并购战愈演愈烈:辉瑞诺、诺德百亿美元竞购 “减肥药新贵” Metsera

為爭奪 Metsera,輝瑞已迅速跟進,將其收購報價提升至與競爭對手諾和諾德完全相同的水平——總價最高可達 100 億美元。此舉使這場激烈的競購戰進入白熱化階段。兩大巨頭爭奪的是 Metsera 在減肥藥領域的潛力管線,包括一款月度注射劑,意圖在預計規模將達千億美元的減肥藥市場中搶佔先機。

週一美國市場一日內宣佈四筆總額超 800 億美元的大型交易,將今年的併購狂潮推向新高。在此背景下,製藥巨頭輝瑞與諾和諾德對 “減肥藥新貴” Metsera 的競購戰也進入白熱化階段。

據英國《金融時報》援引兩位知情人士消息,輝瑞已在週三的截止日期前提交了新報價,將方案提升至與諾和諾德持平的水平:每股 86.20 美元,總價最高 100 億美元。

此舉使輝瑞得以繼續留在牌桌上。此前,Metsera 董事會曾判定其丹麥競爭對手諾和諾德的方案更優。輝瑞與諾和諾德正在激烈角逐,以期將這家擁有潛力管線的生物科技公司收入囊中。

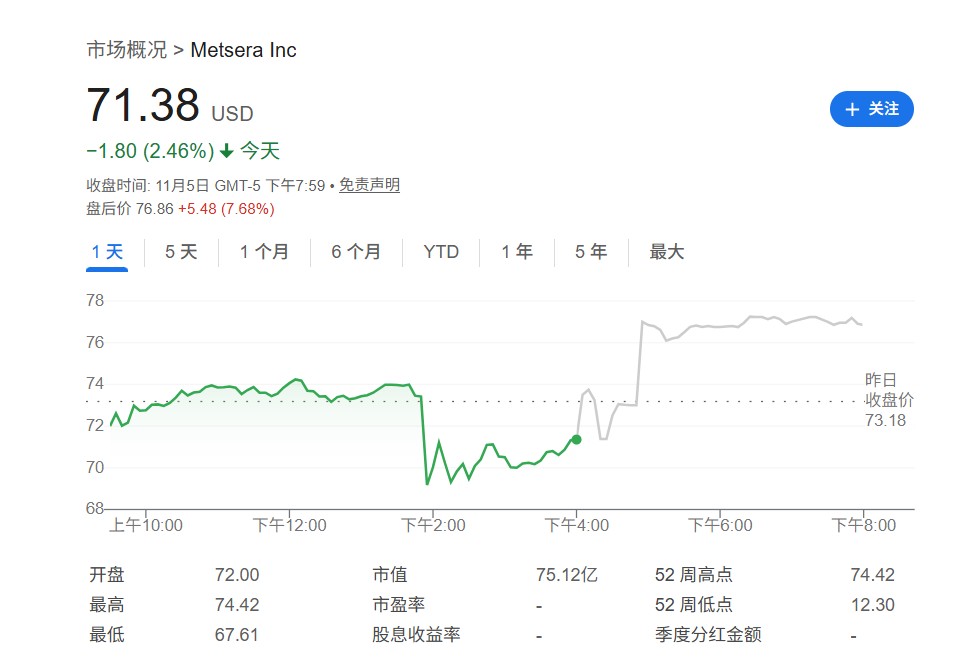

這一最新動態迅速點燃了市場情緒。在輝瑞跟進報價的消息傳出後,Metsera 股價在盤後交易中一度上漲 8%,超過每股 77 美元。

千億賽道上的關鍵一役

這場收購戰的核心,是 Metsera 公司前景廣闊的減肥藥產品管線,其中包括一款可能改變市場規則的月度注射劑。

在當前由諾和諾德的 Ozempic 和禮來主導的市場中,任何能夠提供更便捷、高效治療方案的公司,都可能獲得巨大的競爭優勢。

對於諾和諾德而言,收購 Metsera 是鞏固其市場領導地位的防禦性舉措。而對於輝瑞,這則是一次關鍵的進攻,旨在快速切入這個預計到本世紀末市場規模將超過 1000 億美元的黃金賽道。

贏得 Metsera,意味着將在未來的市場競爭中獲得一個寶貴的戰略籌碼。

一波三折的競購流程

這場競購戰充滿了戲劇性的轉折。最初,輝瑞在 9 月份已與 Metsera 達成初步協議。但上週,諾和諾德突然發起公開的非約束性要約,意圖 “闖入” 這筆交易,從而引發了一場激烈的競購。

據報道,本週二,雙方均提高了報價。諾和諾德的方案為每股 62.20 美元預付款及 24 美元的後續里程碑付款,總計每股 86.20 美元,被 Metsera 董事會認定為 “更優要約”。當時輝瑞的報價為每股 70 美元,對 Metsera 的估值約為 81 億美元。

僅一天後,輝瑞便迅速將報價提升至與諾和諾德持平的水平。根據合併協議條款,若諾和諾德再次提高報價,輝瑞將有兩天時間決定是否匹配。該交易的股東投票計劃於 11 月 13 日舉行。

法庭與監管的雙重考驗

除了商業報價,法律與監管的博弈同樣激烈。輝瑞已提起訴訟,指控諾和諾德為規避反壟斷審查而設計的 “兩步式” 支付結構是 “前所未有且非法的”。儘管在週三的聽證會上受挫,但輝瑞在一份聲明中表示,將 “通過正在進行的訴訟以及在特拉華州聯邦法院懸而未決的平行反壟斷訴訟,繼續積極尋求其主張”。

監管機構的介入使局勢更加複雜。FTC 已致信諾和諾德與 Metsera,警告其交易結構 “可能違反” 競爭法。諾和諾德回應稱,正與 FTC 進行 “建設性對話”,並相信其方案符合反壟斷規則。輝瑞則對監管機構的介入表示歡迎,稱其 “也表達了嚴重關切”。

全球併購熱潮下的縮影

輝瑞與諾和諾德對 Metsera 的爭奪,是當前全球併購市場強勁反彈的一個縮影。

華爾街見聞寫道,數據顯示,今年以來全球併購交易總額已達到 3.8 萬億美元,同比增長約 38%。

企業正積極利用窗口期,通過具有變革性的戰略收購來重塑行業格局。從人工智能基礎設施到生物科技,大型交易頻現,反映出資本對高增長潛力領域的強烈追逐。