The US Treasury bonds are staging a major comeback. "Sell America" is a big mistake! Institutions that shout "the collapse of American exceptionalism" are actually buying US Treasury bonds like crazy?

美債市場在美聯儲降息預期下表現強勁,反彈成為全球債市領跑者。儘管存在預算赤字和對美聯儲獨立性的擔憂,投資者仍持續湧入美債,推動其回報率上升。華爾街機構雖口稱 “美國例外論崩塌”,卻在高收益期瘋狂買入美債,顯示出其作為全球最受信任主權債務資產的地位依然穩固。

儘管存在從預算赤字愈發膨脹到白宮抨擊美聯儲貨幣政策獨立性的持續擔憂情緒,疊加特朗普一系列激進政策痛擊投資者們長期以來堅信的 “美國例外論”,但是隨着美債下半年大舉反彈領跑全球債市,美國政府債務市場仍然鞏固了其作為全球最受信任主權債務資產的絕對統治地位。

自唐納德·特朗普重返白宮重掌美國總統大權以來,全球債券市場中美國的核心首要地位一次又一次地受到質疑。從全面的對等關税政策與減税,到鉅額預算赤字,再到特朗普本人對美聯儲獨立性的持續抨擊,華爾街上的許多頂級投資機構一直在敲響幾乎相同的不祥警鐘:“美國例外論” 走向終結,“賣出一切美國資產”(Sell America),尤其是賣出面臨龐大預算赤字壓力與激進通脹導致潛在通脹升温危機的美國國債資產。

然而,儘管如此,全球投資者們仍在持續湧入美國主權債務市場,推動美債市場在今年下半年上演超級大反彈——那些嘴上説着 “美國例外論已經處於崩塌進程” 的華爾街大型投資機構們實際上正在趁着高收益率時期瘋狂逢低買入美債資產。

“期限溢價” 緩解疊加美聯儲降息預期升温之下的借貸成本下降,美債投資回報持續上升,而且迄今為止最為糟糕的經濟預測展望都未能成真。事實上,規模達 30 萬億美元的美國國債交易市場持續火熱,以美債價格波動計價的投資回報今年迄今達到約 6%,正朝着自 2020 年以來的最佳美債投資年份邁進。

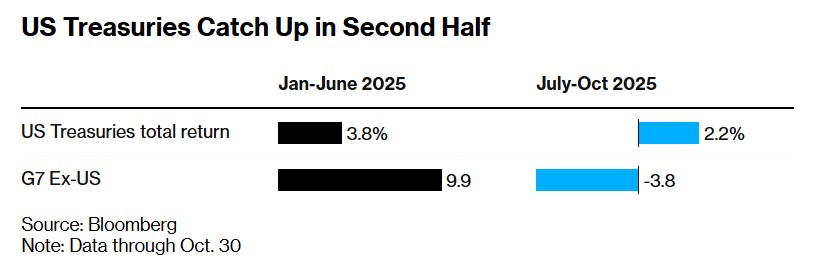

美國國債在下半年追趕上來

那麼,為什麼在 4 月對等關税時期被華爾街大舉唱衰的美國國債吸引瞭如此龐大的需求?原因有以下幾點。首先,通脹在很大程度上仍受到美聯儲高利率環境之下的嚴格控制,企業們從關税政策迄今,尚未將所有關税成本轉嫁給消費者們。其次則是美國財政部關税收入,發債轉向短期債券,再加上特朗普政府對於美國聯邦政府員工隊伍的劇烈削減——這些舉措加上特朗普政府大幅削減赤字的計劃。最後的核心邏輯則是美聯儲在過去兩個月裏連續下調了基準利率,大舉提振了美國經濟,且預計將進一步降息。

但同樣重要的是,從 TCW 集團的 Ruben Hovhannisyan、PGIM 固定收益的 Robert Tipp 以及 Pimco 的 Daniel Ivascyn 等華爾街最頂級債券投資者們的角度來看,美國仍然像是外部世界中 “不那麼糟糕” 的投資選擇,也就是所謂的 “最乾淨的髒襯衫”。它絕非七國集團 (G-7) 中唯一一個負債與赤字膨脹、或政府功能出現失調的國家。其他主要發達國家的央行們要麼接近結束其降息週期,要麼 (以日本為例) 可能加息。而美國仍是迄今為止規模最大、流動性最強的全球固定收益資產市場。

“當你看看其他替代選項時,它們也並非沒有自己的一套挑戰,” TCW 的固定收益基金經理 Hovhannisyan 表示。“‘最乾淨的髒襯衫’ 這個類比非常非常貼切,而且並不存在一個非常明確的高流動性的替代品。”

