When the physical storage of data centers can no longer withstand the "AI faith," the storage "super cycle" has already begun

在全球 AI 算力競賽中,摩根士丹利等華爾街機構宣稱 “存儲超級週期” 已至,企業級存儲硬盤需求激增,推動希捷、西部數據和閃迪等存儲巨頭股價大幅上漲。今年股價漲幅超過 200%,並且雲計算巨頭們上調 AI 數據中心資本開支,預計全球 AI 基礎設施投資到 2030 年將達 3-4 萬億美元。西部數據股價在美股盤初交易中上漲超過 12%,顯示出強勁的市場需求和樂觀的盈利預期。

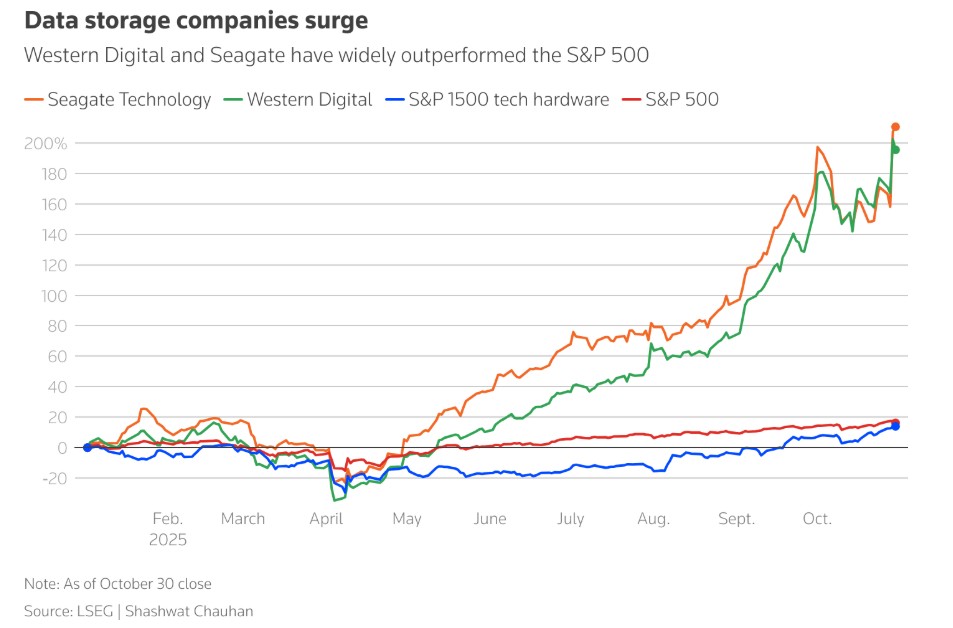

智通財經 APP 獲悉,在全球加速擴張與 AI 訓練/推理密切相關聯基礎設施的史無前例 “AI 算力競賽” 中,摩根士丹利等華爾街大行高呼 “存儲超級週期” 已至,企業級存儲硬盤需求激增推動了數據存儲產品巨頭們,比如希捷 (STX.US)、閃迪 (SNDK.US) 和西部數據 (WDC.US) 的股價今年漲幅超過三位數,可謂大幅跑贏美股大盤乃至全球股票市場。

SK 海力士、三星電子以及美光科技這三大全球存儲芯片領軍者,以及來自中國的存儲芯片/存儲產品領軍者們股價也不甘示弱,今年以來股價強勁延續 AI 驅動的屢創新高 “人工智能超級牛市”,但是相比於漲幅達到三位數的希捷等三大存儲產品巨頭而言則稍顯遜色。

最新的股價彙編數據顯示,在前所未有的 “人工智能狂歡熱潮” 強力推動下,希捷以及西部數據的股價今年迄今均已飆升逾驚人的 200%,目前均在歷史最高位附近,且在華爾街頂級投資機構們看來,這三大企業級硬盤存儲產品巨頭的股價漲勢遠未停歇。雲計算巨頭們 (谷歌母公司 Alphabet、微軟、亞馬遜以及騰訊、阿里巴巴) 集體上調 AI 數據中心資本開支,全球 AI 基礎設施投資到 2030 年或達 3–4 萬億美元,直接 “指數級別推高” 企業級 HDD 硬盤與數據中心企業級 SSD 需求。

在週五美股盤初交易中,西部數據股價上漲超過 12%,按照這一強勁的創新高勢頭,開盤之後一段時間內即是新的歷史高點,此前該公司給出的第二季度盈利預期大幅高於華爾街不斷上修的高預期門檻。

