详解美国数据中心狂潮:45GW,2.5 万亿美元投资,谁在建设,谁在掏钱?

According to Barclays Research, the total capacity of data center projects being planned or constructed in the United States exceeds 45 gigawatts, with total investments expected to exceed $2.5 trillion. Major participants include large-scale cloud providers such as OpenAI, Amazon, Meta, Microsoft, and xAI. Behind the massive investments is a complex financing structure, where private equity firms and specialized infrastructure funds play a key role in addition to the capital expenditures of the tech giants themselves

A competition driven by artificial intelligence for infrastructure is fully underway in the United States.

According to the news from the Chase Wind Trading Desk, Barclays' research report on October 31 shows that the total capacity of large data center projects currently planned in the U.S. exceeds 45 gigawatts (GW), and this construction boom is expected to attract over $2.5 trillion in investment.

The report clearly points out that the main drivers of this round of expansion are OpenAI's Stargate project, large-scale companies such as Amazon, Meta, Microsoft, and Elon Musk's xAI. These companies are planning and building computing power clusters at an unprecedented speed to train and operate increasingly complex AI models.

This is not only an arms race for computing power among tech giants but also poses an unprecedented challenge to the electrical infrastructure in the United States. The surge in electricity demand is hitting the "power wall" of the existing U.S. grid. Insufficient grid capacity, approval delays, and supply constraints are forcing these tech giants to adopt a "Bring-Your-Own-Power" strategy.

Led by Giants: Stargate, Large-Scale Companies, and xAI Dominating Construction

According to Barclays' tracking, a few tech giants are at the core of this 45 GW project construction frenzy.

