Amazon and Apple ignite the tech market! The Nikkei index hits a new high, with a monthly increase reaching a 30-year record

週五,亞馬遜與蘋果的強勁銷售預期推動科技股上漲,日本日經 225 指數創歷史新高,單月漲幅達 30 年來最大。日經 225 指數收盤上漲 2.1%,達到 52411.34 點,10 月累計漲幅 16.6%。日本央行維持利率不變,日元貶值進一步促進出口股表現。科技股成為日經指數上漲的核心動力,AI 相關個股表現亮眼,市場對新首相的財政刺激政策充滿期待。

智通財經 APP 獲悉,週五,受亞馬遜 (AMZN.US) 與蘋果 (AAPL.US) 強勁銷售預期提振科技股,日本日經 225 指數再創歷史新高,同時創下三十年來最大單月漲幅。與此同時,由於日本央行週四在維持利率不變後釋放謹慎信號,日元兑歐元匯率跌至歷史低點、兑美元匯率降至 2 月以來最低水平,日元走弱進一步提振了權重出口股表現。

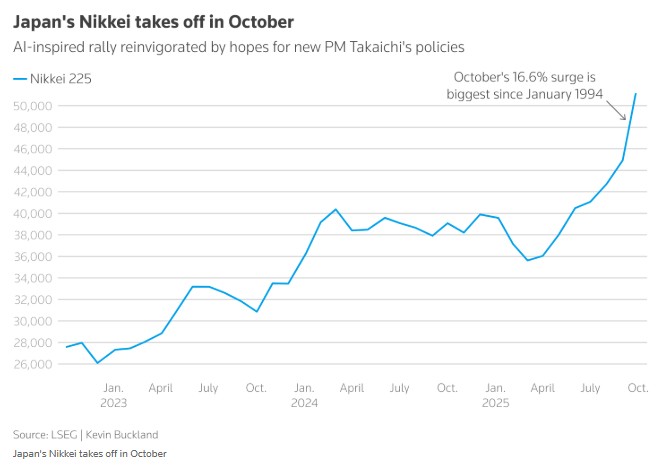

截至收盤,日經 225 指數上漲 2.1%,收於盤中高點 52411.34 點,刷新歷史最高收盤紀錄。該指數 10 月累計漲幅達 16.6%,創 1994 年 1 月以來最大單月漲幅。更廣泛的東證指數盤中最高上漲 1.4%,觸及 3348.06 點的歷史峯值,最終收漲 0.9% 報 3331.83 點,同步創下歷史收盤新高。

據瞭解,亞馬遜週四公佈其雲業務營收增速創近三年新高,推動公司季度銷售指引超越市場預期。與此同時,蘋果首席執行官庫克對假日季 iPhone 銷量及公司整體營收的預測,均超出華爾街分析師預期。

這些強勁業績令日本芯片板塊個股成為週五上漲的主要推手之一:Socionext 股價飆升近 17%;愛德萬測試上揚 3.9%,因其在指數中權重較高,成為日經指數點數貢獻最大個股。

人工智能 (AI) 數據中心相關個股同樣表現亮眼,其中日立股價飆升 7.2%。

近月來,科技股已成為日經指數持續攀升的核心動力,全球股市在對 AI 的熾熱期待中重煥生機。本月,日本市場更獲新首相高市早苗推行積極財政刺激政策的預期加持。

三菱 UFJ 資產管理公司指出,高市早苗的政策重點包括 AI 創新,這意味着日本科技股將同時受益於全球科技熱潮與國內政策的雙輪驅動。

三菱 UFJ 資產管理公司首席市場經濟學家 Naoya Oshikubo 表示,日經指數突破 52000 點 “僅是上行途中的一站。未來仍有上漲空間,預計到明年 4 月前還能再漲 10% 左右”。他還強調:“當前漲勢並非泡沫。”