LAOPU GOLD fell over 8% during trading! Another explanation for gold breaking below 4000: the end of China's tax incentives

Previously, most processors in China could deduct the value-added tax on the input side when selling to downstream consumers. The new policy has changed this long-standing tax incentive mechanism, retaining it only for formal members of the Shanghai Gold Exchange and the Shanghai Futures Exchange, while ordinary retailers will lose this tax benefit. This policy will last until the end of 2027. Analysts believe that this policy adjustment may weaken gold demand and put new pressure on gold prices, which recently reached historical highs

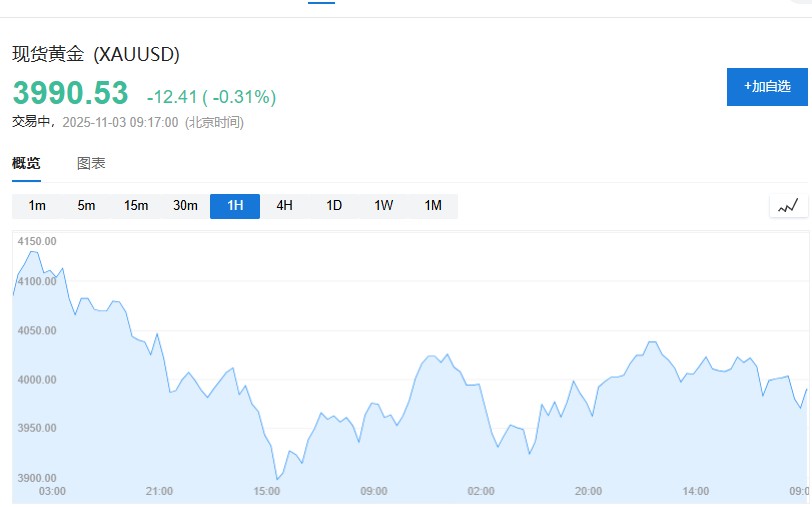

The Ministry of Finance and two other departments announced the cancellation of tax incentives for certain retailers on gold, causing spot gold to fall below the $4,000 mark. This policy adjustment may weaken gold demand and bring new pressure to a market that recently reached a historical high.

Last Saturday, the two departments issued a notice stating that member units or clients trading standard gold through the Shanghai Gold Exchange and the Shanghai Futures Exchange will be exempt from value-added tax when selling standard gold. Taxpayers not selling standard gold through the exchange must pay value-added tax according to current regulations.

This means that under the new policy, tax incentives are only retained for members of the Shanghai Gold Exchange and the Shanghai Futures Exchange, including major banks, refiners, and processors that can directly participate in trading, while ordinary retailers will lose this tax incentive. This policy will last until the end of 2027.

On Monday morning in Asia, gold prices fell in response, with spot gold dropping 0.6% to $3,970 per ounce at one point, currently reported at $3,990 per ounce, while Hong Kong's LAOPU GOLD fell over 8% during trading.

Adrian Ash, head of research at BullionVault, stated that although China's gold demand played a limited role in this year's record bull market, the tax changes in this largest gold-consuming country will dampen global market sentiment.

Policy Adjustment Affects Retail Segment

Previously, most processors in China could deduct the value-added tax on inputs when selling to downstream consumers. The new policy changes this long-standing tax incentive mechanism, retaining it only for formal members of the Shanghai Gold Exchange and the Shanghai Futures Exchange.

These members include large banks, refiners, and processors that can directly participate in trading, while ordinary retailers will lose this tax incentive. The policy adjustment will last until the end of 2027.

Gold Price Fundamentals Remain Supported

As of now, spot gold has fallen 0.3% to $3,990 per ounce. The Bloomberg Dollar Spot Index is nearly flat. Silver has fallen, while platinum and palladium have risen slightly.

Driven by a global retail investor buying spree, gold prices soared to historical highs in early October this year but sharply declined in the last two weeks of October. Despite the pullback, gold prices are still up over 50% year-to-date.

Many fundamental factors driving gold prices are expected to continue, including central bank demand and investors seeking safe-haven assets, which will continue to support gold