Replicating a 1350% stock price increase? Tesla's "ambition," investors' "wishes," and the upcoming key milestones

Elon Musk's trillion-dollar compensation plan has been approved, raising market concerns about whether Tesla can replicate its historic gains. Goldman Sachs believes that Tesla's strategic layout has transcended automobile manufacturing, expanding into areas such as humanoid robots, fully autonomous driving, and self-developed chips. In the coming months, the commercialization progress of Robotaxi and the timeline for FSD's unmanned supervision will become key tests to evaluate whether its vision can be realized

After the highly anticipated shareholder meeting, Tesla not only locked in a sky-high compensation plan for its CEO Elon Musk but also painted a grand blueprint for the market that spans AI, robotics, and autonomous driving. Investors are now focused on whether it can turn its ambitions into the next growth miracle.

According to reports from the Wind Trading Desk, Goldman Sachs released a report on November 7, indicating that Tesla announced at its annual shareholder meeting on November 6 that its 2025 CEO incentive compensation plan received over 75% approval, achieving preliminary approval.

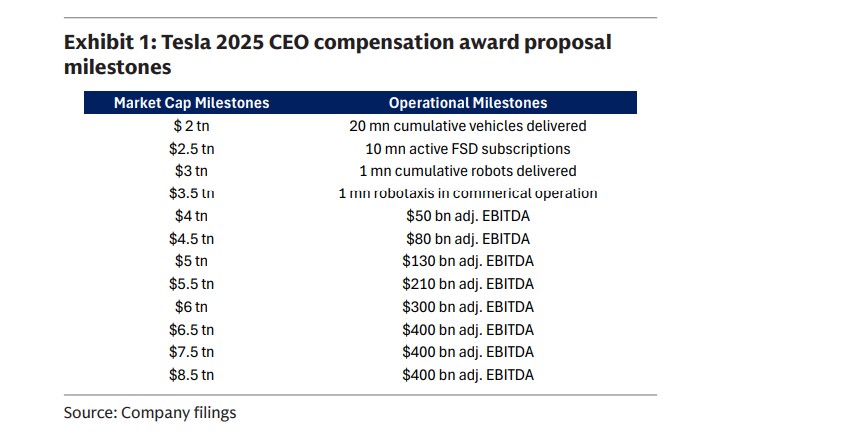

The ambition of this incentive plan is remarkable: it will grant Musk up to 12% of the current total share capital in new shares over the next 10 years, based on the achievement of a series of highly challenging market capitalization and operational milestones, with a total value potentially reaching around $1 trillion. These milestones include increasing the company's market capitalization from $2 trillion to $8.5 trillion and achieving cumulative deliveries of 1 million robots and operating 1 million Robotaxis.

