Focus of the new car-making forces' Q3 report: Can Q4 usher in a moment of profitability for all?

The overall performance of new car-making forces in the third quarter met expectations, but showed a differentiated trend: Nio's losses narrowed to 4.3 billion yuan, with vehicle gross margin increasing by 2.2 percentage points to 12.5%; Li Auto maintained profitability but single-vehicle profit plummeted to 2,900 yuan; XPeng's losses remained flat compared to the previous quarter. Market focus has shifted to the operational turning point in the fourth quarter, where Nio is expected to see a month-on-month surge in deliveries by 72% to 150,000 vehicles driven by new models, which will be a key season to validate its multi-brand strategy

As the new car-making forces are set to successively announce their Q3 2025 financial reports in mid-November, market attention has become highly focused. According to the Chase Wind Trading Platform, Morgan Stanley's report released on November 6 believes that the performance of the new car-making forces in Q3 2025 will generally meet market expectations, but the real highlight is whether an operational turning point can be achieved in Q4.

For investors, the following points are key to assessing the value of each company:

Q3 Core Indicators: Vehicle gross margin and operating expense control are the two key indicators for measuring the quality of Q3 performance.

Q4 Outlook: Compared to the established facts of Q3, the market is more concerned with each company's guidance on Q4 delivery volumes and profit margins, which will directly affect market sentiment and subsequent profit forecasts.

Long-term Value Reassessment: Investors will closely examine each automaker's new model plans and pricing strategies for 2026 to determine whether they can maintain competitiveness amid potential cyclical headwinds. At the same time, non-vehicle businesses, especially AI-related hardware/software businesses, will play an increasingly important role in company valuations.

Preview of the Three Giants' Q3 Performance: Nio's losses are expected to narrow; Li Auto is expected to maintain profitability but with a sequential decline in profits; XPeng's loss scale is expected to remain roughly the same as in Q2.

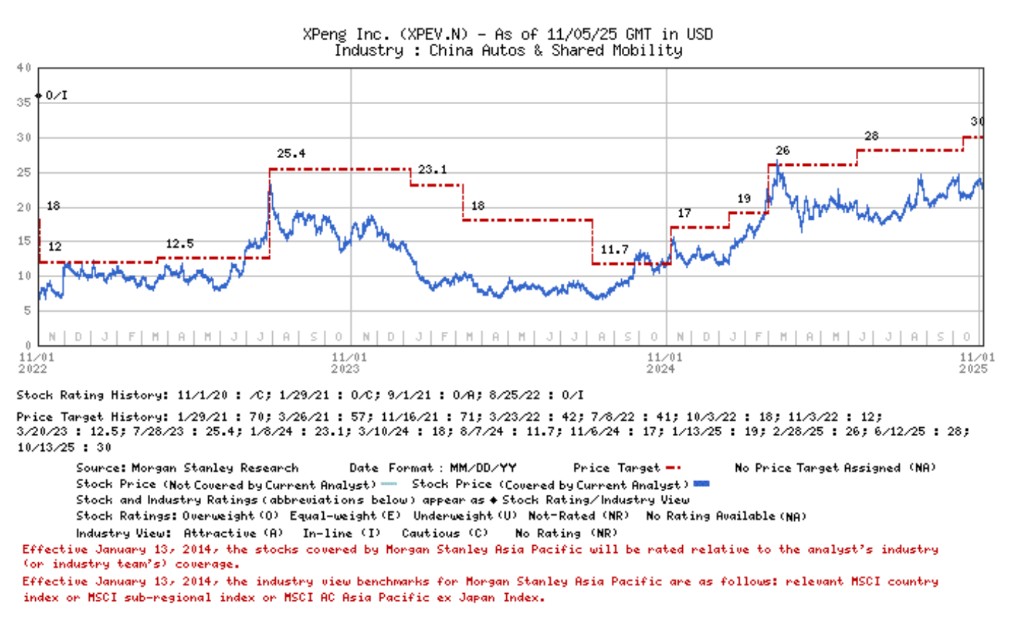

XPeng: Steady Growth in Deliveries, Losses Remain Basically Flat

XPeng's performance in Q3 is generally in line with the company's guidance, and operational conditions remain stable.

