As the market falls into the debate of "bubble," the US dollar quietly reaches a three-month high

Against the backdrop of unclear signals from tech stock earnings reports and central bank policies, risk aversion has risen, driving the US dollar stronger, with the dollar index reaching a three-month high of 99.5. The cooling expectations for Federal Reserve rate cuts and rising US Treasury yields have strengthened the dollar's appeal. The Japanese yen has fallen 4% against the US dollar over the past month, marking its worst monthly performance since July

As global markets are turbulent due to unclear earnings reports from tech stocks and central bank policy signals, the US dollar is quietly strengthening.

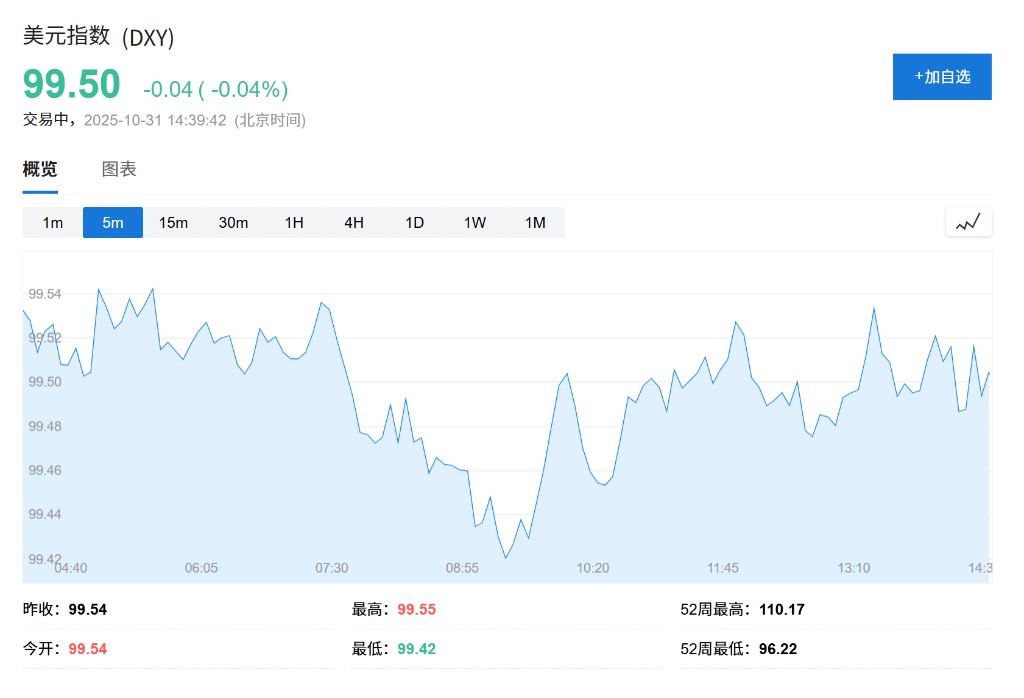

The US dollar index, which measures the strength of the dollar against a basket of six major currencies, held steady at 99.5 on Friday. The previous day, the decline in US stocks triggered a risk-averse sentiment in global markets, pushing the index to a three-month high. Rodrigo Catril, a currency strategist at National Australia Bank, stated, “Risk aversion is favorable for the dollar.”

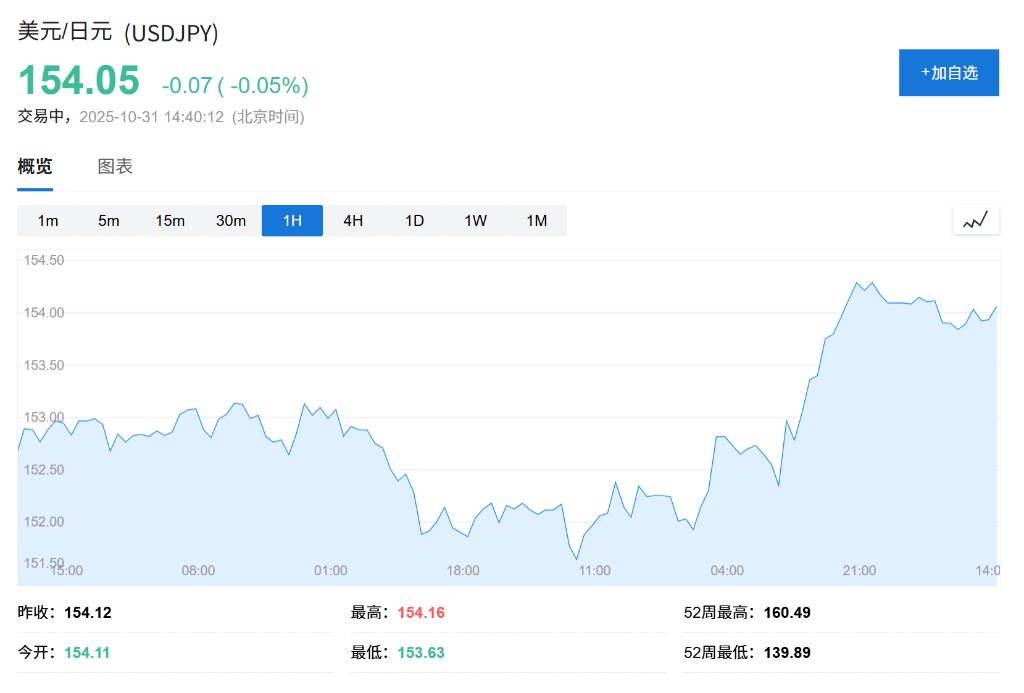

Meanwhile, the yen has stabilized after hitting a nearly nine-month low. Earlier, Japan's new Finance Minister Satsuki Katayama stated that the government is monitoring foreign exchange trends with "high urgency," providing a breather for the continuously depreciating yen. However, the yen has fallen 4% against the dollar in the past month, marking its worst monthly performance since July.

