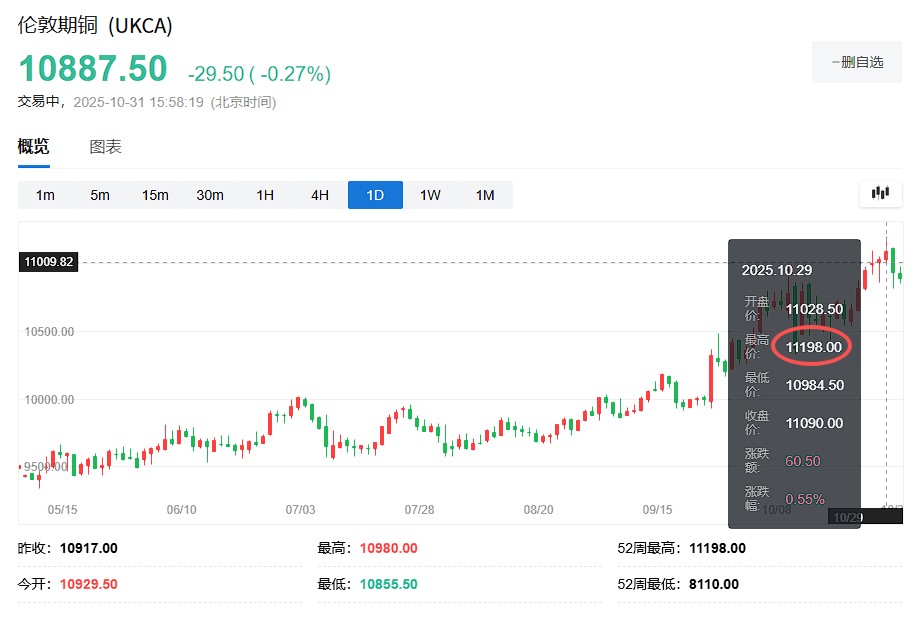

Copper prices break through the "11,000 USD ceiling"! Goldman Sachs "bears": any breakthrough is temporary, and copper prices will reverse in early next year

Goldman Sachs warns that the copper price exceeding USD 11,200 per ton is difficult to sustain and is a sentiment-driven "bull trap." The 13% increase since mid-September has been mainly driven by speculative funds rather than actual supply-demand tightness, with visible global inventories increasing by 700,000 tons by 2025. Goldman Sachs expects investors to exit their long positions in early 2026, with copper prices falling back to the range of USD 10,000-11,000 per ton

As copper prices surge to new heights, Goldman Sachs warns that any further breakthroughs may be a temporary "bull trap," with a sentiment-driven rally facing the risk of reversal.

On October 31, according to the Wind Trading Desk, Goldman Sachs stated in its latest research report that copper prices have surpassed previous historical highs to $11,200 per ton, but this breakthrough is unlikely to be sustained. Although the current fundamentals support copper prices consolidating in the $10,000-$11,000 per ton range, the 13% increase since mid-September has been primarily driven by investor sentiment rather than actual supply-demand tightness.

The analyst team led by Eoin Dinsmore believes that although LME investor positions have reached an extreme stretch level at the 99th percentile over the past five years, the open interest on the U.S. Commodity Futures Trading Commission (COMEX) remains below the peak in the second quarter of 2024, indicating that there may still be further inflows of investors in the short term, temporarily pushing copper prices higher.

However, Goldman Sachs maintains that the market's expected fundamental tightness will not materialize in the next six months, while global visible inventories have increased by 700,000 tons this year. Goldman Sachs expects that investors will exit long positions in early 2026, pushing copper prices back to the $10,000-$11,000 per ton range, maintaining a forecast of an average price of $10,500 per ton in 2026.

This judgment is consistent with Goldman Sachs' previously established new trading range framework of $10,000-$11,000 per ton. According to previous reports from the Wind Trading Desk, Goldman Sachs believes that starting in 2026, copper prices will enter a new trading range of $10,000-$11,000 per ton. This judgment is based on three core trends: constrained supply, structural growth in demand, and strategic reserves.

