"Stock God" Buffett's farewell season marks a legendary career! Berkshire's Q3 operating profit surged 34%, leaving a record cash for the "Abel Era."

Berkshire Hathaway achieved an operating profit growth of 34% year-on-year in the third quarter, reaching USD 13.49 billion, mainly benefiting from the strong performance of its insurance business. The company's cash reserves hit a record high of USD 381.7 billion. Warren Buffett will step down as CEO at the end of the year, with his successor being Greg Abel

According to the Zhitong Finance APP, the business empire led by Warren Buffett, known as the "Oracle of Omaha," Berkshire Hathaway Inc. (BRK.A.US, BRK.B.US), reported its latest performance on Saturday. This business empire, which owns nearly 200 subsidiaries and has close to $400 billion in cash, achieved a significant year-on-year increase of nearly 34% in operating profit for the third quarter, primarily benefiting from the strong performance of its insurance underwriting business. Meanwhile, this large conglomerate and investment giant continued to sell off its stock assets, including shares of Apple and Bank of America, without conducting any stock buybacks, further expanding Berkshire's cash reserves to a record level of $381.7 billion.

This is the last quarterly performance report of the business empire headquartered in Omaha, Nebraska, during the tenure of "Oracle of Omaha" Warren Buffett as CEO. The 95-year-old "prophet of Omaha," who has been active in global business and financial markets for decades, will officially step down as CEO of Berkshire at the end of the year, with his designated successor Greg Abel taking over. Starting in 2026, Abel will also represent Berkshire in announcing quarterly performance reports and writing the annual shareholder letter.

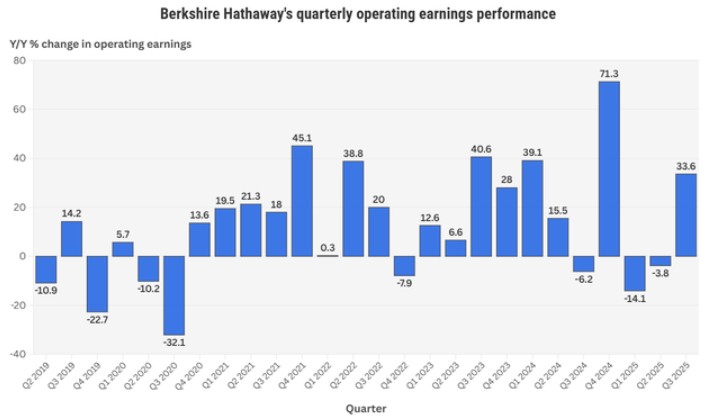

Specifically, the financial report shows that Berkshire's operating profit for the third quarter surged 33.6% year-on-year to $13.49 billion. After experiencing significant year-on-year declines in both the second and first quarters, the business empire finally returned to a growth trajectory in operating profit in the third quarter. The strong growth of this core performance indicator marks a significant recovery of the company's wholly-owned business segments, covering core businesses such as insurance and railroads.

The chart above shows Berkshire's profit performance over the past few quarters. In other performance indicators, the overall net profit attributable to Berkshire's shareholders in the third quarter increased by 17.3% year-on-year to $30.8 billion. As of September 30, 2025, Berkshire's cash reserves surged to an astonishing $381.7 billion, up from the cash reserve peak of $344.1 billion as of June 30, 2025. Of this $381.7 billion super cash reserve, the vast majority consists of short-term U.S. Treasury bonds, with Berkshire's holdings of such short-term debt far exceeding the Federal Reserve's holdings of short-term bonds.

Record cash reserves! As U.S. stocks hit new highs, "Oracle of Omaha" Buffett interprets what it means to be "cash is king"!

There is no doubt that Buffett continues to advocate the "cash is king" strategy through his actions. Berkshire's cash reserves have reached a historic high once again. The world's most famous stock investor has shown an overwhelming preference for cash since 2024, interpreted by the market as a bet that the U.S. economy and stock market will face turmoil. Some Wall Street investment institutions also interpret Buffett's actions as intentionally leaving enough "cash bullets" for the "Abel era"—that is, striving to leave ample room for imagination in Berkshire's future operational maneuvers With a holding scale of short-term U.S. Treasury bonds higher than that of the Federal Reserve and record cash and cash equivalents reserves, coupled with Berkshire Hathaway's increasingly risk-averse financial market investment portfolio in recent years, it fully demonstrates the strong risk-hedging investment attribute of Berkshire as a "safe haven."

However, it is also because of its large cash reserves instead of stock assets during this year's repeated historical highs in the U.S. stock market, especially by continuously reducing its largest holding in Apple Inc. (AAPL.US) since April during the super rebound of the U.S. stock market, missing out on Apple's stock price rising over 30% in the second half of the year, which has led to Berkshire Hathaway's increase of only over 5% this year, significantly underperforming the S&P 500 index and the Nasdaq 100 index.

Berkshire's new cash reserves have exceeded the previous historical record of cash reserves set at the end of the first quarter—$347.7 billion—because Berkshire once again did not conduct any stock buybacks, which also means that Berkshire has not repurchased any stock for five consecutive quarters, possibly indicating that Buffett believes the current valuation of Berkshire, near its historical peak, is not cost-effective.