Behind this series of dynamics is the market's reassessment of the Federal Reserve's future interest rate path. Traders have reduced their bets on the Fed cutting rates again in December, thereby enhancing the attractiveness of dollar assets. The complex macro picture is guiding funds toward the dollar, which is seen as safer.

Yen Under Pressure: Inflation Data and Official Statements in Tug-of-War

The yen is caught in a tug-of-war between expectations of official intervention and ongoing easing policies. Japan's Finance Minister Satsuki Katayama's verbal warning helped the yen rebound 0.1% against the dollar on Friday, to 154.01 yen. Katayama also stated that she would not insist on her earlier comments from March regarding the yen's "real value" being close to 120-130, as her current position requires her to be responsible for monetary policy.

However, fundamental factors continue to pressure the yen. Data released on Friday showed that Tokyo's core consumer prices (CPI) rose 2.8% year-on-year in October, exceeding market expectations and indicating that inflation pressures remain above the Bank of Japan's target. This "hot" data complicates the situation for the Bank of Japan, which just decided to maintain interest rates on Thursday.

Sim Moh Siong, a currency strategist at Singapore Bank, stated, “We are entering a juncture where the weakness of the yen is becoming a focus for politicians.” In addition to its weak performance against the dollar, the yen's exchange rate against the euro is also nearing historical lows.

Fed Rate Cut Expectations Cool, US Treasury Yields Climb

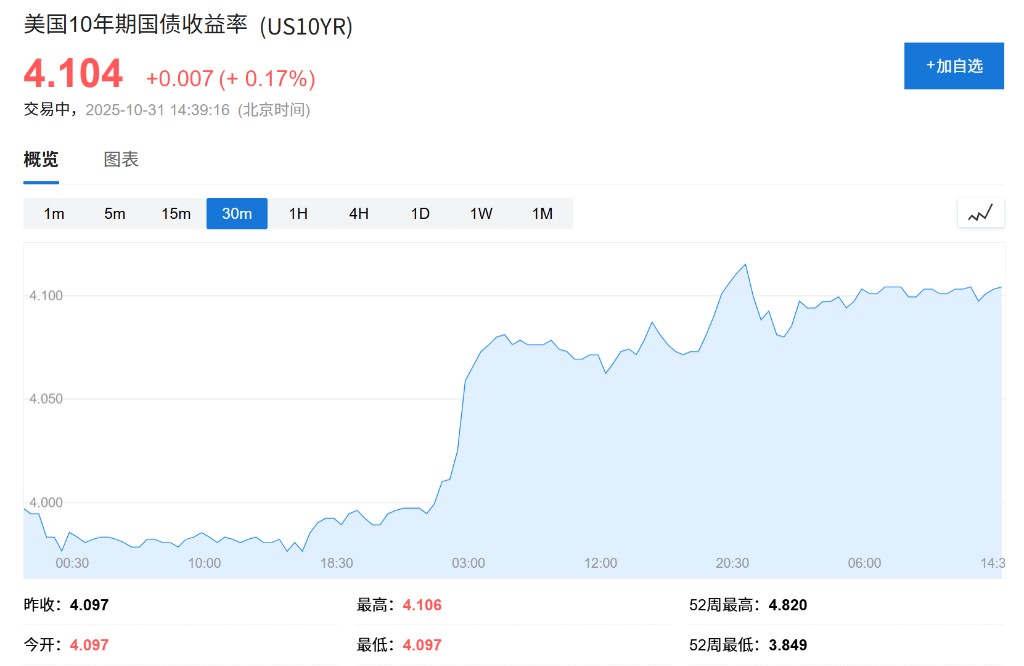

The core driving force behind the strengthening dollar comes from the market's shift in expectations regarding Federal Reserve policy. According to the FedWatch tool from the Chicago Mercantile Exchange Group, futures market data shows that the likelihood of the Fed cutting rates by 25 basis points at the December 10 policy meeting has dropped from 91.1% a week ago to 74.7%. **

Rodrigo Catril of the National Australia Bank pointed out:

“The Federal Reserve is uncertain whether it will cut rates again, and the yen's weakness resulting from the Bank of Japan's actions does not help at all.”

The shift in market expectations is directly reflected in the bond market. The yield on the 10-year U.S. Treasury rose to about 4.1%, a three-week high, up 0.7 basis points from the previous trading day's close, enhancing the relative attractiveness of dollar assets.

Major currencies show mixed performance, euro remains stable

Against the backdrop of a generally strengthening dollar, other major currencies performed unevenly.

The euro rose to $1.156 against the dollar. Previously, the European Central Bank kept interest rates unchanged at 2% for the third consecutive meeting on Thursday and reiterated that its policy is in a “good position” as economic risks recede.

The British pound remained flat at $1.31555, while the market is also paying attention to the political pressure faced by UK Chancellor of the Exchequer Rachel Reeves. Meanwhile, commodity currencies such as the Australian dollar and New Zealand dollar showed weakness, with the Australian dollar down 0.1% to $0.65495 and the New Zealand dollar down 0.2% to $0.57325, reflecting a risk-averse sentiment in the global market