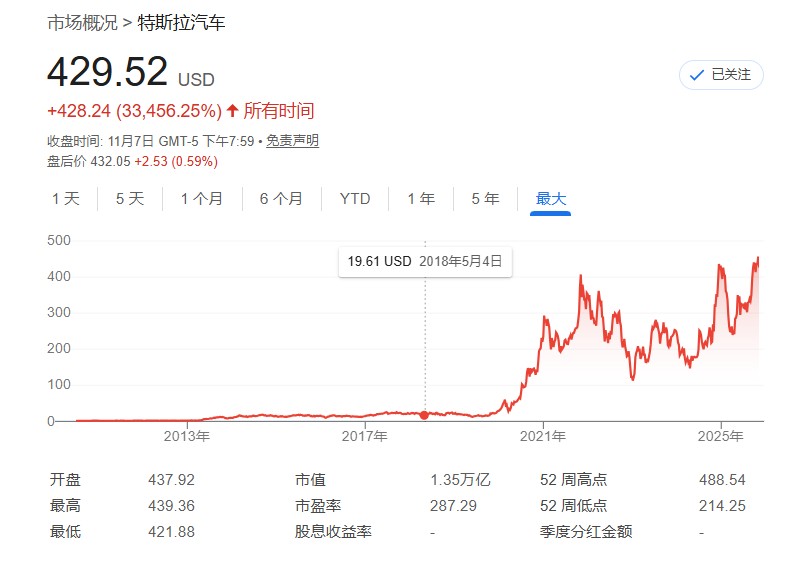

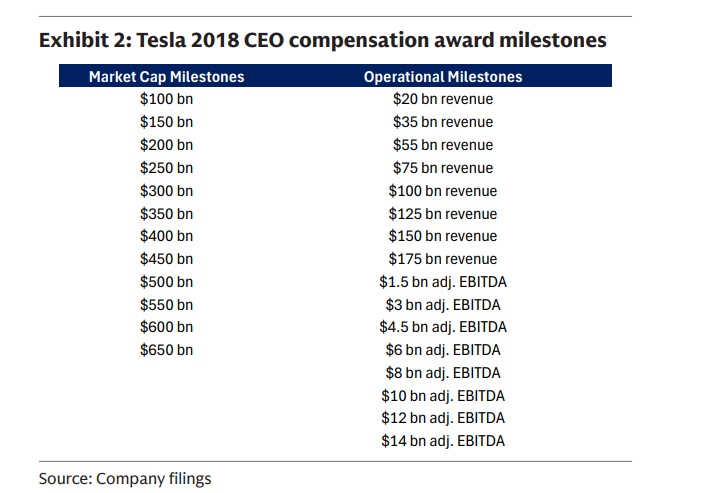

For the market, this is not just a compensation plan. The report points out that investors are viewing this new plan through the "filter" of the 2018 incentive plan. Since the announcement of that plan in January 2018 until September 4, 2025, Tesla's stock price soared by about 1350%, while the S&P 500 index only rose by about 130% during the same period. Therefore, the market generally expects this new "trillion-dollar bet" to once again serve as a powerful catalyst driving Tesla's stock price into a new upward cycle.

Beyond Cars: Tesla's Robotics, Autonomous Driving, and Chip Landscape

At this shareholder meeting, Tesla clearly demonstrated that it has long surpassed the positioning of just being an automotive company. The Goldman Sachs report detailed its vast product roadmap:

-

Optimus Humanoid Robot: Management reiterated plans to start production of the V3 version in 2026, with hopes to launch V4 and V5 in 2027 and 2028, respectively. The company plans to build a production line in Fremont with an annual output of 1 million units and another in Texas with an annual output of 10 million units, with a long-term goal of producing "one hundred million or even one billion robots" each year. The report states that after scaling production (e.g., exceeding 1 million units), the unit production cost (COGS) of Optimus is expected to drop to around $20,000.

-

Full Self-Driving (FSD): Tesla expects that FSD technology may allow users to text while driving within the next 1-2 months. Additionally, the company mentioned that version 14.3 may enable customers to sleep inside the car. In China, the company is striving to obtain full approval by February or March next year.

-

Robotaxi and Automotive Business: The company reiterated its expectation to remove safety observers from its Robotaxi service in Austin by the end of this year. Cybercab is expected to begin production in April next year. At the same time, Tesla has set ambitious capacity goals, aiming to increase its annual automotive production capacity by 50% by the end of next year, closing 2026 with an annualized rate of 2.6 to 2.7 million vehicles, and striving to reach an annualized capacity of 4 million vehicles by the end of 2027

-

Semiconductor Ambitions: Tesla plans to produce its AI5 chip in collaboration with Samsung and TSMC at four locations, and hopes to start production of the AI6 chip within a year after the AI5 goes into production. To meet the future massive demand for chips, the company is even discussing the possibility of building its own wafer fabs.

From Vision to Reality: Four Key Milestones Under Market Scrutiny

A grand blueprint requires solid steps for validation. Goldman Sachs' report emphasizes that after the incentive plan is approved, investors' focus will quickly shift to Tesla's specific progress in achieving these goals. The following four key milestones will serve as a "touchstone" for the market to assess Tesla's execution capability in the coming months:

-

Austin Robotaxi Progress: Whether the safety driver can be removed as planned by the end of the year will be the first important signal of its commercialization capability.

-

Personal FSD "Hands-Free": When it can achieve unsupervised personal FSD (such as allowing texting or sleeping) will be key to measuring the maturity of its AI technology.

-

Fourth Quarter Delivery Volume: The delivery data expected to be released in early January next year will directly reflect the fundamental health of its core automotive business.

-

Optimus V3 Debut: The company hinted during the third-quarter earnings call that it might release Optimus V3 by the end of the first quarter next year, which will be an important window for the outside world to glimpse the real progress of its robotics business.

Although the prospects painted by Tesla are exciting, Goldman Sachs analysts maintain a "neutral" rating in the report, believing that their expectations for the profitability of autonomous driving and robotics businesses are more "cautious" than the company's targets, while also listing several downside risks including intensified market competition, product delays, and slowing demand for electric vehicles.

Goldman Sachs has set a 12-month target price of $400 for Tesla, which implies a 10.3% potential downside compared to the stock price of $445.91 at the time the report was released.

2018 "Moonshot Award" Compensation

Wallstreetcn reported that in 2018, Tesla shareholders voted to approve a highly challenging compensation plan that granted Musk large-scale stock options, contingent upon the company achieving specific goals.

This unprecedented agreement was initially valued at $2.6 billion, and by the time it was halted by a Delaware court in early 2024, its value had soared to $56 billion. Data shows that the market value of this plan once exceeded $100 billion, fluctuating greatly with Tesla's market capitalization.

However, this compensation plan was ruled invalid due to a shareholder lawsuit and is currently under appeal, but the final outcome may take months to be determined

The above wonderful content comes from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)