Deliveries and Revenue: Q3 deliveries were 116,000 units, a year-on-year increase of 12%, falling within the company's guidance range of 113,000 to 118,000 units. Revenue is expected to reach RMB 20.4 billion, also in line with the guidance of RMB 19.6 billion to RMB 21 billion, indicating that its average selling price (ASP) remained stable sequentially.

Margin Analysis: Vehicle gross margin is expected to increase slightly by 0.2 percentage points from Q2's 14.3% to 14.5%, with scale effects offsetting the slower ramp-up of the G7 model and the impact of the Mona 03 model (which accounts for 39%). The overall gross margin for the group is expected to be 17.2%, basically flat compared to Q2's 17.3%.

Profitability: The net loss under U.S. GAAP for Q3 is expected to be approximately RMB 500 million, roughly equivalent to the loss of RMB 478 million in Q2.

Q4 Outlook: The report predicts that thanks to the ramp-up of production capacity for the new P7 and contributions from the X9 extended range version, XPeng's Q4 delivery volume is expected to grow sequentially by 12%-16%, reaching 130,000 to 135,000 units.

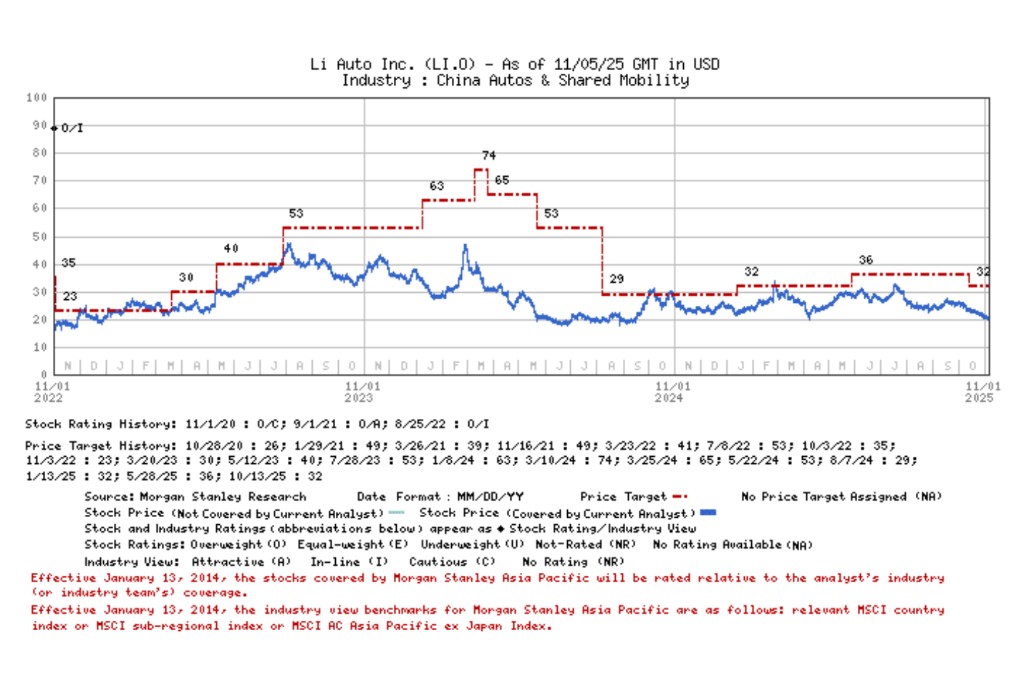

Li Auto: Maintains Profitability but Profit Declines, Focus on New Model Orders

Li Auto maintained profitability in Q3, but several key profit indicators showed a sequential decline, indicating certain operational pressures

Deliveries and Revenue: Q3 deliveries were 93,000 units, in line with the guidance of 90,000 to 95,000 units. However, revenue is expected to be 25.7 billion RMB, a 15% quarter-on-quarter decline, mainly affected by changes in the sales mix of the MEGA model and increased discounts.

Margin Analysis: The vehicle gross margin is expected to be 19.4%, unchanged from the second quarter. However, the overall gross margin for the group is 21%, with a total gross profit of approximately 5.4 billion RMB.