在黃仁勳於 GTC 大會上釋放一系列重磅的積極催化劑,以及微軟、谷歌和 Facebook 母公司 Meta 在最新業績會議上釋放出繼續斥巨資購置 AI 算力基礎設施以大規模建設 AI 數據中心的重大信號之後,全球 AI 芯片產業鏈隨之陷入 “看漲狂歡” 的長期牛市氛圍之中,尤其是 “AI 芯片超級霸主” 英偉達 (NVDA.US) 總市值突破並站穩 5 萬億美元這一超級關口,成為全球首個市值達到 5 萬億美元的公司。

近期全球 DRAM 和 NAND 系列的高性能存儲產品價格持續大漲,加之全球估值最高的 AI 初創公司 OpenAI 已經達成了超過 1 萬億美元的 AI 算力基礎設施交易,以及 “芯片代工之王” 台積電公佈無比強勁的超預期業績並上調 2025 年營收增長預期至 30% 中段,可謂共同大幅強化了 AI GPU、ASIC 以及 HBM、數據中心 SSD 存儲系統、液冷系統、核心電力設備等 AI 算力基礎設施板塊的 “長期牛市敍事邏輯”。

生成式 AI 應用與 AI 智能體所主導的推理端帶來的 AI 算力需求堪稱 “星辰大海”,有望推動人工智能算力基礎設施市場持續呈現出指數級別增長,“AI 推理系統” 也是黃仁勳認為英偉達未來營收的最大規模來源。

全球持續井噴式擴張的 AI 算力需求,加之美國政府主導的 AI 基礎設施投資項目愈發龐大,並且科技巨頭們不斷斥巨資投入建設大型數據中心,很大程度上意味着對於長期鍾情於英偉達以及 AI 算力產業鏈的投資者們來説,席捲全球的 “AI 信仰” 對算力領軍者們的股價 “超級催化” 遠未完結,他們押注英偉達、台積電、美光、SK 海力士以及希捷、西部數據等算力領軍者們所主導的 AI 算力產業鏈公司的股價將繼續演繹 “牛市曲線”。

西部數據、希捷和閃迪,攜手三大存儲芯片巨頭引領 “存儲超級週期”

“西部數據公司 (WDC) 已經與其前五大客户們簽訂延續至 2026 年自然年的大規模企業級 NAND 存儲產品採購訂單,這一事實清楚地表明,隨着與超大規模 AI 訓練/推理密切相關聯的 GPU 計算以及存儲需求繼續攀升,這些大客户們不願在 AI 工作負載激增的形勢之下冒着存儲容量不足的巨大風險,” 來自華爾街金融巨頭摩根大通的分析師團隊在一份報告中表示。

本週早些時候,其最大競爭對手之一希捷科技 (即 Seagate Technology) 在美東時間本週二晚間給出第二季度營收和利潤預期展望均遠遠高於市場預期。自那以來,其股價已上漲 20%,週五有望延續今年以來的屢創新高的強勁漲勢。

希捷以及西部數據是今年標普 500 指數成分股中漲幅排名第二和第三的公司,僅次於美國散户們最愛的股票交易平台運營商 Robinhood(HOOD.US),遠遠跑贏全球市值排名第一的 “AI 芯片霸主” 英偉達,以及 AI ASIC 全球最強領軍者博通 (AVGO.US)。

相比於希捷以及西部數據,規模較小的企業級硬盤存儲產品競爭對手閃迪 (SanDisk) 於 2 月從西部數據中成功分拆上市以來,其股價也已大幅上漲五倍。該公司將於美東時間 11 月 6 日公佈業績,其股價週五上漲超 3%。

標普 1500 科技硬件、存儲與外圍設備板塊指數——囊括上述三家存儲產品公司,今年以來這一基準指數已經大幅上漲逾 11%,並在週四創下新的創紀錄新高點位。

美國市值最龐大的科技巨頭們——谷歌母公司 Alphabet(GOOGL.US)、微軟 (MSFT.US)、Facebook 母公司 Meta(META.US),以及亞馬遜 (AMZN.US) 均在本週公佈的最新業績報告中,重磅宣佈大幅提高年度資本支出計劃,加大對於 AI 芯片、企業級存儲硬件集羣以及整個 AI 數據中心建設的大規模投入。

華爾街金融巨頭高盛預計,到 2030 年,全球與 AI 密切相關的 AI 基礎設施支出可能達到 3 萬億美元至 4 萬億美元,其中可能近半數集中於一系列數據中心企業級 DRAM 與 NAND 存儲產品。

“如果你把時間線撥回到十二個月或二十四個月之前,問任何人關於 AI 算力基礎設施的問題,他們談論的都是 AI GPU 以及 HBM,基本上不會談到已經被市場唾棄已久的硬盤……現在這些存儲巨頭們的強勁漲勢確實令投資者們感到興奮。” 來自 Principal Asset Management 的投資組合經理 Martin Frandsen 表示。

