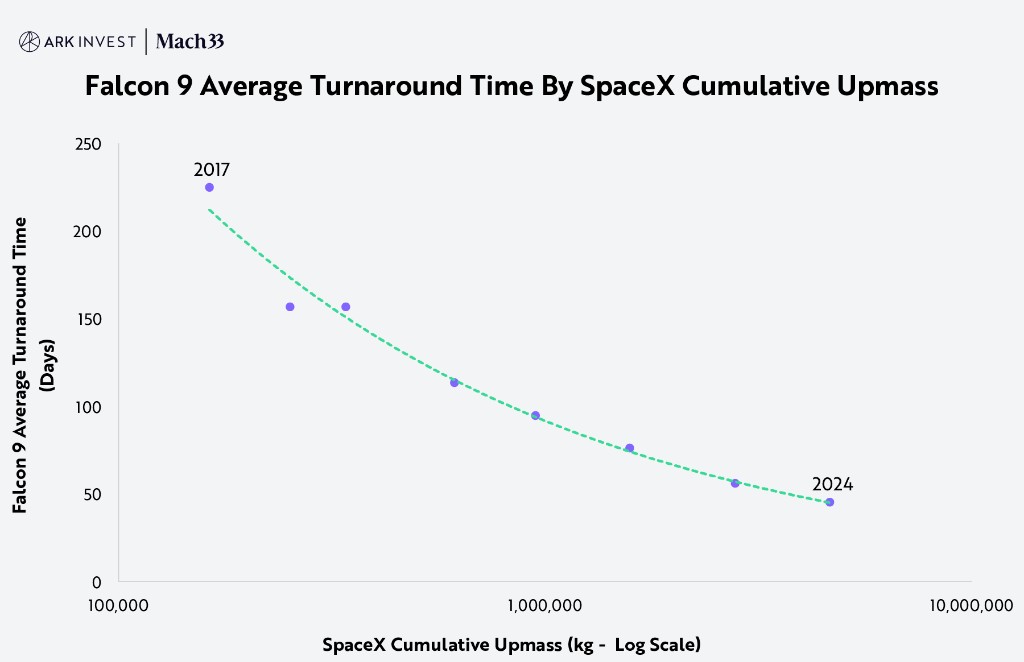

星艦與萊特定律

星艦是多行星生活的核心。儘管前期資本成本高,但星艦的週轉時間和可重用性對其運營影響至關重要。隨着星艦可重用性不斷提高,更少的飛行器和更頻繁的發射週期應能輸送相同的上行質量。基於獵鷹 9 號數據,萊特定律表明,每次軌道上行質量累計翻倍,星艦的週轉時間將以約 27% 的恆定速率下降,如下所示。

資料來源:ARK Investment Management LLC,2025 年,基於 SpaceX 截至 2025 年 5 月 29 日的數據。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。

