华尔街先知 Yardeni:” 多头太多了”,技术指标显示美股或已透支

华尔街著名多头 Yardeni 罕见警告美股过度乐观:标普 500 指数六个月暴涨 37%,多空比率升至 4.27,突破过度乐观关口;技术指标显示标普 500 较 200 日均线高 13%,纳指较支撑位高 17%,接近 7 月高点水平。Yardeni 预计年底前或从高点回落 5%,但仍建议逢低买入,认为不会出现超 10% 的大幅调整。

华尔街著名多头 Ed Yardeni 对美股发出罕见警告,认为投资者过度乐观情绪已成为反向指标,且技术指标显示美股过度拉升,标普 500 指数可能在年底前从高点回落 5%。

11 月 3 日,据媒体报道,Yardeni Research 创始人 Ed Yardeni 表示,当前市场"多头太多了",在经历了 6 个月的猛涨后,投资者对股票只涨不跌的坚定信念正成为令人担忧的信号。标普 500 指数自 4 月初以来已暴涨 37%,这一涨幅在 1950 年以来仅出现过 5 次。

技术面也呈现警示信号:标普 500 指数目前较其 200 日移动平均线高出 13%,这通常意味着反弹已过度延伸。纳斯达克 100 指数则较其长期支撑位高出 17%,接近 2024 年 7 月的最大差距水平——当时股市随后因日元套利交易平仓而在 8 月遭遇抛售。

(标普 500 指数日 K 线图,橙色为 200 日移动均线)

分析认为,这位长期看涨者开始质疑自己对年底涨势的预期,这一转变尤为值得关注,因为 Yardeni 一直是自 4 月以来市场反弹的坚定支持者,其 2025 年底标普 500 指数 7000 点的目标位于华尔街策略师预测的最高水平之列。

尽管如此,Yardeni 仍建议投资者"如有现金就逢低买入",但不要试图预期大幅回调而卖出。他认为短期内不会出现超过 10% 的重大调整。

市场情绪达到极端水平

投资者信心已攀升至一年来最高点。

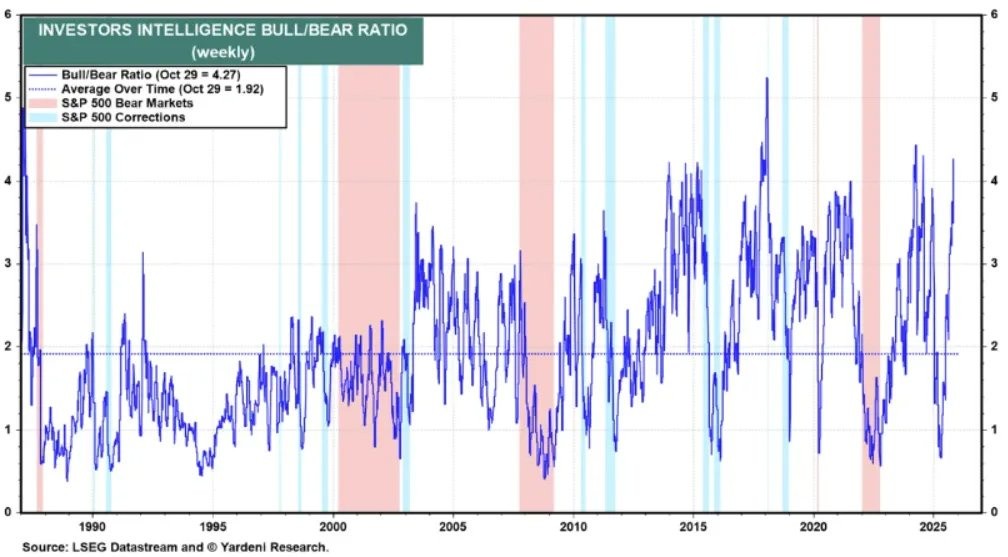

根据 Yardeni Research 的分析,Investors Intelligence 对通讯作者的调查显示,多空比率在 10 月 29 日当周跳升至 4.27,明显突破了历史上标志过度乐观的 4.00 关口。

散户投资者同样充满信心。美国个人投资者协会 (AAII) 的周度调查显示,看涨情绪在过去七周内有五次超过 37.5% 的历史平均水平。这种普遍的乐观情绪引发了 Yardeni 的担忧,他表示"多头太多了"。

Yardeni 通过电话表示:

"关键问题是这轮涨势是否已经透支,以及能否在今年最后几个月延续。考虑到市场广度不佳,仅需一个意外事件就可能将股市从高位打落,但鉴于交易员在假期前后通常保持乐观,这可能很难发生。"

技术指标闪烁警示灯

在标普 500 指数大幅反弹之后,关键技术指标正接近历史极端水平。标普 500 指数较其 200 日移动平均线的溢价幅度达到 13%,或表明反弹已过度延伸。

纳斯达克 100 指数的情况更为极端,目前较长期支撑位高出 17%,接近 2024 年 7 月的最大差距水平。当时股市随后在 8 月因日元套利交易平仓而遭遇抛售,对市场造成冲击。

(图为纳斯达克指数日 K 线走势图,橙色为 200 日移动均线)

这些技术面信号促使 Yardeni 重新审视其看法。

尽管他仍维持 2025 年底标普 500 指数 7000 点的目标——较上周五收盘价仅高出约 2.3%——但他预计该指数可能在 12 月底前从高点回落多达 5%。

不过,Fundstrat Global Advisors 研究主管 Tom Lee 等其他知名多头认为,情绪可能在股市出现重大下跌前维持数周甚至数月的亢奋状态。Lee 仍在逢低买入,看好 11 月的强劲历史表现。

年底行情面临考验

随着 2025 年接近尾声,市场焦点转向美联储政策路径。

交易员押注的降息步伐快于央行释放的信号,这使得本周约十几位央行官员的讲话备受关注,包括纽约联储主席威廉姆斯(John Williams)以及理事沃勒(Chris Waller)和鲍曼(Michelle Bowman)。

分析师表示,投资者对美联储主席鲍威尔在 12 月再次降息可能性上的谨慎立场基本不为所动,这加剧了市场与央行预期的分歧,因此接下来官员们为下次降息时机提供的任何路线图都将受到密切审视。

本周经济数据方面,华尔街将解读美国工厂活动和制造业数据以评估经济健康状况。麦当劳、Uber Technologies 和 Lyft 等公司的业绩也将帮助华尔街判断消费者信心。

超过半数成分股公司已公布季度业绩,该指数有望实现连续第九个季度盈利增长,利润预计增长 13%——几乎是约 7% 的季前预估的两倍。

尽管发出警告,Yardeni 仍建议投资者"如果有现金就逢低买入",但不要预期大幅回调而卖出。他表示不认为股市会很快出现超过 10% 的重大修正。