這對特朗普政府而言是一種證明,該政府認為其 “美國優先” 議程不僅會復興製造業、刺激經濟而不引發通脹,還會削減國家利息支出。就在上個月,美國財政部長貝森特 (Scott Bessent)——這位在年初就拿壓低 10 年期美債收益率來賭上自己聲譽的人——對唱反調者們説了些 “擲地有聲” 的話:“市場風險到底在哪兒?他們就是錯了。”

確實,在今年上半年因 “美國例外論” 土崩瓦解擔憂情緒以及對等關税導致全球因貿易、經濟恐慌而大幅拋售美國債券資產,導致在當時美債投資回報遠遠落後於其他發達國家債務市場之後,自 6 月以來,從美國投資者們的樂觀角度看,美國國債已大幅跑贏國債對手們。基準美債收益率之一的 10 年期美債收益率今年已下跌約半個百分點,降至約 4% 關口,相比於美聯儲今年開啓降息之前大幅降低了政府預算赤字壓力、購房者和企業的融資成本。

當然,更令人擔憂的一點是,美國國債之所以受到追捧,正是因為特朗普主導的新一輪全球貿易戰有可能將美國經濟推向衰退,因此避險買盤蜂擁至美債市場。此外,在非農就業市場持續走弱的情況下,通脹仍有可能再次困擾美聯儲,從而削弱美國債券市場的最強勁看漲投資邏輯。

在美聯儲上週重磅宣佈連續兩次降低基準利率的鴿派貨幣政策之後,主席傑羅姆·鮑威爾強烈強勢反駁了美聯儲 12 月將選擇再次降息已成定局的觀點,可謂在短期內觸發了美國國債的拋售浪潮。

2025 年的最大意外——美債大反彈

時間線剛剛進入 2025 年之時,債券投資者們確實有很多理由對美國國債市場持悲觀態度。當時美債收益率,尤其是 10 年及以上的長期限美債收益率可謂持續飆升,主要原因在於當時市場預期特朗普政府關於提振經濟增長和減税的承諾將大幅擴大赤字,需要更大規模的長期美債發行規模,並使消費品變得更加昂貴。

隨後在 4 月,特朗普推出的激進關税引發了貿易戰將導致外國投資者們短暫迴避所有美國資產的濃厚擔憂情緒。

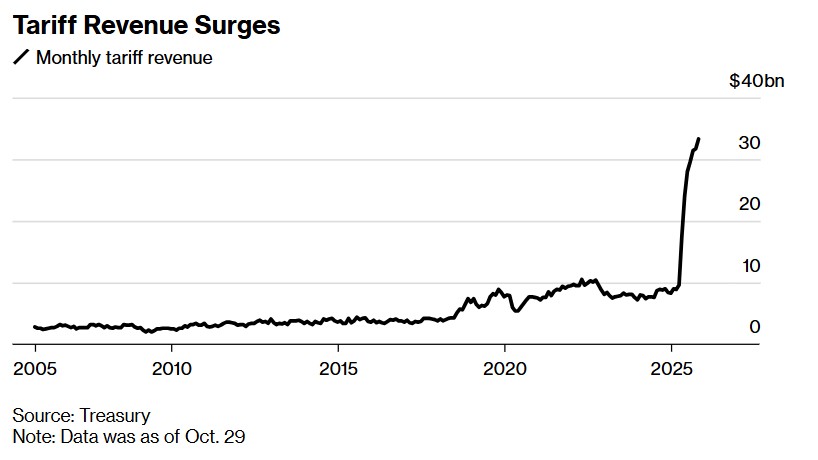

準確來説,逆風情緒並未完全消散。即便關税收入每月大約 300 億美元,美國政府的年度融資需求仍超過 1.5 萬億美元。還存在關税政策被美國最高法院推翻的風險,最高法院將於 11 月 5 日就其合法性進行辯論。

關税收入激增 (統計數據截至 10 月 29 日)

對固定收益投資者們而言的天敵——通脹——仍是一種重大風險。到目前為止,美國企業僅僅將大約 35% 的關税上調壓力轉嫁給了消費者們,聖路易斯聯儲的一份研究報告顯示。

此外,還有美元因素,衡量美元兑一籃子主權貨幣匯率強弱的美元指數在上半年遭遇了數十年來最糟糕的表現。簡單來説,美元持續貶值/疲弱的美元會侵蝕以本幣計價的投資者回報。這對持有美國約 30% 美債資產的外國債權人而言是一個非常危險的信號。

美國政府停擺也讓美國經濟前景變得模糊 (每週蒸發數百億美元經濟產出),當官方數據重新發布時,可能會帶來相當不愉快的定價意外。

“如果你真的看到再通脹或財政赤字擔憂捲土重來,或者對美聯儲獨立性的擔憂,那麼這時你就該擔心債券市場面臨風險了,因為收益率會隨之錯位並走高 (美債收益率與美債價格之間呈反向變動關係)。” 來自資管巨頭先鋒集團的基金經理 John Madziyire 表示。