摩根士丹利在研報中表示,在全球大型企業與各政府部門紛紛斥巨資佈局 AI 的這股史無前例 AI 基建狂熱浪潮中,與人工智能訓練/推理系統密切相關的核心存儲芯片需求仍然無比火爆,推動包括 HBM 存儲系統、服務器級別 DDR5 與企業級 SSD 在內的數據中心存儲業務營收猛增。

不同於 SK 海力士、三星電子以及美光這三大提供底層 DRAM/NAND 存儲芯片的芯片製造商們,西部數據、希捷和閃迪聚焦於成熟的企業級硬盤存儲產品。在今年存儲產品集體大幅漲價浪潮之前,市場對於存儲板塊的押注基本集中於 HBM 存儲系統,當時市場並未察覺到隨着此後 Sora2 等文生視頻以及性能更新迭代愈發強勁的各類 AI 超級大模型陸續問世將帶來的企業級數據中心 SSD 以及 HDD 存儲產品庫存枯竭以至於供不應求。

此外,SK 海力士、三星以及美光將多數產能集中於 HBM 存儲系統——這類存儲產品需要的產能以及製造、封測複雜度相比於 DDR 系列以及 HDD 系列存儲芯片而言複雜得多,因此三大存儲芯片領軍者不斷將產能遷移至 HBM,也在很大程度上導致這些硬盤存儲產品供不應求。

存儲芯片板塊的這波 “史無前例最強漲幅” 為何花落西部數據 (WDC)、希捷 (Seagate) 以及從西部數據拆分出的 “新” 閃迪 (SanDisk)?核心邏輯在於:AI 數據中心建設進程如火如荼不僅帶動 HBM 存儲需求激增,AI 數據中心的三層存儲棧 (熱層 NVMe SSD、温層/近線 HDD、冷層對象與備份) 都在同步擴容,而 HDD 行業寡頭長期以來的供給剋制、NAND 週期回暖疊加雲廠商多年期鎖量,讓這三家的量價與訂單能見度同時提升。

西部數據 (WDC) 的近線/數據中心 HDD 主打 ePMR + UltraSMR 路線,量產 32TB SMR、24TB CMR 等超大容量盤 (Ultrastar DC 系列),服務對象存儲與數據湖超級存儲場景,是 AI 訓練/推理產生海量數據的 “性價比型” 承載層。

希捷 (Seagate) HAMR 平台 (Mozaic 3+) 已量產出貨 30TB 級近線盤,並在推進更高容量 (>30TB) 節點;HAMR 在面密度上領先,直擊雲廠商 “機架功耗/每 TB 成本” 的痛點,是 AI 數據湖與冷數據池的核心受益者。

閃迪 (SanDisk) 數據中心 NVMe SSD 依託 BiCS8 等新一代 3D NAND、QLC 高容量 NVMe(E1.L/E3.S/U.2 形態) 覆蓋 “熱/温層” 高併發與高吞吐,承接 AI 訓練/推理時的特徵庫、檢索與中間結果。

華爾街對於存儲巨頭們看漲情緒升温,這一輪存儲 “超級週期” 有望延續至 2027 年!

全球 HBM 領軍者——HBM 市場份額最大的 SK 海力士三季度業績創歷史新高,營業利潤則飆升 62%,背後是其 HBM 存儲系統的全面 “售罄”,該公司表示已鎖定 2026 年全部 DRAM 和 NAND 客户需求,HBM4 將於 2025 年底出貨。

