Over 1900% increase in 12 months, the "quantum monster stock" far exceeds the "AI monster stock"

The market frenzy for quantum computing concept stocks is unfolding. Companies led by Rigetti and D-Wave saw their stock prices surge by as much as 1900% within 12 months, reaching a market capitalization of over $10 billion, despite having almost no revenue or practical applications. This phenomenon has sparked intense debate in the market about "the next disruptive technology" versus "speculative bubbles."

After the wave of artificial intelligence, the capital market is now turning its attention to the more imaginative field of quantum computing.

Quantum computing companies represented by Rigetti Computing Inc. and D-Wave Quantum Inc. have seen their stock prices soar over 1900% in the past 12 months, far outperforming many popular artificial intelligence stocks, becoming the most controversial speculative hotspot in the market.

This astonishing increase has pushed the market capitalization of both companies to over $10 billion, even surpassing AI star company Palantir and established firms like Campbell's Co. However, they currently have almost no practical applications and are expected to generate little significant revenue in the coming years, with massive cash burn.

Market views on this are polarized. Bulls believe that quantum computing has the potential to solve major issues from disease treatment to climate change and is the next disruptive technology not to be missed. Bears, on the other hand, warn that this is merely a bubble driven by speculative sentiment, lacking fundamental support, and is destined to burst.

High Valuations and Bubble Warnings

Concerns about a bubble are not unfounded. According to Bloomberg compiled data, Rigetti's valuation exceeds 500 times its forward sales, while the figures for AI company Palantir and the Nasdaq 100 index are 72 times and less than 6 times, respectively.

Bruce Cox, a fund manager at Harrington Alpha Fund, is shorting Rigetti and bluntly stated, "The market has no earnings support; the bubble is too crazy."

Despite the high valuations, Wall Street analysts are generally optimistic. All ten analysts covering D-Wave recommend buying. Benchmark analyst David Williams even received a lot of "hate mail" for raising Rigetti's target price.

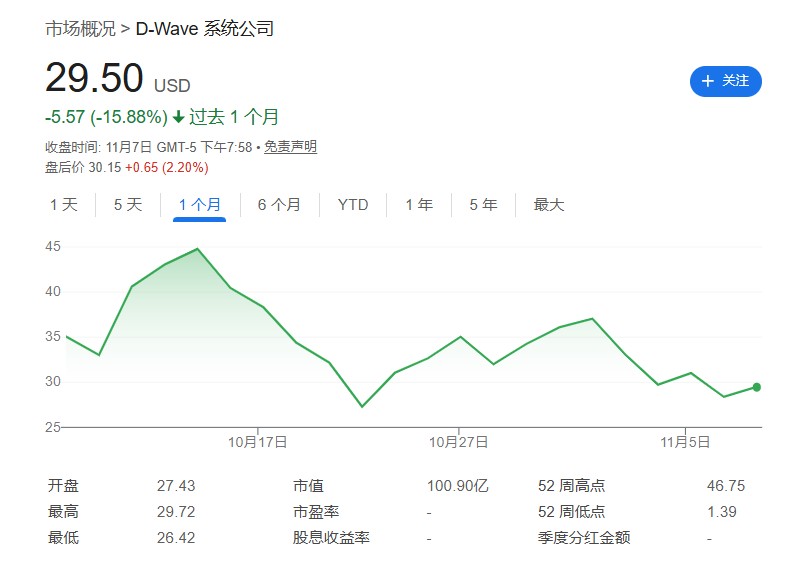

However, this frenzy is also accompanied by extreme volatility. Recently, these two stocks have fallen about 28% and 16% in the past month.