全球資金蜂擁而至,大舉流入美債

不過,就目前而言,海外資金仍在持續流入美債交易市場,幫助推動美債收益率走低,儘管有跡象表明投資者們正在對進一步的美元貶值進行對沖。統計數據顯示,截至 7 月,外國投資者們 (包括機構、全球政府組織以及個人投資者) 美債累計總持有量達到創紀錄的 9.2 萬億美元。

貝森特本人也通過控制長期借貸成本提供了重大幫助。在上任前,他曾抨擊時任美國財政部長珍妮特·耶倫依賴短期國庫券為政府融資,稱此舉旨在壓低市場的長期借貸成本,以在選舉前刺激經濟。

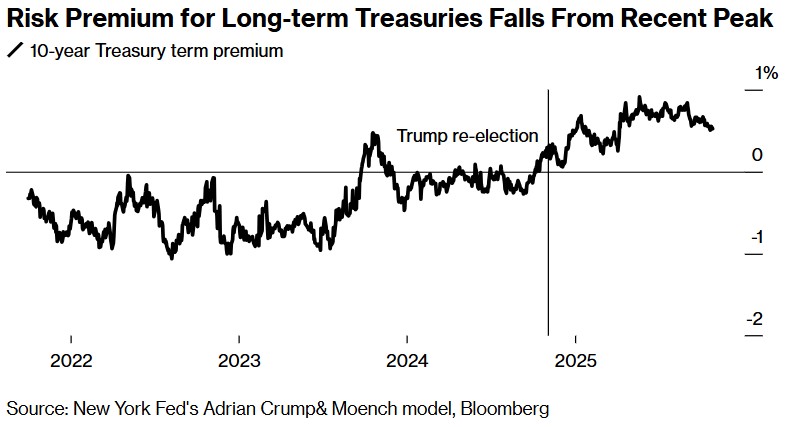

然而自從他掌舵以來,他複製了這種簡單的短債發行做法。這一舉措有助於減輕長期借貸成本的壓力,進而推動 “期限溢價” 持續降温。“期限溢價”——指代投資者們為持有長期債券風險所要求的額外風險補償——在 10 年期美國國債的統計基礎上,該指標已接近自 4 月以來的最低水平。

今年以來,美債投資者們普遍因特朗普政府發起的面向全球貿易戰引發的美國通脹疑慮,以及美國財政部愈發擴張的債務前景而備感壓力。

尤其是在美債市場持續存在的美國政府預算赤字大舉擴張預期與愈發龐大的美債債息悲觀預期,債券交易員們紛紛開始要求更高的 “期限溢價”。因此 10 年期美債收益率在今年持續徘徊在 4%,乃至 4.5% 點位以上,對於股票等風險資產估值造成巨大壓制力。若 10 年期美債收益率持續位於 4% 以下且保持下行軌跡,無疑將非常有助於全球股票市場延續牛市上行軌跡,尤其是與人工智能密切相關的科技股估值有望迎來積極催化。

華爾街的債券交易們普遍預計,當美國財政部在週三公佈季度發債計劃時,將會釋放在融資組合中進一步偏向短期美債發行的重大信號。

長期美債的風險溢價自近期高位回落

對 PGIM 固定收益的首席投資策略師兼全球債券主管 Tipp 而言,美國國債市場相較於其他的重要工業化經濟體仍然顯著勝出。

“儘管美國市場的整體環境愈發混亂且不同尋常,但當你觀察數據時,市場敍事與價格走勢並不一致。” 他強調。“儘管 ‘美國例外論’ 終結的敍事邏輯仍然存在,但美國國債相當有競爭力並吸引外國資金持續流入。當你審視整個全球債券市場以及各自經濟週期的差異時,並沒有一個足夠有説服力的債券市場替代故事可以講得通順。”

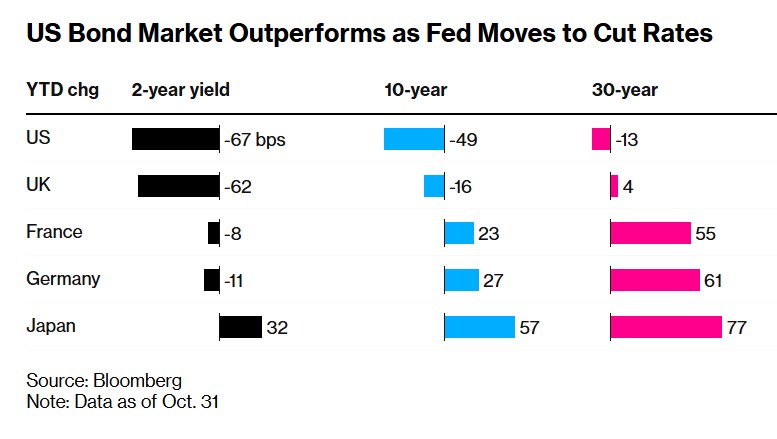

事實上,今年美國 10 年期國債收益率在七國集團中降幅遙遙領先。對於在討論美國金融市場地位熱議中居於話題中心的 30 年期超長期主權債券,在全球主要發達經濟體中,只有美國市場的 30 年期收益率出現下跌。

