Global stock markets opened positively in November, U.S. stock futures continued to rise, gold and silver rebounded, oil prices increased, and Bitcoin fell nearly 3%

本周,交易员将关注全球央行密集的政策会议周,英国央行预计周四将不会降息。此外,美国持续的联邦政府关门继续扰乱关键经济数据发布,令经济前景蒙上阴影。分析指出,贸易局势缓和和全球人工智能热潮的大背景应该会让投资者在 11 月初保持积极情绪,市场焦点将转向美国私营部门数据发布。

全球股市延续今年 4 月以来的强劲涨势进入 11 月,科技巨头财报表现稳健以及贸易紧张局势缓和为市场注入信心。MSCI 全球股指在过去八个交易日中第七次上涨,美股三大股指期货震荡上涨;OPEC+ 决定暂停增产则推动油价上涨;黄金震荡回升至 4020 美元附近,亚市盘中一度跌至 3962 美元;加密货币继续走低,以太坊跌 4%,延续近日跌势。

核心市场走势:

标普 500 期货上涨 0.2%,纳斯达克 100 指数期货涨 0.10%;欧洲斯托克 50 指数期货上涨 0.2%;

日本 10 年期国债收益率上升 1 个基点至 1.655%;澳大利亚 10 年期国债收益率上升 4 个基点至 4.34%;

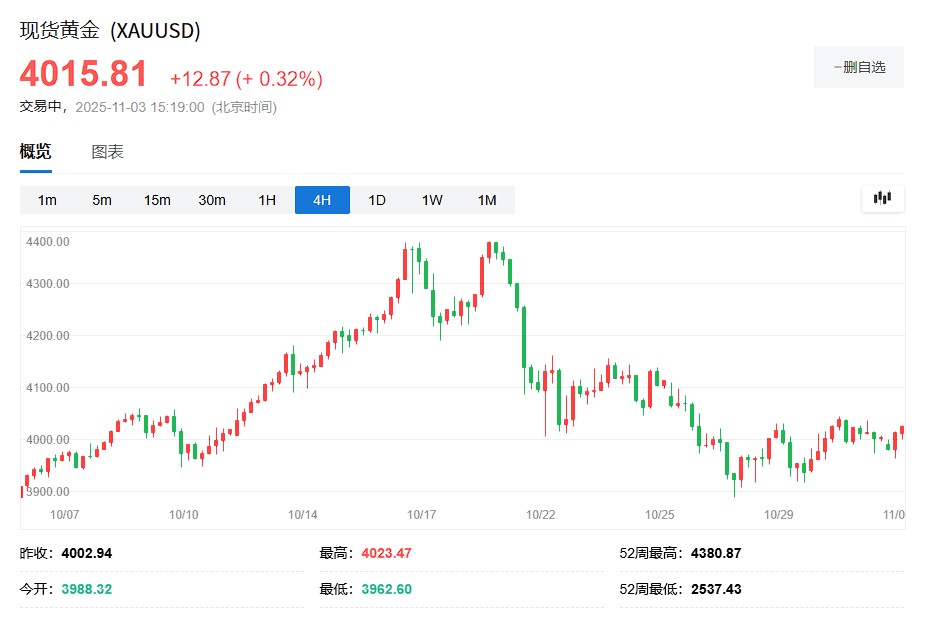

现货黄金上涨 0.3% 至每盎司 4,017.49 美元;现货白银涨幅扩大至 1%,现报 49.058 美元/盎司;

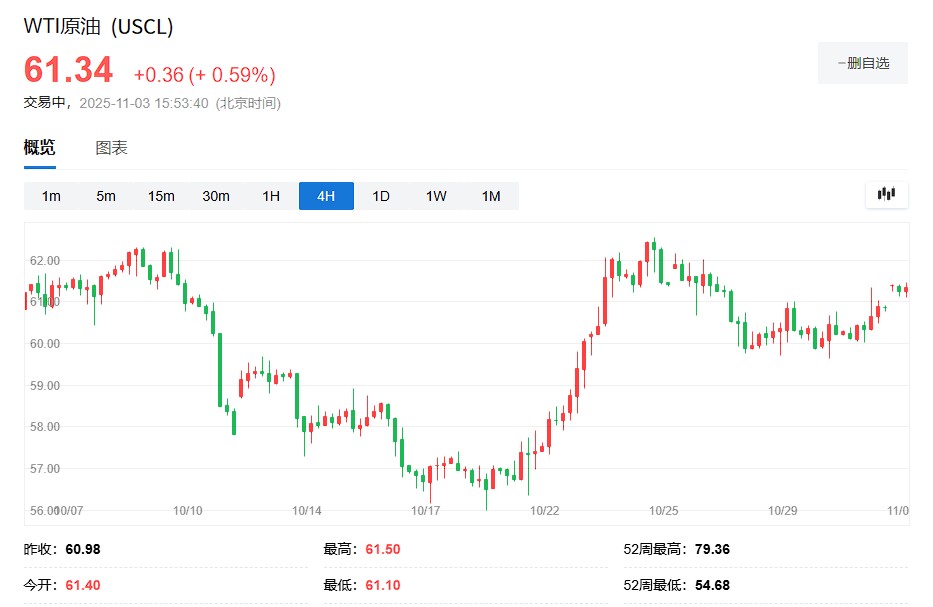

WTI 原油上涨 0.6% 至每桶 61.37 美元;