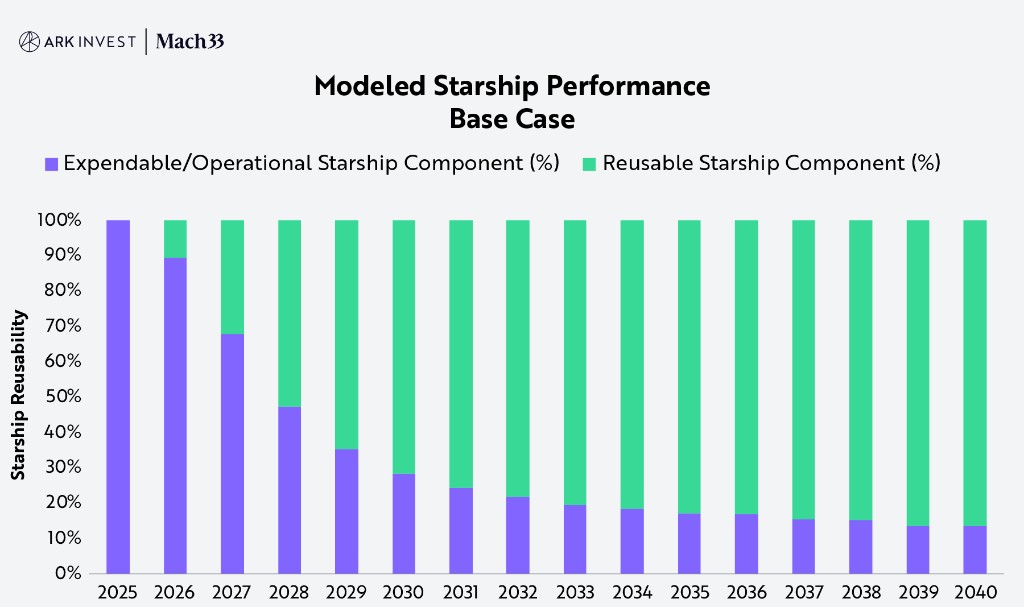

我們認為,最小化火箭週轉時間和提高可重用性對於維持 SpaceX 星座的經濟可行性以及推進其火星雄心至關重要。因此,我們的模型顯示火箭可重用性隨着累計上行質量同步提高,如下所示。

注:根據模型,即使實現快速可重用,星艦的可重用組件也永遠不會達到 100%,因為每次發射總會產生可變成本,例如燃料。資料來源:ARK Investment Management LLC 與 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據源,可應要求提供。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

火星規劃

馬斯克創立 SpaceX 的目標是實現多行星生活,特別是藉助其其他公司的力量使人類能夠移居火星。我們認為,埃隆一直在設計 Optimus 機器人和 Boring Company 設備,為挑戰性的外星環境建造基礎設施,以支持火星殖民。

根據我們的研究,火星在 SpaceX 企業價值中的佔比將隨時間增長,如下所示。然而,儘管與火星相關的資本改進將計入 SpaceX 的資產負債表,但其相關現金流將比星鏈的現金流更具投機性。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據源,可應要求提供。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

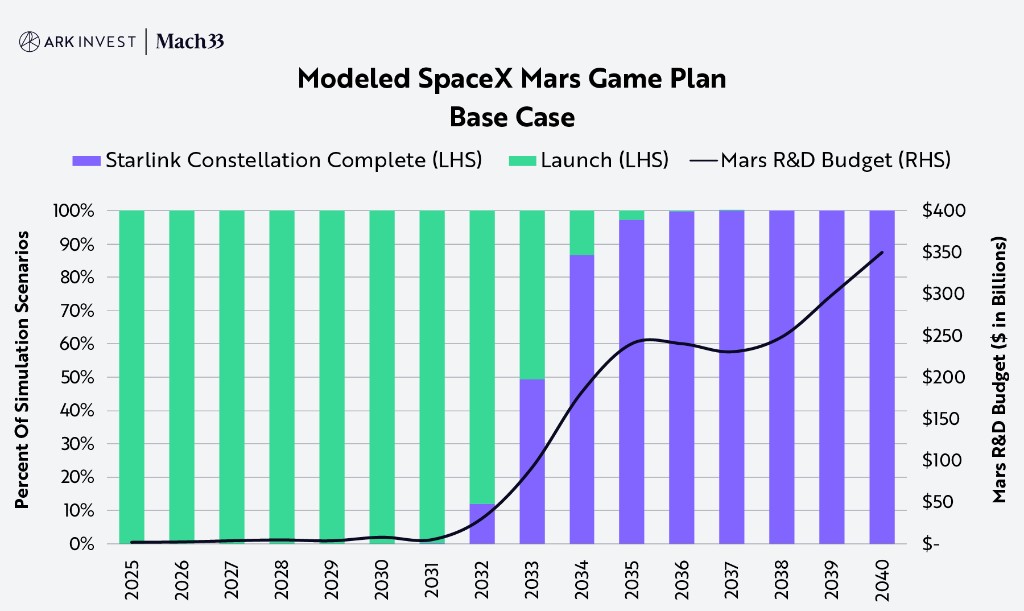

因此,我們的模型假設,在星鏈星座完成前,SpaceX 僅將一小部分預算用於火星。一旦達到該里程碑,SpaceX 可能會將其星鏈資源轉向火星,如下所示。鑑於殖民火星的規模和長期目標,投資者在相當長的時間內可能無法獲得太多資本回報。儘管火星活動可能降低服務地球衞星市場的成本併為小行星採礦鋪平道路,但這些機會超出了本預測的範圍。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據源,可應要求提供。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

