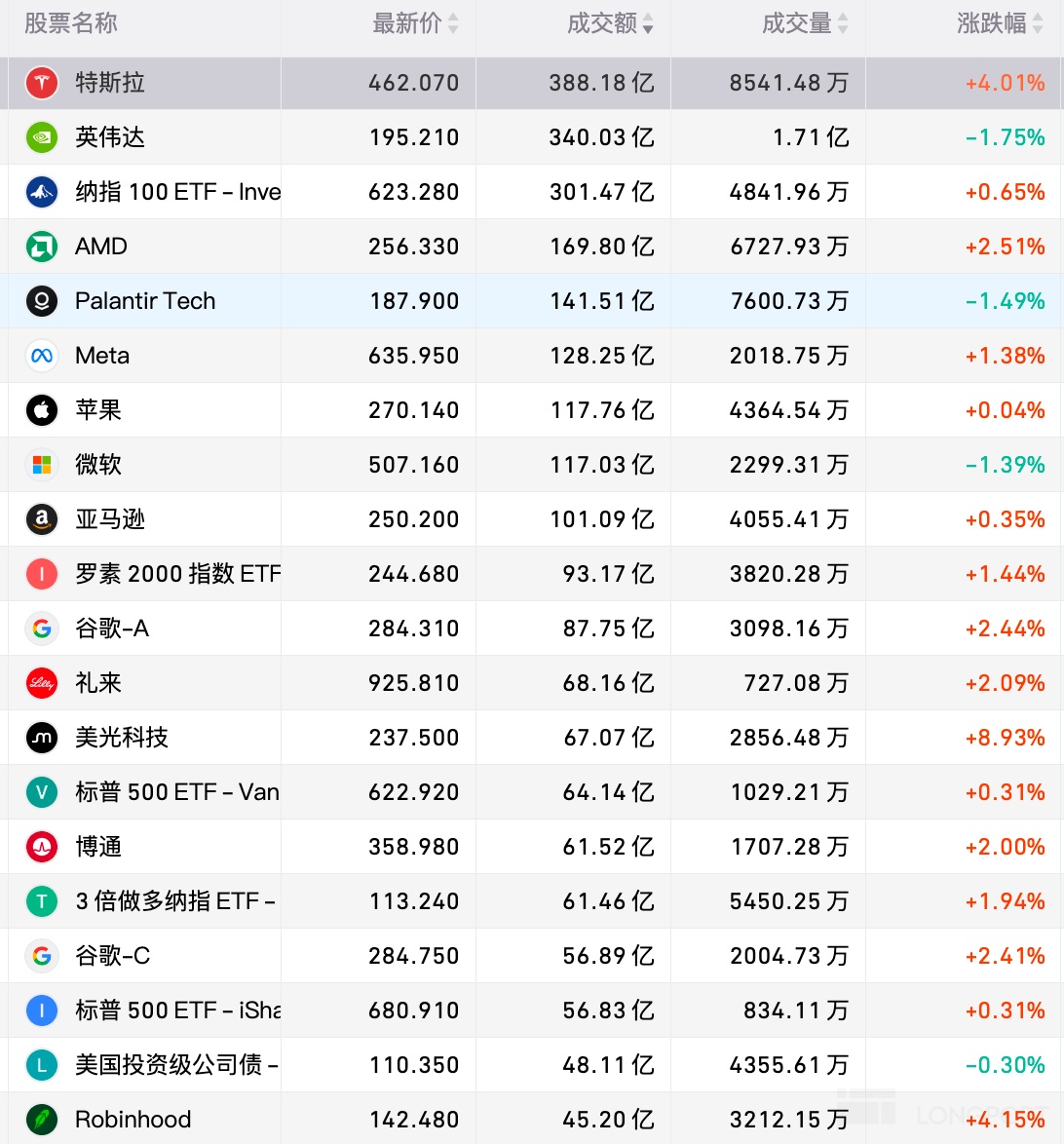

US Stock Fund Activity List | Micron rises nearly 9%, DDR5 spot prices soar 25% this week

11 月 6 日(週三)美股成交額第 1 名特斯拉收高 4.01%,成交 388.18 億美元。據媒體報道,特斯拉在印度銷量慘淡,目前正在調整其市場戰略,現已聘請蘭博基尼印度公司前負責人 Sharad Agarwal 負責印度當地業務。Agarwal 將在本週上任,任務是重振特斯拉印度市場推進計劃。知情人士還稱,聘請 Agarwal 是特斯拉為印度制定更具本土化戰略的一部分。自 7 月中旬在印度啓動銷售以來,特斯拉印度已接到超過 600 輛汽車的訂單,這一數字未達到該公司自身的預期。此外有報道稱,規模達 2 萬億美元的挪威主權財富基金表示,在本週的股東會議前,該基金已投票反對馬斯克在特斯拉近萬億美元的薪酬提案,理由是其規模過大、存在股權稀釋以及關鍵人物風險。第 2 名英偉達收跌 1.75%,成交 340.03 億美元。該股在過去 5 個交易日中有 4 日收跌。據報道,美國知名 “空頭” 邁克爾·伯裏説,他已押注逾 10 億美元做空英偉達公司等科技企業。據 SEC 監管文件顯示,伯裏已斥資約 11 億美元,買入對英偉達和軟件企業帕蘭蒂爾公司的看跌期權。