Berkshire's Class A shares (BRK.A) and Class B shares (BRK.B) have significantly underperformed the benchmark index—the S&P 500 index—this year, indicating that the stock has at least completely lost its unique "Buffett premium" this year, mainly due to continuous stock sell-offs (especially the ongoing sell-off of Apple, and missing the significant rise in Apple's stock price in the second half of the year) and multiple consecutive quarters of pausing stock buybacks.

Behind the enormous cash flow figures is the continuous stock sell-off led by Buffett. Over the past three years, Berkshire Hathaway has cumulatively net sold about $184 billion in stocks, and in the third quarter alone, it sold another $6.1 billion worth of common stocks, marking the twelfth consecutive quarter in which the number of stocks sold significantly exceeded the number bought, with the sell-off primarily concentrated on its largest holdings in Apple, Bank of America, and American Express.

"In Buffett's view, there are currently not many opportunities in the market," commented Jim Shanahan, a senior analyst at Edward Jones. Berkshire's latest financial report seems to convey a message to the market: in Buffett's eyes, the profits from selling in the current stock market may far outweigh the opportunities to buy stocks.

"I believe the pause in buybacks undoubtedly sends a very strong message to shareholders and investors watching Berkshire's stock performance: if they choose not to buy back their own stock, why should we buy?" said Cathy Seifert, a senior analyst at CFRA Research.

Last month, Berkshire announced its largest market acquisition since 2022, agreeing to acquire OxyChem, a petrochemical business under Occidental Petroleum (OXY.US), for approximately $9.7 billion. The latest reported cash reserves reached a historic high of $381.7 billion, which can be said to provide ample ammunition for Berkshire's future large-scale merger and acquisition transactions Strong Insurance Business Drives Significant Increase in Operating Profit

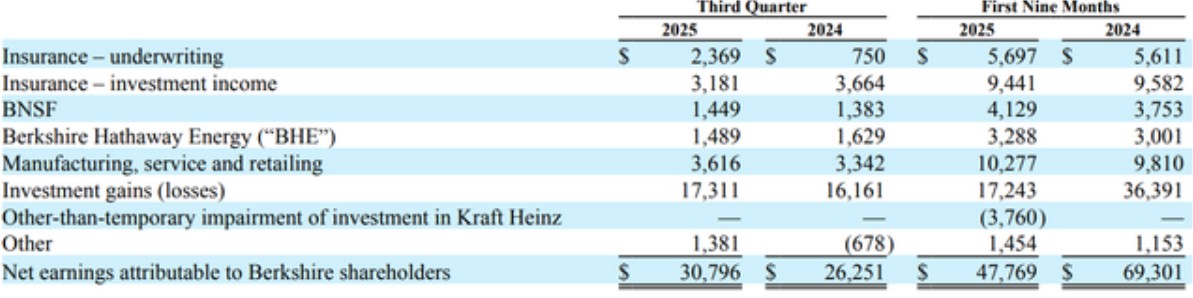

Berkshire Hathaway's third-quarter segment performance is detailed as follows, with the insurance underwriting segment of this business empire performing exceptionally well in the third quarter. The operating profit from a single insurance business surged more than twofold year-on-year to USD 2.37 billion, more than tripling compared to the same period last year.

"The year-on-year profit growth in the third quarter was primarily attributed to relatively low incurred losses from significant disaster events during the year and prior accident year claims, as well as the impact of a provision related to a bankruptcy settlement in the third quarter of 2024," the company stated in a performance announcement.

Buffett has consistently emphasized that "operating profit" better represents Berkshire's true operational performance than net profit. Since 2018, GAAP net income must include unrealized gains and losses from stock investments (ASC 321), leading to significant fluctuations in "bottom-line data" with market volatility, reducing readability. Operating profit, on the other hand, excludes short-term market value fluctuations, so he urges shareholders to "focus on operating profit and pay less attention to various investment gains and losses."

In contrast, the after-tax profit from the insurance investment income business of this comprehensive enterprise and investment giant fell 13.2% year-on-year to USD 3.18 billion, primarily due to the declining trend of domestic interest rates in the United States and the impact of capital allocation measures.

Regarding the investment business returns of Berkshire Hathaway (most of which are unrealized gains), the company recorded USD 17.31 billion in earnings in the third quarter, compared to USD 16.16 billion in the same period last year.

In terms of the railway business performance of this comprehensive enterprise and investment giant, BNSF's after-tax profit grew 4.8% year-on-year to USD 1.45 billion in the third quarter.

BNSF operates one of the largest railway systems in North America, with over 325,000 miles of track across 28 states in the U.S. Financial report data shows that its car/unit volume increased by 0.8% in the third quarter, primarily driven by a surge in North American consumer goods freight volume amid tariff fears.

As for Berkshire Hathaway's energy business segment (Berkshire Hathaway Energy), the after-tax profit unexpectedly declined 8.6% year-on-year to USD 1.49 billion in the third quarter, reflecting a downturn in profitability for Berkshire's U.S. utilities and natural gas pipeline businesses.

The after-tax profit from Berkshire's manufacturing, service, and retail businesses significantly improved by 8.2% year-on-year to USD 3.62 billion in the third quarter.

For Abel, who is about to take the helm of a business empire with nearly 200 subsidiaries and close to USD 400 billion in cash reserves, effectively deploying this massive capital will be the primary challenge of the Abel era Some institutional investors appear to be more anxious. Tom Russo, a partner at Gardner Russo & Quinn, pointed out: "Impatient investors are eager for Berkshire to deploy its massive cash immediately and have turned their attention elsewhere."