Driving the Rally: A Shift from Fundamentals to Sentiment

Goldman Sachs believes that the rise in copper prices since January of this year can be clearly divided into two phases.

The first phase (January to mid-September) saw a 15% increase supported by solid fundamentals: a weaker dollar, improved growth expectations in China, and tightening spot markets outside the U.S., with the narrowing of LME futures spreads confirming this trend.

The second phase (from mid-September to now) has seen a 13% increase primarily driven by investor sentiment. Supply disruptions at mines (especially the Grasberg mine) and expectations of future market tightness have attracted a significant influx of speculative funds.

Goldman Sachs' model breakdown shows that the main driving factors in the earlier phase were Chinese growth factors, the dollar index, and LME futures spreads, while recent trends have shifted to supply-side dominance.

At the same time, Goldman Sachs also pointed out that the major mining disruptions in 2025 to date—Kamoa-Kakula, El Teniente, and Grasberg—are comparable in scale to the closure of Cobre Panama and production cuts by Anglo American that triggered a price surge in 2024 Goldman Sachs estimates that the announced disruptions in 2025 will lead to an annual loss of approximately 700,000 tons in mine supply. However, after adjusting for disruption reserves, the net impact on the supply-demand balance for 2026 is only about 200,000 tons.

According to Goldman Sachs' rule of thumb—every 100,000 tons of tightening in balance corresponds to about a 2% price increase—this supply shock supports copper prices rising to $10,500 per ton, which is the price forecast Goldman Sachs raised after the Grasberg disruption (previously $10,000 per ton).

COMEX positions still have room for growth, with short-term risks of further increases

Goldman Sachs also pointed out that although LME investor positions are in an extremely stretched state (net long value is at the 99th percentile over the past five years), there is still room for further capital inflow into the COMEX market. The total open interest in futures and options is currently only 70% of the peak in 2024, mainly reflecting a small increase in call options.

If COMEX continues to attract investor inflows—such as through the "COMEX-LME price cycle" (COMEX high prices reopening the U.S. import arbitrage window, attracting inventory to the U.S., pushing LME into deeper spot premiums, further enhancing bullish sentiment among investors), copper prices may continue to rise in the short term for the remainder of 2025, even breaking through $11,200 per ton.

Three major supporting factors for expected corrections in early 2026

Goldman Sachs believes that the sentiment-driven rally will reverse in early 2026 for the following reasons:

1. Inventory data inconsistent with scarcity expectations: Global visible inventory has increased by 700,000 tons so far in 2025. Even considering an estimated reduction of 300,000 tons in unreported inventory outside the U.S., the global copper market still shows a surplus of 400,000 tons for the year—this includes the ongoing Grasberg disruption.

2. Signs of weakness on the demand side: China's apparent copper consumption fell by 2% year-on-year in September (down from -1% in August and +15% in the second quarter). The research team on basic materials stocks in China reported softening orders in downstream industries and delays in grid orders. Although China's cathode copper premium remains positive ($40 per ton), it has significantly dropped from $110 per ton in May.

3. Strong growth in global refined capacity: Global refined copper production has increased by 4% this year, with a forecast of -2% year-on-year growth in the fourth quarter facing upward risks. Despite weak mine supply growth in Latin America (especially Chile), strong scrap copper exports (in response to high copper prices) and growth in marginal producers' mine supply provide a hedge. The Democratic Republic of the Congo's (DRC) mine output increased by about 13% year-on-year in July, despite the Kamoa-Kakula disruption at the end of May.

Goldman Sachs stated, "If there is no significant decline in global inventory outside the U.S. in the next six months, we expect speculative net longs to decrease, and copper prices will return to the $10,000-$11,000 range in the first half of 2026, even if recent prices may continue to rise."

This judgment is highly consistent with the strategic framework previously set by Goldman Sachs: $10,000 constitutes the "new bottom line" supported by structural costs on the supply side, while $11,000 is the "ceiling" formed by increased scrap copper supply and aluminum substitution effects