Under the impact of a strong dollar, the Indian rupee is approaching a historical low, and the Reserve Bank of India may be forced to intervene

在美元走強與進口商對沖需求雙重壓力下,印度盧比匯率逼近歷史低點。儘管印度央行疑似出手干預以支撐匯價,但市場信心仍受壓制。美聯儲的鷹派信號及印美貿易不確定性令盧比前景承壓,預計短期將在 88.50 至 89.10 區間內波動。

在全球美元走強的背景下,印度盧比正面臨嚴峻考驗,其匯率已逼近歷史最低水平。

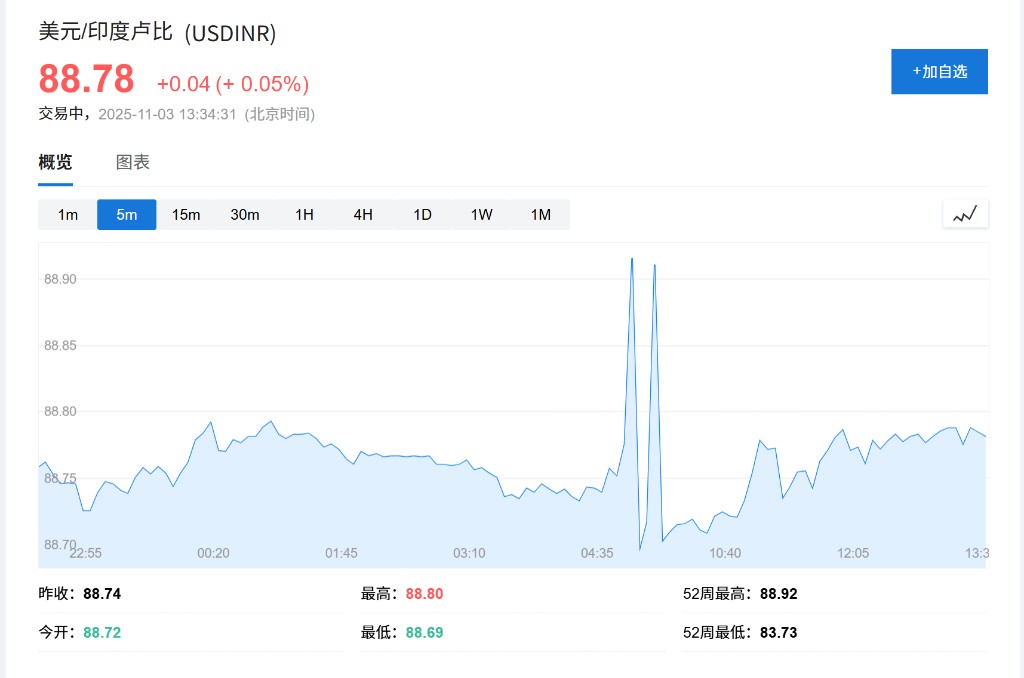

3 日,印度盧比兑美元匯率徘徊在 88.7875 附近,與 9 月下旬創下的歷史低點 88.80 僅一步之遙。交易員稱,印央行的美元拋售行為幫助盧比避免了更大幅度的下跌。

市場普遍認為這是印度央行在出手干預。多位交易員向媒體證實,印度央行的干預旨在為盧比提供支撐。當前,盧比不僅受到強勢美元的壓制,還面臨着國內進口商持續的對沖需求。

央行的潛在干預為市場增添了不確定性。一位孟買的銀行交易員表示,在當前水平,由於干預風險與更廣泛的貶值傾向並存,判斷盧比的短期走向已變得非常困難。

美元走強與進口商對沖構成雙重壓力

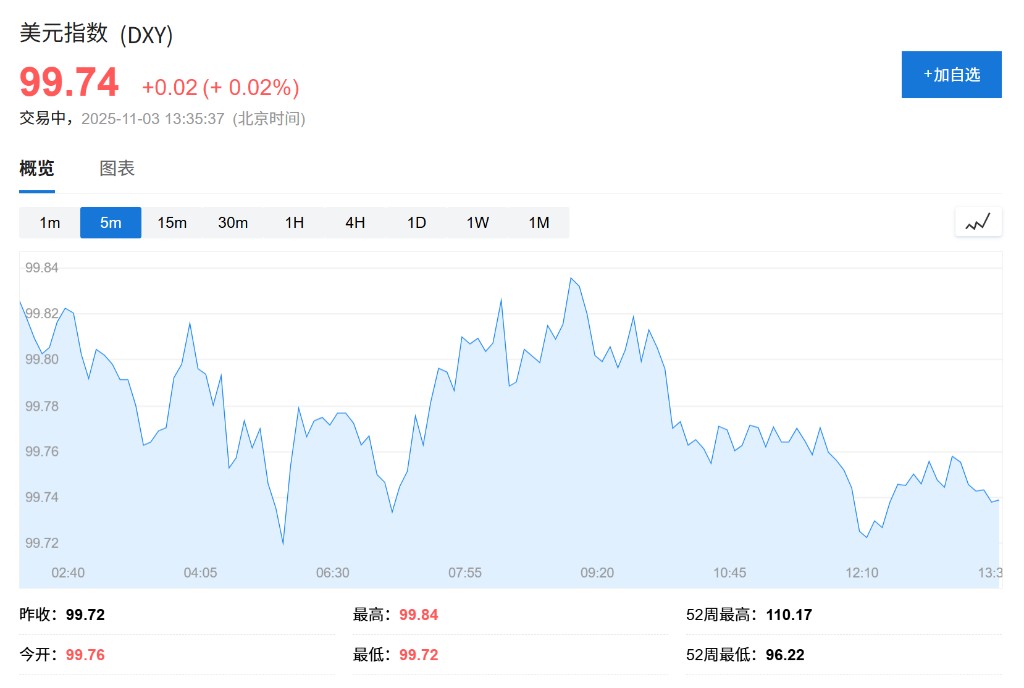

盧比近期承壓的主要外部因素是美元的普遍強勢。週一,衡量美元對一籃子主要貨幣匯率的美元指數盤旋在三個月高點附近。受此影響,亞洲貨幣整體表現平平或温和走弱,盧比也未能倖免。

與此同時,來自印度國內的壓力同樣顯著。交易員指出,印度進口商持續的美元買盤,用於對沖其海外採購成本,對盧比構成了穩定的壓制。

除了短期市場因素,更深層次的政策逆風也加劇了盧比的貶值預期。自 8 月下旬美國對印度出口商品徵收高額關税的措施生效以來,盧比一直面臨着持續的壓力。

此外,美聯儲上週政策展望中顯露的鷹派傾向,也對盧比構成了衝擊。這種鷹派立場改變了市場對美國利率的預期,推高了美元。與此同時,無本金交割遠期外匯(NDF)市場的頭寸到期也刺激了美元需求,進一步削弱了盧比。

市場關注美聯儲動向,短期前景承壓

展望未來,市場焦點將集中在本週多位美聯儲決策者的講話上,以尋求有關美國基準利率未來走向的更多線索。根據芝加哥商品交易所(CME)的 FedWatch 工具,目前市場預計美聯儲在 12 月降息的可能性約為 70%,低於一週前的超過 90%,這反映出市場對寬鬆政策的預期有所降温。

FX 諮詢公司 CR Forex 的董事總經理 Amit Pabari 表示:

“短期內,由於全球美元強勢持續,且市場在等待印美貿易協議取得實質性進展,盧比可能會繼續承受温和壓力,在 88.50 至 89.10 的區間內波動。”