Profitability Status: Due to the launch of the i8 and i6 models, R&D and sales management expenses are expected to increase by 10% and 5% quarter-on-quarter, respectively. The report estimates that Li Auto will record an operating loss of 200 million RMB in Q3, compared to an operating profit of 800 million RMB in Q2. Net profit is expected to be 300 million RMB, but the profit per vehicle has significantly dropped from 9,900 RMB in the second quarter to 2,900 RMB.

Q4 Outlook: Considering the weak sales data in October, the report predicts that Li Auto's delivery guidance for the fourth quarter may be between 105,000 and 110,000 units, a quarter-on-quarter increase of 13%-18%. Investors will closely monitor the backlog of orders for the i8 and i6 models.

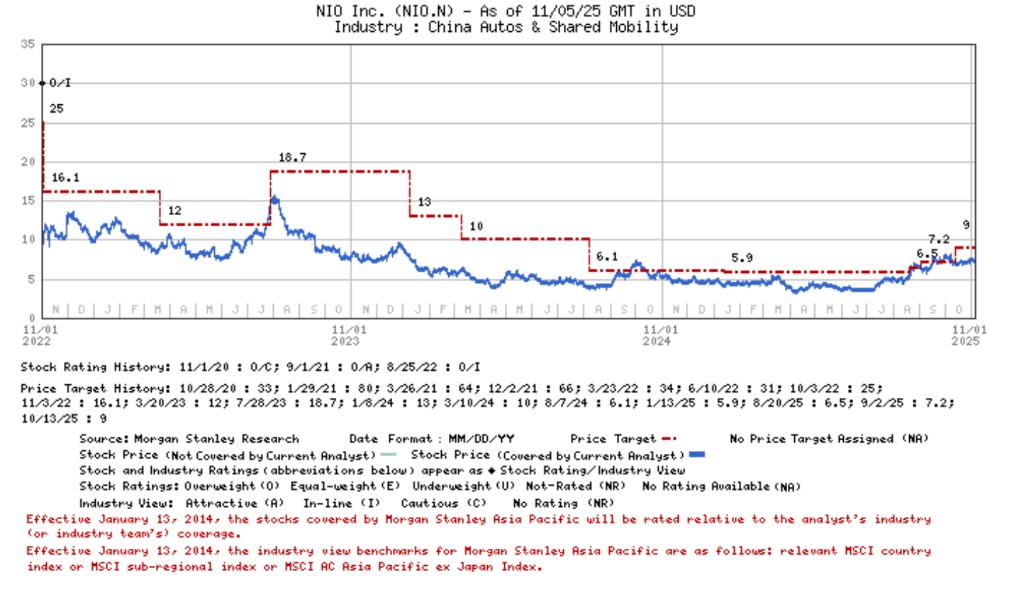

Nio Inc. (NIO.N): Losses Narrow Significantly, Q4 Deliveries May Experience Explosive Growth

Nio Inc. demonstrated good cost control in the third quarter, with losses narrowing significantly quarter-on-quarter, and the market has high expectations for its delivery growth in the fourth quarter.

Deliveries and Revenue: Q3 deliveries were 87,000 units, a 21% quarter-on-quarter increase, but at the lower end of the company's guidance range of 87,000 to 91,000 units. Revenue is expected to be 21.9 billion RMB, in line with the company's guidance of 21.8 billion to 22.9 billion RMB.

Margin Analysis: The vehicle gross margin is expected to reach 12.5%, a 2.2 percentage point increase quarter-on-quarter. Assuming non-vehicle businesses achieve breakeven, the overall gross margin for the group is expected to be 10.9%.

Profitability Status: The organizational restructuring is showing initial results, with Q3 operating expenses expected to decrease from 7 billion RMB to 6.7 billion RMB quarter-on-quarter. Net losses are expected to narrow from 5 billion RMB in the second quarter to approximately 4.3 billion RMB.

Q4 Outlook: The report provides a very optimistic forecast. Thanks to the incremental contributions from the sub-brand Lido L90 and the new ES8 model, Nio's Q4 deliveries may surge by 72% quarter-on-quarter, reaching 150,000 units. This will be a key quarter for the market to validate the success of its new vehicle strategy and multi-brand strategy.