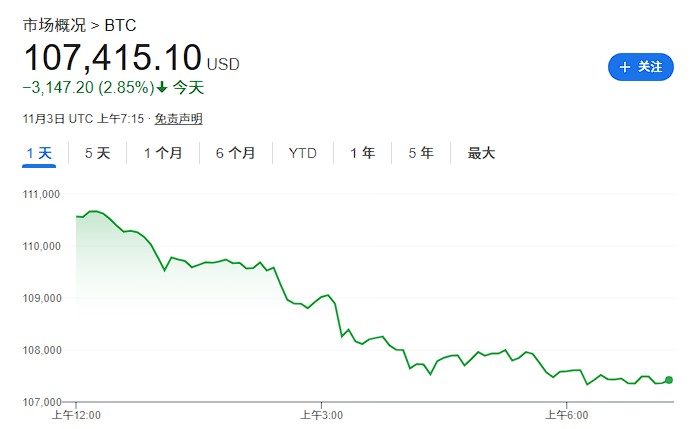

比特币下跌 2.2% 至 107,608.33 美元;以太坊下跌 4% 至 3,710 美元。

亚洲股市周一上涨 0.6%,标普 500 指数期货在上周五上涨后继续攀升 0.2%,财报乐观情绪盖过了对涨势过度集中于科技巨头的担忧。欧洲股市也将高开。日本市场和美国国债现货交易因假日休市。

Lombard Odier 新加坡高级宏观策略师 Homin Lee 表示,"鲍威尔上周的 FOMC 新闻发布会给市场带来了意外,但贸易局势缓和和全球人工智能热潮的大背景应该会让投资者在 11 月初保持积极情绪,市场焦点将转向美国私营部门数据发布。"

本周,交易员将关注全球央行密集的政策会议周。预计澳大利亚、瑞典和巴西的政策制定者将维持利率不变,墨西哥可能降息,英国央行预计周四将不会降息。此外,在美国,持续的联邦政府关门继续扰乱关键经济数据发布,令经济前景蒙上阴影。

黄金在亚市早盘一度跌至 3960 美元,随后拉升收复 4000 美元关口,目前接近 4020 美元,投资者关注全球最大黄金消费市场之一的中国结束税收优惠政策,给市场带来的影响。

消息面,上周六,两部门发布公告称,取消长期实施的黄金税收优惠政策。分析认为,这可能对全球最大黄金消费市场之一的消费者造成打击。黄金在 10 月初飙升至历史新高,受到散户投资者购买狂潮推动,但随后在当月最后两周大幅回落。

BullionVault 研究总监 Adrian Ash 表示:"这个黄金最大消费国的税收变化将打击全球情绪。对于希望在上月飙升后出现更深度回调的交易员和投资者来说,这一消息可能非常受欢迎。"

石油市场方面,OPEC+ 决定在下月进行又一次小幅增产后暂停产量增长,推动 WTI 原油上涨 0.6% 至每桶 61.37 美元。

此举正值市场面临供应过剩前景,布伦特原油在过去三个月已下跌 10%。美国加强对俄罗斯制裁为这一主要出口国的供应前景带来不确定性。

加密货币市场继续走弱,比特币跌近 3%,逼近 10.7 万美元,以太坊下跌 4% 至 3710 美元。比特币 10 月下跌近 5%,终结 2018 年以来在 10 月上涨的纪录。

Van Eck 跨资产策略师 Anna Wu 指出,标普 500 指数"只有在出现重大意外下行时才会停止上涨"。她表示,苹果和亚马逊强劲的财报主导市场,这种强势延续到本周,支撑整体风险情绪。

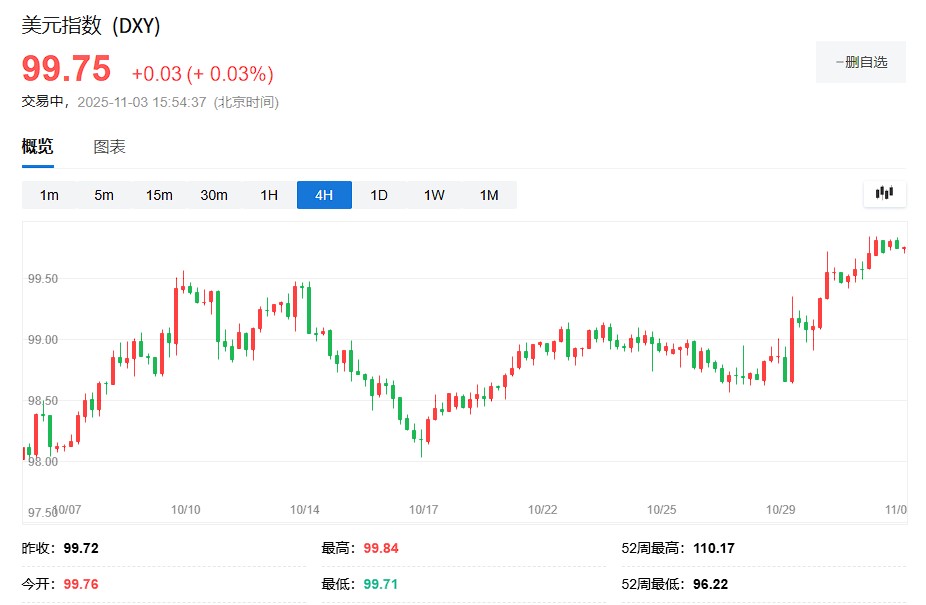

彭博策略师表示,经过三个月的相对平静,外汇市场本周将重新获得关注,美元指数很可能本周触及六个月高点,日元将继续承压。

美元指数周一基本持稳,投资者等待美联储官员讲话以寻找有关央行政策路径的更多线索。