Zhitong Decision Reference | The Market's Strength Still Relies on Technology to Drive It

當前市場熱點轉向醫藥類,但醫藥股對市場帶動有限,市場要走強還需科技引領。美聯儲降息及重要數據公佈在即,ADP 就業報告顯示就業市場放緩,可能影響美聯儲降息路徑。特斯拉股東大會即將舉行,馬斯克薪酬方案及機器人進展將被披露。中國核能科技實現新突破,相關核概念有望催化。

【主編觀市】

美聯儲如期降息,加上元首會談落地,但月末效應疊加證監會對機構風格漂移的嚴格規定,導致港股最後一週走勢沒有穩住。

本週中美均有重要數據公佈,11 月 3 日,中國將發佈 10 月 PMI 數據。11 月 7 日,中國將發佈 10 月進出口數據。數據如果偏好下跌空間就有限。

11 月 5 日美國將發佈 ADP 就業報告,而原定 11 月 7 日的美國官方非農數據因政府停擺可能延遲。近期 ADP 數據已連續兩月為負,顯示就業市場顯著放緩,或為美聯儲 12 月降息路徑提供關鍵依據。

據新華網報道,美國聯邦最高法院此前宣佈,將快速審議特朗普政府徵收的多數關税的合法性,並於 11 月 5 日聽取口頭辯論。事關重大,特朗普有可能親自前往最高法院旁聽關税合法性的口頭辯論,靜待結果。

美參議院有關推進撥款法案停止政府 “停擺” 的下一次表決最早將於 11 月 3 日晚開始。如果能儘快結束停擺對股市有利。

當前市場熱點轉向了醫藥類,催化有高值創新藥迎來支付新通道:2025 年醫保國談首設商保目錄。南方、北方省份檢測到流感病毒陽性標本中,H3N2 亞型佔比均超過九成。不過醫藥股對市場帶動有限,市場要走強還需要靠科技來引領。

11 月 6 日舉行的特斯拉股東大會已進入倒計時,馬斯克萬億薪酬方案的結果即將揭曉,特斯拉機器人最新進展也會有進一步披露。順利的話會帶動無人駕駛,本週小馬智行和文遠知行登陸港股市場,將開啓 “港股 Robotaxi 第一股” 名號的爭奪。還有就是機器人方向。

中國核能科技實現全新突破,我國首次實現基於熔鹽堆的釷鈾核燃料轉換。相關核概念有望催化。

【本週金股】

翰森製藥 (03692)

2025H1,公司總收入 74.34 億元,同比增長 14.3%;歸母淨利潤為 31.35 億元,同比增長 15.02%。

創新藥產品收入為 61.45 億元,同比增長 22.1%,在總收入中的佔比提升至 82.7%。2025H1,阿美替尼、氟馬替尼等抗腫瘤領域產品組合,實現收入 45.31 億元,同比基本持平;艾米替諾福韋片、嗎啉硝唑等抗感染領域產品組合,實現收入 7.35 億元,同比增長 4.9%;伊奈利珠單抗等中樞神經系統疾病領域產品組合,實現收入 7.68 億元,同比增長 4.8%;洛塞那肽、培莫沙肽等代謝及其他疾病領域產品組合,實現收入約人民幣 14.00 億元,同比增長 134.5%。

此外,2025H1,翰森製藥根據就 HS-10535(口服小分子 GLP-1RA) 達成的協議向 MSD 收取 BD 許可費首付款 1.12 億美元。阿美替尼作為國產首款三代 EGFRTKI,銷售增長迅速,適應症持續拓展。樣本醫院銷售數據顯示,從 2020 年的 1841 萬增長到 2024 年的 17.84 億元,年度複合增長率為 214%,2024 年佔三代 EGFRTKI 總銷售額的 28% 左右,國產藥物排名第一。阿美替尼積極拓展與 NSCLC 相關的適應症,目前共獲批四項 NSCLC 相關適應症,2025 年新增獲批術後輔助治療適應症和治療含鉑放化療根治後進展患者的適應症,聯合化療一線治療 NSCLC 的 NDA 還在審評中。阿美替尼於 2025 年 6 月獲得英國 MHRA 批准上市,成為翰森製藥首個獲准進入海外市場的創新藥,公司還將繼續努力獲取 EMA 的海外監管認可。截止 2025H1,公司共有超 40 項候選創新藥開展了 70 餘項創新藥臨牀試驗;2025H1,新增 8 款創新藥進入臨牀試驗,包括 HS-20122(EGFR/c-MetADC)、HS-10510(PCSK9) 等。新增 3 項 III 期臨牀,分別是從荃信生物引進的 HS-20137(IL-23p19) 的銀屑病試驗,以及 HS-20093(B7-H3ADC) 的骨與軟組織肉瘤和 HS-20089(B7-H4ADC) 的卵巢癌的全球 III 期臨牀試驗,這兩款 ADC 的海外權益已授予 GSK。此外,翰森的 TYK2 抑制劑 HS-10374 的銀屑病 III 期臨牀也正在持續推進中,數據顯示皮膚毒性風險較低。