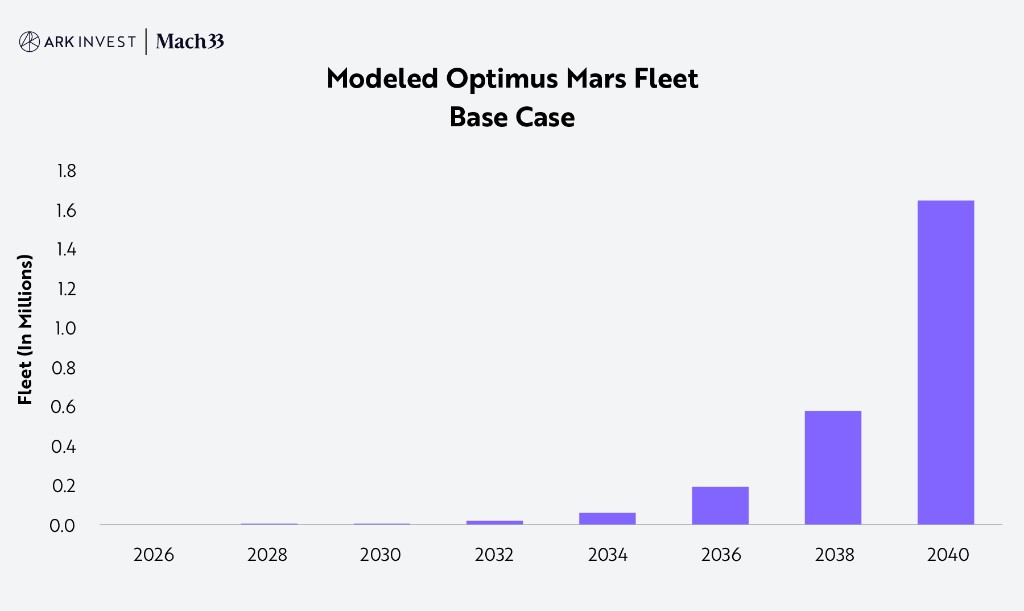

我們的蒙特卡洛模擬假設星艦將搭載經過火星改造的 Optimus 機器人(Optimi)組合,其數量隨時間增長至數百萬,如下所示。根據模型,Optimi 將建造基礎設施以支持永久殖民地,其生產力隨時間提高。支持早期人類居住的有效載荷可能相當複雜。我們的合作方 Mach33 分析了早期火星有效載荷的潛在成本(鏈接)。在早期,火星上的人類有效載荷對 SpaceX 賬面價值的貢獻可能不大。

資料來源:ARK Investment Management LLC 與 Mach33,2025 年。本分析使用了截至 2025 年 5 月 29 日的一系列外部數據源,可應要求提供。本文僅提供信息,不應視為投資建議或購買、出售或持有任何特定證券的推薦。預測本身存在固有侷限性,不可作為投資決策依據,且基於反映我們自身偏見及對公司長期樂觀看法的模型構建。

模型及我們假設的風險與侷限性

ARK 的 17 個關鍵獨立變量覆蓋了我們認為 SpaceX 未來幾年可能出現的合理情景。意外事件,如埃隆·馬斯克突然離開公司,或自然災害或疫情,可能顯著影響這些結果。此外,太空本質上是一個具有重大執行風險的挑戰性領域。如果星艦未能實現快速可重用性,可能會嚴重影響我們為公司預測的價值。同樣,無法保證 Optimus 能夠在模型設定的時間表內支持基礎設施開發,並且鑑於行星際發射窗口的時間限制,延遲可能導致進度大幅滯後。最後,競爭加劇可能減少寬帶的總可尋址市場,而政府支出的變化可能影響星盾的收入潛力。