The high growth of Google Cloud has just begun! Morgan Stanley: Conservatively calculated, the growth rate may exceed 50% next year

大摩認為,通過對谷歌雲收入結構的拆解,即 “積壓訂單” 和 “即時需求” 兩部分業務的協同增長。即便在相對保守的假設下,谷歌雲在 2026 年的營收增長率極有可能超過 50%。雲業務的持續超預期表現,將成為驅動公司估值倍數擴張和 AI 驅動下股價跑贏大盤的關鍵催化劑。

大摩認為,通過對谷歌雲收入結構的拆解,即便在相對保守的假設下,谷歌雲在 2026 年的營收增長率極有可能超過 50%,這一預測比市場普遍預期高出約 15%。

據追風交易台消息,大摩在 11 月 5 日的報告中表示,市場的普遍共識可能嚴重低估了谷歌雲(Google Cloud)的增長潛力。

通過對谷歌雲收入結構的拆解,即 “積壓訂單”(Backlog)和 “即時需求”(On-demand)兩部分業務的協同增長。大摩認為,即便在相對保守的假設下,谷歌雲在 2026 年的營收增長率極有可能超過 50%。雲業務的持續超預期表現,將成為驅動公司估值倍數擴張和 AI 驅動下股價跑贏大盤的關鍵催化劑。

通往 50% 增長之路

大摩將谷歌雲的增長動力分解為兩部分:已簽約但尚未確認為收入的積壓訂單(Backlog),以及客户即時使用的非積壓訂單/即時需求(On-demand)。

歷史數據顯示,積壓訂單一直佔谷歌雲收入的 45-50% 左右,其餘部分由按需業務驅動。這意味着谷歌雲的按需業務在 2023 年和 2024 年分別實現了 29% 和 37% 的同比增長,2025 年至今增速約為 25%。

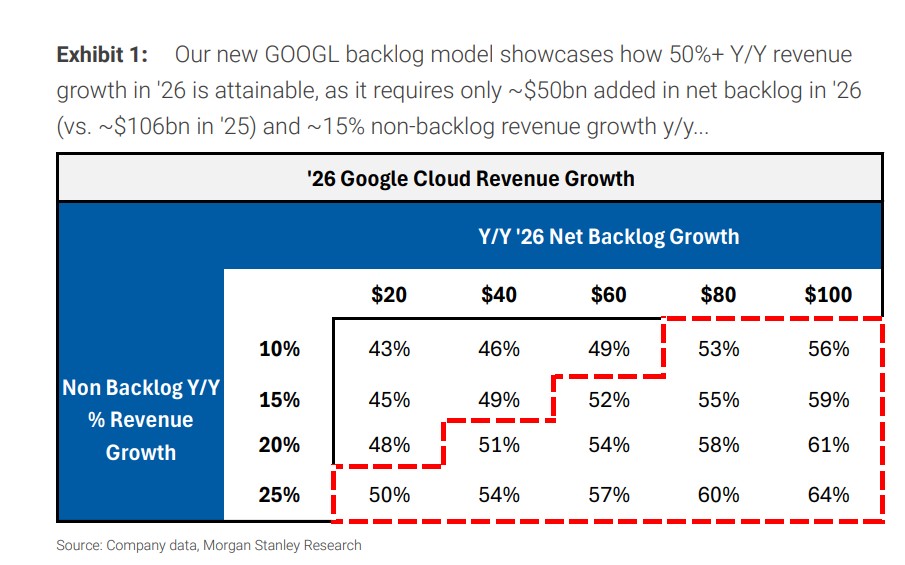

大摩的敏感性分析表明,只要 2026 年淨新增積壓訂單達到約 500 億美元以上(遠低於 2025 年預計的 1060 億美元),同時按需業務保持 15% 以上增長,谷歌雲收入增速就能突破 50%。即便按需業務維持 25% 的同比增長,新增積壓訂單僅為 200 億美元,也能實現 50% 以上的收入增速。

具體來看,每額外增加 200 億美元的 2026 年淨積壓訂單增長,就能為谷歌雲收入增速帶來約 340 個基點的額外提升。同樣,按需業務收入增速每提高 10 個百分點,就能為整體谷歌雲收入增速貢獻約 5 個百分點。

大摩的分析顯示,如果 2026 年實現 50% 以上的增長,谷歌雲收入將比大摩當前預期高出 4% 以上,比市場一致預期高出 15% 以上。在最樂觀情境下(新增積壓訂單 1000 億美元,按需業務增長 25%),2026 年穀歌雲收入增速可達 64%。

AI 時代的戰略價值

摩根士丹利強調,谷歌雲增長的持續性將成為推動 Alphabet 估值倍數擴張和 AI 驅動超額表現的關鍵驅動力。

從積壓訂單構成看,截至 2025 年第三季度,谷歌雲季度末積壓訂單達 1580 億美元,環比第二季度的 1080 億美元大幅增加 500 億美元,同比增長 710 億美元。

大摩預計第四季度積壓訂單將進一步增至 1990 億美元,全年淨新增 1060 億美元。進入 2026 年,儘管新增速度預期放緩,但基數效應和持續的按需業務增長仍將支撐整體收入的強勁增長。

這一分析凸顯了谷歌雲在 AI 時代的戰略價值,以及 Alphabet 通過自研 TPU 芯片和 Gemini 模型構建的差異化競爭優勢。對投資者而言,谷歌雲業務的超預期增長潛力,是支撐 Alphabet 當前估值和未來上漲空間的重要基石。