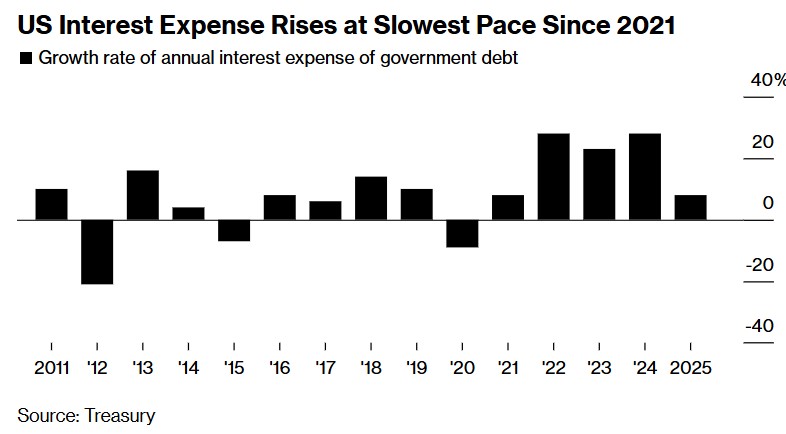

日本、德國和法國的長期借貸成本漲幅最大,原因在於投資者們對於揮霍無度的財政開支的擔憂。歐洲最大規模經濟體德國放鬆了其預算規則,以加強國防和基礎設施支出。法國 “懸浮議會” 之下,遭遇了國際評級機構的信用評級下調,反映出其財政壓力。在日本,長期收益率同樣飆升至紀錄高位,核心邏輯在於高市早苗所青睞的 “安倍經濟學” 框架將帶來預算赤字大舉擴張。當然,美國在未來數年仍須應對高企的債務負擔與預算赤字,但較低的收益率已放緩了其近年來利息支出的強勁增長步伐。

美國利息支出以自 2021 年以來最慢的速度上升

在此背景下,貨幣政策也偏向於美國。經濟學家們普遍表示,歐洲央行基本已結束降息,而日本可能收緊貨幣政策。與此同時,即便在鮑威爾降低了市場對 12 月降息的預期之後,交易員們仍在押注到明年 9 月前美聯儲將再降息三次,並且一些交易員押注如果特朗普提名的美聯儲新任主席立場偏向鴿派,降息預期可能大幅升温。鮑威爾的美聯儲主席任期將於 2026 年 5 月到期。

任期內具有永久投票權的美聯儲理事沃勒的立場則全面偏向鴿派降息立場,他強調美聯儲應在 12 月的下次會議上繼續選擇降息,並表示美聯儲繼續降息是 “正確的做法”。值得注意的是,沃勒於 2020 年由特朗普任命為美聯儲理事,他也是特朗普政府正在考慮的五位美聯儲主席候選人之一。

來自 Pimco 的 Ivascyn 表示,美國市場更低的利率預期與不斷上升的經濟不確定性將把持幣觀望的厭惡風險型投資者們全面推向具備固定收益的美國國債市場。

“隨着美聯儲放鬆政策,你會看到一種情況:一些經濟體的信用風險可能在不斷上升,而你的現金收益卻在不斷下降。” 他強調。“因此你的風險在上升、收益卻在下降,而這可能會繼續支撐高質量的固定收益資產,比如 10 年期美債資產。”

隨着美聯儲轉向降息,美國債市表現更優,領跑全球發達市場主權債市

錯過了就是錯過了

來自華爾街的基金經理們努力在各種相互交織的因素中理清頭緒。

根據機構統計的截至 10 月 30 日彙編數據,在資產規模超過 10 億美元且以美國國債綜合價格指數 (Bloomberg USAgg Index) 來廣泛追蹤固定收益市場為基準收益對比的美國主動型債券管理基金中,約有 62% 的基金在 2025 年跑贏了該指數。這一比例是自 2022 年美聯儲激進加息以來的最低水平。

在悲觀情緒籠罩市場,將美債收益率持續推高之際,Columbia Threadneedle 是那些願意長期持有期限超過五年的美債資產敞口的華爾街資管機構之一。

“如果你在年初對赤字、通脹數據和關税都持非常負面的看法,並且如果你在 1 月以 5% 的美債收益率選擇做空——而今天它是 4%,那你會有點難過,” Columbia Threadneedle 的債券經理 Ed Al-Hussainy 表示。“你錯過了非常出色的美債資產表現時段,但是錯過了就是錯過了。”