American retail giant "consecutive explosions": "Papa Johns" plummets, Yum! Brands considers selling "Pizza Hut"

美國餐飲連鎖行業正遭遇一輪密集衝擊,棒約翰因收購告吹股價暴跌 21%,創下 2020 年 3 月疫情爆發以來最大單日跌幅。Yum! Brands Inc. 宣佈不排除出售必勝客,必勝客銷售額已連續八個季度下滑。這輪行業震盪發生之際,高盛對美國消費者健康狀況發出” 紅色” 警告,稱消費疲軟已從低收入羣體蔓延至中產階級。

美國餐飲連鎖行業正遭遇一輪密集衝擊,多家披薩巨頭相繼傳出負面消息,折射出消費疲軟從低收入羣體向中產階級蔓延的嚴峻現實。

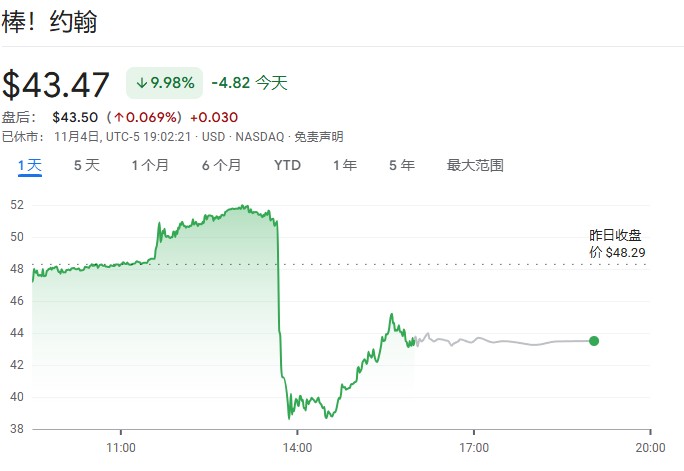

週二,棒約翰股價暴跌 21%,創下 2020 年 3 月疫情爆發以來最大單日跌幅。消息面上,私募股權巨頭 Apollo Global Management 在一週前撤回了以每股 64 美元價格將棒約翰私有化的收購要約。

同日,全球最大餐飲集團 Yum! Brands Inc. 宣佈啓動對必勝客業務的戰略評估,不排除出售這一經營困難的披薩品牌。必勝客銷售額已連續八個季度下滑,目前年銷售額約 10 億美元,較十年前縮水 20%。

這輪行業震盪發生之際,高盛剛剛對美國消費者健康狀況發出"紅色"警告,稱消費疲軟已從低收入羣體蔓延至中產階級,多家企業高管表示當前消費者信心創下"數十年來最差"水平。

棒約翰收購案告吹引發股價重挫

棒約翰股價週二盤中一度下跌 21%,此前媒體援引知情人士報道稱,Apollo Global Management 約一週前撤回了對這家披薩連鎖企業的私有化要約。

今年 6 月,Semafor 曾報道 Apollo 與卡塔爾投資基金 Irth Capital 共同提出了私有化方案。

棒約翰將於週四公佈第三季度財報,媒體調查的分析師預計,該公司調整後盈利將同比下降 5.2%。公司未立即回應置評請求。

此次收購案破裂凸顯私募股權機構對餐飲行業前景的謹慎態度。在消費者支出持續承壓的背景下,即便是老牌連鎖品牌也難以獲得買家青睞。

Yum! Brands Inc. 新任 CEO 上任即謀劃剝離必勝客

上任僅一個月的 Yum! Brands Inc. 餐飲集團 CEO Chris Turner 週二宣佈,公司已啓動對必勝客的戰略評估。這一決定標誌着 Turner 執掌公司後的首個重大戰略舉措。

Turner 在聲明中表示:"必勝客的表現表明,需要採取額外行動幫助該品牌實現其全部價值,這可能在 Yum! Brands Inc. 餐飲之外能更好地實現。"必勝客目前貢獻的營收不到 Yum! Brands Inc. 總收入的 15%,銷售額多年來一直徘徊在 10 億美元左右,較十年前下降 20%。

必勝客的困境主要源於無法吸引顧客。這並非整個披薩市場的問題——競爭對手達美樂和棒約翰在北美市場的營收仍在增長。上季度,必勝客全球同店銷售額下降 1%,已連續八個季度出現下滑。

相比之下,Yum! Brands Inc. 旗下另外兩大品牌塔可鍾和肯德基表現強勁。第三季度財報顯示,塔可鍾和肯德基在美國市場的可比銷售額分別增長 7% 和 2%,肯德基國際業務(佔該品牌 86% 的業務)可比銷售額增長 3%。這幫助 Yum! Brands Inc. 整體可比銷售額增長 3%,超過市場預期的 2.6%。

Robert W Baird & Co 分析師 David Tarantino 在研報中指出,出售必勝客可能受到投資者歡迎,因為該披薩品牌一直是拖累公司整體增長率的錨。他估計,出售這項業務可能為 Yum! Brands Inc. 系統銷售額增長貢獻約 1 個百分點。Yum! Brands Inc. 股價週二一度上漲 6.5%。截至週一收盤,該股今年累計上漲 3.9%,而同期標普 500 指數漲幅為 16.5%。

消費降級陰影籠罩餐飲行業

披薩連鎖企業的困境是美國消費疲軟加劇的縮影。由於持續的通脹壓力導致消費者減少外出就餐,Chipotle Mexican Grill 今年第三次下調銷售預期。公司 CEO Scott Boatwright 表示:"消費者感受到了壓力,我們也感受到了他們的退縮。"他指出,Chipotle 流失的客户轉向了雜貨店而非其他連鎖餐廳,這意味着人們正選擇在家做飯以節省開支。

Chipotle 的業績預警公佈後,其股價在盤後交易中一度暴跌 16.5%。這一來自行業標杆品牌的預警表明,消費降級的壓力不再侷限於低收入人羣,而是開始影響到中高收入消費者。

11 月 1 日,高盛消費品專家 Scott Feiler 指出,更多公司報告消費放緩,且疲軟已擴散至中等收入羣體,尤其是 25-35 歲消費者。過去兩週,消費類股票遭遇大幅拋售,非必需消費品板塊跑輸大盤 500 個基點。

卡夫亨氏 CEO Carlos Abrams-Rivera 在財報電話會議中表示:"我們現在面臨數十年來最糟糕的消費者信心之一。"該公司大幅下調全年銷售指引,預計下降 3% 至 3.5%。