11 月 6 日(週三)美股成交額第 1 名特斯拉收高 4.01%,成交 388.18 億美元。據媒體報道,特斯拉在印度銷量慘淡,目前正在調整其市場戰略,現已聘請蘭博基尼印度公司前負責人 Sharad Agarwal 負責印度當地業務。Agarwal 將在本週上任,任務是重振特斯拉印度市場推進計劃。

知情人士還稱,聘請 Agarwal 是特斯拉為印度制定更具本土化戰略的一部分。自 7 月中旬在印度啓動銷售以來,特斯拉印度已接到超過 600 輛汽車的訂單,這一數字未達到該公司自身的預期。

此外有報道稱,規模達 2 萬億美元的挪威主權財富基金表示,在本週的股東會議前,該基金已投票反對馬斯克在特斯拉近萬億美元的薪酬提案,理由是其規模過大、存在股權稀釋以及關鍵人物風險。

第 2 名英偉達收跌 1.75%,成交 340.03 億美元。該股在過去 5 個交易日中有 4 日收跌。據報道,美國知名 “空頭” 邁克爾·伯裏説,他已押注逾 10 億美元做空英偉達公司等科技企業。據 SEC 監管文件顯示,伯裏已斥資約 11 億美元,買入對英偉達和軟件企業帕蘭蒂爾公司的看跌期權。

第 4 名 AMD 收高 2.51%,成交 169.8 億美元。該公司第三季度業績超預期,並預計第四季度營收約 96 億美元,但在人工智能推動大幅上漲後,過高期望和利潤率擔憂一度令該股承壓。

摩根士丹利發表研究報告指,AMD 第三季表現大致符合預期,當中遊戲業務異常強勁。另外,伺服器市場亦表現強勁,公司持續在 PC 領域推動增長,並於伺服器市場擴大市場份額;嵌入式業務亦迎來週期性復甦,管理層明確表示該業務明年會有增長。AI 方面,公司進展符合預期,經歷上半年倒退後,第三季恢復按年增長,不過與同行相比表現仍較平淡,英偉達與博通的 ASIC 業務增長速度均遠超 AMD。

第 7 名蘋果收高 0.04%,成交 117.76 億美元。蘋果據悉計劃引入谷歌 AI 技術,助力 Siri 重大升級。

第 8 名微軟收跌 1.39%,成交 117.03.48 億美元。微軟週三與阿聯酋科技公司 G42 宣佈,作為微軟在阿聯酋 152 億美元投資計劃的一部分,雙方正深化戰略合作伙伴關係,以加速阿聯酋的數字化轉型。

兩家公司表示,將通過 G42 旗下數字基礎設施提供商 Khazna 數據中心在阿聯酋擴建 200 兆瓦的數據中心容量。該項目預計將於明年年底前上線。

第 11 名谷歌 A 類股收高 2.44%,成交 87.75 億美元。據知情人士透露,蘋果公司計劃使用谷歌開發的一款擁有 1.2 萬億參數的人工智能模型,來助力其長期承諾的 Siri 語音助手全面升級。

因討論未公開而要求匿名的知情人士表示,在經過長時間評估後,兩家公司正敲定一項協議,其中蘋果將每年向谷歌支付約 10 億美元以使用該技術。

蘋果希望藉助谷歌的力量來重建 Siri 的基礎技術,為明年推出一系列新功能奠定基礎。谷歌模型的 1.2 萬億參數遠超蘋果目前的模型。

第 13 名美光收高 8.93%,成交 67.07 億美元。據供應鏈消息稱,三星電子已率先暫停 10 月 DDR5DRAM 合約報價,引發 SK 海力士和美光等其他存儲原廠跟進,將導致供應鏈 “斷糧”,恢復報價時間預計將延後至 11 月中旬。由於三星遲遲不願提供合約報價,直接告訴下游客户 “無貨可賣”,導致短短一週內,DDR5 現貨價格飆升 25%。

第 20 名羅賓漢證券收高 4.15%,成交 45.2 億美元。該公司三季度淨營收 12.7 億美元,分析師預期 12.1 億美元;三季度加密數字貨幣營收 2.68 億美元,分析師預期 2.872 億美元;三季度調整後 EBITDA 為 7.42 億美元,分析師預期 7.269 億美元;三季度 ARPU(單位用户平均收入)為 191 美元,分析師預期 182 美元。