The AI counterattack of cloud computing giant Amazon has quietly begun!

Amazon is expanding its AI infrastructure at an unprecedented pace, with cloud service AWS's revenue growth of 20% in the third quarter, significantly accelerating from 17.5% in the second quarter. In an environment where the demand for AI computing power far exceeds supply, whoever can build data centers faster will gain more market share

Amazon's cloud computing business is shaking off growth fatigue, achieving its fastest revenue growth since 2022 in the latest fiscal quarter. It is regaining the initiative in the fierce AI competition through large-scale infrastructure investments and focused strategies.

Amazon's previously released financial report shows that Amazon Web Services (AWS) saw a 20% revenue growth in the third quarter, significantly accelerating from 17.5% in the second quarter. Although this growth rate is still lower than Microsoft's 40% and Google's similar cloud business growth, considering AWS's quarterly revenue scale of up to $33 billion, far exceeding analysts' estimates of Microsoft's Azure at about $23 billion, this acceleration shows strong momentum.

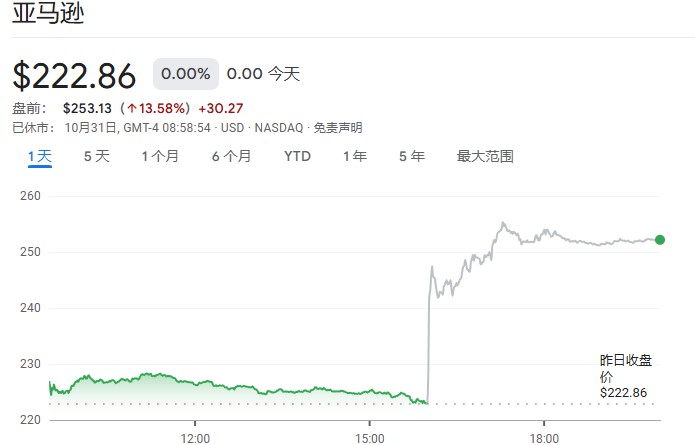

After the earnings report was released, Amazon's stock price surged 13% in pre-market trading, despite the company's overall revenue guidance falling short of expectations. This reflects a reassessment by investors of AWS's business prospects. Previously, Amazon's stock price had only risen about 1% this year, significantly lagging behind its large tech peers and the approximately 16% increase in the S&P 500 index.

Market expectations for AWS's accelerated growth are based on a clear logic: In an environment where AI computing power demand far exceeds supply, whoever can build data centers faster will gain more market share.

Aggressive Expansion Locks in Long-term Customers

Amazon is expanding its AI infrastructure at an unprecedented pace. CEO Andy Jassy revealed that the company added 3.8 gigawatts of data center capacity in the past 12 months, a power scale for AI chips that surpasses any competitor.

CFO Brian Olsavsky stated in an analyst conference call that capital expenditures for this quarter will reach approximately $34.2 billion, totaling $125 billion for the year, with further increases expected in 2026.

These investments have begun to translate into actual orders. This week, Amazon's $11 billion data center campus built for AI model developer Anthropic in Indiana has fully commenced operations.

Wedbush analysts noted in a recent report that sales from Anthropic will contribute nearly 2 percentage points to AWS's revenue growth this year. Although Anthropic is not as prominent as its competitor OpenAI, it has a clearer path to sustainable revenue growth and is expected to become a core AI customer for many years to come, with Amazon being a major investor in Anthropic.

Focus on Advantages Highlights Differentiated Competition

Compared to its competitors, Amazon has a key advantage in the AI infrastructure race: focus.

AWS is crucial for attracting investors to Amazon, as its high profit margins balance the larger but thinner-margin online retail business. This makes cloud computing a priority area for the company's AI investments In contrast, Microsoft faces more dispersed priorities. The company has integrated AI features into core enterprise software such as Word, Excel, and PowerPoint, driving significant sales growth amid the AI boom. However, this places additional demands on its computing infrastructure, and Microsoft must prioritize commitments to enterprise customers. Chief Financial Officer Amy Hood stated on Wednesday that this prioritization is constraining Azure's growth, with expected growth slowing to 37% this quarter.

Balancing Scale and Growth Rate

All major cloud computing providers have indicated that the demand for AI computing power far exceeds supply, and this imbalance is unlikely to be alleviated in the coming quarters or even longer.

AWS's slower growth rate partly reflects scale effects: the larger the base, the harder it is to achieve high growth. However, even considering scale barriers, AWS still has a significant chance of breakthrough in the coming quarters, as the acceleration to 20% revenue growth in the third quarter seems to indicate this trend.

The premise is that AWS can avoid being hindered by constraints such as power and chip supply, which remains a significant uncertainty. If infrastructure expansion proceeds smoothly, AWS will have ample computing power to support growth in the coming months