【產業觀察】

鋰電需求 2026 年預計保持 30% 左右增長,車儲雙端驅動。

車端需求:中國市場依託乘用車以舊換新、商用車報廢更新政策及消費者認可度提升,2026 年增速約 20%;歐洲市場因本土車企放量、新車型推出及政策推動,2026 年預計增長 25%;美國市場今年個位數增長,明年或超預期。

儲能需求:2025 年出貨量超 550GW、增速 75%,2026 年分歧大但公允判斷增速至少 50%,上半年增速更高 (一季度或滿產滿銷增 100%),二季度左右或推動鋰電業績與估值切換。

碳酸鋰供應及價格:供需格局強改善,價格中樞上移。

供給特點:2025-2026 年無需大幅出清供給即可價格反轉,因需求高速增長 (年增 25% 以上);不同價格對應供給量差異大 (6 萬時 20-25 萬噸,10-15 萬時 50-55 萬噸),均值 35 萬噸難滿足中性需求;2025 年全年去庫存,當前庫存僅一個月左右,且受海外礦運輸週期影響,庫存或存不足風險;2026 年供給主要來自非洲 (剛果金等)、國內 (江西、西藏等) 彈性產能。

價格展望:供需格局從過剩轉為瓶頸,交易思路轉向 “逢低多”;價格底部與中樞提升,中樞大概率高於 2025 年,2025 年末-2026 年一季度或現低點但難回前低;一年內基本面價格上限或 10-11 萬,若短缺趨勢形成,價格或更高。

【數據看盤】

港交所公佈數據顯示,恒生期指 (十一月) 未平倉合約總數為 120363 張,未平倉淨數 48674 張。恒生期指結算日 2024 年 11 月 27 號。

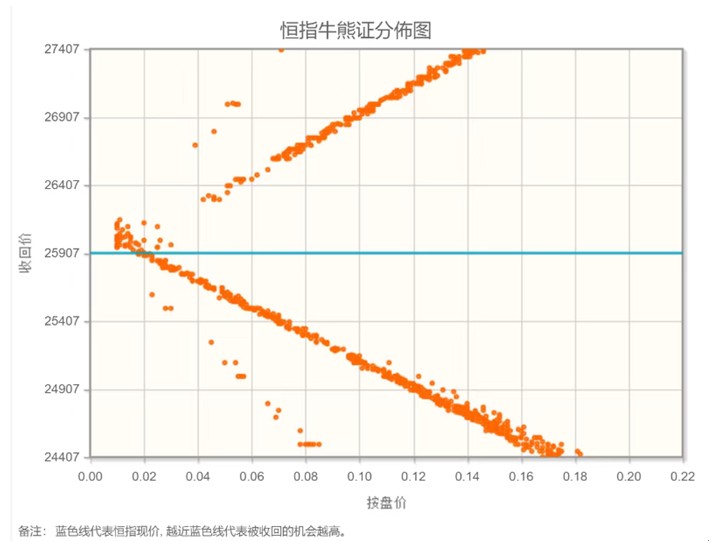

恒生指數在 25907 點位置,上方熊證密集區靠近中軸,三季報業績高峰期,個股調整明顯。美聯儲降息,本週恒生指數看漲。

【主編感言】

恒指在 10 月調整後於關鍵支撐位企穩,11 月 1 日已反彈 0.93%,南向資金持續加倉科技與消費龍頭的動作,更顯市場對估值窪地的認可。港股此輪走勢是內外因素共振的縮影,美聯儲寬鬆與國內政策託底形成合力,但上行節奏仍需觀察政策落地實效,短期震盪不改修復趨勢。