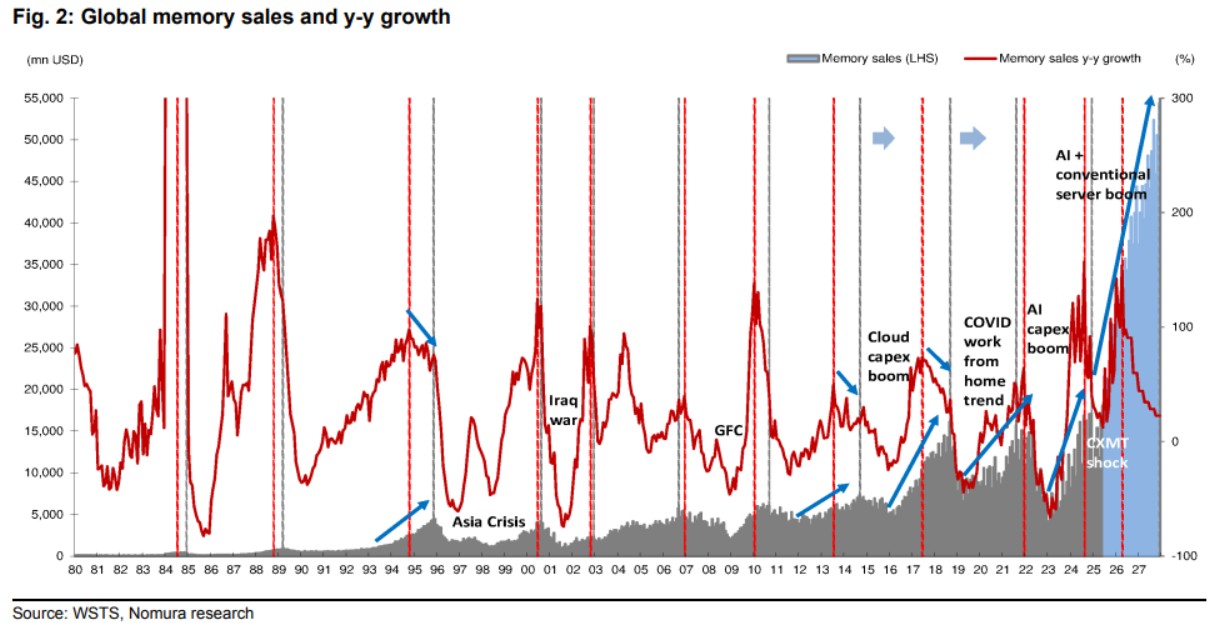

華爾街金融巨頭摩根士丹利表示,SK 海力士的 “售罄” 信號,顯示存儲產能供應將更加緊張,專屬於存儲芯片價格的持續上漲環境將持續貫穿整個 2026 年,有望持續至 2027 年,全球存儲芯片領域的業績增長前景更加接近 2017-2018 年的超級週期基準。另一華爾街金融巨頭野村預計,整個存儲行業範圍內有意義的存儲芯片產能和存儲產品實際產量增長加速預計要到 2027 年中後期才會出現,從而導致供不應求的局面將持續數年之久。

來自花旗集團的資深分析師 Asiya Merchant 在給客户的報告中寫道:“與其同行類似的表述相呼應,西部數據管理層指出,隨着 AI 大模型滲透的加速推進,來自超大規模雲/雲客户們的龐大 AI 工作負載與數據生成帶來持續強勁的存儲需求。為滿足需求,客户們正以更快的速度採用更高容量企業級硬盤,而西部數據也在加速推進下一代 ePMR 和 HAMR 資質認證的規劃性技術過渡。值得注意的是,公司如今已與 7 家客户簽訂了直至 2026 年自然年上半年的堅定訂單,其中有 5 家覆蓋整個 2026 年自然年,此外,其最大的超大規模客户協議有望覆蓋整個 2027 年自然年。”

分析師 Merchant 維持對西部數據的 “買入” 評級,將 12 個月內的目標股價自 135 美元大幅上調至 180 美元,並將西部數據納入花旗集團的 “90 天上行催化劑重點觀察” 名單。截至週五美股盤初,西部數據股價漲超 12% 至 157 美元。

來自 Cantor Fitzgerald 的資深分析師 C.J. Muse 重申,鑑於企業級 HDD 市場的無比強勢需求,西部數據已經進入該機構的 “首選股票” 名單。“考慮到我們仍處於 AI 基礎設施建設的起步初期階段,再加上 HDD 寡頭們以典型的寡頭方式行事 (僅通過 EB transitions、製造/測試效率和自動化來增加產能,確認暫時不新增單位產能),我們預計未來幾個季度緊張狀況將持續,甚至可能加劇。” Muse 在給客户的報告中寫道。Muse 對西部數據給予 “增持” 評級,並將目標價自 160 美元上調至 200 美元。

來自摩根士丹利的資深分析師 Erik Woodring 在研報中評論稱,這是 “實時上演的存儲牛市行情”。價格上調和向大容量存儲驅動器的轉變,幫助希捷經調整後的毛利率創下新高,該機構稱這是報告中最令人印象深刻的部分。Woodring 寫道:“展望未來,我們預期類似的順風因素將繼續推動毛利率上行。” 因此大摩維持 “增持” 評級,並將希捷目標價從 265 美元上調至 270 美元。

Benchmark Equity Research 資深分析師 Mark Miller 指出,關於希捷的利好因素還包括強勁的雲計算需求以及搭載 AI 芯片的 AIPC 個人計算機產量大幅增加。Miller 補充表示,預計該公司當前的訂單積壓已延伸至整個 2027 年。