Morgan Stanley: 2026 will be the year of AI technology hardware

Morgan Stanley believes that this is mainly driven by the upgrade of AI servers. It predicts that after the launch of NVIDIA's Vera Rubin platform in 2026, the demand for cabinets will surge to 60,000 units. The GPU power consumption is expected to soar to 2300W, driving the value of power solutions to grow more than tenfold by 2027, with liquid cooling becoming standard. Core components such as PCB and high-speed interconnects are undergoing significant upgrades, and the entire AI hardware supply chain value is being reassessed

Author: Dong Jing

Source: Hard AI

Morgan Stanley predicts that 2026 will be a key year for explosive growth in AI technology hardware, primarily driven by strong demand for AI server hardware.

On November 3rd, according to Hard AI, Morgan Stanley stated in its latest research report that AI server hardware is undergoing a significant design upgrade driven by GPUs and ASICs. NVIDIA's upcoming GB300, Vera Rubin platform, and Kyber architecture, as well as AMD's Helios server rack project, will bring higher computing power and cabinet density.

Morgan Stanley emphasized in the report that as NVIDIA's Vera Rubin platform launches in the second half of 2026, cabinet demand is expected to surge from approximately 28,000 units in 2025 to at least 60,000 units in 2026. More importantly, to support higher power-consuming GPUs, the value of power solutions may grow more than tenfold by 2027, while liquid cooling solutions will become standard, leading to a continuous increase in the value per cabinet. Additionally, components such as PCB/substrate and high-speed interconnects will also see significant specification upgrades.

This means that the value of the entire AI server hardware supply chain is being reassessed. The firm maintains a positive rating on several AI hardware supply chain companies, believing that the new generation of AI server design upgrades will bring substantial profits to related manufacturers.

Explosive Growth in AI Server Rack Demand

Morgan Stanley clearly pointed out in the report that the growth momentum of AI hardware is shifting from the H100/H200 era to a new cycle driven by NVIDIA's GB200/300 (Blackwell platform) and the subsequent Vera Rubin (VR series) platform.

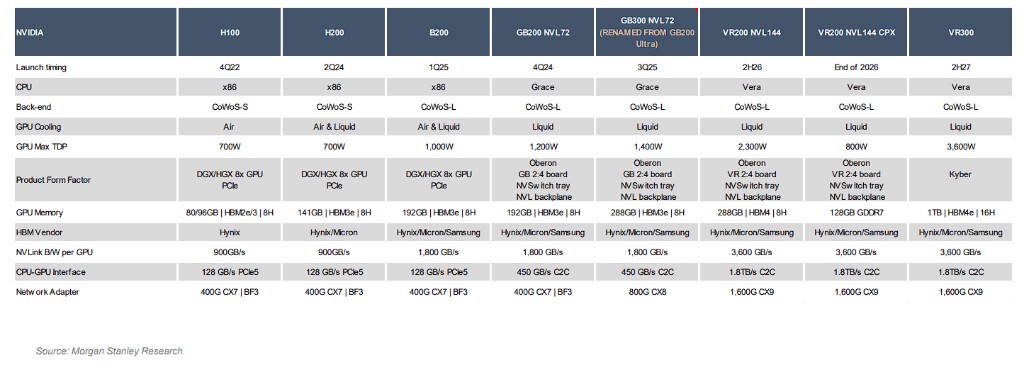

According to NVIDIA's product roadmap, the power consumption and performance of its GPUs are experiencing leapfrog upgrades.

From the H100's 700W TDP to the B200's 1,000W, then to the GB200's 1,200W, and finally to the Vera Rubin (VR200) platform launching in the second half of 2026, whose GPU maximum TDP will soar to 2,300W, with the VR300 (Kyber architecture) in 2027 reaching as high as 3,600W.

(NVIDIA Product Roadmap)

Morgan Stanley believes that this increase in computing density directly drives a comprehensive innovation in server cabinet design and components.

Morgan Stanley predicts that demand for AI server cabinets based solely on NVIDIA's platform will leap from approximately 28,000 units in 2025 to at least 60,000 units in 2026, achieving over a 100% growth. Meanwhile, AMD's Helios server rack project (based on the MI400 series) has also made good progress, further intensifying market demand for advanced AI hardware. The report emphasizes that as cabinet design shifts from single GPU upgrades to integrated designs for entire rack systems, ODM manufacturers with strong integration capabilities and stable delivery records, such as Quanta, Foxconn, Wistron, and Wiwynn, will dominate the supply of GB200/300 cabinets.

Power Consumption and Cooling Bottlenecks Ignite the Value of Power Supply and Liquid Cooling Solutions

One of the most striking points in the report is that the power consumption and cooling challenges brought about by AI hardware upgrades are transforming into significant opportunities for power supply and cooling suppliers. This is seen as one of the fastest-growing segments of value in this round of upgrades.

