The topic of greatest concern in the market: "When will the U.S. government shutdown end?"

The duration of the U.S. government shutdown has raised market concerns. Although U.S. stocks rebounded in the late trading session due to the Democrats' proposal to extend subsidies under the Affordable Care Act, the Republicans rejected the proposal to end the shutdown. According to Polymarket data, the market expects the government shutdown to last until the second half of the month with a probability exceeding 50%. The government shutdown has led to an increase in the Treasury's cash balance, suppressing market liquidity and reducing risk appetite. Once the shutdown ends, market liquidity will significantly increase

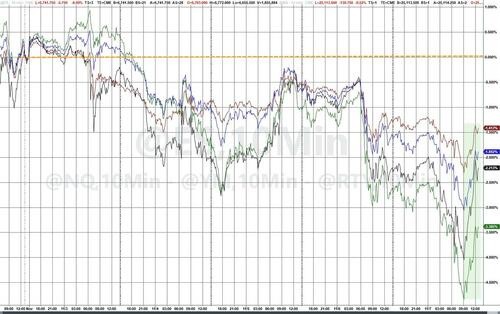

Overnight, as a bleak week came to an end, U.S. stocks rebounded in the closing hours.

The rebound was boosted by reports that "Democrats proposed a one-year extension of Affordable Care Act subsidies in the shutdown dispute" (Figure 1), but then came the news: "Republicans rejected the Democrats' proposal to end the government shutdown."

According to the latest data from Polymarket: the market expectation probability that the U.S. government shutdown will last until the second half of the month has exceeded 50% (Figure 2).

Due to the government shutdown, the U.S. Treasury's cash balance has been piling up (Figure 3), which has effectively contracted market liquidity and suppressed risk appetite. Once the shutdown ends, a large amount of liquidity will flood into the market, similar to February 2021.