-

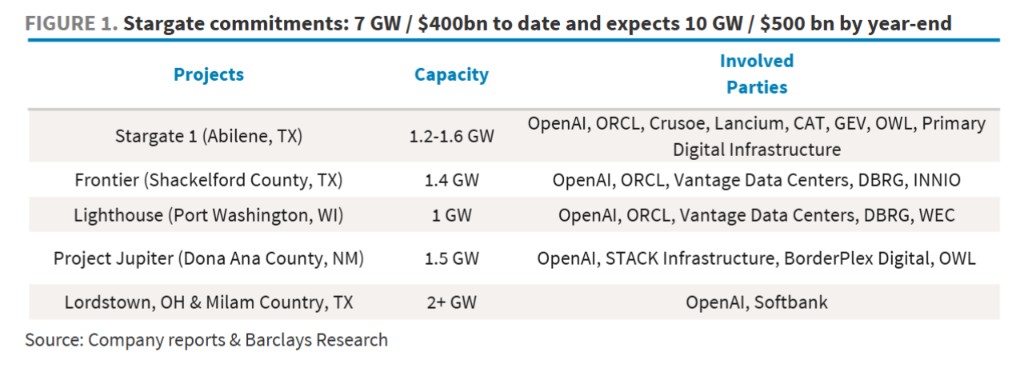

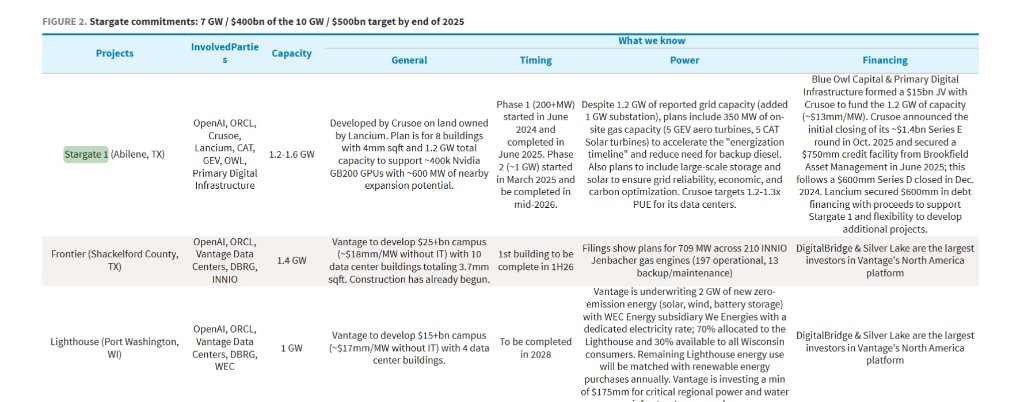

OpenAI and the Stargate Project: This project aims to achieve a target of 10 GW and $500 billion in investment by the end of 2025. Currently, approximately 7 GW of capacity has been committed, distributed in Texas, Wisconsin, and other locations, with partners including Oracle, SoftBank, and data center developers Vantage and Crusoe.

-

Meta: Is advancing multiple "Titan clusters," including the 1 GW Prometheus project in Ohio and the Hyperion project in Louisiana, which plans to expand to 5 GW.

-

Amazon: Has added 3.8 GW of capacity globally in the past 12 months and expects to double its capacity again by 2027. Barclays estimates that it could add approximately 13 GW of capacity in the U.S. alone between 2026 and 2027.

-

Microsoft: Is building a 900 MW AI factory in Wisconsin and has planned several similar projects in other regions of the U.S.

-

xAI: Is expanding its data center in Memphis, Tennessee, to 1.4 GW for training its Grok model.

The cost of this investment feast is extremely high. Report data shows that the construction cost of data centers (excluding IT equipment) has reached over $17 million per megawatt. For example, OpenAI's Stargate project corresponds to an investment commitment of over $400 billion for its 7 GW capacity, translating to a cost of up to $57 million per megawatt (including IT equipment), highlighting the enormous capital density of AI infrastructure

"Power Wall" Pressing Down: Grid Bottlenecks Give Rise to Self-Built Power Plant Models

The limitations of the power grid are the most severe challenges currently facing data center construction. A Barclays report emphasizes that even when grid connections are approved, project parties still prefer to build on-site power generation facilities to accelerate "power-on time" and ensure power reliability.

A typical example is the Stargate 1 project, which, despite having received approval for 1.2 gigawatts of grid access, still plans to deploy approximately 350 megawatts of on-site natural gas generation capacity. The report notes that this move aims to "accelerate the project's power-on timeline" and replace diesel with natural gas as a long-term backup power source.

To cope with the millisecond-level power fluctuations brought about by AI workloads, the industry is adopting an "all-in-one solution." For example, Meta's Prometheus project utilizes a combination of gas turbines, gas internal combustion engines, and diesel engines to provide base power, respond to power fluctuations, and enable emergency starts. This complex power solution is becoming an industry trend.

Who's Paying: Capital and Costs Behind Trillion-Dollar Investments

Behind the massive investments lies a complex financing structure and rising costs. In addition to the capital expenditures of tech giants themselves, private equity firms and specialized infrastructure funds play a key role. For instance, Blue Owl Capital and Crusoe established a $15 billion joint venture to fund the Stargate 1 project.

At the same time, the "Energy as a Service" (EaaS) model is on the rise. Energy companies like Williams are signing long-term power purchase agreements with data center operators, investing billions of dollars to build and operate dedicated power generation facilities.

Williams invested $2 billion in Meta's Prometheus project and signed a similar contract worth $3.1 billion with another large client. This indicates that data center operators tend to outsource the development and operation of energy assets to specialized companies.

Supply Chain Challenges: Equipment Delivery and Labor Shortages Become Concerns

The explosive growth in demand has put immense pressure on the power equipment supply chain. The Barclays report cites a document stating that due to tight market demand, the price of heavy gas turbines has risen by 50% in less than two years, and delivery times have significantly extended. Equipment manufacturers like GE Vernova and Caterpillar, while increasing production capacity, still face constraints from parts and labor shortages.

The report also mentions that some companies are circumventing long order queues by acquiring second-hand or "off-the-shelf" new equipment. For example, Fermi America obtained valuable generation capacity for its data center by acquiring an unused Siemens gas turbine from a liquefied natural gas project

The above wonderful content comes from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)