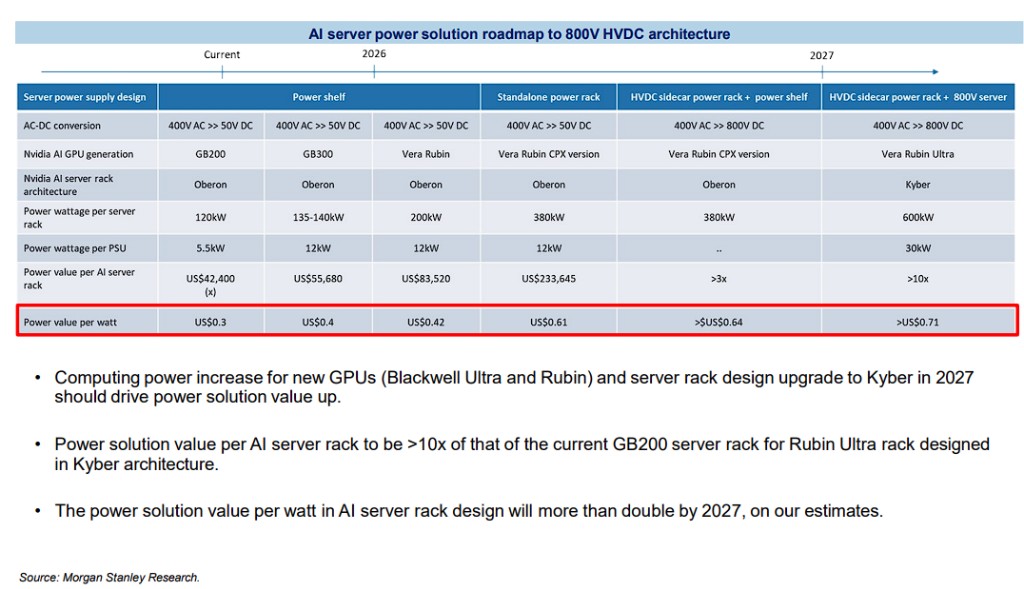

In terms of power supply, with the total power consumption of a single cabinet sharply increasing, traditional power supply architectures are becoming unsustainable.

The report predicts that the power supply architecture will transition to an 800V high-voltage direct current (HVDC) solution. This shift will greatly enhance the value content of power supply solutions.

Morgan Stanley expects that by 2027, the value of power supply solutions designed for the Rubin Ultra cabinet (using the Kyber architecture) will be more than ten times that of the current GB200 server cabinet. At the same time, by 2027, the value of power supply solutions corresponding to each watt of power consumption in AI server cabinets will also double compared to the current stage.

In terms of cooling, liquid cooling has shifted from an alternative solution to a necessity. The report points out that as the TDP of the GB300 platform exceeds 1,400W, liquid cooling has become standard equipment. This directly increases the value of cooling components. Specific data shows:

The total value of cooling components for a GB300 (NVL72) cabinet is approximately $49,860. By the next generation Vera Rubin (NVL144) platform, due to further increases in cooling demands for computing trays and switch trays, the total value of cooling components for a single cabinet will increase by 17%, reaching $55,710. Among them, the value increase for cooling modules designed for switch trays is as high as 67%.

Morgan Stanley states that this clearly indicates that key component suppliers in the liquid cooling supply chain, such as cold plate modules, cooling fans, and quick connectors (NVQD), will directly benefit.

Comprehensive Upgrade of the Value Chain, PCB/Substrate and High-Speed Interconnects Rise Sharply

In addition to power supply and heat dissipation, the report also emphasizes the profound impact of AI platform upgrades on printed circuit boards (PCBs) and various interconnected components. Each iteration of GPUs comes with higher requirements for the number of PCB layers, material grades, and sizes.

According to the roadmap for NVIDIA GPUs compiled by Morgan Stanley:

ABF substrates: The number of layers increases from 12 layers (12L) for H100 to 14 layers for Blackwell (B200), and then to 18 layers for Vera Rubin (VR200), with corresponding increases in size.

OAM (OCP Accelerator Module) motherboards: PCB specifications upgrade from 18-layer HDI (High-Density Interconnect) for H100 to 22-layer HDI for GB200/300, and may reach 26-layer HDI on VR200.

CCL (Copper Clad Laminate) materials: Transitioning from ultra low-loss (Ultra low-loss, M7) to extreme low-loss (Extreme low-loss, M8) grades to meet higher data transmission rate requirements.

Morgan Stanley believes that these upgrades in technical details mean that the manufacturing process of PCBs is more complex and of higher value. The increased demand for high-layer HDI boards and high-grade CCL materials will bring structural growth opportunities for PCB manufacturers and upstream material suppliers with corresponding technical capabilities.

The report clearly states that the design upgrades of AI GPUs and ASIC servers will strongly support the wave of capacity expansion in the PCB/substrate industry.

At the same time, Morgan Stanley states that data and power interconnection solutions are also being upgraded to match higher data transmission speeds and capacity requirements